Mobile acquiring services and mini terminals in Russia - it's time to take Visa and MasterCard!

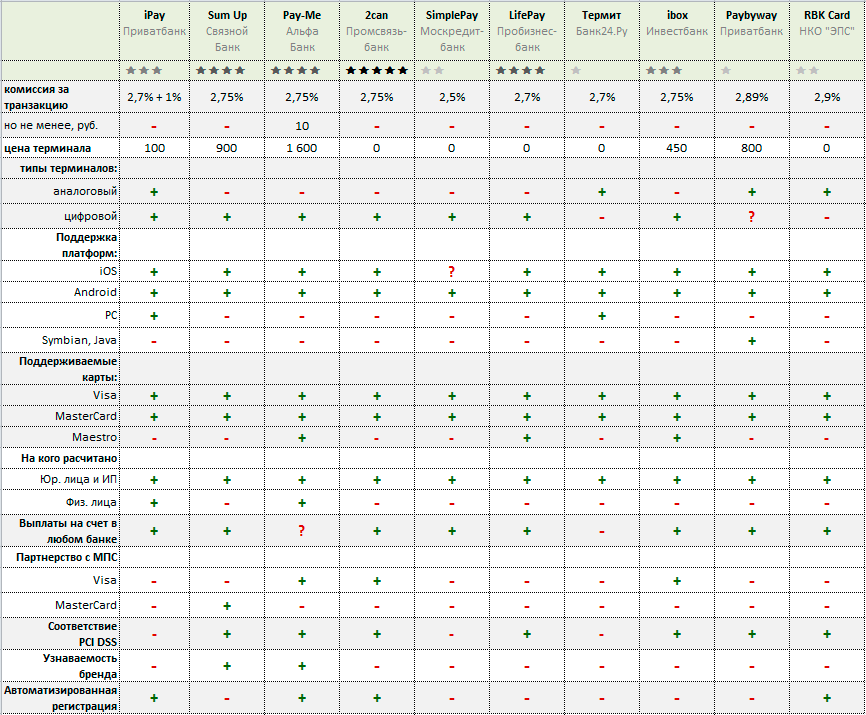

Square , PayPal , iZettle are world famous companies that offer solutions for accepting bank cards. None of the brands is represented in Russia. But we have ten of our own. I conducted an independent study of mobile acquiring services in Russia , which allow you to accept payments with Visa and MasterCard bank cards: iPay , Sum Up , Pay Me , 2Can , SimplePay , LifePay , Termite , ibox , Paybyway and RBK Card .

Square , PayPal , iZettle are world famous companies that offer solutions for accepting bank cards. None of the brands is represented in Russia. But we have ten of our own. I conducted an independent study of mobile acquiring services in Russia , which allow you to accept payments with Visa and MasterCard bank cards: iPay , Sum Up , Pay Me , 2Can , SimplePay , LifePay , Termite , ibox , Paybyway and RBK Card .I wanted to understand what drives people and the market, what services offer and who might be interested in these solutions. If you are engaged in private practice or freelancing , you have your own business , or you are interested in e-commerce - this article is for you. Under the cat you will find an overview of services , a test report , as well as specific recommendations for receiving cards .

Content:

- Mobile acquiring : advantages and disadvantages in comparison with traditional trade acquiring.

- Types of mobile terminals : what are in nature and what is offered in Russia.

- Mobile acquiring services - features,% of commissions and the cost of terminals, convenience and safety.

- 2Can is a transparent, automated and clearly working service for business.

- iPay is a service for quick start and acceptance of payments by individuals.

- Pay-Me is an interesting service from well-known brands, but raw and highly ambiguous.

- Life Pay , Sum Up , ibox - decent services with significant advantages and modest disadvantages.

- Mobile acquiring tendencies : why it is profitable for everyone, that with security, where the market moves.

- We start accepting card payments! .

Mobile acquiring: advantages and disadvantages

The very possibility of paying with a card is an obvious plus, and far from the only one.

Six essential advantages for me as a cardholder:

- A card is an opportunity to spend other people's money while you are working . Thanks to the credit limit, grace-period of 50 days and minimal self-discipline, I do not pay %% for a loan. My money for current expenses is on a debit card at 10% per annum.

- points for purchases are awarded points or bonuses (cash back) - 3%. This is not an end in itself, but if you try to pay with a card everywhere, then once a month you can completely buy something useful, and once in a few months something valuable.

- You can refuse to store cash checks . If you have any questions about the warranty on the goods - printed out an extract from the Internet bank, this will be a confirmation of the purchase.

- very easy to control your expenses . Money does not disappear anywhere and does not dissolve.

- This is the most profitable way to withdraw money from payment systems . Qiwi, Yandex or co-branded WebMoney cards - paying with such a card is really more profitable than withdrawing cash from an ATM or transferring somewhere;

- I don’t like to carry on a trifle, recalculate the change, and ask questions like “don't you look at 20 rubles?” .

Ok, but then why every entrepreneur does not accept cards for payment? It used to be unavailable, then expensive, but now it’s time. Card payments are unlikely to press cash payments, but are guaranteed to increase customer loyalty, and with it the conversion of payments and the average bill.

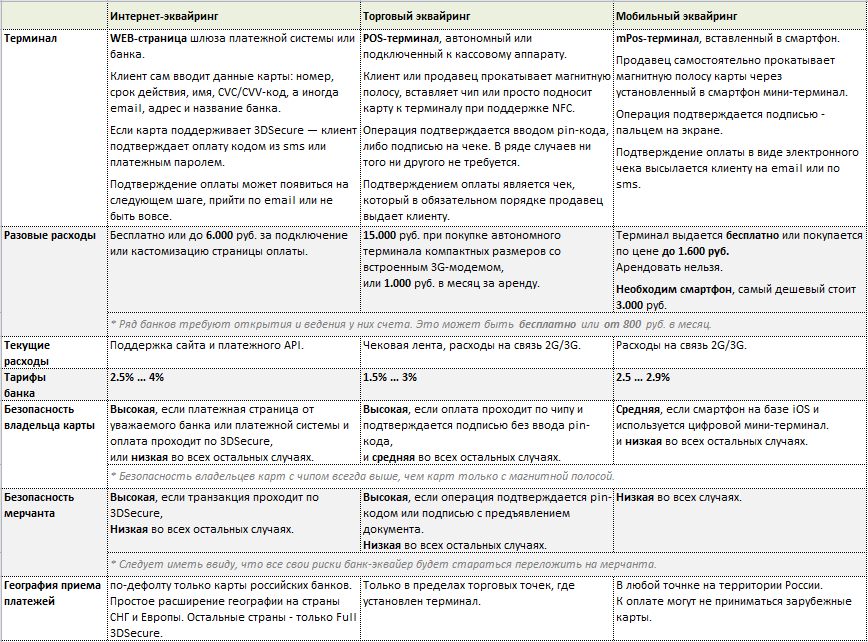

There are two main ways to accept bank cards: Internet acquiring - payment via the website using card details, and merchant acquiring - payment through the POS terminal using the physical media of the card (magnetic strip or emv chip). Mobile acquiring is a type of merchant, however, with the risks and commercial conditions that are more typical for Internet acquiring. Each of the methods has its own scope of application, solution costs and risks:

')

Mobile acquiring is the easiest and most affordable way to accept card payments, which is especially valuable for small and mobile businesses:

- This is a way to start a project from a “low start” , i.e. quickly, practically with zero costs and a commission of 2.5%. All you need is a smartphone and a mini terminal.

- it is an opportunity to equip employees in the office and in the fields with terminals - without exception and even free of charge. Agree, carry a device with a size with a matchbox is much better than a POS-terminal weighing as two 3.5 ”hard drives and the size of a boot. Equipment for mobile acquiring is modern and does not require staff training.

- Mobile acquiring is available to individuals , but there are nuances and limitations.

The disadvantages include:

- large acquiring banks do not offer mini-terminal-based solutions .

- distrust of technology by cardholders . It takes some time to develop the habit and understanding of people. To overcome this barrier, services actively use popular brands, such as Svyaznoy for Sum Up, Beeline for Pay-Me.

- medium security for the cardholder . The fact is that Android smartphones are vulnerable to viruses, and the simplest (analog) mini-terminals do not encrypt card data during transmission to the application. This is an objective risk, which makes it possible to massively drain card details and steal money. That is why most of the services reviewed here provide only digital mini-terminals, and in all promo devices use devices from Apple.

- low security level for merchant . Rolling a magnetic stripe of a card that has an emv-chip, all risks are borne by the acquiring bank, and in fact it shifts them to the merchant. The cardholder may protest such a transaction. And then without the merchant having any sane confirmations (besides the client’s signature curve on the screen), it will be impossible to prove anything.

When paying via emv-chip and entering a pin-code, all risks are assumed by the issuing bank, which it will successfully transfer to the cardholder. This is called Liability Shift.

In the near future, this risk cannot be eliminated, since Most of the terminals on the market are able to read only the magnetic stripe of the card. - low speed and convenience of payment . In order to accept the payment, you need to perform 6-7 actions: connect the terminal, start the application, walk through all menu steps, get the client's signature on the screen, enter its number or email. In addition, data exchange can take place over the cellular network in the area of uncertain reception.

All the described disadvantages are not critical if the payer and the merchant have time and there is no obvious reason not to trust each other.

Types of mobile terminals

The principles of operation of any POS-terminals are the same. The difference of solutions lies in their cost, reliability and requirements for the speed of payment.

POS-terminals: cash, banking and mobile:

- Cash POS-terminal sends the card data to the cash register or cash register system, which adds the amount to them, forms the payment and sends it to the bank. It is used in most large retailers where there are many cash desks, a large flow of buyers and a single information system.

- Bank POS-terminal does not connect to the cash register - it is a standalone and independent device with a battery, a thermal printer, a WiFi adapter or a 3G modem. The payment amount is entered directly on its keyboard, and the generated payment is transmitted to the bank via wireless. Used in HoReCa and most retail stores.

- The mobile mini-terminal reads the card data and transmits it to the mobile application launched on the smartphone. The application requests the amount, forms the payment and sends the data to the processing center of the bank. Scope of application - small business and mobile employees with a small amount of card payments.

Mobile mini-terminals are of the following types:

- Magnetic strip, chip, or combined .

There are magnetic strip readers ( Fig. 1, 3, 4 ) and card readers with a chip ( Fig. 2, 5, 6 ). In Russia, 99% of mini-terminals are for magnetic stripe cards. - Connected via usb port, audio jack or bluetooth .

The device can be connected to a smartphone via Bluetooth ( Fig. 5 ), Apple's 30pin-jack ( Fig. 6 ) or mini-jack audio jack ( Fig. 1, 2, 3, 4 ). Devices that connect to a smartphone via Bluetooth are often called “Chip-and-PIN” , because they allow you to carry out a full authorization and payment on a chip card with secure pin-code entry on a separate device. USB-connected devices require certification from the hardware manufacturer (for example, MFi for Apple products). The most versatile and inexpensive are terminals based on mini-jack. - Analog and digital .

There are analog ( Fig. 3 ) and digital readers ( all others ). Digital is more resistant to possible interference and read errors, and is able to encrypt the data read from the card before transferring it to the smartphone.

We focus only on the most common in Russia mobile mini-terminals that connect to a smartphone via an audio jack (mini-jack), read data from a magnetic strip, are available in analog or digital design (Fig. 1, 3, 4) . This is the cheapest, least secure and compatible with almost any smartphone equipment - the perfect solution to start on the unformed market.

In the meantime, we insert the miracle device in the headphone jack, the rest of the advanced world does this:

SumUp . Mini terminal for reading cards with an emv-chip. Connects via mini-jack. Available only for Europe, the Russian SumUp represented by Svyaznoy Bank does not offer such:

iZettle . Mini terminal for reading cards with an emv-chip. Connects through Apple 30pin-port.

PayPal Here . Stand-alone mini-terminal with a pin-pad for cards with an emv-chip. It connects via bluetooth:

Mobile Acquiring Services in Russia

There are a lot of mobile acquiring projects in runet - there are startups, integrators, suppliers and developers of turnkey solutions. Since Since this article focuses on ordinary people and small businesses , then services have been selected that meet the criteria:

- they offer a ready-made solution : I came to the site, registered, prepared the documents, got a mini-terminal, downloaded the application and started working;

- are ongoing projects , not prototypes and not just start-ups launched. There is where to call or write to ask all your questions;

- work legally in Russia and service Visa and MasterCard cards in partnership with a bank;

- offer certified equipment , ideally have PCI DSS and Visa or MasterCard certification as a partner .

There are at least ten services in Runet that were found and which more or less satisfy these criteria:

(if someone knows others - please report in the comments)

Criteria for evaluation

Evaluated the main parameters of the service according to information taken from open sources.

Such minor properties as support for Maestro cards, PC / Java / Symbian platforms were not taken into account. The partnership with the Visa or MasterCard IPS also decided to exclude, since it does not carry any obvious advantages, and the level of service reliability can be formally assessed by the presence of a PCI DSS certificate. Certificates of PCI PTS none of the considered services are present.

The efficiency of payments as a parameter is not considered, because I doubt that services and banks in their contracts prescribe the obligation to clear out the next business day and sanctions in case of non-compliance with these conditions.

As for tariffs, then 2.5% or 2.75% - no difference (∆ = 10%). But 2.89% or 3.7% - the difference from 2.5% is significant (∆ = 15.6% ... 48%).

“Pluses” is true, “minuses” and “questions” are false. Who has more points - and he is done well.

Such minor properties as support for Maestro cards, PC / Java / Symbian platforms were not taken into account. The partnership with the Visa or MasterCard IPS also decided to exclude, since it does not carry any obvious advantages, and the level of service reliability can be formally assessed by the presence of a PCI DSS certificate. Certificates of PCI PTS none of the considered services are present.

The efficiency of payments as a parameter is not considered, because I doubt that services and banks in their contracts prescribe the obligation to clear out the next business day and sanctions in case of non-compliance with these conditions.

As for tariffs, then 2.5% or 2.75% - no difference (∆ = 10%). But 2.89% or 3.7% - the difference from 2.5% is significant (∆ = 15.6% ... 48%).

“Pluses” is true, “minuses” and “questions” are false. Who has more points - and he is done well.

- The first place in my rating is taken by the 2can service.

- LifePay , Sum Up and Pay Me shared the second place.

- The third place is occupied by iPay and iBox .

- The services Simple Pay, RBKCard, Termite and Paybyway are currently outsiders in the ranking.

However, as time goes on, the situation is changing, and I do not urge to completely disregard them.

It was decided to consider automated services: one of those available only to legal entities is 2can , and all accessible to individuals are Pay-Me and iPay . Why is priority given to individuals? Everything is very simple. Those who want to do business are always much more than those who do it.

2can - 2can.ru

- the project of the Smartfin company, as the main settlement bank acts "Promsvyazbank". The company also provides a technology (white label) solution for Master Bank, Russian Standard Bank and Otkrytie Bank.

- the project of the Smartfin company, as the main settlement bank acts "Promsvyazbank". The company also provides a technology (white label) solution for Master Bank, Russian Standard Bank and Otkrytie Bank.The system is designed for legal entities and individual entrepreneurs. Payments are made to a current account in any bank no later than on the fifth day. Market average commission (2.75%). Digital mini-terminals are provided free of charge. The conditions are absolutely transparent, the connection is automated as much as possible. Start working really in two weeks.

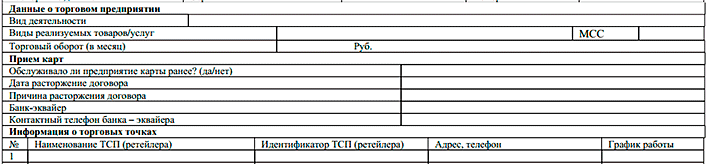

Connection

First you need to register on the site and fill out the average size of the questionnaire. Next, you need to upload scans to your personal account: statutory documents (or certificates for individual entrepreneurs), certificates of opening a current account in any bank, a manager's passport and a signed application form. Also asked for a photo of the head.

First you need to register on the site and fill out the average size of the questionnaire. Next, you need to upload scans to your personal account: statutory documents (or certificates for individual entrepreneurs), certificates of opening a current account in any bank, a manager's passport and a signed application form. Also asked for a photo of the head.The documents go to the checkout and after a couple of days, a notification by email ( screenshot ) arrives. If everything is ok, then in four days the contracts are uploaded to the personal account. There are two contracts: with the bank - a settlement agreement using cards, and with 2can - a service agreement.

Contracts must be carefully reviewed, printed out and signed and sent to 2can by express mail. In order to speed up the question, they are asked to put scans of several pages of contracts with signatures in the office. While for a couple of days there are paper versions, 2can negotiate the connection with the bank. As soon as 2can receives the documents and signs a copy of the bank agreement, the account is activated:

It becomes possible to order a mini-terminal in the same place in your personal account: the number of pieces and the delivery address are selected. 2can be ready to send any required quantity, for free. Digital terminals, together with instructions packed in a nice plastic case, are delivered by courier.

To receive payments, you need to activate the application on your smartphone. To do this, enter the contract number and the special activation code received in your account. Mobile mini-terminal is tied to a specific device (application). To change the device, you must first untie it in your account, generate a new code and only after that activate the terminal on the new device.

Withdrawal of funds

According to the conditions, the bank takes 1.85% from each transaction, 2can - 0.9% , a total of 2.75%. The amounts of all transactions per day minus the commissions are combined into one tranche and transferred to the merchant.

Funds are withdrawn only to the settlement account of a legal entity or an individual entrepreneur. The account can be in any Russian bank - there are no requirements to open a special transit or settlement account in any partner bank. If you are a PI and you do not have an account, you will have to open it. Fortunately, there are banks, where the opening costs 1.000 rubles, and the service is free.

Payment procedure

The payment process consists of seven steps:

- we start the mPos application , we connect the adapter, we enter the access code established by us ( fig. 1 ) and we select from the menu "Payment" ( fig. 2 )

- enter the amount and comment on the payment ( Fig. 3 ).

- We draw the card in the mini-terminal ( Fig. 4 ), check the last four digits of the card number in the application and on the card ( Fig. 5 ), press the button

- the payment process takes place: authorization and debiting of the amount on the card ( Fig. 6 ). The wait is a few seconds. If everything is ok, the transaction ends.

- we ask the payer to sign ( fig. 7 ).

- we send the client a check by email or in the form of sms ( Fig. 8 ). It is not clear why it is impossible to send both to the phone and by email at the same time.

- if the phone is entered, then a receipt in electronic form with all the details of the payment comes to the client's number ( Fig. 9 ).If you select email, then there comes such a check.

An interesting fact is that the application requests the current geolocation, and in the service’s personal account or in the check you can get a link to Google Maps with the coordinates of the place where the payment was made.

An important feature of the service is the ability to cancel the payment (make a refund or chargeback) - both from the mobile application and from the personal account. Also, at any time and for each transaction, you can re-send the check - by email or in the form of sms.

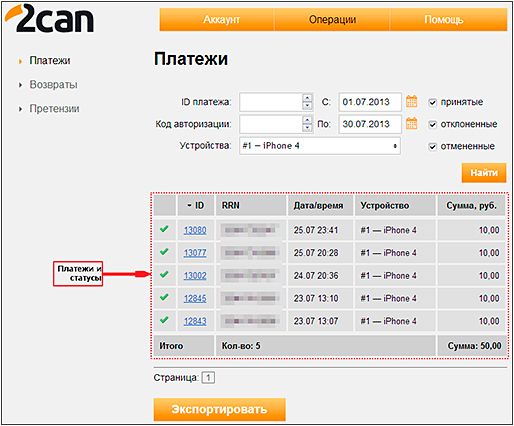

Test report 2can

A total of 5 test payments were made using Visa and MasterCard cards of various banks. Cards with emv-chip, and without it. Visa: from Classic Instant Issue to Gold. Maestro cards are recognized by the application, but are not accepted for payment. Payment occurred in various geographic locations in St. Petersburg. Five transactions of 10 rubles each were held on July 23, 24 and 25.

All transactions are approved and carried out without delay. Issuing sites sent sms about debiting.

Operations were reflected in the application archive:

(screenshots from the old version of the application for iOs, the guys just a few days ago updated the application - it became better)

as well as in your account on the site:

Since there may be several devices with mini terminals, each application has its own history of operations performed only on it. The general history of all operations for all applications is available in your account. There is an important nuance - if you delete the application, and then reinstall it and activate it with the new code, then all past transactions made through the same terminal and on the same device will not be loaded. They can be seen only through a personal account.

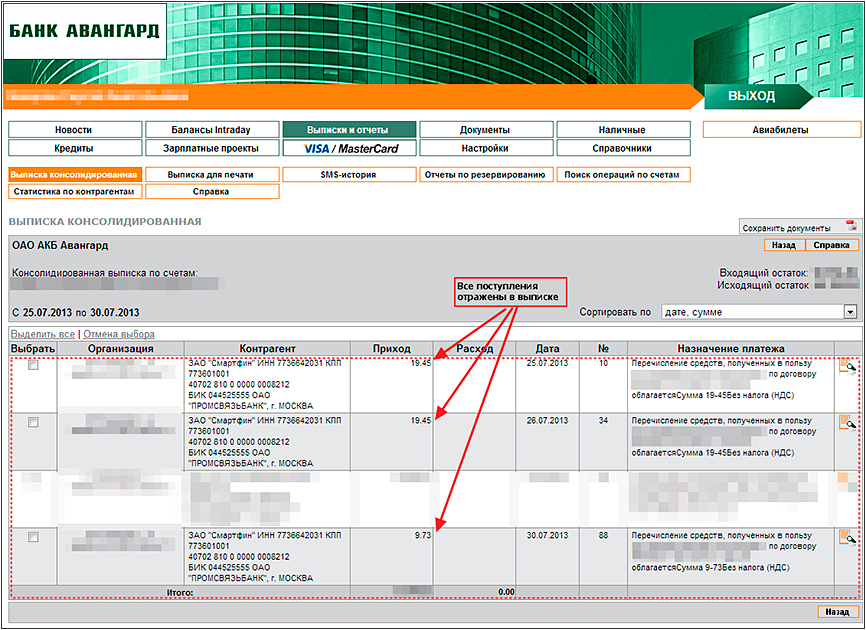

The funds for the 23rd day were credited to the settlement account on July 25, for the 24th day - July 26th, for the 25th day - July 30th, apparently the weekend played a role here. Everything was received in full, minus the commissions of 2.75%, as can be seen from the account statement in the Internet bank:

findings

2can is the most balanced solution for legal entities and individual entrepreneurs. Transparency of conditions and full automation. They do not impose any conditions on the type of business and its turnover. You can use the current account. They offer an average market% commission, everything else is free. Difficulties may be servicing cards of foreign banks or making payments in excess of 15.000 rubles. The service fully confirms its title as the winner of the Startup of the Year 2012 Award .

Disadvantages of 2can:

- strict restrictions on default - the maximum amount of a transaction is 15,000 rubles., only Russian banks are serviced.

- Payment history in the mobile application is not synchronized . When reinstalling the application, the data on past transactions will be available only through the personal account on the site.

- transfer of funds up to 5 days (calendar). In fact, from two to five days.

- connection about two weeks . Timing is really halved if you add quickness to managers.

- there is no iPad application , although it is announced in its personal account that it is available.Screenshot

Both links are the same - they lead to the same iPhone application.

Advantages of 2can:

- Loyal and transparent conditions - after visiting the site there are no questions left on the terms of connection. That you do not "leave a request, and we will contact you ...".

- fully automated service - minimum interactions with the email manager. Convenient personal account, fully accompanying the process of connecting and working with the service. Available immediately after registration and before signing the contract. Great attention is paid to usability.

- acceptable business risks . Most of the risks lie in the technological solution itself — the reader of the magnetic stripe of the card — in fact, common to all the services operating in the market. Accessing a mobile application by code, using only digital mini-terminals, the procedure for linking terminals and activating a mobile application are advantages.

- A high degree of trust in the company - a new company, judging by publicly available information from the Unified State Register of Legal Entities was formed in April 2012, but it has serious investors and partners in the person of Visa and top banks. PCI DSS certified.

iPay - getpos.ru

- Pioneer of the mobile terminal market in Ukraine and Russia. The project of Ukrainian "PrivatBank", and in Russia its "daughter" operates - "Moskomprivatbank". The system is focused on physical. individuals with a small amount of transactions. The declared% of the commission is 2.7%, in reality it is 3.7%. You can start accepting payments for one visit to the bank.

- Pioneer of the mobile terminal market in Ukraine and Russia. The project of Ukrainian "PrivatBank", and in Russia its "daughter" operates - "Moskomprivatbank". The system is focused on physical. individuals with a small amount of transactions. The declared% of the commission is 2.7%, in reality it is 3.7%. You can start accepting payments for one visit to the bank.Connection

The connection procedure is simple - you need to come to a passport at any branch of Moskomprivatbank, purchase a mini-terminal and have a bank card . In offices only the analog version of the terminal is sold for 100 rubles. (in the picture) , digital can be ordered on the site for 499 rubles. + shipping. Included is a mini-terminal, instructions and non-activated bank card.

The connection procedure is simple - you need to come to a passport at any branch of Moskomprivatbank, purchase a mini-terminal and have a bank card . In offices only the analog version of the terminal is sold for 100 rubles. (in the picture) , digital can be ordered on the site for 499 rubles. + shipping. Included is a mini-terminal, instructions and non-activated bank card.To activate the terminal and the application you will need a bank card. The easiest and most reliable way is to get a “Universal” card without a credit limit, with free issue and service. You can activate the card from the kit with a mini-terminal - "Universal Credit Card". However, this is a credit card and to activate it, you still need to enter into an agreement in the office.

Card comparison

The Universalna card can be obtained independently in any branch of the bank. This is Visa Electron, non-nominal, non-embossed with a CVC code, issued for a period of 4 years. Yes, another ruler of 8 cm is drawn on the back of the card ( ingenious! ).

The Universal Credit Card card comes with a mini-terminal, this is probably the Visa Classic Instant Issue, not infrequent, but embossed, with a CVC code, issued for 3 years.

The Universalna card can be obtained independently in any branch of the bank. This is Visa Electron, non-nominal, non-embossed with a CVC code, issued for a period of 4 years. Yes, another ruler of 8 cm is drawn on the back of the card ( ingenious! ).

The Universal Credit Card card comes with a mini-terminal, this is probably the Visa Classic Instant Issue, not infrequent, but embossed, with a CVC code, issued for 3 years.

After we have a terminal and a valid card in our hands, we can install the application, go through a simple registration and set up the money withdrawal direction.

Withdrawal of funds

Funds can be withdrawn in three directions: to the LiqPay payment system, to a bank card, to the bank account of an organization or entrepreneur in Russia or Ukraine. The direction is set in the application settings, and it can be changed at any time. The most optimal option is to display the Moskomprivatbank card with which the terminal was activated. In this case, the commission will be 2.7% per transaction + 1% for cash withdrawals at their own ATMs. , . 3,7%.

? Everything is very simple. LiqPay, — . 2 , - . — . -, .ua, - .

Why is this solution focused on a small amount of transactions? First, the money goes to the account of an individual. The bank, of course, is against the fact that these funds were received as a result of business activities. In the case of any not even well-founded suspicions, he can safely block the account and the card and terminate the service agreement. Secondly, ask around for people working with Privatbank's LiqPay payment system. You will hear a lot of interesting things: a high percentage of transaction failures due to abutments against limits and system filters, cases of sudden blocking of accounts. Transactions to receive funds addressed to individuals by the bank are called “money transfers by individuals”, governed by the relevant rules , 3DSecure. , , - .

:

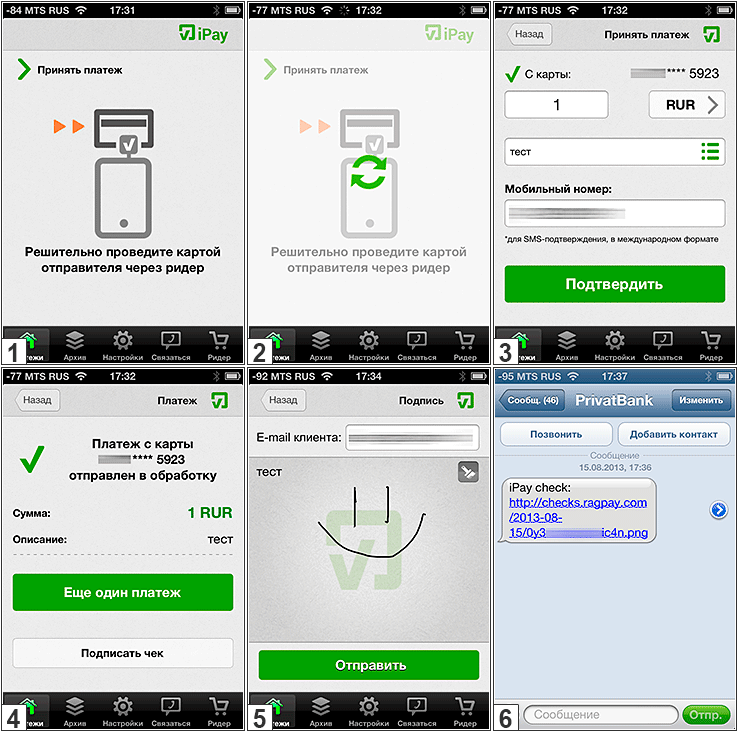

- iPay , , - «» ( . 1 ).

- ( . 2 ).

- , , ( . 3 ).

- , ( . 4 ) .

- email ( . 5 ).

- sms ( . 6 ). email ( ).

iPay

: Visa Classic c 3DSecure, — 3DSecure MasterCard World Visa Gold . Maestro , . 29 . «» . - sms . email . , , . , LiqPay, . , .

30 , 31 , . -. 2,7%, - «24»:

findings

iPay — . .

iPay:

- — , , .Screenshot

- , . .

- . « » -.

- . email.

- . 1.000 .

- high commission 3.7% - 2.7% per transaction + 1% for cash withdrawals. When converting currencies even more.

- an unpopular bank , not all regions are present, a small network of its own ATMs.

- strange work of the Internet Bank Privat24 : shows the card debt, updates the statement with a delay of 24 hours.

- high business risks for companies and entrepreneurs due to the absence of a contract on paper with clearly defined conditions.

Advantages of iPay:

- The quickest solution is to start accepting cards in half an hour.

- low cost - only 100 rubles., which will then return.

- available to individuals .

- support for maps of 11 CIS countries , incl. Russia, Ukraine and Belarus.

Pay Me — pay-me.ru

— «» («» ), «» «-», -. , (10 .). , ., . — .

— «» («» ), «» «-», -. , (10 .). , ., . — .«», - . , pay-me.ru .

. , - , ..

Screenshot

, . , Visa Money Transfer MasterCard MoneySend. ( iPay), O!pp — -, P2P- Visa Mastercard . :

- . . . 3DSecure. - sms, .. 50% .

- . ., ., , , . .

Registration on the site runs smoothly and fairly quickly, then you need to fill out a form with company details and upload scans of documents. The stated period for consideration of the application - 5 days. And then surprises await ... Every time you update the page or new login, the service asks you to fill in the questionnaire again, without giving out any errors and recommendations. The questionnaire is completely filled, all necessary documents are uploaded. After 5 and even after 20 days, the same picture is observed, even after the call to the support. No letters or calls from service experts with questions like “how are you?” Or “how to help?”. As a result, it was not possible to register in the system and start working:

- , — . pay-me.ru , :

findings

Pay-Me — , ., . , .

Pay-Me:

- . , , .

- - — 1.600 .

- not suitable for micropayments . Commission service 2.75%, but not less than 10 rubles. per transaction. This means that payments with a check of less than 360 rubles. will be unprofitable.

- conflicting requirements for the current account . There is a possibility that it should be opened strictly in Alfa-Bank.

- unavailability of terminals is an obstacle to start. You can buy only at the offices of Beeline in Moscow

- limited service for individuals . In fact, this is a transfer from card to card, but not acquiring.

Advantages of Pay-Me:

- recognition of the Beeline and Alfa-Bank brands , due to which high loyalty and trust of cardholders can be achieved.

- a high degree of trust in Alfa-Bank as the most technologically advanced bank in Russia.

- .

- - , Visa Money Transfer MasterCard MoneySend.

- , 2013 . - - -.

Life Pay, Sum Up, ibox

These services will be discussed more briefly with an emphasis on the advantages and disadvantages. Primary registration was made in each of them, but it did not go further. Information for review is taken from their sites, in the course of correspondence with company representatives and from other public sources. If someone from the public is ready to conduct independent testing or to add information - he is ready to discuss and comment in the comments.

Life Pay - life-pay.ru

— « », «», : , - , , . . % (2.7%), - .

— « », «», : , - , , . . % (2.7%), - .. . . . . . .

— « . ?» , :

- .

- .

- (, , , «» / ..).

- — .

- ( -) .

Life Pay:

- — « » 350 .

Life Pay:

- . Wellpay, , ChronoPay Rambler. . TO-30 . PCI DSS. , Chronopay .

- .

- .

- .

- , , -.

Sum Up — ru.sumup.com

— , 12 . « », . -, % (2.75%). . — .

— , 12 . « », . -, % (2.75%). . — .Sum Up : , - . GetTaxi.

Sum Up:

- The average degree of trust in the company . The reputation of the bank is deteriorating against the background of the constant deterioration of tariffs for major products, including premium. Since the end of 2012, the policy of the Bank "Svyaznoy" implies an active "hardening of dough". The project was launched with “small investments” and according to the “make it work” principle. So far, there are no objective guarantees that it will develop in the long term.

- paid and not automated registration . After pre-registration on the site, the manager communicates by email - sends document templates and an invoice for payment of the terminal. After paying the bill and sending the signed scans of documents, we are ready to continue the communication. In the near future, Svyaznoy Bank plans to distribute terminals through bank branches and communication salons.

Advantages of Sum Up:

- «» — , -20 3.000 ( 05.2013). .

- .

- Sum Up. API , Sum Up - . , - ( CEO Sum UP Russia 22.05.2013).

- convenient mobile apps for iOs for both iPhone and iPad, adapted for retail - with a catalog of goods and a shopping basket.

ibox - i-box.ru

- Investbank project. Focuses on business - legal entities and entrepreneurs. They offer an average market% commission (2.75%) and mini-terminals for 450 rubles. Pay to the account in any bank. Manual Registration.

- Investbank project. Focuses on business - legal entities and entrepreneurs. They offer an average market% commission (2.75%) and mini-terminals for 450 rubles. Pay to the account in any bank. Manual Registration.Information about the project is quite small. Company details on the site there. Groups in social networks are empty. Domain is registered on the person.

email. ( ), :

, « ibox» — Pay-Me , , - .

— . Those. - . , — .

i-box:

- . - , , -100 . Visa. , ., facebook , i-box.

- judging by all the development of the service is frozen . The announcement of the imminent release of a mobile application for Windows Phone is dated April 2013, at the moment the application is not released, according to information from the site - is expected soon.

- paid terminals - 450 rubles.

Advantages of i-box:

- Only digital terminals are used .

- accept Maestro cards .

Mobile Acquiring Trends

In the process of writing an article and studying the mobile acquiring market, I managed to reread quite a lot of information. I do not pretend to be an expert, but I will try to give some of the most obvious and reasonable predictions.

Why mobile acquiring benefits everyone

- . .

- . — . - — % , , .

- , , . , , , ..

2012 — , , , , — :- 300.000 . ( 2015 .).

- - 60 ( 2014 .).

- 20 35 ( ) .

- : , . klerk.ru , : (35%), UCS (25%), (6%), (4%), (4%). 600 -, 26%.

- . — , .

. , , .

- —

- - . , Android, . .

- - . , , , -. — , , - :) pin-, :(

, emv-. , pin-. — , pin- — .

, Visa Europe 2012 . -, . PCI PTS, . , emv-. - - - . . Square «», StarBucks . PayPal Chip&Pin , Bluetooth. Groupon - POS- Verifone. 15.000 chip&pin - — D200 PAX Technologies, , 165 ., iF Design Award 2013:

-, , . , , — Chip&Pin, -. - . , . , , , Visa Mastercard. . - - . , — .

, iZettle Visa Visa Ready, — -, . , " The Service — all the tools you need to start, run and improve your business":- -, Chip&Pin iPad.

- .

- , .

- — , CRM (/), .

- % 2.75% 1.5% £15.

— - — . , ( ) . - . - - . . — . , , .. NFC (Near Field Communication). NFC-, . .

— , default city. POS- - Visa Paywave Mastercard Paypass. -, . i-Free NFC- , () , .NFC- -.

: ,

#1 —

- officially registered companies and individual entrepreneurs who want to accept cards for payment using mobile terminals:

- Smartphones will be needed . If there is - this is good. If not - can be purchased, ranging from 2600 rubles. :

- Apple iPhone 4 or higher

- Android 4.x smartphone with support for 3G, WiFi, GPS (A-GPS) and mini-jack 3.5mm audio output.

- Prepare a standard package of documents - scans in pdf or jpg:

- certificates of INN and OGRN (tax registration and state registration),

- director's passport

- certificate from the bank or agreement on opening a current account,

- photo manager (not from the passport).

- Choose between 2can and Life Pay , or sign up for both at once.

- 200% , , . . , % .

- , . — .

- : 1 . 20%. , made in China, . .

- , . — . :

- : 16 , , 5 , Visa Mastercard, .

- , : , , ( ). . .

- .

- . «». , . — ok, — .

- sms.

- , :

- email- , email.

- - : .

- .

- 3 .

- , . : , . , , klerk.ru , .

- , . 2.75% ? ? : — , . — « Visa / Mastercard».

- Do not focus on mobile acquiring . If there is an office and customers go there, install a fixed terminal. If there is a site and through it you can sell - tie the card acceptance on the site. Choose banks from the TOP-100 or well-known payment systems with PCI DSS certificate.

Instruction # 2 - for individuals

- individuals who are only planning to become entrepreneurs, but are already ready to test accepting card payments:

- Do not rush to regat IP or LLC , open an account in the bank and keep accounts. For the first transaction, this is not necessary. Moreover, it is legal if you are not engaged in an activity that is licensed or contrary to the laws of the Russian Federation. Listen less and use common sense more.

- iPay .

- , , — .

, . «!», , !

Source: https://habr.com/ru/post/191196/

All Articles