Money Authentication Technique

For many centuries, since the time of the invention of money, there has been a confrontation between currency issuers and counterfeiters. The former use increasingly sophisticated methods of protection, and the latter find ways to forge them. Modern banknotes have such complex security features that they cannot be tested without special technical equipment. In addition, it is often required to provide authentication at all without human participation, for example, in payment terminals, or in banks with automated processing of large amounts of cash.

Let us consider in detail how modern currencies are protected, how authentication takes place (validation) and what equipment is used for this.

Human readable signs

Methods of protection against forgery invented a huge amount. But unfortunately, not all of them are suitable for automatic validation. Either the security element is hard to read and present in digital form, or there are no clear criteria for “checking passed / not passed”, or both. So the best validator is still the keen eye of an expert.')

Human-readable signs are very diverse, interesting, and more and more are invented every year. In an amicable way, their description draws on a separate article, but since it will be further discussed nevertheless about the equipment, we restrict ourselves to a short list.

- Watermark. The images created by the paper sections of different density are visible to the light. Perhaps the most famous sign.

- Security thread. Metallic or polymer tape embedded in the thickness of the paper. Can be simple or diving. Diving thread repeatedly goes to the surface of the sheet and sinks back.

- Microprint. A banknote pattern may contain tiny symbols, usually a denomination or bank symbol, or just small items that are visible only under magnification.

- Protective fibers. Scraps of multi-colored threads, located in the paper stock. The fiber can be simple or woven from several threads of different colors.

- Microperforation. Laser punched even equal little holes that make up an image or an inscription. Like watermarks, they show up to the light. The relief of the holes should not be felt with the fingers, the paper around them should not be charred.

- Relief printing. Inscriptions and drawings, distinguishable to the touch. Perform as a utilitarian function (tags for the blind), and the function of protection against forgery.

- Kipp effect. Corrugated surface area, on the side edges of the corrugated image is applied, which is visible only when viewed from an acute angle.

- Combined images. Figure, different elements of which are located on different sides of the sheet. When looking at the lumen of the parts must be precisely suited to each other and give a solid image.

- Oryol seal. Thin lines, the color of which changes along the line without visible interruptions and creep of colors. Regular multi-color printing will inevitably give in this case a register of colors.

- Stamping foil. Figure, made of metal foil, pressed onto the surface of the paper.

- MVC. Moire stripes of different colors that are visible when the banknote is tilted.

- Ovi. Optically variable paint. An element that changes its color depending on which angle to look at it.

- Hologram. An element that gives a three-dimensional holographic image that rotates when the banknote is tilted.

Computer readable features

And what to consider and check the machines? A set of machine-readable signs of authenticity are much more modest.Banknote size

The dimensions of the banknote, strictly speaking, do not belong to the security features, but most detectors check them first. First of all, it allows you to immediately cut off any garbage: scraps of bills, foreign objects, stuck together and folded money. And secondly, it is a simple but fairly reliable way to recognize the currency and denomination of a banknote.

Dimensions are checked optically by scanning in transmitted light. If the device is not equipped with a full-size scanner, it can determine only one of the dimensions, measuring the time for the sensors to overlap with a banknote as it is pulled through the mechanism. Also, by attenuating the luminous flux, the device detects doubled banknotes.

Visible image

The image of a banknote in visible light is obtained by scanning, or in transmitted light, or in reflected (each side separately), or both, and so. The device can not check the entire surface, but only a few characteristic zones. In this case, there are enough separate sensors, each of which is an optocoupler: LED + photodiode.

For reliable validation, a full image is required, in which case photo-receiving lines are used, similar to those found in conventional scanners. The resolution of the rulers may lie in the range from 10 to 200 DPI, and an increase in resolution does not always lead to an increase in the quality of recognition.

Scanning can be carried out in one color (as a rule, red, less often white), and can be full-color. In the second case, the scanner contains several color channels. It is not always the standard RGB. Base colors are selected based on the recognizable currency paint spectra. There can be more than three colors: for example, red (640 nm), green (525 nm), blue (~ 450 nm) and dark red (~ 750 nm, almost on the border with infrared), in which features of the pattern of US dollars are clearly visible .

Infrared image

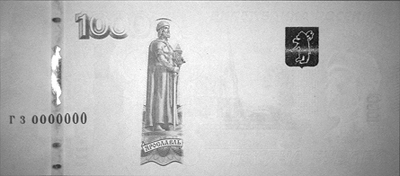

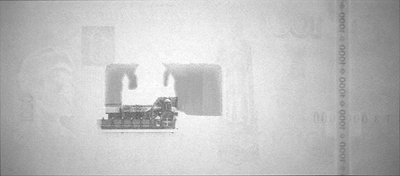

The image in infrared light (880-940 nm) is one of the main machine-readable features. When printing banknotes, special ones are used. metameric paints . A drawing made with such colors may look homogeneous in visible light, but in IR, to have clearly distinguishable dark and light areas.

Fig. 1. Infrared image of a banknote 1000 RUB of a modification of 2010. Image from the site cbr.ru

Fig. 2. Infrared image of a banknote 100 USD. Image from banknot-spb.ru

Fig. 3. Infrared image of a banknote 500 EUR. Image from banknot-spb.ru

In addition, scanning in infrared to the light allows you to reliably recognize watermarks, protective tapes and metallized elements of the banknote. IR scanning allows you to determine the optical density of the paper, using it as another checkable feature, or simply to reject double sheets.

UV tags

As one of the protective features of the bill contain labels marked with phosphors , which, when irradiated with ultraviolet light in the visible spectrum. There are phosphors of all colors of the rainbow, so that a banknote under UV looks very beautiful.

Fig. 4. Ultraviolet banknote tags 100 RUB modified in 2004. Image from cbr.ru

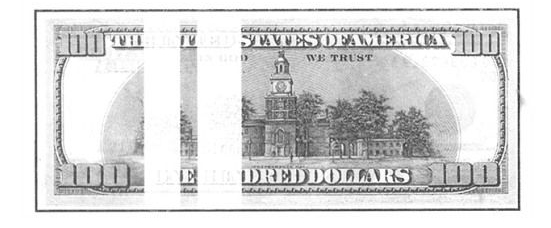

Dollars look much more modest, one narrow band glows, the color depends on the nominal.

Fig. 5. Ultraviolet banknote tags 50 USD. Image from banknot-spb.ru

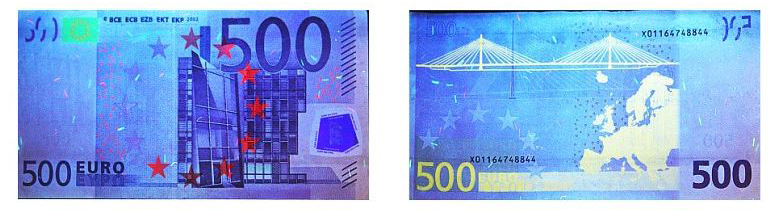

But the euro sparkles with all the colors.

Fig. 6. Ultraviolet banknote tags 500 EUR. Image from banknot-spb.ru

Protective fibers also possess luminescent properties (in RUB and EUR), and different fibers have different glow colors. In woven fibers in rubles one thread glows, and the second is not, because of which the fiber looks dashed. Another security feature is the lack of background luminescence of the paper. Plain writing paper contains optical brighteners, due to which it glows blue under UV light. The money is printed on unbleached paper, which does not give a background glow.

To check the UV-marks, the validator is equipped with an ultraviolet lamp or LEDs (360-380 nm). The luminescence of the tags is captured by the photoreceivers of the visible spectrum, which are closed by light filters that cut off the primary ultraviolet. The simplest detectors check only the absence of background luminescence of paper, devices of a higher level remove the full scan. The glow of the protective fibers is practically not checked due to their small size and irregular arrangement.

Magnetic tags

Magnetic properties of paint are applied to some parts of the banknote. For example, on rubles of the Russian Federation modifications up to 2004 inclusive magnetic is the number of a banknote (green). On rubles modification of 2010 certain fragments of the image possess magnetic properties.

Fig. 7. Magnetic elements of a banknote 1000 RUB modification of 2010. Image from the site cbr.ru

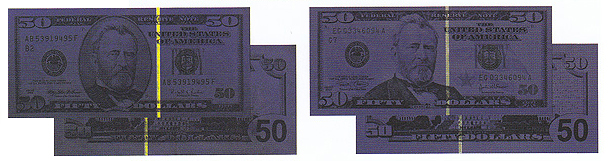

US dollars have several bizarre magnetic zones.

Fig. 8. Magnetic elements of the banknote 100 USD. Image from banknot-spb.ru

The protective thread, the number and a fragment of the image are magnetised on the euro.

Fig. 9. Magnetic elements of the banknote 500 EUR. Image from banknot-spb.ru

Magnetic tags are divided into "hard" and "soft." The first ones are carried out with the use of hard magnetic materials and can retain their own magnetization. "Soft" tags are demagnetized immediately when the external field is turned off. For recognition of magnetic tags, read heads are used, similar to conventional tape recorders. Heads for validators, as a rule, wide (2-5 cm) to capture a large area. To read the “hard” marks, the banknote is first dragged over a permanent magnet, and then over the heads, which catch the residual magnetization.

Special element "And"

Conventional phosphors emit light with a wavelength greater than that of the exciting radiation. For example, visible light is emitted when exposed to ultraviolet light. There is a class of substances called anti - Stokes phosphors for which this law is not fulfilled. The action of the protective element "And" is based on the properties of the anti-Stokes phosphors. [four]

When an element is illuminated with intense infrared light (with a wavelength of 940–960 nm), it begins to emit in the green region of the spectrum (~ 520 nm). In rubles, anti-Stokes labels are located on the front side on the lower left (gray numbers of the denomination) and on the right (gray background of the nominal).

Fig. 10. Anti-Stokes elements of the banknote 5000 RUB modified in 2010. Image from cbr.ru

There are luminescent labels with a more complex testing technique, for example, requiring laser irradiation and glowing in the infrared.

Special element "M"

This protection element is a paint that has a different absorption coefficient in different parts of the spectrum in the IR region. If the banknote is illuminated alternately with the light of 940 nm and 850 nm, the element “M” will appear flashing (when observed in IR light, again). [five]

In rubles of modifications before 2001, such an element was present in the form of a point, a ribbon or a section of an image. There are no reliable data about later modifications.

Fig. 11. Special element "M" banknotes 500 RUB. Image from banknot-spb.ru

In US dollars, the Treasury seal has similar properties.

Fig. 12. Special element "M" banknotes 100 USD. Image from banknot-spb.ru

Secret signs

In order to complicate the work of counterfeiters, information is far from being published on all the security features. There are secret security elements that are not known to the general public, and which are checked only by the Central Bank itself. An indirect source of information about them can be patents. To protect against counterfeiting can be used a lot of interesting things.

For example, identification of the characteristics of the ignition and afterglow of the phosphor. [11] Or the use of electroluminors. [12] Or the introduction into the pulp of fibers with magnetic properties. [13] Or metallized elements that have well-defined resonances in the microwave range. [14] Or even nanodiamonds (no kidding!). [15]

Goznak for machine manufacturers sells a special device for checking special signs (produced at the LOMO plant in St. Petersburg). It works like a USB device. What is inside is unknown, for reliability the whole device is sealed.

Banknote processing devices

Viewing Detectors

The viewing detector only visualizes the security features, and the operator decides whether the bill is genuine or not. On the one hand, the device is obtained as simple and cheap as possible, and on the other, it requires certain skills.

The UV detector consists of one or more UV lamps, often with a magnifying glass and large-scale mesh. The luminescence of the protective elements is checked "by eye".

Fig. 13. UV detector CoinMate SLD-16M. Image from coinmate.us

The infrared detector is a bit more complicated. It contains IR illumination of the working area, a camera with an appropriate filter and a display showing the image from the camera. To control the special element “M”, two groups of illumination are used, with different wavelengths, which are switched on alternately. Special element while blinking.

Fig. 14. Infrared detector Grace IRD-800. Image from grace-chn.com

There are combined (IR + UV) devices. In addition, viewing detectors can be equipped with remote cameras (for studying suspicious fragments “close”), magnetic mark detectors, and similar accessories.

Fig. 15. Universal detector Dors 1200 with remote camera and magnetic tag visualizer. Image from dors.ru

Auto Detectors

The automatic detector does not require any special knowledge from the

Show animation

Fig. 16. The principle of operation of the automatic detector of authenticity

The simplest detectors have only a few single photodetectors and, thus, scan several individual lines of an image, usually in the IR range. More advanced models read the complete image of a banknote using a photo-receiving ruler. Additionally, magnetic sensors and UV illumination may be present.

Fig. 17. Detector DoCash 430 c open path. Visible discrete photosensors and magnetic heads. Image from docash.ru

Fig. 18. Detector Dors 230 c open path. Visible photodetector line. Image from systema.biz

Counters and sorters

The main drawback of automatic detectors is low speed, they accept banknotes one by one. And if a lot of money? For such cases, banknote counters were invented: a pack was immediately loaded into the device, and it quickly (at a speed of 600–1500 pieces per minute) flipped through bills one by one, carefully putting the converted pack into the output pocket.

Show animation

Fig. 19. The principle of operation of the banknote counter

There are two main ways to leaf through a pack.

- Mechanical. Before the path there are rollers made of “sticky” rubber, and rollers made of thick rubber. In the simplest case, the bundle is located above the rollers which push the lower bill into the path, and so that the bills enter one by one, there are rollers rotating in the opposite direction above the entrance to the path, which push the extra bills back.

- Vacuum. The bundle is pressed against the perforated tape, under pressure is created under it, and the bills stick to the tape, which drags them into the path.

It is worth saying that authentication is not available at all counters. The simplest models cannot do anything except mechanical recalculation and rejection of stuck banknotes or sheets that vary greatly in size (for example, scraps).

Higher class meters already have UV and magnetic sensors. Even more expensive machines carry out a full scan of the banknote in the IR range. From this point on, the counter is already able to determine the currency and denomination of the bills passing through it. You can recount a wad of money and immediately find out how many banknotes of each denomination are in it, and what is the total amount.

High-end counters scan in the visible, IR, UV ranges, read magnetic marks, and also measure paper thickness by mechanical or capacitive method. The latter feature allows you to distinguish new banknotes from worn, torn and glued. Thus, the meter can sort by currency, denomination, orientation, authenticity and wear.

Such counters, as a rule, have two receiving pockets: main and rejection, which allows not to interrupt the counting process when a suspicious banknote is detected.

Show animation

Fig. 20. The principle of operation of the two-pocket banknote sorter

From the two-pocket counter multi-pocket machines, often referred to as note sorters, lead their genealogies. The simplest of them look like a regular desktop counter, slightly “bloated” in height, with several receiving pockets.

Fig. 21. Sorter Kisan K500 Pro. Image from kisane.ru

And in the higher price segment there are real monsters: machines that occupy a whole table (or even several), with a dozen pockets, with the possibility of extension, with additional modules for packing money, with validation of everything that is possible,

Video presentation of the counting and sorting machine JetScan MPS 4200

Bill acceptors

Bill acceptors are used in vending and gaming machines, payment terminals, ATMs and other self-service systems. They provide cash intake, nominal value determination, banknote validation and stowage in lockable cassettes. The requirements for stand-alone validators are quite high: a bilateral multichannel optical scanner, UV and magnetic detectors are almost always used. Bill acceptors are equipped with various systems that prevent the effects on the mechanism and deception. For example, a foreign object detector notices the presence of fishing line or tape, for which you can pull the banknote back. To protect against vandalism, bill acceptors can be equipped with protective shutters ( tatters ).

Mechanisms for receiving money are divided into purchase and bundle. The first "eat" on one banknote, the feed goes forward narrow. Bundling mechanisms immediately take a pack of banknotes, recalculate, determine the values and validate. Such bill acceptors are installed mainly on ATMs, although there are attachments for ordinary purchase receivers that allow you to take a wrap at once (up to 20 banknotes) and then feed it in one sheet at a time.

Fig. 22. JCM UBA bill acceptor assembled with a cassette and separately. Image from jcm-express2000.ru

Banknotes deposited after passing through the validator fall into the deposit section (Escrow) . The volume of this compartment may vary: from 1 bill to the entire pack. In case of cancellation of a transaction, notes from escrow are returned. If the transaction is confirmed, the banknotes are stacked in a cassette (Cashbox) - lockable and sealed box. To get money from the cassette mechanism of the bill acceptor can no longer. The volume of cartridges can be from several hundred to several thousand banknotes. Sorting by nominal is usually not carried out, all bills are shoved in a cassette in a row.

Separately, it is worth mentioning recirculators - devices capable of both receiving and issuing cash. Do not confuse recirculator with a pair of separate devices: receiver + dispenser. In the latter case, separate cassettes are used for receiving and issuing, and the bills deposited can be transferred to the issuance only through collection.

The recirculator accepts money, sorts by nominal value and puts it in separate cassettes. From the same cassettes, he can make the issuance of bills or, for example, count the change. The requirements for validators in recirculating systems are the toughest. For example, no more than two dozen models passed tests at the Central Bank of the Russian Federation. [6]

Video Presentation CashCode B2B Recirculator

Verification algorithms

Before we talk about the algorithms used, it is worth noting that the “hardware” in different classes of devices is very different (- Thank you, Captain Obvious!) . The simplest detectors work on 8/16-bit controllers, and it is difficult to implement complex checks or processing of large data arrays in them. High-level detectors, bill acceptors and banknote counters are usually controlled by ARM controllers or something similar. To speed up individual operations (image processing, frequency conversion), DSP processors and FPGAs are used . Manufacturers of large banking sorters usually put some kind of industrial computer running Win CE, Linux or QNX inside.To simplify the software, data from all scanners (visible, UV, IR, magnetic) are combined into one multichannel file. If necessary, the image is aligned and normalized.

Data processing is carried out in three stages:

- Determination of currency and value.

- Authentication.

- If required, the definition of wear (decay) banknotes.

Manufacturers of banking technology carefully guard their algorithms and know-how, so you have to tell only the most common points. Naturally, a simple pixel-by-pixel comparison of a banknote scan with a sample will not give anything good, and noises, uneven submission, and different degrees of depreciation of banknotes, and a whole bunch of things contribute to it.

Most validation algorithms are based on testing individual traits that have good repeatability. For example, several carefully selected scan zones are selected for analysis and image parameters are compared in these zones with samples and with each other. The following parameters can be checked:

- overall brightness and contrast zone

- image histogram characteristics

- statistical moments

- moments of image

- correlation functions

- frequency characteristics obtained by Fourier and wavelet transformations

At the first stage, with the help of the simplest and fastest algorithms, the validator determines what is behind it for a banknote: which currency and which nominal value. That is, most of the options are cut off in a short time, which this note cannot be . If, on the basis of the selection results, there are no applicants left, the bill is rejected as unrecognized.

After the most likely bidder is selected (or several, depending on the implementation), the actual validation begins. The system checks the set of characteristics specific to a particular denomination of a particular currency. There are signs of "hard", the very first discrepancy of which rejects a banknote, and "soft", which lead to the rejection of "the sum of points."

Coincidence / mismatch thresholds are usually set up so as to exclude errors of the first kind — the false passing of a fake bill. At the same time, the frequency of errors of the second kind (false failure of a valid banknote) is from 0.3% (for counters) to 6% (for automatic detectors and bill acceptors).

The description of all verifiable features is stored in the currency database : a separate entry for each denomination and each modification of the banknote. Money of different years of release are similar only in appearance, but the location of the protective features is completely different. There are single currency and multiple currency validator executions. In the latter case, the currency can be selected by the user or determined automatically.

Modern validators support updating databases via the network, when connected to a computer or from a flash card. By updating, you can add support for other currencies, new banknote modifications, and improve recognition of old ones. To prevent analysis and reverse engineering of the algorithms by unauthorized persons, the bases are transmitted and stored on the device in an encrypted form.

Prospects and forecasts

Tracking numbers

Many bank-level counting machines have the function of recognizing banknote numbers. In most cases, this feature is not used. At least, there is no uniform number tracking system yet. Several years ago, the Central Bank of Russia began an experiment on registering numbers of cash passing through it. [7] In an experimental procedure, equipment for reading numbers is installed in cash processing centers. [eight]

Number tracking has three main objectives:

- anti-counterfeiting

- theft investigation

- money wear rate estimate

So far, there is not and is not planned to provide commercial banks with registrars. But when such a system starts working everywhere, it will mean, in fact, the end of the anonymity of cash. It will be possible to track the movements of each individual banknote, there will appear “black lists” of numbers, for example, stolen banknotes. Like credit cards, cash can be “blocked” by calling the bank.

RFID tags

The European Central Bank conducts research on the use of radio frequency tags (RFID). [9] Similar studies are underway in Japan. Tags are planned to be introduced into banknotes primarily as a degree of protection against fakes. Indeed, modern cryptographic RFID tags are well protected from hacking and copying. The technology still rests on the relatively high cost of tags (it is advantageous to equip them only with large denominations) and their low survivability.

The ubiquitous RFID of banknotes, in theory, will make it possible to organize a global system for tracking cash, like number recognition, and even more efficient. However, all sorts of side effects are possible, such as pickpockets, who will choose a victim with the help of portable scanners.[10] Paranoids have already stocked

Non-reproducible tags and cryptographic money

All modern methods of protection against counterfeiting are based on the fact that the technology of making labels is secret. That is, the bank knows how to print a secured bill, but the counterfeiter does not know. Such a system, like any one based on Security through obscurity , cannot be considered 100% reliable. Information leaks happen, attackers find ways to fake more and more complex tags.

There is a fundamentally different approach based on the use of irreproducible labels. That is, each copy of the label is unique due to its nature; even the issuer cannot duplicate it. If the label will carry any information, then every banknote can be identified by it. It suffices now to create a database that stores the identifiers of all genuine banknotes. Who is not in the database - that fake.

Even more convenient is the use of asymmetric cryptography. After the label has been manufactured, the bank reads it, encrypts it with its private key, and prints it on the banknote in the form of any machine-readable message (for example, a barcode or magnetic record). For validation, it is enough to decrypt the identifier using the public key and compare it with the tag data. Duplicate banknotes cannot be made because of the irreproducibility of the label, and it is impossible to issue another without knowing the bank's private key.

The main complexity of this technology - the label should be created on the basis of random processes, but at the same time should be read reliably and repeatable. One of the possible mechanisms is the use of speckle- scattering pictures . The label used is a suspension of glass beads in an epoxy polymer [16]or even just the surface of the paper. [17] Currently, this technology is used to protect objects of art, but you can expect a quick start to use for banknotes.

Quantum money

A further development of the idea of non-reproducible tags is quantum money . A label is a collection of particles in certain quantum states. The tag cloning will be impossible due to the fundamental laws of quantum mechanics ( The theorem on the prohibition of cloning ).

Today, such protection is in the field of science fiction. Not yet found methods for long-term reliable storage of quantum states even in laboratory conditions, not to mention the introduction of banknotes. In addition, recent research in the field of weak measurements calls into question the very impossibility of copying quantum marks.

PS:

The picture to attract attention - Porter Counterfeit Detector , a device for detecting fakes, produced in the 1920s and 40s in the United States. A checked banknote was placed under the glass along with a known genuine one, and a comparison was made with the help of rulers and a scale grid.A more detailed description and other photos

The author thanks the ice2heart habrauser for valuable comments and additions.

References

- cbr.ru - description of signs of authenticity RUB

- ecb.int - description of authenticity signs EUR

- newmoney.gov - description of signs of authenticity USD

- banknot-spb.ru - special element "M"

- banknot-spb.ru - special element "And"

- cbr.ru — - , ,

- kiosks.ru —

- izvestia.ru —

- fleur-de-coin.com — RFID banknotes

- habrahabr.ru —

- US 7067824 — Method, device and security system, all for authenticating a marking

- RU 2344046 —

- RU 2344218 — , , ,

- RU 2276409 —

- RU 2357866 — , nv

- US 6584214 — Identification and verification using complex, three-dimensional structural features

- RU 2385492 — ,

Source: https://habr.com/ru/post/185806/

All Articles