Why it is worth taking loans

Hi, Habr!

Hi, Habr!Yesterday's my article ( clearly on why I do not take loans ) caused a very strong reaction, maybe even hurt someone, then I apologize. Mainly, they pointed out to me an error that the cost of renting an apartment is not taken into account while Vasya saves the necessary amount on the deposit. Well, sensible remark, I hasten to correct my mistakes (after all, the one who does nothing is not mistaken, isn’t he?).

At the end of the bonus - an online calculator with graphs,

We supplement the task

I present to you Petya. He is also a programmer, but unlike Vasya, a more literate person - he tried to save something before getting married. By the time the issue of housing was raised, he had accumulated A rub. But in contrast to Vasya, Petya does not have the opportunity to live somewhere (

')

Comment

Despite the fact that here we tried to equalize the conditions for deposit and credit, the conditions still remain unequal. Because in spite of the fact that with a deposit + lease and with a loan, Petit has an apartment from the very beginning, at the end of the term of the deposit, Petit’s deposit will have a newer apartment than a 'loan' one. And considering that apartments also have “expiration dates”, then if you put aside financial issues, the result of the contribution will be more profitable than a loan, in terms of an old apartment. That is, depreciation must also be borne in mind.

In this task, we consider a loan with a fixed amount of payments (annuity loan). We also consider the fact that in the case of a contribution, Peter makes a fixed monthly installment, the same as if he had paid a loan.

In addition, despite the expansion of the task, much in it is not calculated, with what you can face in real life. No one is immune from a sharp rise in prices, a change in interest rates, the loss of a good source of salary and other life circumstances. As they say - “you cannot foresee everything”. In our life it is, unfortunately, so.

Decision

Detailed solution

We introduce the same coefficients as in the problem about Vasya - f , g , h .

In the case of a deposit, Peter will pay the rent every month:

Then he will be able to replenish the deposit every month for the amount of:

Consider how the deposit amount will change at the end of each month:

In the case of a loan, we need to take a smaller amount: S - A. Otherwise, everything is solved just like in the problem “about Vasya”. That is, we have a system:

Where do we find m :

In the case of a deposit, Peter will pay the rent every month:

Then he will be able to replenish the deposit every month for the amount of:

Consider how the deposit amount will change at the end of each month:

In the case of a loan, we need to take a smaller amount: S - A. Otherwise, everything is solved just like in the problem “about Vasya”. That is, we have a system:

Where do we find m :

From here we can build a graph of the function:

Example 1

Consider the same examples as with Vasya.

Deposit interest: F = 10% per annum.

Loan interest: G = 12.5% per annum.

Inflation rate: H = 8.7% per annum (taken as the average for 2008-2012)

Petya can afford to allocate B = 40000 rubles per month.

Peter really wants to buy an apartment worth S = 2,733,000 rubles.

Peter has an initial amount of A = 400,000 rubles.

Rental rate K = 0.5%

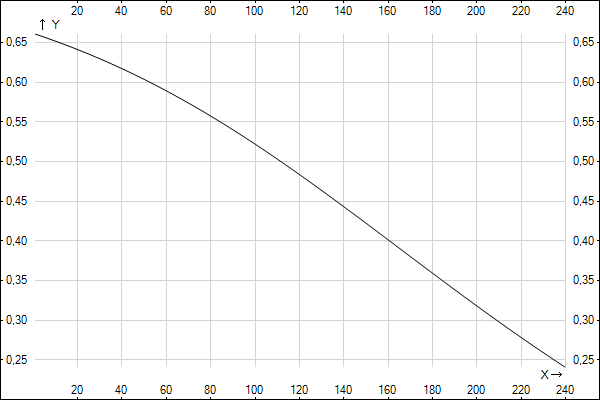

Here, as we see, the situation turned upside down, compared to the story about Vasya. Making a contribution is not profitable, and, the longer the term, the longer.

Example 2

Imagine that Peter became deputy director, and began to postpone at B = 80,000 rubles.

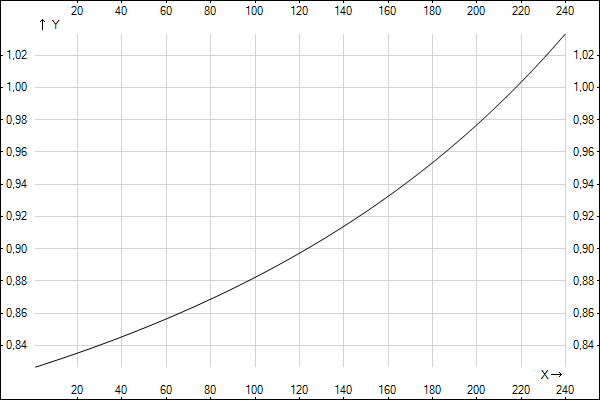

Here profitability varies depending on the period. In this situation, one might think how to do better.

Example 3

Consider the first example, but change only the size of inflation:

Inflation rate: H = 11% per annum

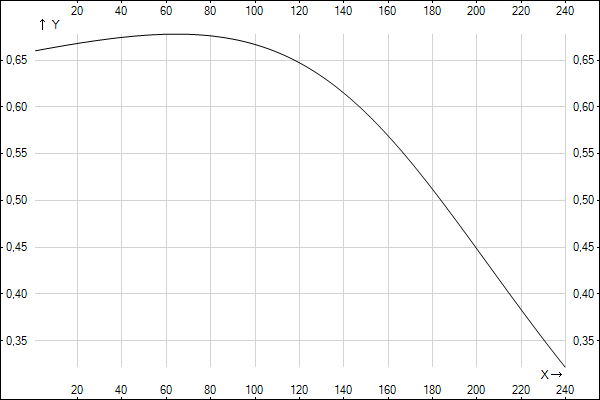

Here the results differ little from the first example, with the only difference that the loss from the contribution is even greater.

Example 4

Consider another realistic example, modern consumer credit. Data as in example 1, but change the interest rate on the loan:

Deposit interest: F = 10% per annum.

Loan interest: G = 20% per annum.

Inflation rate: H = 8.7% per annum.

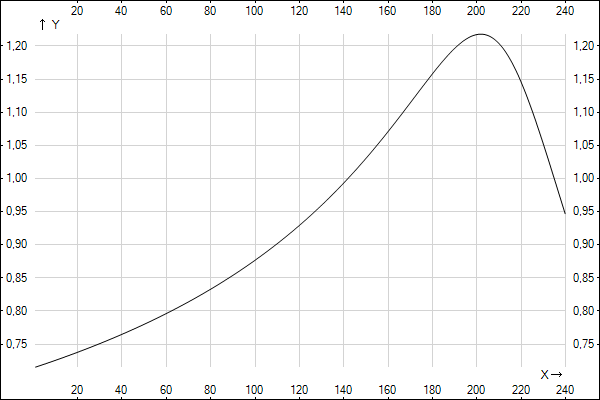

Here the graph is more interesting, because with time the difference decreases insignificantly, but then the profitability of the contribution still drops. Although here the decisive role may be played by the amount of monthly replenishment.

Example 5

Consider the previous example, but Vasya can postpone for B = 48,000 rubles.

Here the profitability of the contribution begins with n = 145 sharply increases to n = 200, and then also drops sharply.

Conclusion

As we see, in a situation when a thing is needed now, in most cases it is more profitable to take a loan, because the rental price greatly reduces the effectiveness of the contribution. Although much, of course, depends on the parameters. Just for the occasion, I wrote an online calculator where you yourself can set the necessary parameters, and see the profitability of one or another way of purchasing housing.

Online calculator / Mirror ( Download to computer )

Upd .: a little updated calculator, instead of the coefficient, now you can enter the actual rental amount in rubles (indexation is still taken into account).

Source: https://habr.com/ru/post/190170/

All Articles