Google Play - we work legally!

Hi, Habr!

Today, I want to talk about how to make your hobby for developing Android applications even a small, but official business. About how to legally receive money earned on Google Play, about the "terrible" currency control and the "mysterious" passport of the transaction.

So, first of all, we need to register individual entrepreneurs (by the simplified tax system 6%). A lot has been written about this, so we will not dwell in detail. I went the easiest way: I used one of the online accounting services (I can give a link in a personal). This service forms a package of documents, gives detailed instructions, prints invoices and reminds you when it is necessary to send a piece of paper to a tax, in general, it is convenient.

')

After registering the IP, it is necessary to make a decision in which bank to open a current account. Much depends on this, with the currency control of this particular bank, we will have to deal further. Also, the cost of maintenance may vary significantly. I chose Sberbank (yes, I know about its glitches and confusion). However, there are positive aspects: a very friendly currency control, they answer all questions in detail and always help in any controversial points (do not hesitate to call and talk). When you open an account, "in the load" is a web client to manage the whole thing. When you come to your senses after the shock of its interface, you understand that electronic document management is still cool! No visits to the bank, all the necessary documents / operations are processed via the Internet, over time, you learn to do it, practically, on the machine.

Consider getting money from sales (Google Checkout) and advertising (Google AdMob). First of all, in the account’s payment settings, we indicate the foreign exchange transit account of our IP. After receipt of payment, we need to sell this currency within 15 days (to our ruble account), as well as to issue a “certificate of currency transactions.” Strictly speaking, there is the possibility of currency and not to sell, but we will follow the path of least resistance. This happens as follows:

1. We are waiting for payment. This is Sberbank, so there is no need to count on any alerts, just go to the 15-18th day of each month in Sberbank Business Online and monitor account transactions.

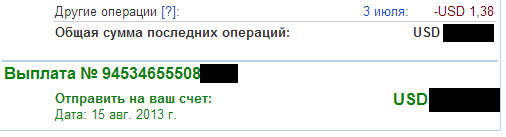

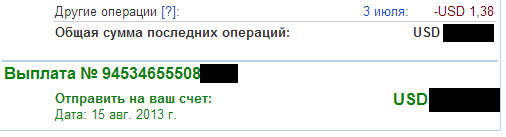

2. When the money has arrived, we create a “Certificate of currency transactions for 138-I”. In the certificate, you need to specify the "document number of the currency transaction" (as I understand it, this is an incoming PP or something like that). In general, the bank is obliged to send a notification with the number, date and amount, but usually, the employee simply calls (or call ourselves, to the branch where the account is opened). Also, we will need a supporting document - this is a public offer contract, which we accept by registering an account (go to the Terms and Conditions page, select Russian and save in doc or pdf). This is for advertising revenue. For Google Checkout, the terms are not translated , so we translate ourselves. In addition, the Sberbank VC requires to attach a screenshot / document where the amount of the transaction would appear to the certificate of currency transactions. For example, such:

3. If we do not want to immediately issue a passport of the transaction, then we write to the bank a letter of the following content (once, here in Sberbank Business Online): Amount under the public offer contract b / n from [account registration date] between Google Ireland Limited and FE [FIO] does not exceed 50,000 USD (fifty thousand US dollars).

4. Next, a “Order on the implementation of the mandatory sale” is created, where the certificate of currency transactions is created, created in step 2.

5. After the money has been received on the IP ruble settlement account, we create a payment order and make a transfer to your card account. Everything, PROFIT !, as they say.

If the total amount of settlements with the counterparty reaches $ 50,000, it is necessary to issue a passport of the transaction. Here we use the same contract of the public offer, the only caveat: we will need the dates of commencement and termination of obligations under the contract. Start is the date of registration of the developer account. As its confirmation, the receipt of payment of the registration fee on the Play Store (the receipt can be found in the history of purchases).

Regarding the end date, we add to the start date of 10-15 years (so as not to return to this issue in the near future) and write a letter to the bank: Please consider the date of termination of obligations under the contract w / n from [the date of registration of the account], date: [ your date]. The specified date is calculated in accordance with the customs of business turnover.

When a bank’s VC accepts a transaction passport, a number is assigned to it, which we will use when conducting references on foreign exchange transactions. If earlier, for this counterparty, there were certificates without concluding a contract, they must be re-sent to the bank (with a correction sign), indicating the passport number of the transaction.

As you can see, everything is not so difficult. The benefits of official registration as an entrepreneur, I think, are obvious. If we talk about alternatives, then the easiest option is to pay 13% of personal income tax. No papers, passport transactions for nat. persons not required. In the same Sberbank, currency control does not work at all for individuals. Of course, in theory, you fall under the “illegal entrepreneurship”, but if you pay taxes regularly, then this option is also quite acceptable.

On this, like, everything. If there are any unrevealed questions - please in the comments. All inspiration, growth and new ideas!

Today, I want to talk about how to make your hobby for developing Android applications even a small, but official business. About how to legally receive money earned on Google Play, about the "terrible" currency control and the "mysterious" passport of the transaction.

PI and account

So, first of all, we need to register individual entrepreneurs (by the simplified tax system 6%). A lot has been written about this, so we will not dwell in detail. I went the easiest way: I used one of the online accounting services (I can give a link in a personal). This service forms a package of documents, gives detailed instructions, prints invoices and reminds you when it is necessary to send a piece of paper to a tax, in general, it is convenient.

')

After registering the IP, it is necessary to make a decision in which bank to open a current account. Much depends on this, with the currency control of this particular bank, we will have to deal further. Also, the cost of maintenance may vary significantly. I chose Sberbank (yes, I know about its glitches and confusion). However, there are positive aspects: a very friendly currency control, they answer all questions in detail and always help in any controversial points (do not hesitate to call and talk). When you open an account, "in the load" is a web client to manage the whole thing. When you come to your senses after the shock of its interface, you understand that electronic document management is still cool! No visits to the bank, all the necessary documents / operations are processed via the Internet, over time, you learn to do it, practically, on the machine.

Receiving the money

Consider getting money from sales (Google Checkout) and advertising (Google AdMob). First of all, in the account’s payment settings, we indicate the foreign exchange transit account of our IP. After receipt of payment, we need to sell this currency within 15 days (to our ruble account), as well as to issue a “certificate of currency transactions.” Strictly speaking, there is the possibility of currency and not to sell, but we will follow the path of least resistance. This happens as follows:

1. We are waiting for payment. This is Sberbank, so there is no need to count on any alerts, just go to the 15-18th day of each month in Sberbank Business Online and monitor account transactions.

2. When the money has arrived, we create a “Certificate of currency transactions for 138-I”. In the certificate, you need to specify the "document number of the currency transaction" (as I understand it, this is an incoming PP or something like that). In general, the bank is obliged to send a notification with the number, date and amount, but usually, the employee simply calls (or call ourselves, to the branch where the account is opened). Also, we will need a supporting document - this is a public offer contract, which we accept by registering an account (go to the Terms and Conditions page, select Russian and save in doc or pdf). This is for advertising revenue. For Google Checkout, the terms are not translated , so we translate ourselves. In addition, the Sberbank VC requires to attach a screenshot / document where the amount of the transaction would appear to the certificate of currency transactions. For example, such:

3. If we do not want to immediately issue a passport of the transaction, then we write to the bank a letter of the following content (once, here in Sberbank Business Online): Amount under the public offer contract b / n from [account registration date] between Google Ireland Limited and FE [FIO] does not exceed 50,000 USD (fifty thousand US dollars).

4. Next, a “Order on the implementation of the mandatory sale” is created, where the certificate of currency transactions is created, created in step 2.

5. After the money has been received on the IP ruble settlement account, we create a payment order and make a transfer to your card account. Everything, PROFIT !, as they say.

Transaction passport

If the total amount of settlements with the counterparty reaches $ 50,000, it is necessary to issue a passport of the transaction. Here we use the same contract of the public offer, the only caveat: we will need the dates of commencement and termination of obligations under the contract. Start is the date of registration of the developer account. As its confirmation, the receipt of payment of the registration fee on the Play Store (the receipt can be found in the history of purchases).

Regarding the end date, we add to the start date of 10-15 years (so as not to return to this issue in the near future) and write a letter to the bank: Please consider the date of termination of obligations under the contract w / n from [the date of registration of the account], date: [ your date]. The specified date is calculated in accordance with the customs of business turnover.

When a bank’s VC accepts a transaction passport, a number is assigned to it, which we will use when conducting references on foreign exchange transactions. If earlier, for this counterparty, there were certificates without concluding a contract, they must be re-sent to the bank (with a correction sign), indicating the passport number of the transaction.

Conclusion

As you can see, everything is not so difficult. The benefits of official registration as an entrepreneur, I think, are obvious. If we talk about alternatives, then the easiest option is to pay 13% of personal income tax. No papers, passport transactions for nat. persons not required. In the same Sberbank, currency control does not work at all for individuals. Of course, in theory, you fall under the “illegal entrepreneurship”, but if you pay taxes regularly, then this option is also quite acceptable.

On this, like, everything. If there are any unrevealed questions - please in the comments. All inspiration, growth and new ideas!

Source: https://habr.com/ru/post/191280/

All Articles