About NFC, SMS Payments and the Future

Agree, a mobile phone is the thing that is always at hand, something we are used to and without which we can’t imagine our life. Referring to research conducted by Mashable technolog employees, more than 75% of the population have access to a mobile phone. Its use in everyday life is so obvious that using it as a wallet is just another bonus to its almost unlimited possibilities.

Consequently, the development of the mobile payments industry is no longer something surprising and unusual, but quite logical. Using a mobile phone, you can make both the purchase of real goods in the online store, and the content on the site, as well as pay for everyday and everyday services. He may soon completely replace cash and credit cards. We can talk about the advantages of mobile payments for a long time, but the main advantage is the simplicity in making payments.

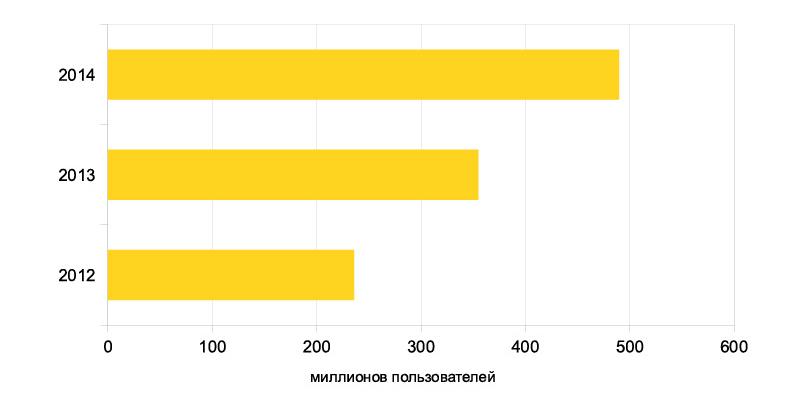

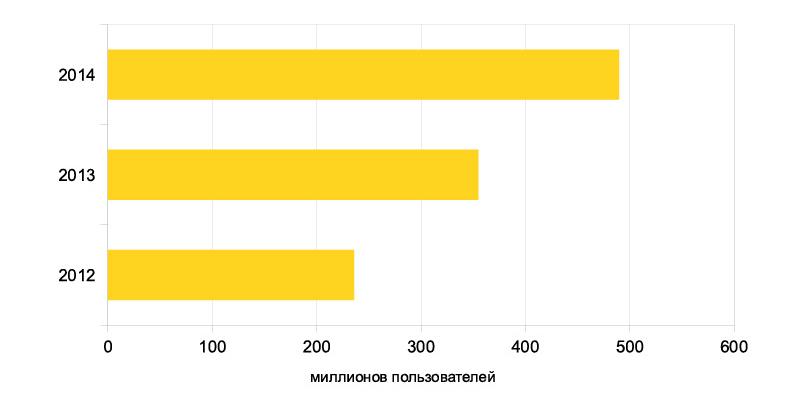

Number of users of mobile payments

')

There are several payment methods that do not require the use of cash: Premium SMS (PSMS), electronic payment systems such as WebMoney and PayPal, and NFC ( Near Field Communication ) technology. We will consider in more detail Premium SMS and NFC payments, which are the most convenient types of mobile payments for use.

Payment via PSMS is an easy and fast way to pay for the desired service without leaving your home and using only your mobile phone. In practice, it has been proven that PSMS is a success both with content providers and those who want to purchase this content. Well, this is not surprising: the time savings, as well as the convenience and simplicity of this payment method are obvious. This once again confirms that the audience of users who can pay for services via PSMS is quite wide. And despite the fact that some mobile market experts predict a gradual disappearance of SMS payments, we have a different opinion. According to statistics, the volume of the SMS-payments market grew by 44% in 2012. The upward trend is justified by the fact that SMS payments have a number of advantages with respect to other payment methods, and the number of mobile subscribers is growing every day.

Of course, not everything is so rosy. Speaking about the shortcomings of SMS payments, it is worth mentioning the high commission of cellular operators, which is added to the real cost of the service or product. That is, the buyer pays not only for the product itself, but also pays for the services of a cellular operator.

Let's take a closer look at the NFC technology, which has only just begun to develop, but does not cease rapidly to acquire clearer outlines, and there is every chance that in the future great prospects will open up before it. Moreover, more and more in analytics we meet the assumption that it is the NFC that will force out payments by SMS as such.

NFC is a technology for exchanging data between devices that are approximately 10 centimeters apart. One of the ideas of this technology is to simplify the buying process and save potential buyers from a variety of bank cards, or rather to make them virtual, which eliminates the need to carry them everywhere with you. After “linking” a bank card to a smartphone with an NFC chip, in order to pay for the purchase, you just need to touch the NFC reader with the phone.

As in the case of SMS payments, a mobile phone with NFC-module support also acts as a payment tool. NFC chip can be embedded in a smartphone, a SIM card or in a memory card. NFC support in mobile phones makes them truly functional. If this technology gains momentum and becomes available in most countries, including Russia, their owners will be able to use it, making purchases, paying in restaurants, cafes, gas stations, parking lots. Mobile phones with an NFC chip can replace a payment plastic card, thanks to a very convenient user interface, high speed of making payments and universality.

But while a clear lack of technology NFC remains underdeveloped infrastructure, or rather, its absence. In order to further develop the NFC market, it is necessary to provide at least a network of payment terminals that support NFC technology, since they are the basis for the formation of infrastructure. An important aspect is also the interest in developing the technology of mobile operators and banks as key participants in the process.

Considering the advantages and disadvantages of PSMS and NFC, several aspects should be highlighted for comparison:

1. Potential users.

Definitely it can be said that potential users of both PSMS and NFC are the owners of mobile phones. Further distribution of the sphere of influence depends only on what the user will pay. The owner of the smartphone with the NFC module can pay both the fare in public transport, and the purchase in the store or the bill in the cafe. At the same time, users of sites with paid services will be able to pay for the necessary service, just using SMS payments, and in these cases NFC is not relevant. Moreover, the number of social networks, dating sites, online games does not decrease, but grows, and the number of Premium messages sent by users to pay for services on these sites grows with it.

In addition, no matter how fast the NFC technology has developed, its audience is already initially limited. This is explained by the fact that a NFC-enabled mobile phone is tied to a bank card, which not everyone has. So, a minor user will not be able to use NFC for payment. And such users have the lion’s share of the market as long as the gaming industry continues to evolve. And this once again proves that SMS payments are a necessary tool for that part of the audience, which for one reason or another cannot use NFC payments.

2. Scope of application.

NFC is not for nothing called the technology of the future, because a wide range of its application is obvious: the technology can be applied in almost all areas, including medicine, education, sports, business and services.

In the future, a happy owner of a smartphone with an NFC module will not be able to carry a wallet: any service, whether buying a hamburger at a fast-food restaurant or paying for parking, can be paid for using a phone. With a good deal (the development of infrastructure for NFC) there is a possibility that cash and completely recede into the background. The payment process using the NFC module is much faster than cash payment, and there is no need to carry paper and metal money with you.

With the development of the mobile industry, and most importantly the development of mobile software, the number of sites that can be accessed from a mobile phone and the number of users who do not ignore this possibility has increased. Accordingly, the amount of money they spend on these sites has grown. Traveling around the site from a mobile, the user pays for using various services, just by sending an SMS to a short number. Thus, it saves time and gets the service using only a mobile phone and access to the web. Therefore, online services with which the Internet is filled, no doubt need in this type of payment, like PSMS. These are both dating sites, and social networks, file sharing, torrent trackers, forums with paid access, sites with content for a mobile phone, online games and other services. This payment method allows you to purchase virtual goods that do not have physical value in online games with their virtual worlds and in social networks. At various sites, users buy virtual currency, pay for registration, VIP-status, take part in polls, give friends gifts.

3. Security.

Vulnerability of NFC technology as a virtual wallet, according to experts, exists. If the phone to which a bank card is attached is lost or simply stolen, the “new owner” will have direct access to your money. While you will call the bank in order to block your card, someone can already manage your finances. Very often, Russian banks prescribe in the card issuance agreements a clause stating that they do not cover and are not liable for all losses that you incur until the moment of the theft notification.

PSMS, like any other payment method, from time to time is faced with fraudulent activity. Untrusted sites often trust naive users. The only effective way to combat fraudsters in this area is to inform Internet users about all the possible fraudulent tricks and tricks. If users are promptly notified, it will protect them from visiting such sites, or at a minimum will help to be more vigilant.

Anyway, it is not profitable for mobile operators to work with such sites, as they lose the trust of subscribers, and they go to competitors or billing companies, because if they ignore users' complaints, they also lose trust and reputation, and accordingly and customers along with earnings. Strict regulation by operators and a thorough check of each project before its connection from our side reduced to a minimum the number of incidents related to unauthorized withdrawals from mobile subscriber accounts.

However, not only Internet users become victims of fraudsters. Cellular operators and billing companies also face the problem of the security of SMS payments. In this case, we are talking about frode. Fraud - this is fraudulent actions that are carried out using a mobile phone. Simply put, fraud sms are paid messages sent from a number that has no funds in its account. Until recently, fraud was one of the main security problems of SMS billing. Now billing companies have made every effort to ensure that the fight against fraud was effective. Antifrod restrictions apply and the number of fraud is noticeably reduced, which is good news. Cellular operators are constantly updating platforms, improving protection tools, thereby reducing fraud traffic, and step by step approaching a complete solution to the problem.

4. User countries.

If it is sensible to see which countries are really ready to accept NFC technology, it becomes clear that few are ready for this. In order to introduce technology and enable it to function, a pre-formed base is needed. It will not be enough just to announce that NFC technology has already appeared in this country, because it should first of all be available to potential users. In developed countries, NFC development did not stop at the embryo stage, but went further: the consumer segment gradually began to develop, new business models appeared, it became possible to pay for goods and services using NFC.

In addition, a direct connection of bank cards with NFC technology implies the development of a credit card payment system and the presence of these cards in more than half of the population, and this is not typical of all countries. In other words, potential users of this modern technology are residents of countries in which credit cards are common and almost everyone has.

The most active countries in using NFC are: Japan, Korea, Germany, France, Australia and the USA. In Japan, interest in contactless payments appeared quite a long time ago. As a payment method, the Japanese are actively using NFC at gas stations, railway stations, cafes, grocery stores, and in the near future the payment system will be available even in a taxi. South Korea is not far behind Japan, and very soon its residents will be able to pay for travel and purchases using a phone with an NFC chip. France supported the theme of technology development with the opening of the world's first supermarket with the NFC system. For the US, NFC is a well-grounded transition to the next level: Americans do not particularly like cash, so this simple and non-cash payment method has already managed to win the sympathy of American users. In addition, the technology is supported by leading US operators Verizon Wireless, AT & T Mobility and T-Mobile USA and mobile phone manufacturers. Referring to the research of ABI Research, in the USA by 2017 the turnover of NFC payments will be 191 billion dollars.

Today, the use of contactless technologies in Russia is also gaining momentum. So, the “big three” tries to keep up with each other and is already fully introducing technology into various fields of activity: in the salons of Megaphone one can meet special NFC readers to pay for goods and services; using NFC technology, MTS allows you to pay for fuel at gas stations; Beeline - for travel on the subway. However, there are two main factors that directly impede the process of introducing NFC technology into use by the broad masses. First, it is the lack of awareness of potential users about the existence and capabilities of NFC. Secondly, as already mentioned, there is still no infrastructure, the establishment of which requires both funding and time. Without a universal infrastructure, NFC payments will remain at the stage of several projects, which will disappear with time.

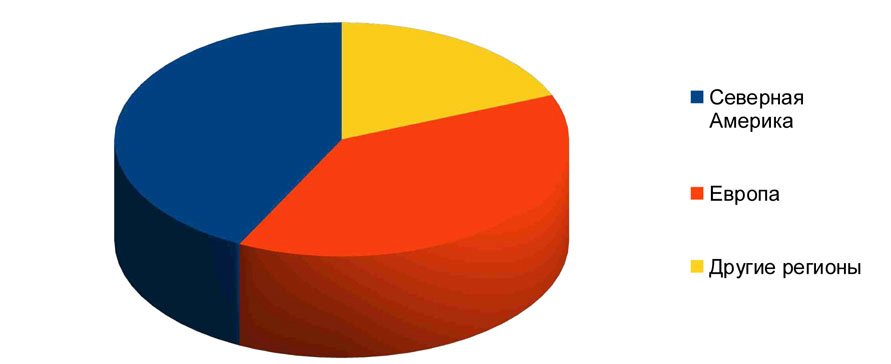

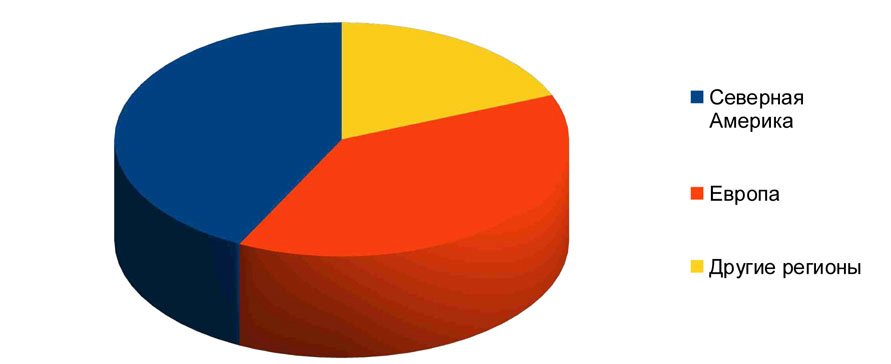

According to research analysts, progress in the development of NFC will not be in all countries. The highest level of technology penetration will be observed in North America and European countries.

Summing up, we can say that contactless payment technologies have something to fight for in terms of attracting potential users. If SMS payments have already proved themselves and increase user loyalty, then NFC needs more than one year to strengthen its position in the payment market. NFC technology is universal, besides it opens up new opportunities in the field of mobile payments, but at this stage not all countries are ready to meet with it. Nevertheless, there is a huge chance that the technology will gain high speed. By saving time and facilitating the payment process, NFC has already managed to attract the attention of many leading IT companies, who are in a hurry to add new devices to the latest technologies.

According to some mobile market experts, SMS payments are yesterday, but this opinion is wrong. Today, the sphere of SMS-payments is actively developing, and at its base are all the same good old SMS-messages. For example, a direct carrier billing appeared, which increased the income from sales of media content, because it was started by those users who did not want or could not use a bank card as a payment instrument. In turn, subscriptions on websites that allow users to pay for a certain period of using the service have become popular. In addition, the development of SMS-payments is not only due to Internet users, but also through new commercial solutions. With their appearance, the range of goods and services that can be paid for via SMS, including even parking, is expanded.

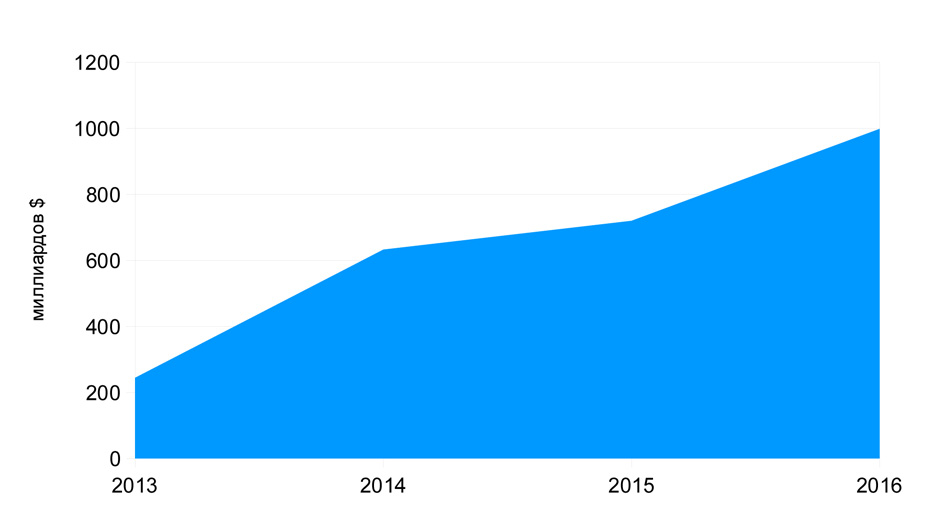

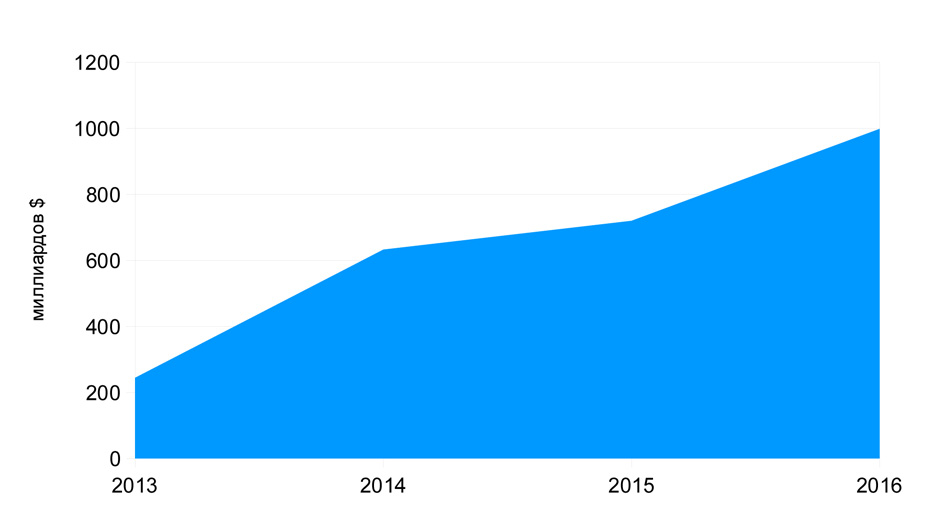

The growth of the market of SMS payments in the world

Forecast of the development of the mobile payments market in the world

Definitely, the markets for NFC and PSMS technology are different. Summing up, we can say that the development of NFC does not at all threaten an emergency death for SMS payments. Each of these payment methods has its own audience and the area in which it is most developed and expedient. Based on this, we can conclude that the wind of change, which came along with the innovative technology of NFC, will not move the SMS payments from a confident position, but will complement the market. PSMS and NFC can exist in parallel and independently from each other, developing in different directions, which is definitely only for the benefit of consumers who can choose the most suitable payment method.

Consequently, the development of the mobile payments industry is no longer something surprising and unusual, but quite logical. Using a mobile phone, you can make both the purchase of real goods in the online store, and the content on the site, as well as pay for everyday and everyday services. He may soon completely replace cash and credit cards. We can talk about the advantages of mobile payments for a long time, but the main advantage is the simplicity in making payments.

Number of users of mobile payments

')

There are several payment methods that do not require the use of cash: Premium SMS (PSMS), electronic payment systems such as WebMoney and PayPal, and NFC ( Near Field Communication ) technology. We will consider in more detail Premium SMS and NFC payments, which are the most convenient types of mobile payments for use.

Payment via PSMS is an easy and fast way to pay for the desired service without leaving your home and using only your mobile phone. In practice, it has been proven that PSMS is a success both with content providers and those who want to purchase this content. Well, this is not surprising: the time savings, as well as the convenience and simplicity of this payment method are obvious. This once again confirms that the audience of users who can pay for services via PSMS is quite wide. And despite the fact that some mobile market experts predict a gradual disappearance of SMS payments, we have a different opinion. According to statistics, the volume of the SMS-payments market grew by 44% in 2012. The upward trend is justified by the fact that SMS payments have a number of advantages with respect to other payment methods, and the number of mobile subscribers is growing every day.

Of course, not everything is so rosy. Speaking about the shortcomings of SMS payments, it is worth mentioning the high commission of cellular operators, which is added to the real cost of the service or product. That is, the buyer pays not only for the product itself, but also pays for the services of a cellular operator.

Let's take a closer look at the NFC technology, which has only just begun to develop, but does not cease rapidly to acquire clearer outlines, and there is every chance that in the future great prospects will open up before it. Moreover, more and more in analytics we meet the assumption that it is the NFC that will force out payments by SMS as such.

NFC is a technology for exchanging data between devices that are approximately 10 centimeters apart. One of the ideas of this technology is to simplify the buying process and save potential buyers from a variety of bank cards, or rather to make them virtual, which eliminates the need to carry them everywhere with you. After “linking” a bank card to a smartphone with an NFC chip, in order to pay for the purchase, you just need to touch the NFC reader with the phone.

As in the case of SMS payments, a mobile phone with NFC-module support also acts as a payment tool. NFC chip can be embedded in a smartphone, a SIM card or in a memory card. NFC support in mobile phones makes them truly functional. If this technology gains momentum and becomes available in most countries, including Russia, their owners will be able to use it, making purchases, paying in restaurants, cafes, gas stations, parking lots. Mobile phones with an NFC chip can replace a payment plastic card, thanks to a very convenient user interface, high speed of making payments and universality.

But while a clear lack of technology NFC remains underdeveloped infrastructure, or rather, its absence. In order to further develop the NFC market, it is necessary to provide at least a network of payment terminals that support NFC technology, since they are the basis for the formation of infrastructure. An important aspect is also the interest in developing the technology of mobile operators and banks as key participants in the process.

Considering the advantages and disadvantages of PSMS and NFC, several aspects should be highlighted for comparison:

1. Potential users.

Definitely it can be said that potential users of both PSMS and NFC are the owners of mobile phones. Further distribution of the sphere of influence depends only on what the user will pay. The owner of the smartphone with the NFC module can pay both the fare in public transport, and the purchase in the store or the bill in the cafe. At the same time, users of sites with paid services will be able to pay for the necessary service, just using SMS payments, and in these cases NFC is not relevant. Moreover, the number of social networks, dating sites, online games does not decrease, but grows, and the number of Premium messages sent by users to pay for services on these sites grows with it.

In addition, no matter how fast the NFC technology has developed, its audience is already initially limited. This is explained by the fact that a NFC-enabled mobile phone is tied to a bank card, which not everyone has. So, a minor user will not be able to use NFC for payment. And such users have the lion’s share of the market as long as the gaming industry continues to evolve. And this once again proves that SMS payments are a necessary tool for that part of the audience, which for one reason or another cannot use NFC payments.

2. Scope of application.

NFC is not for nothing called the technology of the future, because a wide range of its application is obvious: the technology can be applied in almost all areas, including medicine, education, sports, business and services.

In the future, a happy owner of a smartphone with an NFC module will not be able to carry a wallet: any service, whether buying a hamburger at a fast-food restaurant or paying for parking, can be paid for using a phone. With a good deal (the development of infrastructure for NFC) there is a possibility that cash and completely recede into the background. The payment process using the NFC module is much faster than cash payment, and there is no need to carry paper and metal money with you.

With the development of the mobile industry, and most importantly the development of mobile software, the number of sites that can be accessed from a mobile phone and the number of users who do not ignore this possibility has increased. Accordingly, the amount of money they spend on these sites has grown. Traveling around the site from a mobile, the user pays for using various services, just by sending an SMS to a short number. Thus, it saves time and gets the service using only a mobile phone and access to the web. Therefore, online services with which the Internet is filled, no doubt need in this type of payment, like PSMS. These are both dating sites, and social networks, file sharing, torrent trackers, forums with paid access, sites with content for a mobile phone, online games and other services. This payment method allows you to purchase virtual goods that do not have physical value in online games with their virtual worlds and in social networks. At various sites, users buy virtual currency, pay for registration, VIP-status, take part in polls, give friends gifts.

3. Security.

Vulnerability of NFC technology as a virtual wallet, according to experts, exists. If the phone to which a bank card is attached is lost or simply stolen, the “new owner” will have direct access to your money. While you will call the bank in order to block your card, someone can already manage your finances. Very often, Russian banks prescribe in the card issuance agreements a clause stating that they do not cover and are not liable for all losses that you incur until the moment of the theft notification.

PSMS, like any other payment method, from time to time is faced with fraudulent activity. Untrusted sites often trust naive users. The only effective way to combat fraudsters in this area is to inform Internet users about all the possible fraudulent tricks and tricks. If users are promptly notified, it will protect them from visiting such sites, or at a minimum will help to be more vigilant.

Anyway, it is not profitable for mobile operators to work with such sites, as they lose the trust of subscribers, and they go to competitors or billing companies, because if they ignore users' complaints, they also lose trust and reputation, and accordingly and customers along with earnings. Strict regulation by operators and a thorough check of each project before its connection from our side reduced to a minimum the number of incidents related to unauthorized withdrawals from mobile subscriber accounts.

However, not only Internet users become victims of fraudsters. Cellular operators and billing companies also face the problem of the security of SMS payments. In this case, we are talking about frode. Fraud - this is fraudulent actions that are carried out using a mobile phone. Simply put, fraud sms are paid messages sent from a number that has no funds in its account. Until recently, fraud was one of the main security problems of SMS billing. Now billing companies have made every effort to ensure that the fight against fraud was effective. Antifrod restrictions apply and the number of fraud is noticeably reduced, which is good news. Cellular operators are constantly updating platforms, improving protection tools, thereby reducing fraud traffic, and step by step approaching a complete solution to the problem.

4. User countries.

If it is sensible to see which countries are really ready to accept NFC technology, it becomes clear that few are ready for this. In order to introduce technology and enable it to function, a pre-formed base is needed. It will not be enough just to announce that NFC technology has already appeared in this country, because it should first of all be available to potential users. In developed countries, NFC development did not stop at the embryo stage, but went further: the consumer segment gradually began to develop, new business models appeared, it became possible to pay for goods and services using NFC.

In addition, a direct connection of bank cards with NFC technology implies the development of a credit card payment system and the presence of these cards in more than half of the population, and this is not typical of all countries. In other words, potential users of this modern technology are residents of countries in which credit cards are common and almost everyone has.

The most active countries in using NFC are: Japan, Korea, Germany, France, Australia and the USA. In Japan, interest in contactless payments appeared quite a long time ago. As a payment method, the Japanese are actively using NFC at gas stations, railway stations, cafes, grocery stores, and in the near future the payment system will be available even in a taxi. South Korea is not far behind Japan, and very soon its residents will be able to pay for travel and purchases using a phone with an NFC chip. France supported the theme of technology development with the opening of the world's first supermarket with the NFC system. For the US, NFC is a well-grounded transition to the next level: Americans do not particularly like cash, so this simple and non-cash payment method has already managed to win the sympathy of American users. In addition, the technology is supported by leading US operators Verizon Wireless, AT & T Mobility and T-Mobile USA and mobile phone manufacturers. Referring to the research of ABI Research, in the USA by 2017 the turnover of NFC payments will be 191 billion dollars.

Today, the use of contactless technologies in Russia is also gaining momentum. So, the “big three” tries to keep up with each other and is already fully introducing technology into various fields of activity: in the salons of Megaphone one can meet special NFC readers to pay for goods and services; using NFC technology, MTS allows you to pay for fuel at gas stations; Beeline - for travel on the subway. However, there are two main factors that directly impede the process of introducing NFC technology into use by the broad masses. First, it is the lack of awareness of potential users about the existence and capabilities of NFC. Secondly, as already mentioned, there is still no infrastructure, the establishment of which requires both funding and time. Without a universal infrastructure, NFC payments will remain at the stage of several projects, which will disappear with time.

According to research analysts, progress in the development of NFC will not be in all countries. The highest level of technology penetration will be observed in North America and European countries.

Summing up, we can say that contactless payment technologies have something to fight for in terms of attracting potential users. If SMS payments have already proved themselves and increase user loyalty, then NFC needs more than one year to strengthen its position in the payment market. NFC technology is universal, besides it opens up new opportunities in the field of mobile payments, but at this stage not all countries are ready to meet with it. Nevertheless, there is a huge chance that the technology will gain high speed. By saving time and facilitating the payment process, NFC has already managed to attract the attention of many leading IT companies, who are in a hurry to add new devices to the latest technologies.

According to some mobile market experts, SMS payments are yesterday, but this opinion is wrong. Today, the sphere of SMS-payments is actively developing, and at its base are all the same good old SMS-messages. For example, a direct carrier billing appeared, which increased the income from sales of media content, because it was started by those users who did not want or could not use a bank card as a payment instrument. In turn, subscriptions on websites that allow users to pay for a certain period of using the service have become popular. In addition, the development of SMS-payments is not only due to Internet users, but also through new commercial solutions. With their appearance, the range of goods and services that can be paid for via SMS, including even parking, is expanded.

The growth of the market of SMS payments in the world

Forecast of the development of the mobile payments market in the world

Definitely, the markets for NFC and PSMS technology are different. Summing up, we can say that the development of NFC does not at all threaten an emergency death for SMS payments. Each of these payment methods has its own audience and the area in which it is most developed and expedient. Based on this, we can conclude that the wind of change, which came along with the innovative technology of NFC, will not move the SMS payments from a confident position, but will complement the market. PSMS and NFC can exist in parallel and independently from each other, developing in different directions, which is definitely only for the benefit of consumers who can choose the most suitable payment method.

Source: https://habr.com/ru/post/191542/

All Articles