Services of P2P money transfer from card to card Visa and Mastercard

Task: how to get money from another person here and now?

You provide services, but not an entrepreneur. You decided to sell something. You pay for everyone. You need to pay off credit card debt. Here is just a small list of those situations when you need to transfer money from one person to another.

You provide services, but not an entrepreneur. You decided to sell something. You pay for everyone. You need to pay off credit card debt. Here is just a small list of those situations when you need to transfer money from one person to another.In general, there are several options for transferring money: give it in cash, transfer it with electronic money, issue a payment via the Internet bank, make a transfer from a bank card to a Visa or Mastercard bank card. Each method is good in its own way, but the cards still rule!

It was interesting for me to review Russian services of P2P transfers via bank cards.

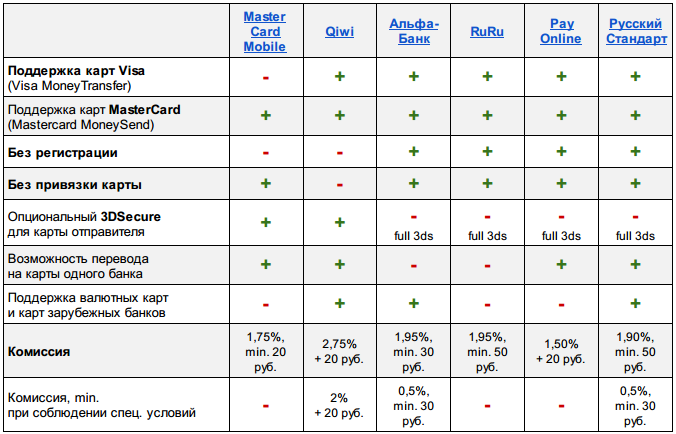

As of July 2013, 6 services were found to transfer money from card to card using Visa Money Transfer® and MasterCard MoneySend® technologies:

Under the cut you can find specific recommendations. I suggest the public to use, clarify and supplement.

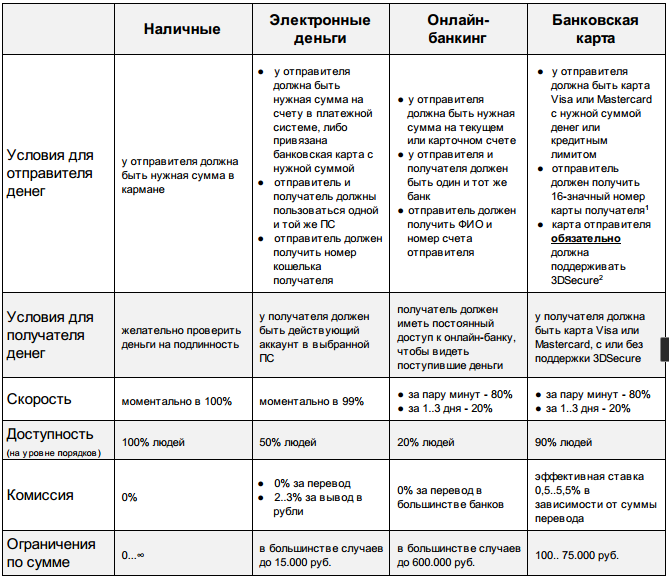

Comparison of methods: Cash, E-Money, Online Banking, Visa / Mastercard

')

About the card number ... The money sender needs to know the card number of the recipient in most card to card transfer services. The card numbers alone are not enough for the scammers to take over your money. But still, if you guess the month and year, in some cases you can make a transaction, and neither CVC, nor the first and last name, nor 3DSecure are needed. Therefore, it is not necessary to report the card number to everyone right and left and publish it in open access.

About 3D Secure (3DS) ... This is a well-known bank card protection technology - it involves confirming the operation by entering a code from an sms, a one-time code from a scratch card or a statement from an ATM, or a payment password. 3DS authentication equates to a digital signature - i.e. such a transaction is almost impossible to protest. Not all cards support 3DS, because technology for banks is worth the money. Here is an incomplete list of banks who support 3DS.

Some leading banks implement the service frankly bad. For example, VTB24 - to activate 3DS on the map - you have to go with your feet to the bank and write a statement. Or, for example, Sberbank — to get a list of codes — you need to take care of this in advance and print out an extract with 20 codes at an ATM. At least it was until recently.

According to experts, and personal experience, the normal support of 3DS is realized only in 50% of bank cards in Russia.

Cash is the easiest option. But what if there is no cash: not enough money, forgot the wallet, nowhere to exchange, the ATM is far away.

Electronic money is not universal enough. Suitable if both people use them, and with the same. If the e-money is different - there is a need to exchange them. It is getting harder and more expensive, and certainly not instant. And so the translation within a specific subscription is instantaneous, the transfer fees are minimal, or even zero at all. Cash withdrawal fees are still at the level of 2-3%.

Bank transfer is not fast. Online banking assumes that the sender and the recipient have an Internet bank in any of the banks. But even if this is the case, then this method can be regarded as instantaneous only if the sender and the recipient of the account are opened in the same bank. Otherwise, the transfer takes from 1 to 3 calendar days, the fees are different: from fixed 20 rubles without %%, to 3% of the amount.

A bank card as a means of payment is the most simple and straightforward. Cards have the maximum coverage and accessible to any person "from the crowd." Visa and MasterCard have come up with acquiring for a long time, but it is available only for companies (and entrepreneurs). For ordinary people - individuals - the technology of safe transfer of funds from one person’s card to another is implemented: MasterCard MoneySend and Visa MoneyTransfer (or Visa Personal Payments).

Comparison of services of P2P transfers from card to card

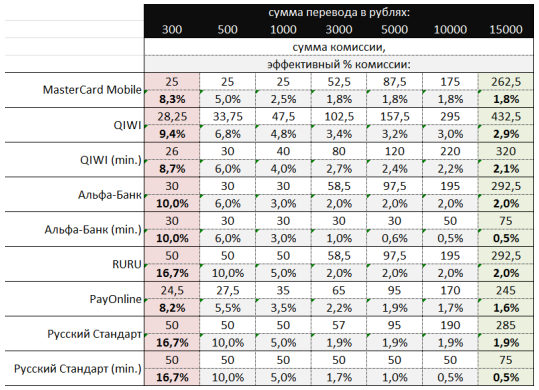

Comparison of service fees

I figured out how much the real commission will be when transferring 300, 500, 1.000, 3.000, 5.000, 10.000 and 15.000 rubles. Interesting numbers turned out: from 0.5% to 16.7%.

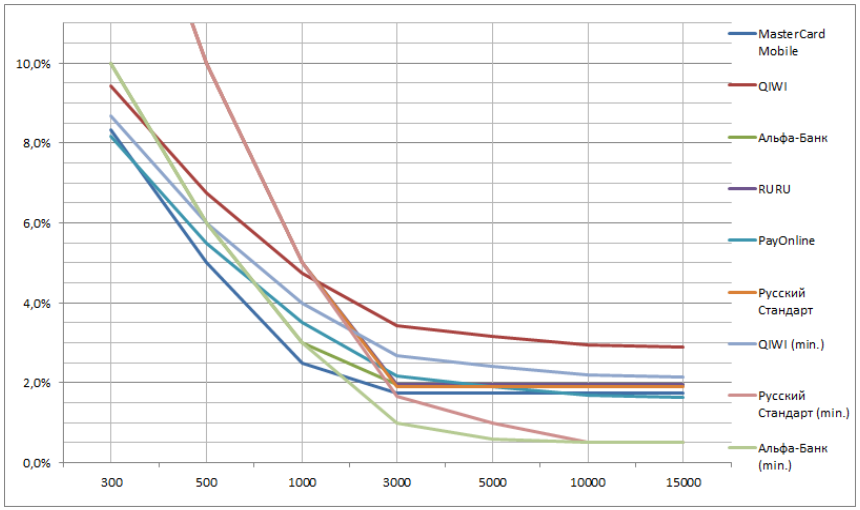

It's easier to see everything on the chart:

As I already wrote, some banks offer special conditions for transferring funds to their own cards (in the table and in the chart these are the “min” options). For example, Alfa Bank offers 0.5% + 30 rubles. instead of 1.95% + 30 rubles. for the translation. Bank "Russian Standard" offers 0.5% + 50 rubles. instead of 1.90% + 50 rubles. Agree, it is reasonable to use the services of those banks that face the customer.

Results

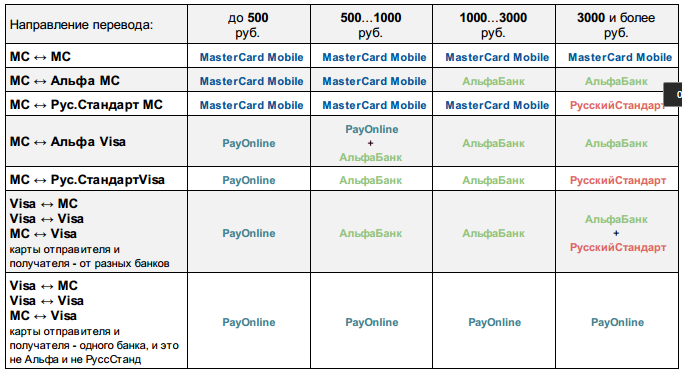

You can find the most favorable conditions in a given situation, knowing the amount of the transfer , the type of the sender and the recipient (Visa or Mastercard) and the bank that issued the recipient card .

- MasterCard Mobile is the most balanced service, but for transfer only between MasterCard cards of any banks. The sender needs to register with the service. The lowest commission when transferring amounts up to 1000 rubles. Strange as it may seem, the vaunted Visa system did not bother to launch anything like it for its cards (author's comment).

- PayOnline is the most universal service. The lowest transfer fee between Visa cards with an amount less than 500 rubles.

- Alfa-Bank is the lowest commission when transferring from any card to the Alfa-Bank card, starting from the sum of 1000 rubles.

- Russian Standard - the lowest commission when transferring from any card to the card of the Russian Standard, ranging from the amount of 3000 rubles.

- Qiwi - oddly enough, loses to everyone, with the amount of the transfer of more than 1000 rubles.

- RuRu and Russian Standard are the most greedy for transfers of less than 1000 rubles.

Who needs it and why?

In what situations can P2P transfer services be useful?

- You provide services . You are not an entrepreneur, you do not have a cash register or a pos-terminal with you, and you are also not ready to issue invoices and acts yet - all this is only in the near future. You are a freelancer, a remoter, or a hairdresser, a massage therapist - yes, anyone. You have done the work, you need to get money, here and now.

- You decided to sell something from the old trash. Placed an ad, a man comes, everything is OK, you - give your trash, a man - money. And all this must be done at the same time.

- You pay for the whole company . Relaxing in a bar or restaurant, in the end bring a single bill. Someone may not have the change or the required amount in cash. Others would like to pay by card. And it begins. As a result, the card is paid by one person, the others are thrown off in cash, and it would be nice to get money from the rest, too. there is a chance that they will not be seen again, or they will not forget about it on purpose.

- You urgently need to throw money . Situations are different, incl. and with our dear people. Sometimes there is simply no time to understand and search for the nearest WesternUnion or Contact either to the recipient or to the recipient.

- You need to pay off credit card debt . Sometimes it happens that you need to throw money to yourself. Soon the end of the month, and then you remember that you got into the credit limit. The most annoying thing is that it can be quite a bit, for example, the subscription fee for SMS messages has been written off. And that's all, if time does not replenish 50 rubles. - A negative credit rating is guaranteed for a long time.

Recommendations

1. Create two cards of two different banks. For example:

- Mastercard “MTS Debitovaya” card or “Bank in your pocket” from Russian Standard Bank. Is free.

- connect the “On-life” or “Basic” service package and get the chip MasterCard Standard card from Alfa-Bank. 800 rubles per year.

2. Carefully examine the services of P2P transfers:

- Translation service from PayOnline processing center . Register yourself, attach your cards and get links to pay. These links can be distributed to users: posting on the website, in the social network group, sent via email and sms is safe, because instead of the card number there will be your email. So, do the steps:

- Register with PayID .

- Binding bank card .

- Creating a page for making transfers - Acceptance of transfers (without specifying the amount).

- Translation service from Alfa-Bank . Use to transfer funds between Alfa-Bank cards. You do not need to register.

- RSExpress from Russian Standard Bank . Use to transfer funds between Russian Standard Bank cards. It is not necessary to register.

- MasterCard Mobile

To transfer money to the sender will need to register on this site. This option is the most profitable, but also the least convenient. It is suitable if it is a prepayment and is taken in advance. Either there is time, and the person sending the money is located to learn something new.

I wish there was something to translate!

Source: https://habr.com/ru/post/187200/

All Articles