Features of the gaming market in China - part 2

Many investors refuse to invest in gaming startups because of the nature of the gaming market - they are never sure whether the game will take off or not, whether you earn, return the investment or go negative. “The gaming industry is tied up with hits, this is not a business, this is good luck,” one often hears from IT investors and business angels.

Indeed, the market for games, or rather, the market for mobile casual games is developing rapidly and quickly, new types of gamers are emerging, the needs and desires of players are changing, the trends of game mechanics are moving. And yet, experienced developers and publishers get to understand the market, their user, to release new favorite hits (marketing budgets ... marketing budgets ... well, yes, not without them ...). But it is in the West ...

The Chinese market is lagging behind the western one (for example, kazualki are just coming into fashion, and this is in China, where young people document their every step on the social network!), But it seems that they are going to go through the evolutionary steps familiar to the Western world 2-3 times faster , missing something, evolving somewhere in a way ...

“The market is still evolving, the exit time is important, the speed of iterations is critical, development time is critical,” explains Allen Fu, head of Unity Technologies China, “platform holders know their users, see the statistics, they are interested in maximum monetization, they tell you that they need, and you are obliged to give it to them "tomorrow", otherwise they will turn to another. "

')

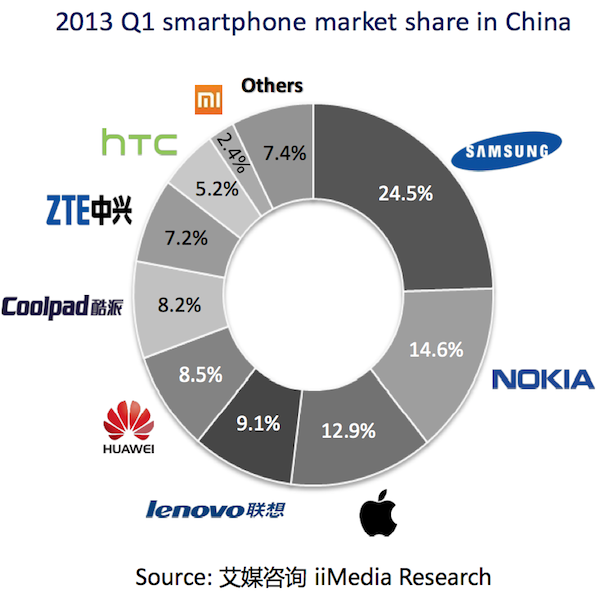

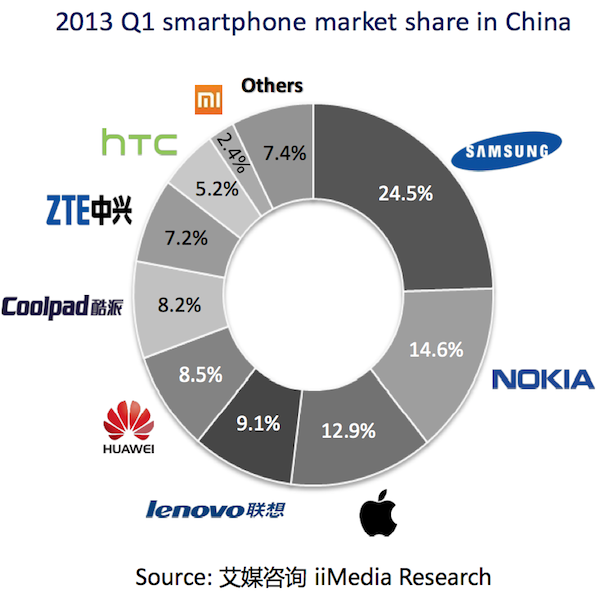

China is the territory of Android, operators believe in it, most gamers use Android devices. The share of iOS is 12.9% in the Chinese market, according to iiMedia Research, Android - 65%.

The next figure from the Chinese Internet Information Center - as of the end of 2012, more than 420 million devices with Internet access were registered in China. At the same time, 68% or about 286 million owners of these devices play games.

An important difference from the western market is that the share of Google Play and Apple AppStore together is only 16%, and almost 60% of alternative portals, such as 360.cn, 91.com and d.cn.

As a result, there are game content operators, game download platforms, game promotion platforms, mobile operators, device manufacturers, billing operators between the game developer and the user ... It becomes clear that you will have to play by special rules and generously share revenues from the game (about this next).

Because of the abundance of content and the universal practice of copying anything and everything, without feature and marketing, you should not hope for any success of your application. Even so: the release of the game in China, in principle, makes sense only if you enlist the support of a strong local player.

In Unity Games China we keep a constantly updated catalog of games that is available to our partners. Our internal team selects games on Unity that the Chinese user might like and shows them to their partner. If the partner likes the game, he puts forward a list of proposals for the adaptation of this game and the proposed marketing option.

Adaptation of the game, as a rule, includes a change in monetization (often radical), adding content relevant for China (panda and the temple!), Cutting the game down to a given size (all intro, extra animations, audio, textures are cruelly compressed, etc. .). Sometimes you have to remake the game to run on weak Android devices.

All this is done by the internal team of Unity Games China, sometimes with the support of the game developer. The process is important to complete within a few days after the operator’s invitation. We translate and transform a normal mobile game in 5-8 days. Days, friends, days, otherwise someone else will take your place in the operator's Hailait.

Examples from the recent past are Ballistic and Critter Escape. Localization, porting from iOS to Android and embedding the payment system took our team 6 days for Ballistic and 8 days for Critter Escape.

We recently entered into a contract with Qihoo 360 (www.360.cn, ~ 250 million users),

91 Mobile (www.91.com, ~ 200 million users) and China Mobile Games (g.10086.cn, ~ 80 million users), according to which a separate section of games on Unity - Unity Games Zone will appear in the app stores of these providers.

To be continued…

Features of the gaming market in China - part 1

Features of the gaming market in China - part 3

My blog is in English (including about China and ChinaJoy)

Indeed, the market for games, or rather, the market for mobile casual games is developing rapidly and quickly, new types of gamers are emerging, the needs and desires of players are changing, the trends of game mechanics are moving. And yet, experienced developers and publishers get to understand the market, their user, to release new favorite hits (marketing budgets ... marketing budgets ... well, yes, not without them ...). But it is in the West ...

The Chinese market is lagging behind the western one (for example, kazualki are just coming into fashion, and this is in China, where young people document their every step on the social network!), But it seems that they are going to go through the evolutionary steps familiar to the Western world 2-3 times faster , missing something, evolving somewhere in a way ...

“The market is still evolving, the exit time is important, the speed of iterations is critical, development time is critical,” explains Allen Fu, head of Unity Technologies China, “platform holders know their users, see the statistics, they are interested in maximum monetization, they tell you that they need, and you are obliged to give it to them "tomorrow", otherwise they will turn to another. "

')

China is the territory of Android, operators believe in it, most gamers use Android devices. The share of iOS is 12.9% in the Chinese market, according to iiMedia Research, Android - 65%.

The next figure from the Chinese Internet Information Center - as of the end of 2012, more than 420 million devices with Internet access were registered in China. At the same time, 68% or about 286 million owners of these devices play games.

An important difference from the western market is that the share of Google Play and Apple AppStore together is only 16%, and almost 60% of alternative portals, such as 360.cn, 91.com and d.cn.

As a result, there are game content operators, game download platforms, game promotion platforms, mobile operators, device manufacturers, billing operators between the game developer and the user ... It becomes clear that you will have to play by special rules and generously share revenues from the game (about this next).

Because of the abundance of content and the universal practice of copying anything and everything, without feature and marketing, you should not hope for any success of your application. Even so: the release of the game in China, in principle, makes sense only if you enlist the support of a strong local player.

In Unity Games China we keep a constantly updated catalog of games that is available to our partners. Our internal team selects games on Unity that the Chinese user might like and shows them to their partner. If the partner likes the game, he puts forward a list of proposals for the adaptation of this game and the proposed marketing option.

Adaptation of the game, as a rule, includes a change in monetization (often radical), adding content relevant for China (panda and the temple!), Cutting the game down to a given size (all intro, extra animations, audio, textures are cruelly compressed, etc. .). Sometimes you have to remake the game to run on weak Android devices.

All this is done by the internal team of Unity Games China, sometimes with the support of the game developer. The process is important to complete within a few days after the operator’s invitation. We translate and transform a normal mobile game in 5-8 days. Days, friends, days, otherwise someone else will take your place in the operator's Hailait.

Examples from the recent past are Ballistic and Critter Escape. Localization, porting from iOS to Android and embedding the payment system took our team 6 days for Ballistic and 8 days for Critter Escape.

We recently entered into a contract with Qihoo 360 (www.360.cn, ~ 250 million users),

91 Mobile (www.91.com, ~ 200 million users) and China Mobile Games (g.10086.cn, ~ 80 million users), according to which a separate section of games on Unity - Unity Games Zone will appear in the app stores of these providers.

To be continued…

Features of the gaming market in China - part 1

Features of the gaming market in China - part 3

My blog is in English (including about China and ChinaJoy)

Source: https://habr.com/ru/post/188776/

All Articles