Lenovo: the third (or fourth) place in the smartphone market

Last week, several analytic companies immediately published the results of their research concerning the global smartphone market in the second quarter of 2013.

Perhaps the most curious moment that has found a place in the IDC and Canalys reports is the position of Lenovo. Both offices reported that henceforth the specified Chinese manufacturer (though not quite the manufacturer - Lenovo does not have its factories for assembling smartphones, the devices are manufactured according to a contractual scheme) is among the five largest smartphone suppliers in the world. For the first time in its history.

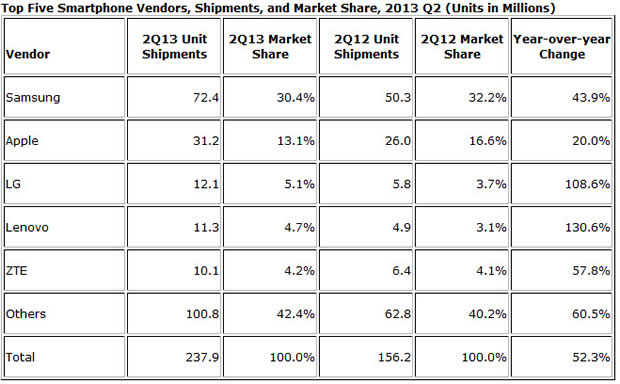

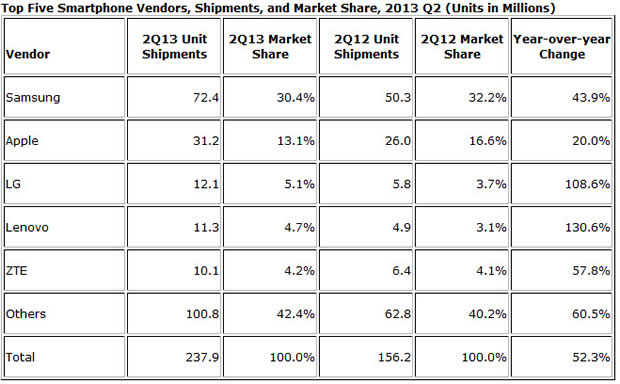

Further more interesting. Here is a label compiled by IDC:

')

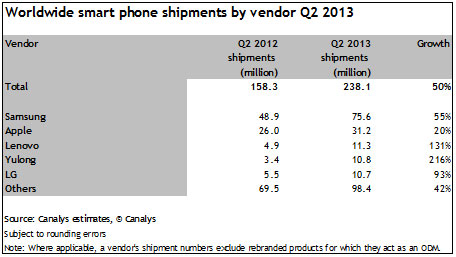

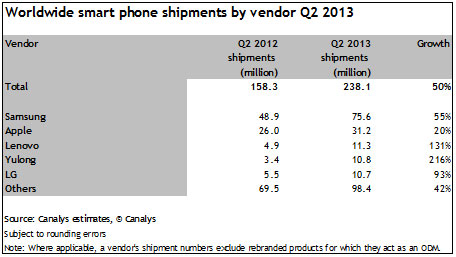

But her "sister", published by Canalys:

It is easy to see that the sales volumes of Samsung and Apple are comparable in both reports, but the LG data differ significantly. The number of handsets sold by Lenovo is the same, but because of differences in the estimates of LG's shipments, IDC put Lenovo in fourth place, while Canalys ranked third. At the same time, the top 5 suppliers according to Canalys did not include ZTE, which ranked fifth in IDC.

Anyway, Lenovo is really in the lead. True, leadership is, in fact, limited to the native PRC, where Lenovo is second with 12.3%. (The first is that Samsung has with 17.6%.) It is easy to calculate that Lenovo sells about 95% of its smartphones in the Chinese market. In fact, in addition to the PRC, Lenovo models are sold only in Russia and another pair of countries with a distribution model of sales. Meanwhile, operator markets such as Japan, Europe and the most desirable US Lenovo are not yet subject to, there you need to be able to work with telecommunication companies (read - local operators), and Lenovo does not have such experience. But in China everything is simpler: the giant China Mobile relies on cheap smartphones that support TD-SCDMA networks (this is 3G, if someone does not know), and cooperates with Lenovo with pleasure. And with Yulong too. (The only question is why IDC did not pay attention to this brand, since it is so big and significant.)

In general, entry-level smartphones are the backbone of the Lenovo lineup. According to the characteristics, they differ little from the products of local Russian brands - MediaTek's kingdom, two SIM-cards and stuff like that. There are, of course, more curious solutions - like the Lenovo IdeaPhone K900 with an Intel Atom processor, a metal case and a Full HD screen. True, according to eyewitnesses (are there any lucky owners here?), This model was created under the leadership of Intel, and was created, let's say, in a hurry: they stuffed all the best on the market, and only the “glue” was picked. Read - like a top-end kit, but difficult to use. Because, again, Lenovo has no experience in creating top-class solutions.

By the way, a curious story is connected with the Lenovo mobile division. In 2008, the company sold its phone division of Lenovo Mobile Communication Technology to a group of investors led by Hony Capital. The new owners for the year released a number of models under the Lenovo brand, and in December of 2009, Lenovo, which decided to re-engage in the production of communications, bought the unit back. On the Chinese site Lenovo Mobile for a long time, dozens of purely Chinese “clone” phones hung (some resembled Samsung models, others copied Sony Ericsson devices), and then Lenovo SUDDENLY took up smartphones. I mean, while Lenovo’s serious approach to telecom, with all due respect for it (and it is, and not imaginary at all), is still missing. It is “grown” for years, if not decades.

And finally, I will say the following: Canalys argue that the top five largest Chinese “smartphone” brands - Lenovo, Yulong, Huawei, ZTE and Xiaomi - in total control 20% of the global smartphone market. A year earlier, it was 15%. It is terrible to imagine what will happen in 2014 ...

Perhaps the most curious moment that has found a place in the IDC and Canalys reports is the position of Lenovo. Both offices reported that henceforth the specified Chinese manufacturer (though not quite the manufacturer - Lenovo does not have its factories for assembling smartphones, the devices are manufactured according to a contractual scheme) is among the five largest smartphone suppliers in the world. For the first time in its history.

Further more interesting. Here is a label compiled by IDC:

')

But her "sister", published by Canalys:

It is easy to see that the sales volumes of Samsung and Apple are comparable in both reports, but the LG data differ significantly. The number of handsets sold by Lenovo is the same, but because of differences in the estimates of LG's shipments, IDC put Lenovo in fourth place, while Canalys ranked third. At the same time, the top 5 suppliers according to Canalys did not include ZTE, which ranked fifth in IDC.

Anyway, Lenovo is really in the lead. True, leadership is, in fact, limited to the native PRC, where Lenovo is second with 12.3%. (The first is that Samsung has with 17.6%.) It is easy to calculate that Lenovo sells about 95% of its smartphones in the Chinese market. In fact, in addition to the PRC, Lenovo models are sold only in Russia and another pair of countries with a distribution model of sales. Meanwhile, operator markets such as Japan, Europe and the most desirable US Lenovo are not yet subject to, there you need to be able to work with telecommunication companies (read - local operators), and Lenovo does not have such experience. But in China everything is simpler: the giant China Mobile relies on cheap smartphones that support TD-SCDMA networks (this is 3G, if someone does not know), and cooperates with Lenovo with pleasure. And with Yulong too. (The only question is why IDC did not pay attention to this brand, since it is so big and significant.)

In general, entry-level smartphones are the backbone of the Lenovo lineup. According to the characteristics, they differ little from the products of local Russian brands - MediaTek's kingdom, two SIM-cards and stuff like that. There are, of course, more curious solutions - like the Lenovo IdeaPhone K900 with an Intel Atom processor, a metal case and a Full HD screen. True, according to eyewitnesses (are there any lucky owners here?), This model was created under the leadership of Intel, and was created, let's say, in a hurry: they stuffed all the best on the market, and only the “glue” was picked. Read - like a top-end kit, but difficult to use. Because, again, Lenovo has no experience in creating top-class solutions.

By the way, a curious story is connected with the Lenovo mobile division. In 2008, the company sold its phone division of Lenovo Mobile Communication Technology to a group of investors led by Hony Capital. The new owners for the year released a number of models under the Lenovo brand, and in December of 2009, Lenovo, which decided to re-engage in the production of communications, bought the unit back. On the Chinese site Lenovo Mobile for a long time, dozens of purely Chinese “clone” phones hung (some resembled Samsung models, others copied Sony Ericsson devices), and then Lenovo SUDDENLY took up smartphones. I mean, while Lenovo’s serious approach to telecom, with all due respect for it (and it is, and not imaginary at all), is still missing. It is “grown” for years, if not decades.

And finally, I will say the following: Canalys argue that the top five largest Chinese “smartphone” brands - Lenovo, Yulong, Huawei, ZTE and Xiaomi - in total control 20% of the global smartphone market. A year earlier, it was 15%. It is terrible to imagine what will happen in 2014 ...

Source: https://habr.com/ru/post/189534/

All Articles