Market Overview of IT Distribution in Ukraine: Corporate Sector

We know that copy-paste is not very welcome on the Habré, but in this case we saw a good review, so we decided to reprint it, because it doesn’t have it. The review is worthy of being reprinted.

The total volume of the IT market in Ukraine in 2012, according to various sources, is estimated at $ 3–3.2 billion. This figure remained almost unchanged compared to 2011. We are talking about sales of software and hardware without taking into account outsourcing programming services, the volume of which at this stage cannot be reliably calculated. At the same time, the total cost of IT services does not exceed $ 300-400 million, officially implemented software - $ 200-300 million. The remaining mass of sales ($ 2.4-2.5 billion) falls on hardware components. Most of these products came into the country due to domestic distributors. At the same time, if we subtract from the total market the share of services that are mainly provided by integrators, then the total volume of the domestic IT distribution segment can be determined in the range of $ 2.8-3 billion.

')

But here the share of user solutions is large - from tablets to computer.

mice, accounting for 70-75% of sales. In view of the specifics of our publication as a whole and of this article in particular, we will further consider only the segment of corporate decisions, which in 2012, according to our data, was $ 600-650 million. In this direction there are players and work specifics that are worthy of a separate analysis.

Also note that in the area of corporate solutions, despite the general decline in demand, the main role is played by large customers. The SMB sector has not yet become decisive. As before, the main volume of deliveries of IT solutions (equipment, software, services) in 2012 was completed into projects for 15–20 largest customers. Among them are banks (PrivatBank, Ukrsotsbank, Oschadbank), communication operators (Kyivstar, MTS, Astelit, Ukrtelecom), industrial groups (DTEK, Metinvest, Ar-SelorMittal Kryvyi Rih ”), state structures (“ Ukrpochta ”,“ Ukraerorukh ”,“ Naftogaz ”,“ Ukrtransgaz ”,“ Ukrhydroenergo ”) and several others.

Multivendor Distributors

Ukrainian distributors in the corporate solutions segment can be divided into two main groups - multivendor, representing products in several market niches, and specialized ones, which emphasize the promotion of one or two priority areas.

The largest companies belong to the first group. In particular, it includes four IT distributors - ERC, MUK, MTI, Megatrade, which in 2012 accounted for about 70% of supplies to the corporate sector of the Ukrainian market. All of these companies, despite their differences, have a set of common characteristics that can be attributed to one group.

Among the characteristic parameters: annual sales in the corporate segment of at least $ 50 million; a wide partnership network consisting of hundreds of companies (dealers, integrators); an extensive portfolio of suppliers of IT solutions for many segments (servers, storage systems, LANs, software, SCS, video conferencing, UPS, software, security systems, components and other areas), the number of represented manufacturers ranges from forty to more than eighty; own training and service centers; staff of several hundred people.

At the same time, each of the companies adheres to its business model (Table 1). For example, Megatrade supplies only to the corporate segment, while most of the products sold by ERC are in the user market. In the MUK nomenclature, up to 80-85% are solutions for large customers and SMBs. MTI's multi-vendor distributor has been active in the corporate IT sector, but the company has been developing this area for only a few years, and a significant share of the supply has been in consumer solutions, where MTI has more than twenty years of experience.

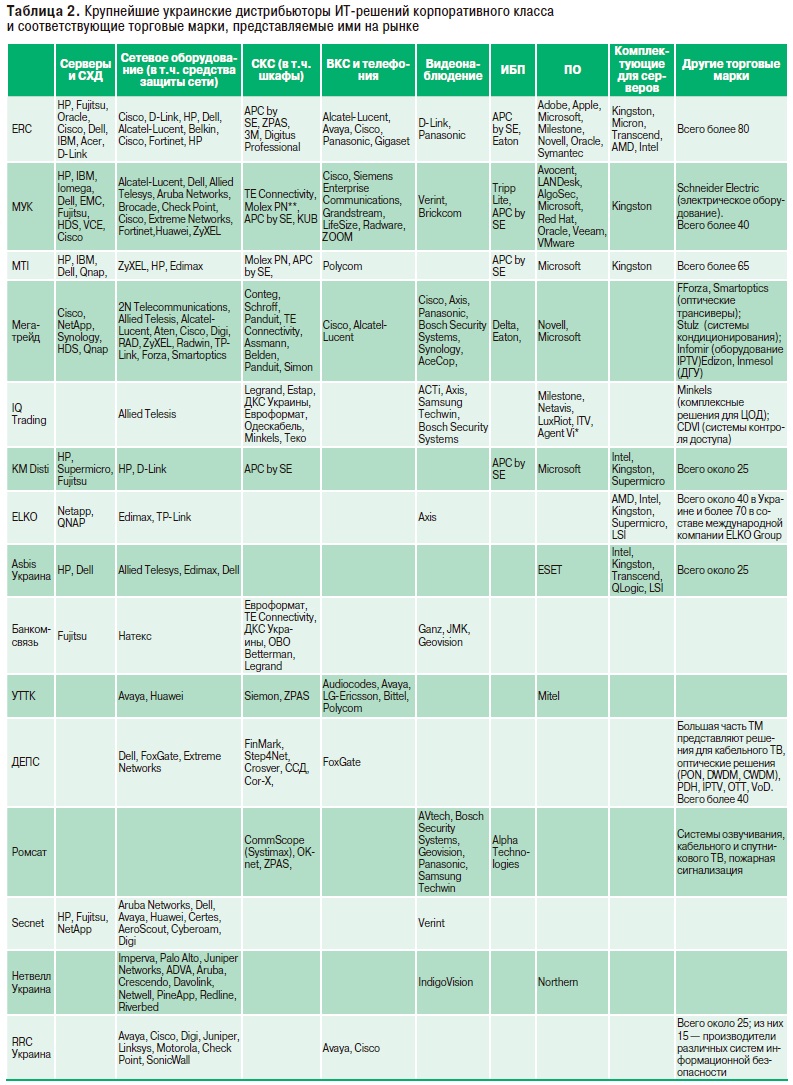

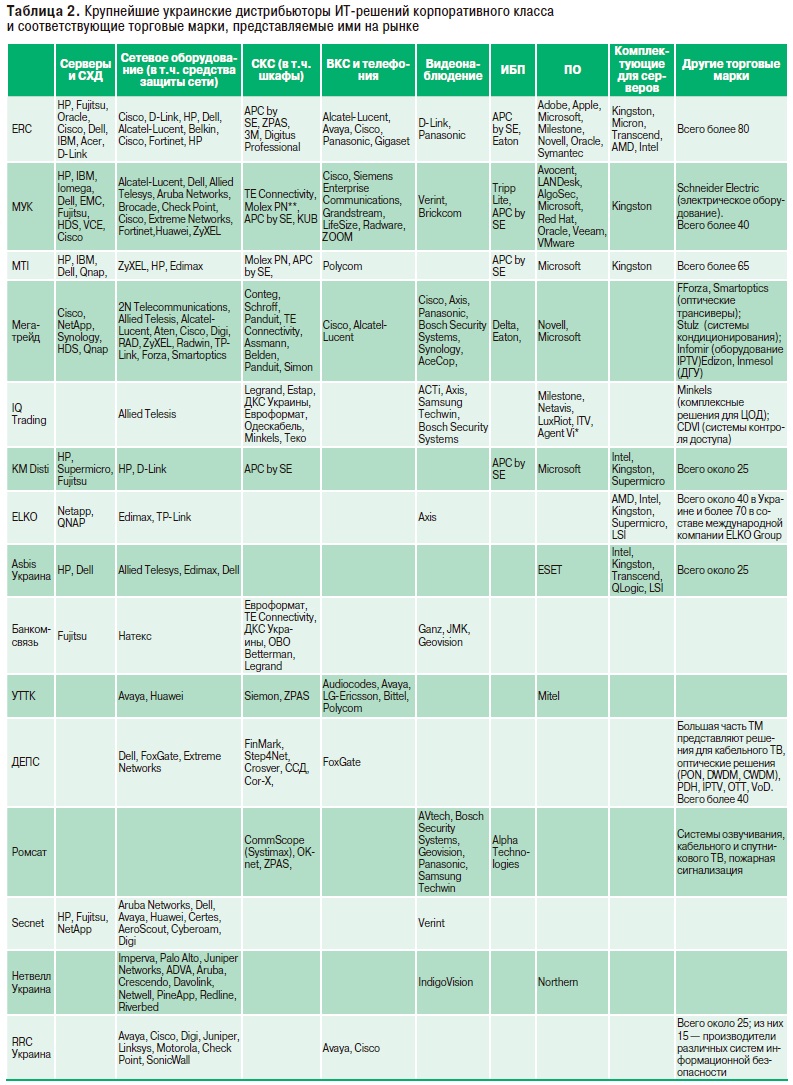

As for distribution by sales, ERC is the market leader. At the same time, deliveries to the corporate segment occupy a relatively small share in the company's overall business. In general, this result was achieved due to a large gross sales volume and a well-established sales channel - the company's affiliate network consists of more than 1,700 participants, and over eighty brands in the manufacturers' portfolio (Table 2). Recall also that ERC has been operating in the Ukrainian market since 1995.

The second place, according to estimates by SI, with a small margin from the leader is taken by MUK, which maintains contacts with more than 900 partners. Unlike ERC, the company focuses on the corporate segment. The total number of brands represented by the company on the Ukrainian market is more than forty. We also note that the MUK service center is an authorized partner of APC by SE, AudioCodes, Cisco, Dell, EMC, Fortinet, Fujitsu, Hitachi Data Systems, HP, Huawei, IBM, Iomega, Samsung, Tripp Lite, etc. In addition, Own training center provides professional training on HP, Fortinet, Extreme Networks, Fujitsu, VMware solutions. However, "MUK" is actively increasing the number of brands offered. So, in 2012 and the first half of 2013, contracts were concluded with nineteen companies, including: AlgoSec, Allied Telesys, AMP (TE Connectivity), Aruba Networks, ASUS, Brickcom, Gazer, Gigamon, Google APPS, Kingston, KUB , Nakivo, OKI, Qihan, Ricoh, Samsung, Schneider Electric, VCE, ZyXEL. Another twelve manufacturers are actively negotiating, so the list of MUK partners will be expanded this year.

Note that “MUK” (“Merisel Ukraine”) started working in our country since 1997 as a regional division of the Russian distributor Merisel CIS (later Verysell), but already in 1998, “MUK” became an independent company.

The third place in terms of deliveries to the corporate IT segment is shared by MTI and Megatrade. MTI (on the market since 1991) represents more than 65 trademarks in our country and cooperates with almost five hundred partners all over Ukraine (there are about 150-200 companies in the corporate sector). This year, the company received the status of a distributor in Ukraine of SCS Molex PN solutions. Prior to this, MUK was promoting the brand, since 2013, she preferred TE Connectivity, but at the same time reserved the right to supply Molex PN products to the CIS countries (except Ukraine). MTI also actively promotes Microsoft solutions, is one of the largest suppliers in Ukraine of servers and storage systems of HP, IBM, Dell. Note that MTI does not have its own training center in the field of corporate IT, but it supports a service center.

In addition to the distribution direction, MTI develops other areas of business. It also includes the Pretoria network of computer hardware stores; SI BIS system integrator; MTI Security Systems company - supplier and integrator of security systems; own automated logistic complex of class "A" and other structures.

The activity of Megatrade began in 1996 and is fully concentrated in the corporate segment. The distributor’s affiliate network covers several hundred companies, and the number of trademarks represented is about forty. "Megatrade" works in all major areas of the corporate IT market in Ukraine (Table 2) and is actively increasing its portfolio of proposed solutions. Over the past year, such companies as Synology and HDS (corporate storage systems), TP-Link (network equipment), Bosch Security Systems and AceCop (video surveillance systems) have emerged among the partners of Megatrade. At the same time, the company is the only distributor in Ukraine of the trademarks Conteg, Simon, Bosch Security Systems, Delta, Synology, Stulz, TP-Link (only for the SMB segment). The company's service center is authorized by manufacturers such as Aten, 2N Telecommunications, IBM, Eaton, Delta, NetApp, and Cisco, Digi, Allied Telesis, Alcatel-Lucent, Axis, RAD serve as service partners in distribution agreements. In addition, the company has the only Stulz training center in the country. Recall that Megatrade is included in the Octava group of companies (along with Incom, Datagroup, Best Power Ukraine, etc.).

According to representatives of the largest Ukrainian distributors, despite the abundance of manufacturers represented on the market, in the corporate sector, only ten well-known brands provide the main revenue from sales. Among them are IBM, HP, Fujitsu, Dell, EMC, Cisco, Oracle, HDS, APC by SE, Microsoft. It is also worth noting that the distributors of the big four, as, indeed, some small companies, operate not only in Ukraine, but also are representatives of many brands in the CIS countries

All four of the above companies are not only suppliers of products, but also work in the direction of project distribution (or as it is also called Valueadded distribution, VAD). This model implies that the company's specialists are actively involved in the development and implementation of projects that use the equipment supplied by them, as well as provide additional technical, consulting and service services. It is worth noting that this model is becoming increasingly popular, especially during the economic downturn. The fact is that the direct distribution margin, which is obtained on the price difference from the manufacturer and for the dealer, is steadily decreasing. Simple sale of "boxes" and licenses brings less income. On the other hand, the situation is complicated by small suppliers with a short lifespan, who either try their hand at the corporate segment or are created for specific projects. In any case, their overhead costs are lower and the margin is higher than that of large distributors, which allows small companies to exist and occupy certain niches, at the same time washing out the market.

The answer of the major distributors is to provide additional professional services. So, a company can conduct a pre-project audit, analysis of documentation, provide consulting services, even develop a sketch of a project - this is not to mention the possibilities of quality service support and training of customer’s employees. In addition, the own financial resources of a major distributor allow us to provide partners with a commodity loan, deferred payment and other services.

It is also worth noting that competitors often act as competitors

integrator companies that have the status of direct partners and the right to independently import products of one or another manufacturer into the country. But this situation does not have a decisive influence on the market, since in most cases integrators still use the services of distributors who, as a rule, have more established supply chains.

"Second tier"

In addition to the four companies mentioned above, there are about a dozen suppliers on the Ukrainian market, which can be attributed to the “second tier” of multivendor distributors in the field of corporate IT. However, their total share does not exceed 15-20%.

The characteristic features of such companies are the presence in the portfolio of several dozen brands representing various areas, supporting relationships with dozens of partners in Ukraine, specialization in individual segments. In some cases, you may have your own training or service center. The annual turnover is usually much lower than that of the companies of the first group. The “second tier” multivendor distributors include IQ Trading, KM Disti, ELKO, Asbis Ukraine, Bankomsvyaz, UTTC, DEPS, Romsat, RRC Ukraine, Secnet, Netwell Ukraine and some more companies. However, significant multi-profile vendors in the relatively small Ukrainian corporate IT market cannot be too much.

Due to relatively small resources (compared to the four leaders), the second group of distributors have a pronounced specialization in one direction and relatively weak positions in the other. For example, IQ Trading occupies a strong position in the segment of the SCS (Table 2) and video surveillance (CCTV). In the first case, the company offers products Legrand, Odeskabel, Estap, Teko and Euroformat wardrobes, and DKS Ukraine trays. Last year, the distributor's portfolio was replenished with integrated solutions for the data center of the Dutch developer Minkels (part of the Legrand Group). In the field of CCTV, IQ Trading supports a wide variety of solutions that allow you to create full-fledged software and hardware security systems for video surveillance and control this direction. For example, Samsung Techwin products were added to the solutions of Axis, ACTi, Bosch in 2012. IQ Trading also promotes Milestone, Netavis, LuxRiot, ITV, Agent Vi trademarks software in our country, which is intended for CCTV systems and video analytics.

The emphasis on two directions of distribution - SCS and CCTV - is also noticeable in Romsat, which offers cable solutions Comm Scope (Systimax), OK-net, ZPAS cabinets and security systems AVtech, Bosch Security Systems, Geovision, Panasonic, ACTi, Samsung Techwin. In addition, the company offers many other solutions that do not belong to the IT sector - in the segment of sound systems, cable and satellite TV, fire alarms, etc.

A notable player in the segment is KM Disti, which has strong positions in the supply of HP server products, D-Link network solutions, Intel and Supermicro components, as well as developments of a number of other well-known brands.

Bankomsvyaz is both a distributor and a prominent integrator. The main deliveries fall on the SCS segment (Euformat, TE Connectivity, DKS Ukraine, OBO Betterman, Legrand) and video surveillance (Ganz, JMK, Geovision). In addition, Bankomsvyaz is a long-term supplier of Fujitsu solutions, but the positions of the Japanese manufacturer on the Ukrainian market in recent years have been very insignificant, and most of the sales are carried out by MUK and ERC.

Quite large distributors are "UTTK" and "DEPS". The first of them occupies a strong position in the field of IP-telephony and video conferencing systems, the second offers a large set of solutions for cable TV and data transmission over optical networks (PON, DWDM, CWDM) in the domestic market. Several companies represent international distribution groups in Ukraine. Among them are ELKO, Asbis Ukraine, Secnet, Netwell Ukraine, and RRC Ukraine. Moreover, the first company specializes more in solutions for the consumer market, and the last one in information security systems, being also a distributor of Juniper Networks network solutions.

Specialized Distributors

The largest group of IT distributors in the corporate sector is represented by specialized companies that operate in one or two market niches. Some of them import products from only one manufacturer to Ukraine (in this case, they can be called mono-vendor distributors). The total sales of specialized companies is about 10-12% of the volume of the Ukrainian corporate IT distribution market.

Typical representatives of mono-vendor suppliers are, for example, Alpha Grissin Infotech Ukraine (offering Emerson Network Power products to Ukrainian partners) or Rittal TOV, the main representative of the German manufacturer Rittal. Both vendors develop and produce integrated solutions for creating data center infrastructure.

In some cases, the same distributor combines the principles of specialization and mono-vendorism - as a result, a company emerges that supplies solutions from one manufacturer to one or two market niches. An example of this is Synergia SE - the exclusive supplier of R & M solutions in Ukraine. There are a few dozens of specialized distributors in our country, especially in the area of corporate software (Table 3), information security systems, SCS, there are similar companies in the field of LAN, telephony, video conferencing. Often, such organizations are integrators of the delivered solutions. The specialized distributors include, for example, Luger Grid, Madek, NTT Energy. The first is in our country solutions HiRef (air conditioning systems), DGS Tessari Energia, UPS brand Elen and electrical components ASCO (owned by Emerson). Madek supplies DGU FG Wilson, UPS APC by SE and Gamatronic, switchboard equipment Schneider Electric and ABB, diesel rotary UPS Eurodiesel and a number of other specialized solutions. NTT Energy imports General Electric UPS, SDMO SDMO, Ortea stabilizers, Efore current systems, Victron Energy inverters into Ukraine.

The current situation in the corporate IT distribution segment is such that even the absence of a market downturn is a good sign. Over the next year, growth is not expected here, even the most optimistic experts say only about a possible increase in market volumes by no more than 3-4%. At the same time, a realistic forecast implies a continuation of stagnation. Such conditions provoke distributors to search for new sources of income. For some companies, the transition to the corporate sector has become such, someone is expanding the portfolio of brands they represent or increasing sales of custom solutions. Small companies are leaving the market, giving the initiative to large organizations - thus, there is a tendency to strengthen the role of leaders and market consolidation. Also, all large and medium-sized IT distributors strive to earn extra services (VAD), service, training, and also increase the loyalty of partners by giving them financial preferences, such as deferred payment, commodity loans, etc.

- — .

« » «», «», MTI, ITBiz, «» .

,

№ 2 () 2013

.

( ) — .

The total volume of the IT market in Ukraine in 2012, according to various sources, is estimated at $ 3–3.2 billion. This figure remained almost unchanged compared to 2011. We are talking about sales of software and hardware without taking into account outsourcing programming services, the volume of which at this stage cannot be reliably calculated. At the same time, the total cost of IT services does not exceed $ 300-400 million, officially implemented software - $ 200-300 million. The remaining mass of sales ($ 2.4-2.5 billion) falls on hardware components. Most of these products came into the country due to domestic distributors. At the same time, if we subtract from the total market the share of services that are mainly provided by integrators, then the total volume of the domestic IT distribution segment can be determined in the range of $ 2.8-3 billion.

')

But here the share of user solutions is large - from tablets to computer.

mice, accounting for 70-75% of sales. In view of the specifics of our publication as a whole and of this article in particular, we will further consider only the segment of corporate decisions, which in 2012, according to our data, was $ 600-650 million. In this direction there are players and work specifics that are worthy of a separate analysis.

Also note that in the area of corporate solutions, despite the general decline in demand, the main role is played by large customers. The SMB sector has not yet become decisive. As before, the main volume of deliveries of IT solutions (equipment, software, services) in 2012 was completed into projects for 15–20 largest customers. Among them are banks (PrivatBank, Ukrsotsbank, Oschadbank), communication operators (Kyivstar, MTS, Astelit, Ukrtelecom), industrial groups (DTEK, Metinvest, Ar-SelorMittal Kryvyi Rih ”), state structures (“ Ukrpochta ”,“ Ukraerorukh ”,“ Naftogaz ”,“ Ukrtransgaz ”,“ Ukrhydroenergo ”) and several others.

Multivendor Distributors

Ukrainian distributors in the corporate solutions segment can be divided into two main groups - multivendor, representing products in several market niches, and specialized ones, which emphasize the promotion of one or two priority areas.

The largest companies belong to the first group. In particular, it includes four IT distributors - ERC, MUK, MTI, Megatrade, which in 2012 accounted for about 70% of supplies to the corporate sector of the Ukrainian market. All of these companies, despite their differences, have a set of common characteristics that can be attributed to one group.

Among the characteristic parameters: annual sales in the corporate segment of at least $ 50 million; a wide partnership network consisting of hundreds of companies (dealers, integrators); an extensive portfolio of suppliers of IT solutions for many segments (servers, storage systems, LANs, software, SCS, video conferencing, UPS, software, security systems, components and other areas), the number of represented manufacturers ranges from forty to more than eighty; own training and service centers; staff of several hundred people.

At the same time, each of the companies adheres to its business model (Table 1). For example, Megatrade supplies only to the corporate segment, while most of the products sold by ERC are in the user market. In the MUK nomenclature, up to 80-85% are solutions for large customers and SMBs. MTI's multi-vendor distributor has been active in the corporate IT sector, but the company has been developing this area for only a few years, and a significant share of the supply has been in consumer solutions, where MTI has more than twenty years of experience.

As for distribution by sales, ERC is the market leader. At the same time, deliveries to the corporate segment occupy a relatively small share in the company's overall business. In general, this result was achieved due to a large gross sales volume and a well-established sales channel - the company's affiliate network consists of more than 1,700 participants, and over eighty brands in the manufacturers' portfolio (Table 2). Recall also that ERC has been operating in the Ukrainian market since 1995.

The second place, according to estimates by SI, with a small margin from the leader is taken by MUK, which maintains contacts with more than 900 partners. Unlike ERC, the company focuses on the corporate segment. The total number of brands represented by the company on the Ukrainian market is more than forty. We also note that the MUK service center is an authorized partner of APC by SE, AudioCodes, Cisco, Dell, EMC, Fortinet, Fujitsu, Hitachi Data Systems, HP, Huawei, IBM, Iomega, Samsung, Tripp Lite, etc. In addition, Own training center provides professional training on HP, Fortinet, Extreme Networks, Fujitsu, VMware solutions. However, "MUK" is actively increasing the number of brands offered. So, in 2012 and the first half of 2013, contracts were concluded with nineteen companies, including: AlgoSec, Allied Telesys, AMP (TE Connectivity), Aruba Networks, ASUS, Brickcom, Gazer, Gigamon, Google APPS, Kingston, KUB , Nakivo, OKI, Qihan, Ricoh, Samsung, Schneider Electric, VCE, ZyXEL. Another twelve manufacturers are actively negotiating, so the list of MUK partners will be expanded this year.

Note that “MUK” (“Merisel Ukraine”) started working in our country since 1997 as a regional division of the Russian distributor Merisel CIS (later Verysell), but already in 1998, “MUK” became an independent company.

The third place in terms of deliveries to the corporate IT segment is shared by MTI and Megatrade. MTI (on the market since 1991) represents more than 65 trademarks in our country and cooperates with almost five hundred partners all over Ukraine (there are about 150-200 companies in the corporate sector). This year, the company received the status of a distributor in Ukraine of SCS Molex PN solutions. Prior to this, MUK was promoting the brand, since 2013, she preferred TE Connectivity, but at the same time reserved the right to supply Molex PN products to the CIS countries (except Ukraine). MTI also actively promotes Microsoft solutions, is one of the largest suppliers in Ukraine of servers and storage systems of HP, IBM, Dell. Note that MTI does not have its own training center in the field of corporate IT, but it supports a service center.

In addition to the distribution direction, MTI develops other areas of business. It also includes the Pretoria network of computer hardware stores; SI BIS system integrator; MTI Security Systems company - supplier and integrator of security systems; own automated logistic complex of class "A" and other structures.

The activity of Megatrade began in 1996 and is fully concentrated in the corporate segment. The distributor’s affiliate network covers several hundred companies, and the number of trademarks represented is about forty. "Megatrade" works in all major areas of the corporate IT market in Ukraine (Table 2) and is actively increasing its portfolio of proposed solutions. Over the past year, such companies as Synology and HDS (corporate storage systems), TP-Link (network equipment), Bosch Security Systems and AceCop (video surveillance systems) have emerged among the partners of Megatrade. At the same time, the company is the only distributor in Ukraine of the trademarks Conteg, Simon, Bosch Security Systems, Delta, Synology, Stulz, TP-Link (only for the SMB segment). The company's service center is authorized by manufacturers such as Aten, 2N Telecommunications, IBM, Eaton, Delta, NetApp, and Cisco, Digi, Allied Telesis, Alcatel-Lucent, Axis, RAD serve as service partners in distribution agreements. In addition, the company has the only Stulz training center in the country. Recall that Megatrade is included in the Octava group of companies (along with Incom, Datagroup, Best Power Ukraine, etc.).

According to representatives of the largest Ukrainian distributors, despite the abundance of manufacturers represented on the market, in the corporate sector, only ten well-known brands provide the main revenue from sales. Among them are IBM, HP, Fujitsu, Dell, EMC, Cisco, Oracle, HDS, APC by SE, Microsoft. It is also worth noting that the distributors of the big four, as, indeed, some small companies, operate not only in Ukraine, but also are representatives of many brands in the CIS countries

All four of the above companies are not only suppliers of products, but also work in the direction of project distribution (or as it is also called Valueadded distribution, VAD). This model implies that the company's specialists are actively involved in the development and implementation of projects that use the equipment supplied by them, as well as provide additional technical, consulting and service services. It is worth noting that this model is becoming increasingly popular, especially during the economic downturn. The fact is that the direct distribution margin, which is obtained on the price difference from the manufacturer and for the dealer, is steadily decreasing. Simple sale of "boxes" and licenses brings less income. On the other hand, the situation is complicated by small suppliers with a short lifespan, who either try their hand at the corporate segment or are created for specific projects. In any case, their overhead costs are lower and the margin is higher than that of large distributors, which allows small companies to exist and occupy certain niches, at the same time washing out the market.

The answer of the major distributors is to provide additional professional services. So, a company can conduct a pre-project audit, analysis of documentation, provide consulting services, even develop a sketch of a project - this is not to mention the possibilities of quality service support and training of customer’s employees. In addition, the own financial resources of a major distributor allow us to provide partners with a commodity loan, deferred payment and other services.

It is also worth noting that competitors often act as competitors

integrator companies that have the status of direct partners and the right to independently import products of one or another manufacturer into the country. But this situation does not have a decisive influence on the market, since in most cases integrators still use the services of distributors who, as a rule, have more established supply chains.

"Second tier"

In addition to the four companies mentioned above, there are about a dozen suppliers on the Ukrainian market, which can be attributed to the “second tier” of multivendor distributors in the field of corporate IT. However, their total share does not exceed 15-20%.

The characteristic features of such companies are the presence in the portfolio of several dozen brands representing various areas, supporting relationships with dozens of partners in Ukraine, specialization in individual segments. In some cases, you may have your own training or service center. The annual turnover is usually much lower than that of the companies of the first group. The “second tier” multivendor distributors include IQ Trading, KM Disti, ELKO, Asbis Ukraine, Bankomsvyaz, UTTC, DEPS, Romsat, RRC Ukraine, Secnet, Netwell Ukraine and some more companies. However, significant multi-profile vendors in the relatively small Ukrainian corporate IT market cannot be too much.

Due to relatively small resources (compared to the four leaders), the second group of distributors have a pronounced specialization in one direction and relatively weak positions in the other. For example, IQ Trading occupies a strong position in the segment of the SCS (Table 2) and video surveillance (CCTV). In the first case, the company offers products Legrand, Odeskabel, Estap, Teko and Euroformat wardrobes, and DKS Ukraine trays. Last year, the distributor's portfolio was replenished with integrated solutions for the data center of the Dutch developer Minkels (part of the Legrand Group). In the field of CCTV, IQ Trading supports a wide variety of solutions that allow you to create full-fledged software and hardware security systems for video surveillance and control this direction. For example, Samsung Techwin products were added to the solutions of Axis, ACTi, Bosch in 2012. IQ Trading also promotes Milestone, Netavis, LuxRiot, ITV, Agent Vi trademarks software in our country, which is intended for CCTV systems and video analytics.

The emphasis on two directions of distribution - SCS and CCTV - is also noticeable in Romsat, which offers cable solutions Comm Scope (Systimax), OK-net, ZPAS cabinets and security systems AVtech, Bosch Security Systems, Geovision, Panasonic, ACTi, Samsung Techwin. In addition, the company offers many other solutions that do not belong to the IT sector - in the segment of sound systems, cable and satellite TV, fire alarms, etc.

A notable player in the segment is KM Disti, which has strong positions in the supply of HP server products, D-Link network solutions, Intel and Supermicro components, as well as developments of a number of other well-known brands.

Bankomsvyaz is both a distributor and a prominent integrator. The main deliveries fall on the SCS segment (Euformat, TE Connectivity, DKS Ukraine, OBO Betterman, Legrand) and video surveillance (Ganz, JMK, Geovision). In addition, Bankomsvyaz is a long-term supplier of Fujitsu solutions, but the positions of the Japanese manufacturer on the Ukrainian market in recent years have been very insignificant, and most of the sales are carried out by MUK and ERC.

Quite large distributors are "UTTK" and "DEPS". The first of them occupies a strong position in the field of IP-telephony and video conferencing systems, the second offers a large set of solutions for cable TV and data transmission over optical networks (PON, DWDM, CWDM) in the domestic market. Several companies represent international distribution groups in Ukraine. Among them are ELKO, Asbis Ukraine, Secnet, Netwell Ukraine, and RRC Ukraine. Moreover, the first company specializes more in solutions for the consumer market, and the last one in information security systems, being also a distributor of Juniper Networks network solutions.

Specialized Distributors

The largest group of IT distributors in the corporate sector is represented by specialized companies that operate in one or two market niches. Some of them import products from only one manufacturer to Ukraine (in this case, they can be called mono-vendor distributors). The total sales of specialized companies is about 10-12% of the volume of the Ukrainian corporate IT distribution market.

Typical representatives of mono-vendor suppliers are, for example, Alpha Grissin Infotech Ukraine (offering Emerson Network Power products to Ukrainian partners) or Rittal TOV, the main representative of the German manufacturer Rittal. Both vendors develop and produce integrated solutions for creating data center infrastructure.

In some cases, the same distributor combines the principles of specialization and mono-vendorism - as a result, a company emerges that supplies solutions from one manufacturer to one or two market niches. An example of this is Synergia SE - the exclusive supplier of R & M solutions in Ukraine. There are a few dozens of specialized distributors in our country, especially in the area of corporate software (Table 3), information security systems, SCS, there are similar companies in the field of LAN, telephony, video conferencing. Often, such organizations are integrators of the delivered solutions. The specialized distributors include, for example, Luger Grid, Madek, NTT Energy. The first is in our country solutions HiRef (air conditioning systems), DGS Tessari Energia, UPS brand Elen and electrical components ASCO (owned by Emerson). Madek supplies DGU FG Wilson, UPS APC by SE and Gamatronic, switchboard equipment Schneider Electric and ABB, diesel rotary UPS Eurodiesel and a number of other specialized solutions. NTT Energy imports General Electric UPS, SDMO SDMO, Ortea stabilizers, Efore current systems, Victron Energy inverters into Ukraine.

The current situation in the corporate IT distribution segment is such that even the absence of a market downturn is a good sign. Over the next year, growth is not expected here, even the most optimistic experts say only about a possible increase in market volumes by no more than 3-4%. At the same time, a realistic forecast implies a continuation of stagnation. Such conditions provoke distributors to search for new sources of income. For some companies, the transition to the corporate sector has become such, someone is expanding the portfolio of brands they represent or increasing sales of custom solutions. Small companies are leaving the market, giving the initiative to large organizations - thus, there is a tendency to strengthen the role of leaders and market consolidation. Also, all large and medium-sized IT distributors strive to earn extra services (VAD), service, training, and also increase the loyalty of partners by giving them financial preferences, such as deferred payment, commodity loans, etc.

- — .

« » «», «», MTI, ITBiz, «» .

,

№ 2 () 2013

.

( ) — .

Source: https://habr.com/ru/post/182248/

All Articles