China payment systems

Recently, I often have to work with payment systems in China. The Internet market is developing here by leaps and bounds, and, accordingly, it is necessary to understand what goes where and where.

Moreover, if before everything was only for the Chinese and residents of nearby territories (Hong Kong, Macao, Korea, Japan, Singapore, Thailand), now all companies are taking big steps towards foreigners. Many on Habré themselves live on the mainland or nearby, many buy something in China, so, I think, the post will be useful to many.

In the text there will be hieroglyphs (and where without them in a post about China), but I will always try to give an explanation and translation.

So, let's begin.

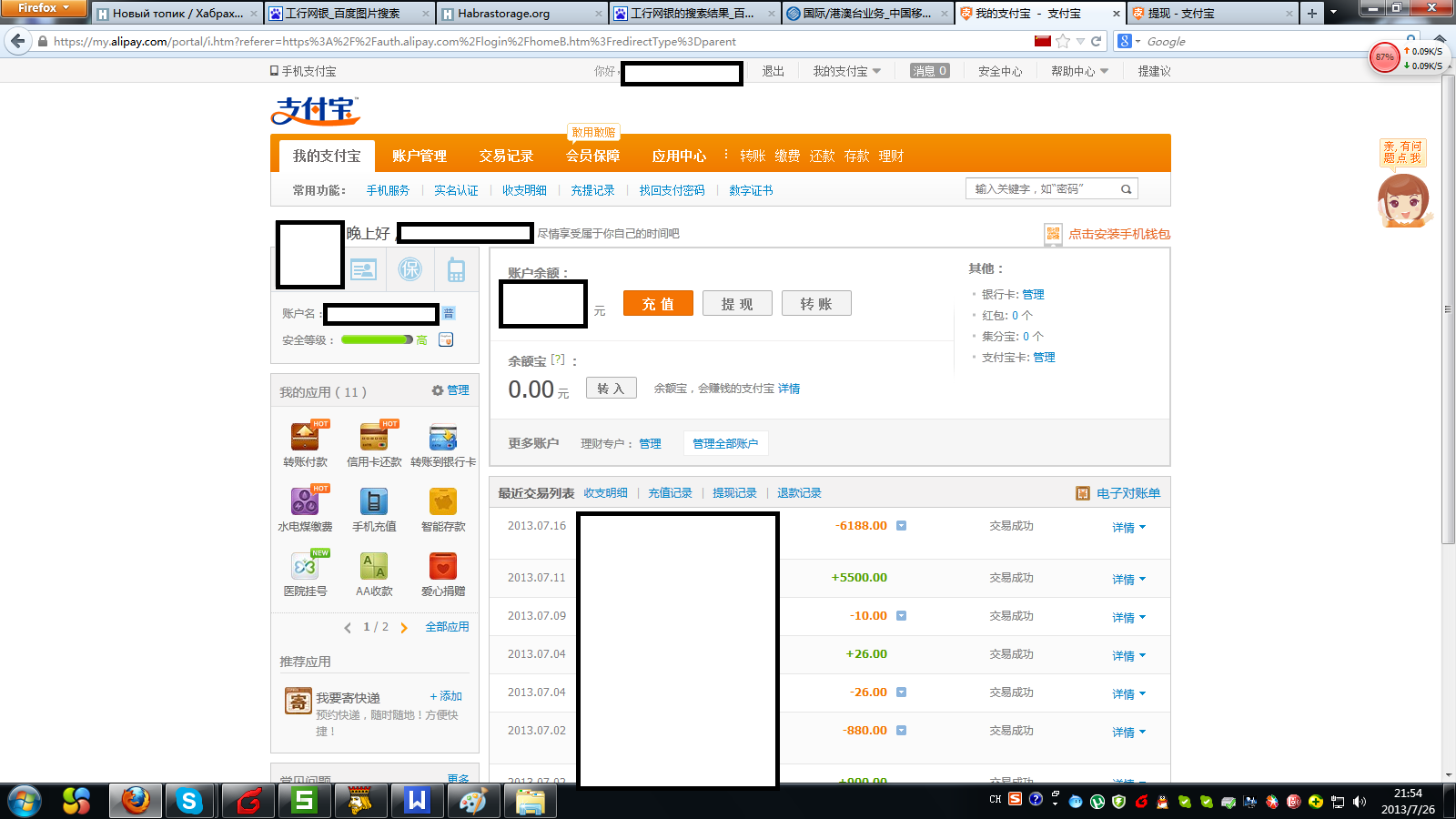

A few years ago it was difficult for a foreigner not to use any payment system, but in general, to open a current card account in a bank, now it is easy, how to send two bytes. Alipay - ahead of everyone. If five years ago, when communicating with the support service at the word "foreigner", they bulged eyes and gathered in crowds to look at it, then three years ago, to verify their account, they only needed a surety from a Chinese friend. A year ago (approximately) it became possible to verify on your own passport. So all go to meet you. It's simple.

But also difficult at the same time. As everyone knows, the yuan is not hard currency (hard currency). Therefore, no integration with international payment systems (with some exceptions) is not and is not planned. But first things first.

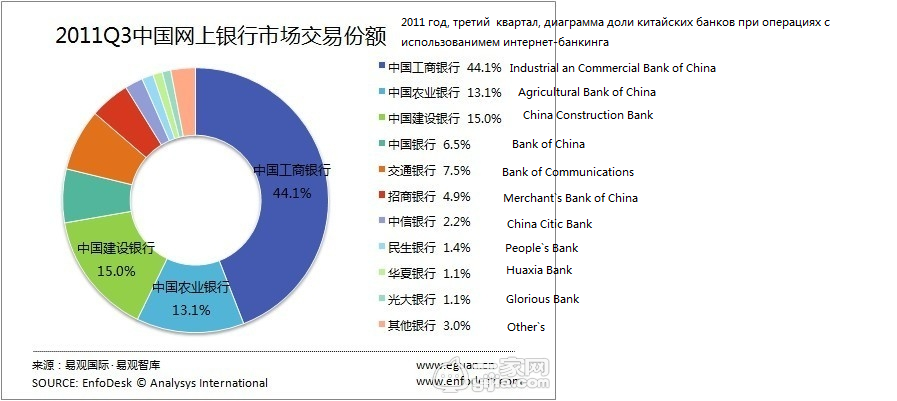

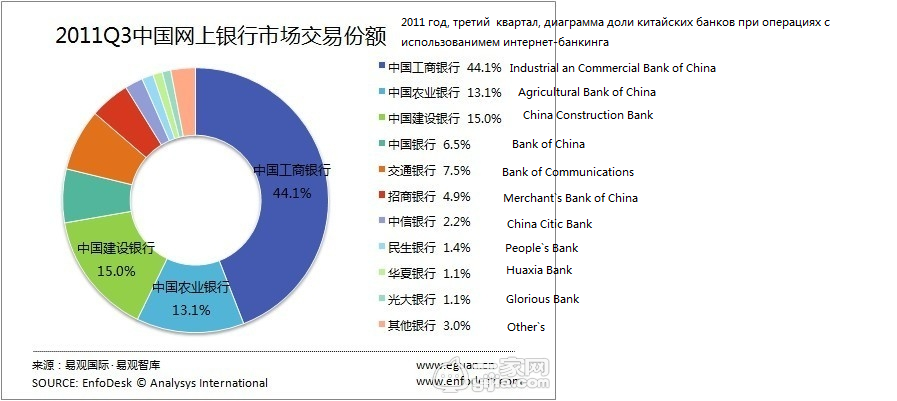

To begin with, the money is the easiest to enter and withdraw, having a bank account. There are other ways, but this one is the most convenient. First of all, you need to choose a bank, and our chart will help us in this.

As you can see, the lion's share otvel ICBC. No wonder. Almost the most progressive bank. He only has Internet banking in English, there is the possibility of transfers to foreign Visa and Mastercard, the largest number of functions, the largest selection of means for authorization (USB token, grid with passwords, SMS password, etc.). In general, an almost unequivocal choice if you choose a bank for yourself. If for a company, it is necessary to compare the rates for remittances and withdrawals, the adequacy of the security service when converting currency to yuan, etc. China Construction Bank is more convenient for me.

One of the most convenient authentication methods is USB token and SMS passwords. It is better to choose passwords via SMS, because 100% work with browsers other than IE and on systems other than Windows, while none of the banks can. Moreover, the roaming connection (for working with Internet banking abroad) takes an hour. And roaming rates (I have China Mobile) will pleasantly surprise you. 1 yuan = 1.25 UAH = 5.3 rubles.

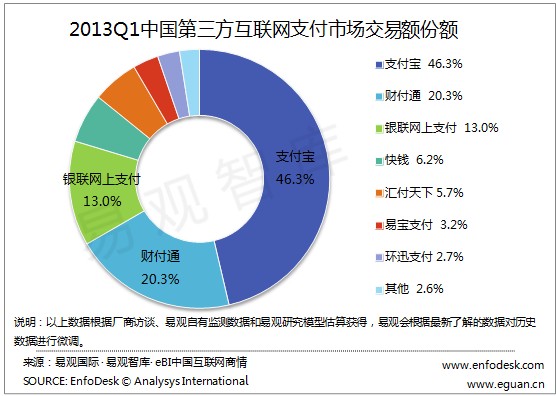

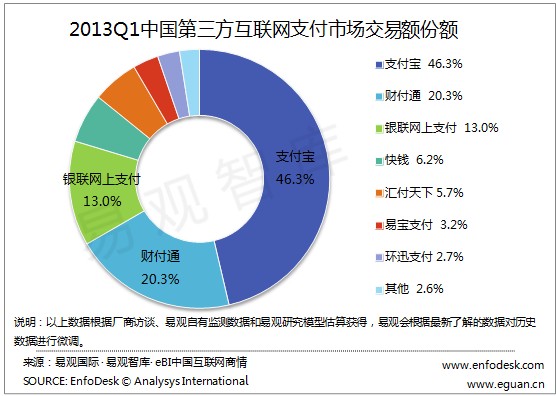

We now turn directly to the payment systems. And, again, a chart. There is no way to do without Chinese in the text ...

List (according to the chart):

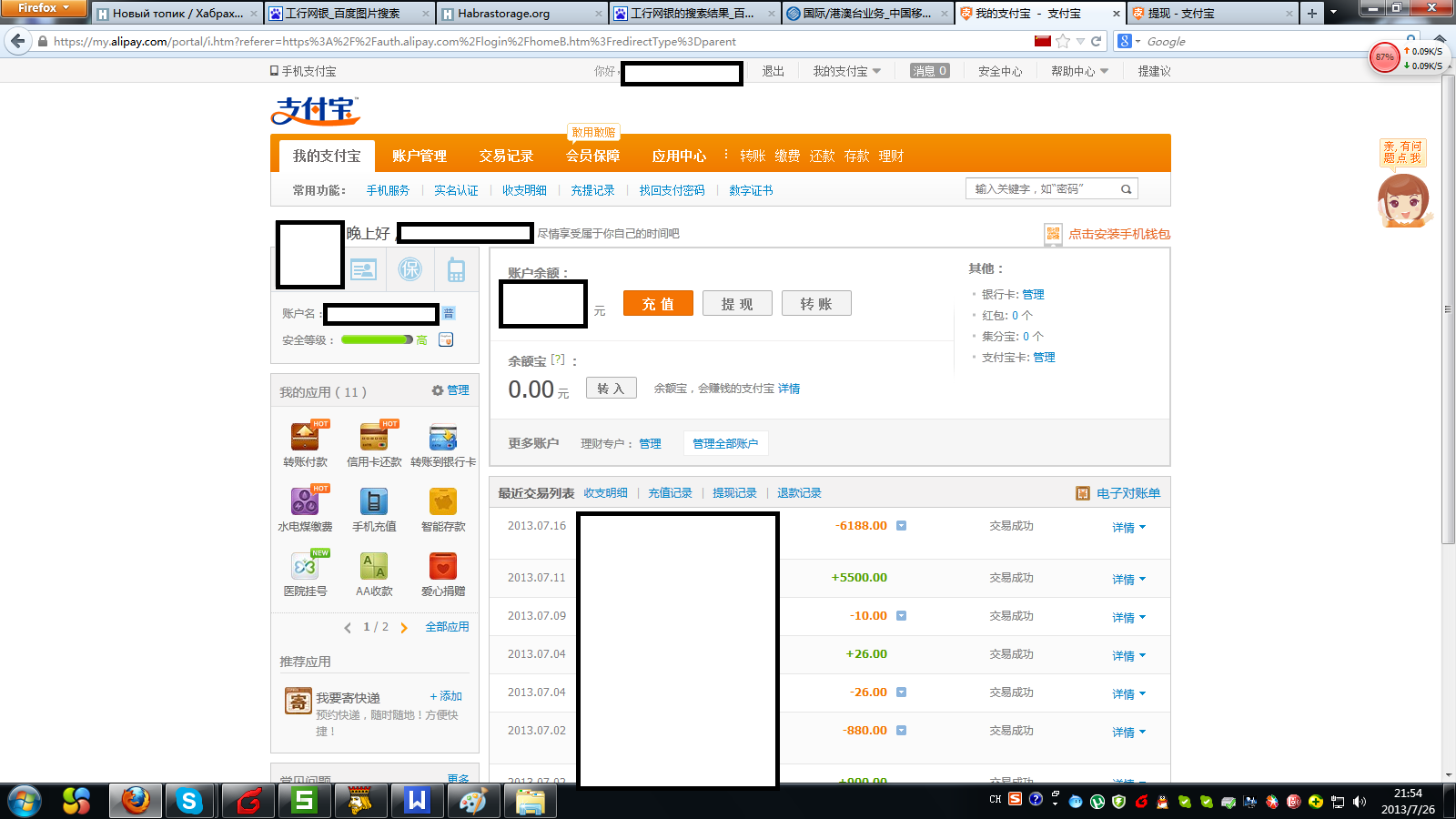

1) 支付 宝. Alipay.com Payment system giant holding Alibaba. 46.3 percent of the market. Convenience and rates are great. Registration and depositing money is free, withdrawal within one day is free, for two hours - 0.2 percent. Free limits - 1000 Yuan per month for newbies, 10,000 Yuan per day for verified users and 20,000 Yuan per month for VIP clients (who earned more than 1,500 points). It is accepted on any Chinese site, but, of course, its popularity is explained by the fact that it is possible to pay for purchases on Taobao only through it. There is, by the way, an international branch that allows you to accept payments in RMB and receive them into your foreign currency account.

2) 付 通. Tenpay.com The second most rated payment system. Another giant of the market, the company that owns it, also owns QQ online messenger (over a billion users). My acquaintance with her began and ended at the moment when I tried to register. She, B *** D, did not like ANYTHING of the entered data - neither the name (maximum four characters), nor the number of the shenfengchen (ID) - (or 15, or 18 digits), nor the existing card (at the moment there are problems with link with China Construction Bank). I spat, imagined jabbering with tech support and left, I don’t regret anything, it’s another thing if you’re an avid gamer and can’t live without browser-based toys or Chinese MMORPGs. Then you can not do without QQ-money, which means you will have to deal with them, look for familiar Chinese, etc. By the way, the one-to-one interface is lapped at Alipay, just go to their start pages.

3) 银联 网上 支付 - UnionPay Online Payments

4) 块钱 - 99bill

5) 汇 付 天下 - ChinaPNR - these three have never had to face

6) 首信 易 支付 - payEase. A payment aggregator that works only with legal entities, by the way, is the only way to pay for purchases in the Chinese Itunes Store and Appstore. Receiving, by the way, international payment cards.

The rest are very small, it makes no sense to consider them.

The process of buying and paying is simple, as elsewhere, it makes no sense to dwell on it. We select the goods, click on the “Pay” button, throws us to the website of the respective payment system, if there is enough money on it, pay, if not, select “Pay via online banking”, log in to the bank gateway, pay, profit.

Of course, the full functionality of all of the above is guaranteed only in Internet Explorer and only under Windows. Although progress in this plan is already there. Alipay has already released its Keeper for Linux in the form of * .deb package, Construction Bank announced support for Firefox (which, however, crashes when authorizing using a token), but then all the little things. The main thing is the beginning of the line, and everything else will follow.

As you can see, China's payment systems are as friendly and easy to use as possible.

ZY Of course, there are a lot of things left behind the cut, but I consider the process of creating a money transfer in pictures, limits and tariffs for receiving revenue for legal entities to be unnecessary. Who needs it - welcome to the drug with questions. Thanks for attention.

Moreover, if before everything was only for the Chinese and residents of nearby territories (Hong Kong, Macao, Korea, Japan, Singapore, Thailand), now all companies are taking big steps towards foreigners. Many on Habré themselves live on the mainland or nearby, many buy something in China, so, I think, the post will be useful to many.

In the text there will be hieroglyphs (and where without them in a post about China), but I will always try to give an explanation and translation.

So, let's begin.

A few years ago it was difficult for a foreigner not to use any payment system, but in general, to open a current card account in a bank, now it is easy, how to send two bytes. Alipay - ahead of everyone. If five years ago, when communicating with the support service at the word "foreigner", they bulged eyes and gathered in crowds to look at it, then three years ago, to verify their account, they only needed a surety from a Chinese friend. A year ago (approximately) it became possible to verify on your own passport. So all go to meet you. It's simple.

But also difficult at the same time. As everyone knows, the yuan is not hard currency (hard currency). Therefore, no integration with international payment systems (with some exceptions) is not and is not planned. But first things first.

To begin with, the money is the easiest to enter and withdraw, having a bank account. There are other ways, but this one is the most convenient. First of all, you need to choose a bank, and our chart will help us in this.

As you can see, the lion's share otvel ICBC. No wonder. Almost the most progressive bank. He only has Internet banking in English, there is the possibility of transfers to foreign Visa and Mastercard, the largest number of functions, the largest selection of means for authorization (USB token, grid with passwords, SMS password, etc.). In general, an almost unequivocal choice if you choose a bank for yourself. If for a company, it is necessary to compare the rates for remittances and withdrawals, the adequacy of the security service when converting currency to yuan, etc. China Construction Bank is more convenient for me.

One of the most convenient authentication methods is USB token and SMS passwords. It is better to choose passwords via SMS, because 100% work with browsers other than IE and on systems other than Windows, while none of the banks can. Moreover, the roaming connection (for working with Internet banking abroad) takes an hour. And roaming rates (I have China Mobile) will pleasantly surprise you. 1 yuan = 1.25 UAH = 5.3 rubles.

We now turn directly to the payment systems. And, again, a chart. There is no way to do without Chinese in the text ...

List (according to the chart):

1) 支付 宝. Alipay.com Payment system giant holding Alibaba. 46.3 percent of the market. Convenience and rates are great. Registration and depositing money is free, withdrawal within one day is free, for two hours - 0.2 percent. Free limits - 1000 Yuan per month for newbies, 10,000 Yuan per day for verified users and 20,000 Yuan per month for VIP clients (who earned more than 1,500 points). It is accepted on any Chinese site, but, of course, its popularity is explained by the fact that it is possible to pay for purchases on Taobao only through it. There is, by the way, an international branch that allows you to accept payments in RMB and receive them into your foreign currency account.

2) 付 通. Tenpay.com The second most rated payment system. Another giant of the market, the company that owns it, also owns QQ online messenger (over a billion users). My acquaintance with her began and ended at the moment when I tried to register. She, B *** D, did not like ANYTHING of the entered data - neither the name (maximum four characters), nor the number of the shenfengchen (ID) - (or 15, or 18 digits), nor the existing card (at the moment there are problems with link with China Construction Bank). I spat, imagined jabbering with tech support and left, I don’t regret anything, it’s another thing if you’re an avid gamer and can’t live without browser-based toys or Chinese MMORPGs. Then you can not do without QQ-money, which means you will have to deal with them, look for familiar Chinese, etc. By the way, the one-to-one interface is lapped at Alipay, just go to their start pages.

3) 银联 网上 支付 - UnionPay Online Payments

4) 块钱 - 99bill

5) 汇 付 天下 - ChinaPNR - these three have never had to face

6) 首信 易 支付 - payEase. A payment aggregator that works only with legal entities, by the way, is the only way to pay for purchases in the Chinese Itunes Store and Appstore. Receiving, by the way, international payment cards.

The rest are very small, it makes no sense to consider them.

The process of buying and paying is simple, as elsewhere, it makes no sense to dwell on it. We select the goods, click on the “Pay” button, throws us to the website of the respective payment system, if there is enough money on it, pay, if not, select “Pay via online banking”, log in to the bank gateway, pay, profit.

Of course, the full functionality of all of the above is guaranteed only in Internet Explorer and only under Windows. Although progress in this plan is already there. Alipay has already released its Keeper for Linux in the form of * .deb package, Construction Bank announced support for Firefox (which, however, crashes when authorizing using a token), but then all the little things. The main thing is the beginning of the line, and everything else will follow.

As you can see, China's payment systems are as friendly and easy to use as possible.

ZY Of course, there are a lot of things left behind the cut, but I consider the process of creating a money transfer in pictures, limits and tariffs for receiving revenue for legal entities to be unnecessary. Who needs it - welcome to the drug with questions. Thanks for attention.

')

Source: https://habr.com/ru/post/187964/

All Articles