Legal tax minimization in Ukraine for IT companies

In 1935, Judge J. Sunderland expressed the principled position of the US Supreme Court:

“The taxpayers’ right to avoid taxes ...

using all permitted by law

funds can not be challenged by anyone "

I continue a small educational program on the correct work with the laws of our country. Earlier, I wrote about the legal security of IT business in the CIS . As stated in the quote above, which I recently read somewhere, everyone has the right to pay a minimum of taxes within the law, and this article is about that. As in the previous article, I will consider one working scheme.

I continue a small educational program on the correct work with the laws of our country. Earlier, I wrote about the legal security of IT business in the CIS . As stated in the quote above, which I recently read somewhere, everyone has the right to pay a minimum of taxes within the law, and this article is about that. As in the previous article, I will consider one working scheme.

Immediately make a reservation so that you understand what will be discussed: first, I will only talk about legal methods of tax minimization, and secondly, my scheme was created specifically for companies of a certain type, namely IT companies that work in the field of IT services and have, as a rule, a relatively small turnover (up to 10 million dollars a year) and high margins. For companies that do not fit my description, there will be somewhat different minimization schemes, and why - it will be clear from the article below.

')

First you need to understand that not to pay taxes at all - will not work. You can and should pay a minimum, but still pay. Any business activity in Ukraine must be registered, and taxes must be paid on income from it. If you are still trying to work in black, I must warn you, recently it has become dangerous, what exactly I will tell below.

If you are just starting your business, you need to start by registering the company or legal entity. faces. Even if you do not plan to create a transnational corporation, but trite freelance, this is also considered an entrepreneurial activity.

If business activity is already underway, and all registrations have been around for a long time, you can always switch to a convenient tax system, according to law, this opportunity is given every quarter.

Once again, I’ll talk about a legitimate minimization scheme.

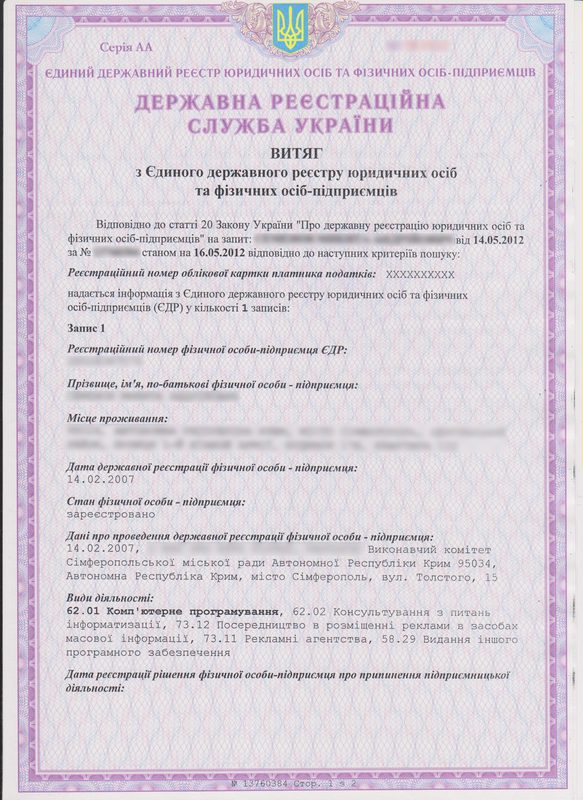

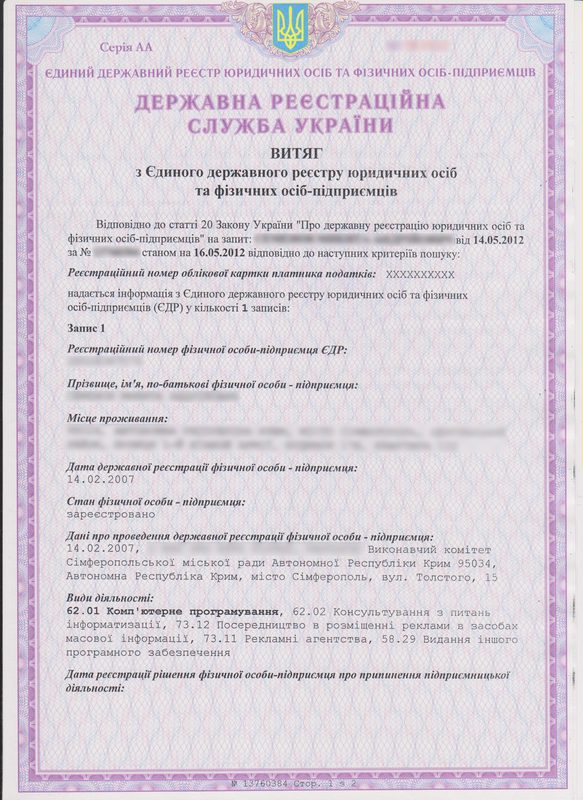

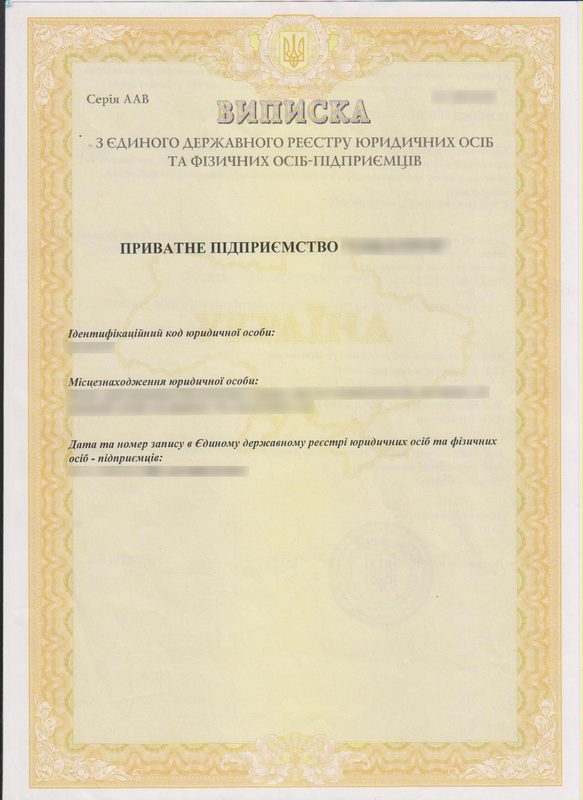

This option is perfect for freelancers, start-up entrepreneurs and microbusiness. You register as a business entity, get an extract from the state. registry. Below is an example of extraction (given on request for any business entity), and in the next section of the article I will show the extract itself.

Fig. 1. Removing the SPD

Then, in the tax inspectorate, write an application for receiving the 3rd group of single tax payers, and from the moment of transfer (the next month for the newly registered after writing the application) you pay 5% of income as taxes. The annual turnover is allowed up to 3 million UAH., After exceeding this threshold it is necessary to go to the 5th group or to refuse the single tax in general. In addition, the monthly need to pay about 400 UAH. (the amount is floating, calculated from the minimum wage) to the pension fund (provided that you do not have employees and other non-obligatory contributions to various funds).

Fig. 2. Evidence of a single tax

There is also an alternative option - SPD of the 5th group, which implies 7% of income taxes, but the annual turnover should not exceed 20 million UAH. for the previous period (year).

This method is suitable for those who provide IT services and have a margin of at least 20%. Consider an example: SPD provides a service for 1000 UAH, in which the margin is incorporated 20%. This will mean that 800 UAH. will go to the cost part, 50 UAH. will be paid as taxes and 150 UAH. will remain as net profit to the owner.

How does it work in practice?

You open a bank account at the bank, bill the customers, pay them, and the money comes in your account, after you transfer the money from the account to a plastic card and withdraw it at an ATM. Quarterly provide a report to the tax office, pay 5% tax and contribution to the pension fund. You can also invoice not to a current account, but directly to a plastic card, in order to save on servicing a current account, but, as a rule, accountants start getting confused and money is often returned when you pay or hang up in banks' transit accounts, therefore, to avoid unnecessary problems I advise work through a checking account.

The disadvantage of this method is that many large companies do not work with SPD, and without legal entities. faces you will lose some customers.

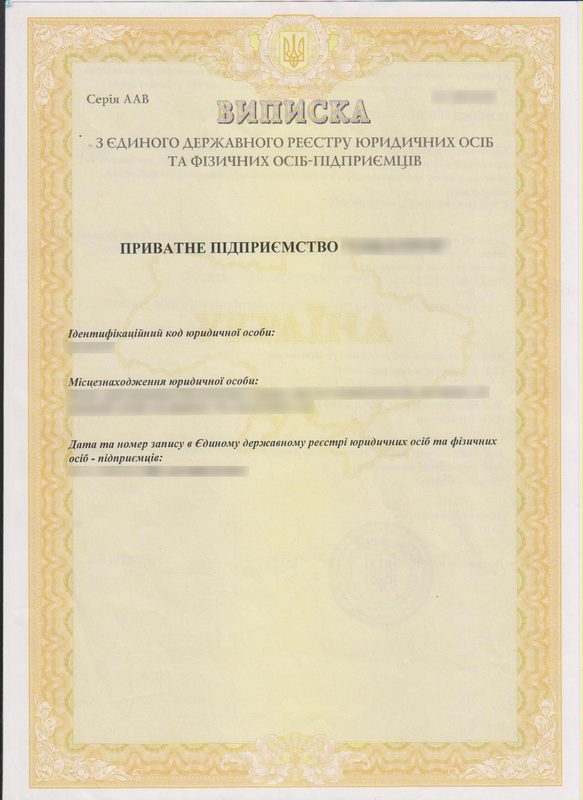

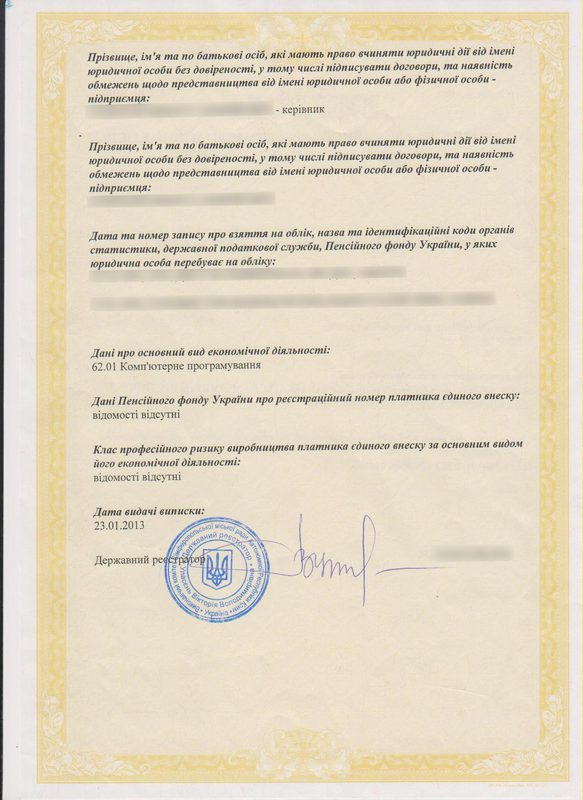

Jur. A person can also be a single tax payer at a rate of 5%, 4th group. Turnover is allowed up to 5 mln. in year. The scheme is the same as for SPD: register, get an extract, etc.

And the alternative is the 6th group of a single tax with a turnover of up to 20 million and a tax of 7% of income.

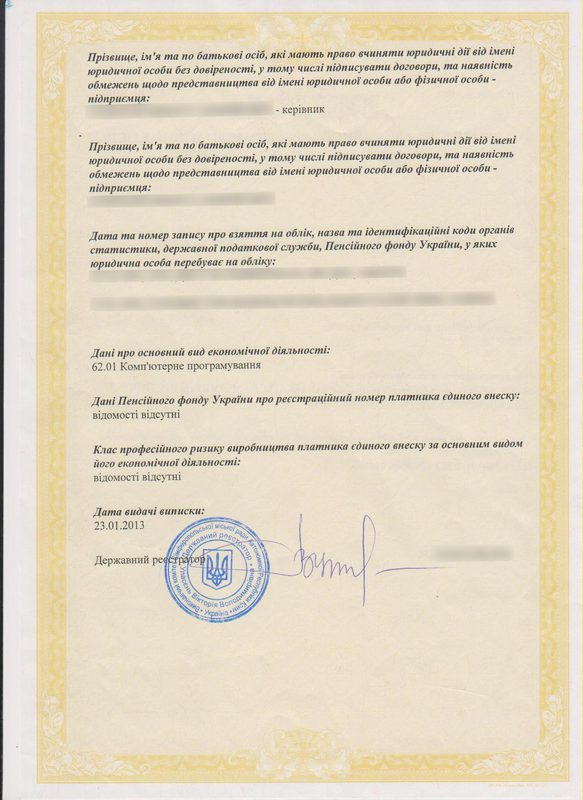

Fig. 3. Extract lr. face

We make out all employees of the company as SPD, and we pay their salary as payment for services under the contract, thus, they will pay 5% of taxes from the salary and 400 UAH. to the pension fund, which the company must reimburse to the employee in a good way, and the salary received will not be as “in the envelope” before, but completely white and legal. In addition, employees will go to the official retirement experience. It is important that contracts with employees should be for real work with an end result, which can be considered as a separate part of the total work (subcontracting), because this is not a payroll scheme, it is actually a contract work between unauthorized persons.

Whenever possible, all fixed expenses are transferred to non-cash and we pay them from jur. Persons: office rent, communications, procurement, etc.

The net profit that is accumulated in the accounts, we can deduct as dividends by resolving the meeting of founders no more than once a quarter, after paying all taxes (uniform enterprise tax + 5% income tax on dividends) and it is also white and fluffy get us. The only negative is the withdrawal of money once a quarter, and not when you wish, as in SPD.

With a turnover of more than 5 million, you can open additional legal. faces and make such a holding. The law does not limit the number of legal entities. individuals. The director and the founder can be one, but when checking the tax one will have to explain and prove how one director manages to do so many posts at once, without having hired employees. In tax there is a special program that monitors business entities by turnover, hired employees, tax intensity, etc. And if a subject has a large turnover and does not have hired employees, he falls into the area of tax risk, after which, with a high degree of probability, a check will come to him with questions about how he alone copes with everything.

This scheme is used by many Ukrainian mid-level IT companies.

A small note: in this scheme, besides income taxes, there are taxes on the director’s salary and, ideally, also an accountant (although by law there can be one director), and if large volumes are planned, it’s worth thinking about other employees, take into account in economic calculations.

How does it work in practice?

You open a bank account at the bank, issue invoices to customers, they pay them and the money comes to the bank account, then you make the necessary payments from this money (to employees who are registered as SPD; employees who are issued at the enterprise, expense accounts, etc.) . The remaining part is net income and is withdrawn in cash not as a salary, but once a quarter as dividends. With dividends, you must pay 5% of income tax, after which you can dispose of them at your discretion.

The disadvantage of this scheme is that not everything can be paid by bank transfer, and you may urgently need cash to pay for something, and you can withdraw it only once a quarter, so you need good working capital. In addition, employees who are registered as SPD will need to submit reports to the tax inspectorate.

It is necessary to know the possible problems, then they can be avoided in whole or in part.

One of the most common problems is banal forgetfulness to submit a report or pay tax on time.

What to do?

First of all, still do not forget! Set yourself a reminder, hang a piece of paper over the workplace, ask to remind relatives or friends, but you should not forget about this. If you still forget - it is not fatal, but most likely you will have to pay a fine.

Some people still accept money in cash and then do not show it anywhere. This can be done both from hand to hand, and by transferring cash to a personal plastic card. Under the “from hand to hand” scheme, there is a risk of running into a tax purchase for purchases, and if cash was received with violations, this is fraught with consequences. When transferring cash through a bank is still more dangerous: impersonal plastic cards can be with a limit of up to 1000 UAH, i.e. obviously not suitable for doing business, and unlimited cards are always attached to someone, and information about transfers is not just stored for years in banks, it all necessarily merges into tax (in our country there is no “bank secrecy”), therefore it’s too early or late to you can come, the only question is when. The tax statute is 3 years, so you need to think about the last years, and not just about the future.

What to do?

Taking cash in cash, do it officially, with all taxes paid.

For tax evasion sometimes money from jur. persons poured on the SPD on a single tax. Even in my scheme, it will seem beneficial: jur. a person pays 5% of a single tax and another 5% of income tax on dividends, while you have to wait at least 3 months, while SPD pays only 5% of a single tax, and there is always a temptation to transfer money from your legal entity. persons on their LDS. This is illegal — called money laundering and tax evasion. If the tax it sees and proves the connection of individuals, there will be big problems.

What to do?

Do not transfer money from your legal entity. persons to their LDS or LDS relatives.

As our lawyer says: “The tax always works on the principle of hitting,” that is, not always according to the law, but within the framework of its authority: the phrase is very scary, if you think about the meaning. Our laws give free rein to tax and other fiscal authorities. This means that the tax can accuse you of evading taxes on absolutely any amount. Responsibility of the tax inspectorate for an unreasonable decision is not provided by the law. And, an entrepreneur can only challenge this decision through the court, which in turn, even if you are right, is guaranteed to take your side, only with certain financial investments from your side. Tax costs are never reimbursed, although it is provided by law.

What to do?

In the last article I have already said that it is better to do business in another country. This is the perfect option. Well, if you’re still unlucky enough to do business in Ukraine, it remains only to fight, to defend your rights by all legal means. It is most effective not to fall into the “tax risk” zone, thereby avoiding a routine check. In the event of a collision and illegal tax decisions, only the court remains.

Having a large turnover without hired employees, you can get into the area of tax risk, which will lead to verification by the tax inspectorate. The tax inspectorate doesn’t have a lot of checking employees, they don’t have time to check everyone, so a special program was created that automatically calculates business entities that can evade paying taxes, and go to check with these entrepreneurs.

What to do?

To share cash flows for different, unrelated to each other, business entities. For every 100 thousand UAH. income per year ideally have one employee. And, of course, be ready to prove to the audit that the work was done by the number of hired people who officially work for you.

Hiring an employee officially, he needs to assign a salary and pay taxes on it. Many try to save money and pay the minimum wage officially, and the rest in an envelope. Naturally, it is illegal, and the state is trying to fight it, so payers of the gray salary often come with checks.

What to do?

Not to pay a gray salary is if according to the law. In general, when checking you need, you can explain why the minimum wage is paid, and your employees could confirm it. For example, they took a person for an internship, no money for high wages, this is a competitive salary, etc.

Now there are active conversations about reducing income tax to 5% instead of 15% and reducing the single social contribution for the IT industry, but for now this is only talk.

So, the article describes a scheme that can be used by IT companies providing services and having high margins. For companies that are engaged in the resale of advertising, equipment and other capital-intensive, but low-margin products, other legal tax minimization schemes should be used. Just one article does not cover, so those in need can contact me personally, contacts are not difficult to find.

Attention!!! Ukraine has a very unstable legislation, which changes almost every year, so this article can be used in 2013, and then track changes in legislation. Subscribe to our pages in the social. networks, we will periodically report about innovations.

Pay taxes, work in white and sleep well!

PS Let me tell you a little secret: our not-so-specific previous publications on legal topics were actually timed to the opening of our new company, which is called Taxov and specializes in legal services for IT business. More information can be found on the official website of the law firm " Taxov ".

PPS We will try to publish changes in legislation and continue to write about various schemes for proper operation, so subscribe to us on Facebook , VK or Twitter

Original article here: http://taxov.com/legal_tax_minimization_for_IT_companies_in_Ukraine.html

Author:

Nikita Semenov ( Facebook , VK , LinkedIn )

Owner

Law firm Taxov

“The taxpayers’ right to avoid taxes ...

using all permitted by law

funds can not be challenged by anyone "

I continue a small educational program on the correct work with the laws of our country. Earlier, I wrote about the legal security of IT business in the CIS . As stated in the quote above, which I recently read somewhere, everyone has the right to pay a minimum of taxes within the law, and this article is about that. As in the previous article, I will consider one working scheme.

I continue a small educational program on the correct work with the laws of our country. Earlier, I wrote about the legal security of IT business in the CIS . As stated in the quote above, which I recently read somewhere, everyone has the right to pay a minimum of taxes within the law, and this article is about that. As in the previous article, I will consider one working scheme.Immediately make a reservation so that you understand what will be discussed: first, I will only talk about legal methods of tax minimization, and secondly, my scheme was created specifically for companies of a certain type, namely IT companies that work in the field of IT services and have, as a rule, a relatively small turnover (up to 10 million dollars a year) and high margins. For companies that do not fit my description, there will be somewhat different minimization schemes, and why - it will be clear from the article below.

')

A little about how things work

First you need to understand that not to pay taxes at all - will not work. You can and should pay a minimum, but still pay. Any business activity in Ukraine must be registered, and taxes must be paid on income from it. If you are still trying to work in black, I must warn you, recently it has become dangerous, what exactly I will tell below.

If you are just starting your business, you need to start by registering the company or legal entity. faces. Even if you do not plan to create a transnational corporation, but trite freelance, this is also considered an entrepreneurial activity.

If business activity is already underway, and all registrations have been around for a long time, you can always switch to a convenient tax system, according to law, this opportunity is given every quarter.

Minimization scheme

Once again, I’ll talk about a legitimate minimization scheme.

Option number 1. SPD - an individual on a single tax of the 3rd group.

This option is perfect for freelancers, start-up entrepreneurs and microbusiness. You register as a business entity, get an extract from the state. registry. Below is an example of extraction (given on request for any business entity), and in the next section of the article I will show the extract itself.

Fig. 1. Removing the SPD

Then, in the tax inspectorate, write an application for receiving the 3rd group of single tax payers, and from the moment of transfer (the next month for the newly registered after writing the application) you pay 5% of income as taxes. The annual turnover is allowed up to 3 million UAH., After exceeding this threshold it is necessary to go to the 5th group or to refuse the single tax in general. In addition, the monthly need to pay about 400 UAH. (the amount is floating, calculated from the minimum wage) to the pension fund (provided that you do not have employees and other non-obligatory contributions to various funds).

Fig. 2. Evidence of a single tax

There is also an alternative option - SPD of the 5th group, which implies 7% of income taxes, but the annual turnover should not exceed 20 million UAH. for the previous period (year).

This method is suitable for those who provide IT services and have a margin of at least 20%. Consider an example: SPD provides a service for 1000 UAH, in which the margin is incorporated 20%. This will mean that 800 UAH. will go to the cost part, 50 UAH. will be paid as taxes and 150 UAH. will remain as net profit to the owner.

How does it work in practice?

You open a bank account at the bank, bill the customers, pay them, and the money comes in your account, after you transfer the money from the account to a plastic card and withdraw it at an ATM. Quarterly provide a report to the tax office, pay 5% tax and contribution to the pension fund. You can also invoice not to a current account, but directly to a plastic card, in order to save on servicing a current account, but, as a rule, accountants start getting confused and money is often returned when you pay or hang up in banks' transit accounts, therefore, to avoid unnecessary problems I advise work through a checking account.

The disadvantage of this method is that many large companies do not work with SPD, and without legal entities. faces you will lose some customers.

Option number 2. Jur. persons on a single tax.

Jur. A person can also be a single tax payer at a rate of 5%, 4th group. Turnover is allowed up to 5 mln. in year. The scheme is the same as for SPD: register, get an extract, etc.

And the alternative is the 6th group of a single tax with a turnover of up to 20 million and a tax of 7% of income.

Fig. 3. Extract lr. face

We make out all employees of the company as SPD, and we pay their salary as payment for services under the contract, thus, they will pay 5% of taxes from the salary and 400 UAH. to the pension fund, which the company must reimburse to the employee in a good way, and the salary received will not be as “in the envelope” before, but completely white and legal. In addition, employees will go to the official retirement experience. It is important that contracts with employees should be for real work with an end result, which can be considered as a separate part of the total work (subcontracting), because this is not a payroll scheme, it is actually a contract work between unauthorized persons.

Whenever possible, all fixed expenses are transferred to non-cash and we pay them from jur. Persons: office rent, communications, procurement, etc.

The net profit that is accumulated in the accounts, we can deduct as dividends by resolving the meeting of founders no more than once a quarter, after paying all taxes (uniform enterprise tax + 5% income tax on dividends) and it is also white and fluffy get us. The only negative is the withdrawal of money once a quarter, and not when you wish, as in SPD.

With a turnover of more than 5 million, you can open additional legal. faces and make such a holding. The law does not limit the number of legal entities. individuals. The director and the founder can be one, but when checking the tax one will have to explain and prove how one director manages to do so many posts at once, without having hired employees. In tax there is a special program that monitors business entities by turnover, hired employees, tax intensity, etc. And if a subject has a large turnover and does not have hired employees, he falls into the area of tax risk, after which, with a high degree of probability, a check will come to him with questions about how he alone copes with everything.

This scheme is used by many Ukrainian mid-level IT companies.

A small note: in this scheme, besides income taxes, there are taxes on the director’s salary and, ideally, also an accountant (although by law there can be one director), and if large volumes are planned, it’s worth thinking about other employees, take into account in economic calculations.

How does it work in practice?

You open a bank account at the bank, issue invoices to customers, they pay them and the money comes to the bank account, then you make the necessary payments from this money (to employees who are registered as SPD; employees who are issued at the enterprise, expense accounts, etc.) . The remaining part is net income and is withdrawn in cash not as a salary, but once a quarter as dividends. With dividends, you must pay 5% of income tax, after which you can dispose of them at your discretion.

The disadvantage of this scheme is that not everything can be paid by bank transfer, and you may urgently need cash to pay for something, and you can withdraw it only once a quarter, so you need good working capital. In addition, employees who are registered as SPD will need to submit reports to the tax inspectorate.

Possible problems

It is necessary to know the possible problems, then they can be avoided in whole or in part.

Not timely submitted reports or tax payment

One of the most common problems is banal forgetfulness to submit a report or pay tax on time.

What to do?

First of all, still do not forget! Set yourself a reminder, hang a piece of paper over the workplace, ask to remind relatives or friends, but you should not forget about this. If you still forget - it is not fatal, but most likely you will have to pay a fine.

Receiving cash in cash

Some people still accept money in cash and then do not show it anywhere. This can be done both from hand to hand, and by transferring cash to a personal plastic card. Under the “from hand to hand” scheme, there is a risk of running into a tax purchase for purchases, and if cash was received with violations, this is fraught with consequences. When transferring cash through a bank is still more dangerous: impersonal plastic cards can be with a limit of up to 1000 UAH, i.e. obviously not suitable for doing business, and unlimited cards are always attached to someone, and information about transfers is not just stored for years in banks, it all necessarily merges into tax (in our country there is no “bank secrecy”), therefore it’s too early or late to you can come, the only question is when. The tax statute is 3 years, so you need to think about the last years, and not just about the future.

What to do?

Taking cash in cash, do it officially, with all taxes paid.

Related faces

For tax evasion sometimes money from jur. persons poured on the SPD on a single tax. Even in my scheme, it will seem beneficial: jur. a person pays 5% of a single tax and another 5% of income tax on dividends, while you have to wait at least 3 months, while SPD pays only 5% of a single tax, and there is always a temptation to transfer money from your legal entity. persons on their LDS. This is illegal — called money laundering and tax evasion. If the tax it sees and proves the connection of individuals, there will be big problems.

What to do?

Do not transfer money from your legal entity. persons to their LDS or LDS relatives.

Hitting the tax inspectorate

As our lawyer says: “The tax always works on the principle of hitting,” that is, not always according to the law, but within the framework of its authority: the phrase is very scary, if you think about the meaning. Our laws give free rein to tax and other fiscal authorities. This means that the tax can accuse you of evading taxes on absolutely any amount. Responsibility of the tax inspectorate for an unreasonable decision is not provided by the law. And, an entrepreneur can only challenge this decision through the court, which in turn, even if you are right, is guaranteed to take your side, only with certain financial investments from your side. Tax costs are never reimbursed, although it is provided by law.

What to do?

In the last article I have already said that it is better to do business in another country. This is the perfect option. Well, if you’re still unlucky enough to do business in Ukraine, it remains only to fight, to defend your rights by all legal means. It is most effective not to fall into the “tax risk” zone, thereby avoiding a routine check. In the event of a collision and illegal tax decisions, only the court remains.

Tax risk zone

Having a large turnover without hired employees, you can get into the area of tax risk, which will lead to verification by the tax inspectorate. The tax inspectorate doesn’t have a lot of checking employees, they don’t have time to check everyone, so a special program was created that automatically calculates business entities that can evade paying taxes, and go to check with these entrepreneurs.

What to do?

To share cash flows for different, unrelated to each other, business entities. For every 100 thousand UAH. income per year ideally have one employee. And, of course, be ready to prove to the audit that the work was done by the number of hired people who officially work for you.

Gray salary check

Hiring an employee officially, he needs to assign a salary and pay taxes on it. Many try to save money and pay the minimum wage officially, and the rest in an envelope. Naturally, it is illegal, and the state is trying to fight it, so payers of the gray salary often come with checks.

What to do?

Not to pay a gray salary is if according to the law. In general, when checking you need, you can explain why the minimum wage is paid, and your employees could confirm it. For example, they took a person for an internship, no money for high wages, this is a competitive salary, etc.

Instead of conclusion

Now there are active conversations about reducing income tax to 5% instead of 15% and reducing the single social contribution for the IT industry, but for now this is only talk.

So, the article describes a scheme that can be used by IT companies providing services and having high margins. For companies that are engaged in the resale of advertising, equipment and other capital-intensive, but low-margin products, other legal tax minimization schemes should be used. Just one article does not cover, so those in need can contact me personally, contacts are not difficult to find.

Attention!!! Ukraine has a very unstable legislation, which changes almost every year, so this article can be used in 2013, and then track changes in legislation. Subscribe to our pages in the social. networks, we will periodically report about innovations.

Pay taxes, work in white and sleep well!

PS Let me tell you a little secret: our not-so-specific previous publications on legal topics were actually timed to the opening of our new company, which is called Taxov and specializes in legal services for IT business. More information can be found on the official website of the law firm " Taxov ".

PPS We will try to publish changes in legislation and continue to write about various schemes for proper operation, so subscribe to us on Facebook , VK or Twitter

Original article here: http://taxov.com/legal_tax_minimization_for_IT_companies_in_Ukraine.html

Author:

Nikita Semenov ( Facebook , VK , LinkedIn )

Owner

Law firm Taxov

Source: https://habr.com/ru/post/182762/

All Articles