Vividly about why I do not take loans

A loan is when a bank robs you and you still pay it for it.

A loan is when a bank robs you and you still pay it for it. The fireman Sidorov was inactive: the bank was burning - the loan was extinguished.

Hi, Habr!

Many of you have probably heard such jokes about loans and mortgages more than once. Some, probably, have repeatedly used calculators of deposits and loans, and evaluated the profitability of one or another method of accumulating money. I also recently became interested in this topic, and approached this problem mathematically.

')

Formulation of the problem

Programmer Vasya has a stable job and salary. All this time he led a carefree life, and did not think about savings, but recently Vasya got married and began to think about his own home. He thought, and decided that he could steadily postpone B rubles. per month. Now the apartment is worth S rub. The country has stable inflation H %. The interest on the deposit - F %, and the loan G %. Contribution with capitalization once a month.

Characters are fictional, all coincidences are random.

To find

What is the best way for Vasya to save money in a bank or get a loan? How much more profitable?

Restrictions

The task does not take into account various other circumstances. For example, the need to pay for a rental apartment, for the period of accumulation, about the possibility of indexation with wage inflation, and therefore payments. Also, changes in inflation and interest rates, commissions are not taken into account. The questions about the reliability of banks and other life circumstances are left aside.

Decision

Since Vasya has a fixed amount of replenishment, we can consider the profitability of one or another way of acquiring housing, finding the number of months that he will have to allocate this amount, before full payment of the amount of housing.

Detailed solution

Let be:

n is the number of months for which Vasya will save on housing.

m is the number of months that Vasya will repay the loan.

Then from the ratio m / n we will be able to judge the profitability of a particular method m / n times.

We introduce the coefficients:

Consider how the deposit amount will change at the end of each month:

Using the formula:

find that the amount at the end of the term will be equal to:

But for the n-months the apartment managed to rise in price due to inflation. Find its value:

Total:

In the case of a loan, the formulas will be similar, with the only difference that money loses value, and the interest on the loan compensates for this:

From the above two formulas, we deduce that:

n is the number of months for which Vasya will save on housing.

m is the number of months that Vasya will repay the loan.

Then from the ratio m / n we will be able to judge the profitability of a particular method m / n times.

We introduce the coefficients:

f = 1 + f / (100 * 12)These are the monthly multiplication / loss coefficients of the deposit / value / value.

g = 1 - G / (100 * 12)

h = 1 + H / (100 * 12)

Consider how the deposit amount will change at the end of each month:

Using the formula:

find that the amount at the end of the term will be equal to:

But for the n-months the apartment managed to rise in price due to inflation. Find its value:

Total:

In the case of a loan, the formulas will be similar, with the only difference that money loses value, and the interest on the loan compensates for this:

From the above two formulas, we deduce that:

Thus, we derived a general formula for the profitability of a deposit / loan, depending on their timing:

Example 1 - Liberal

I took the following real numbers as an example:

Deposit interest: F = 10% per annum.

Loan interest: G = 12.5% per annum.

Inflation rate: H = 8.7% per annum (taken as the average for 2008-2012)

Vasya can afford to allocate B = 40000 rubles per month.

Vasya really wants to buy an apartment worth S = 2,733,000 rubles.

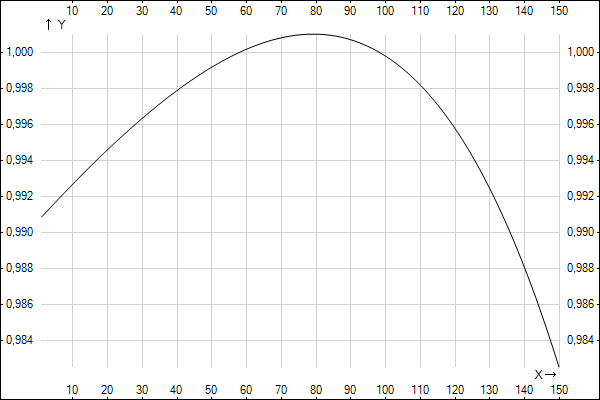

The result was such a graph (thanks to the service yotx.ru) :

As you can see, it is logical that the less the term of the deposit / loan, the smaller the difference between them. In addition, the graph has an asymptote, with the value n = 140. This suggests that by any means you cannot repay a loan for the same amount, the same amount of monthly payment, as if Vasya had postponed the deposit. That is, this is the limit of crediting, and therefore Vasya can accumulate the required amount only by deposit.

For example, if Vasya takes a loan of 2,733,000 rubles. for 10 years (120 months), he will need to pay just 40,000 rubles each. By bank deposit, he will accumulate the required amount taking into account inflation (5,160,834 rubles) for 88 months. Total 120/88 = 1.36, which fits with the schedule.

Take a loan amount, more than 3 833 000 rubles. (this price in 140 months will turn into 10,538,000 rubles due to inflation, it is this amount that will be in the account by that time) Vasya cannot afford, since with the same amount of monthly payments it is impossible to repay the loan, however He did not stretch the time.

Example 2 - Exotic

Consider the same example, but change only the size of inflation:

Inflation rate: H = 11% per annum

It is worth noting that this option is unlikely, since usually the interest rate on deposits is always higher than the rate of inflation. Although not always.

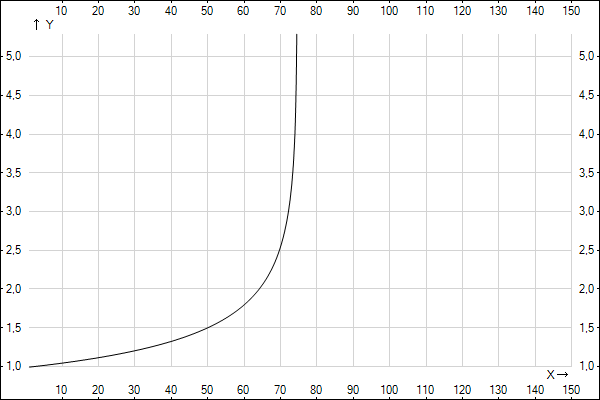

We get the schedule:

Here we get an interesting situation when the deposit is profitable only in the interval of ~ 58-97 months, in all other cases it is more profitable to take a loan.

For example, Vasya will take the same 2,733,000 rubles. on credit. With a bank deposit, he will accumulate the required amount taking into account inflation (8,169,345 rubles) for practically the same 120 months.

Example 3 - Predatory

Consider another realistic example, modern consumer credit. Data as in example 1, but change the interest rate on the loan:

Deposit interest: F = 10% per annum.

Loan interest: G = 20% per annum.

Inflation rate: H = 8.7% per annum.

As we see, Vasya is already harder here, since it becomes very expensive to take a loan on such conditions for more than 6 years compared to a deposit. And the credit limit for Vasya is much less - 2,400,000, that is, Vasya can no longer buy the desired apartment, even for 50 years

Conclusion

So, is it worth taking loans? Of course, you decide. Loans have an advantage - you get what you want now, therefore, you can already use your new apartment and not wait 10 years, so even 1.5x-2x overpayment is not so bad in this case, especially if you have to pay rent for someone else apartment all the time. On the other hand, in our life there are no guarantees that the conditions of the problem will be stable as in the examples, and the main thing here is not to go beyond the asymptote, otherwise the loan will be simply an unbearable burden.

And finally, a survey on the topic.

UPDATE

Continuation of calculations, in view of rent + calculator.

Source: https://habr.com/ru/post/190056/

All Articles