Course lectures "Startup". Peter Thiel. Stanford 2012. Session 14

In the spring of 2012, Peter Thiel ( Peter Thiel ), one of the founders of PayPal and the first investor of Facebook, held a course in Stanford - “Startup”. Before starting, Thiel stated: "If I do my job correctly, this will be the last subject you will have to study."

One of the students of the lecture recorded and laid out a transcript . In this case, f1yegor and astropilot translate the fourteenth lesson.

Session 1: Future Challenge

Activity 2: Again, like in 1999?

Session 3: Value Systems

Lesson 4: The Last Turn Advantage

Session 5: Mafia Mechanics

Activity 6: Thiel's Law

Activity 7: Follow the Money

Session 8: Idea Presentation (Pitch)

Lesson 9: Everything is ready, but will they come?

Lesson 10: After Web 2.0

Session 11: Secrets

Session 12: War and Peace

Lesson 13: You are not a lottery ticket

Session 14: Ecology as a Worldview

Session 15: Back to the Future

Session 16: Understanding

Session 17: Deep Thoughts

Session 18: Founder — Sacrifice or God

Session 19: Stagnation or Singularity?

I. Reflection on energy

Alternative energy and clean technologies have attracted a huge amount of investment capital and public attention over the past decade. Almost nothing worked as expected. Thus, the experience of clean technologies can be extremely instructive. Asking significant questions, what went wrong and what can be done better, we will be able to reconsider our views and apply a lot of what we talked about in lectures.

')

A. Proper structure

How should we perceive energy as a sector of the economy? What is the appropriate frame of reference?

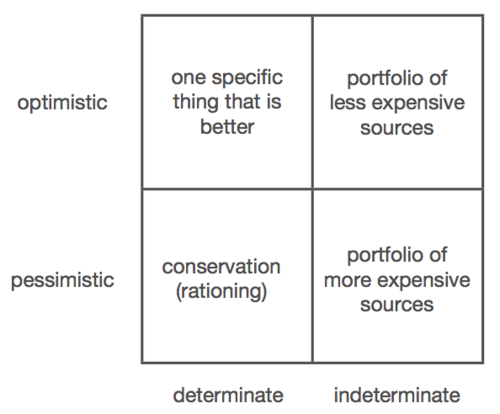

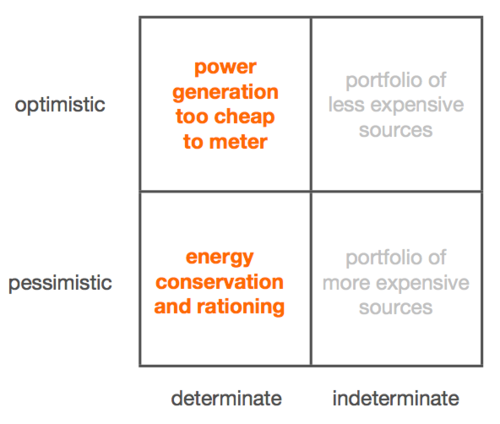

It may be useful to recall a 2x2 matrix of defined / uncertain and optimistic / pessimistic outcomes. We give an example of the corresponding quadrants:

It is important to note, and it is in the context of clean technology that we will see that the planned uncertainty does not really work. You can't just schedule a job change every two years and call it a plan. This is the lack of a plan. This is similar to the plan to become rich. “I intend to become rich and famous” is a vague aspiration, not a plan. Plans are not a portfolio that you can’t just compile. With this approach to work, there should be a certain level of detail. For example, the approach “If I make X, this will lead to 5 specific opportunities at a particular point in time in the future, in which I will choose the most favorable one” may be specific enough to take effect.

But in practice, people usually do not choose specific goals, which will then develop. They only understand that they will have enough opportunities, and which ones they will determine later. Thus, in theory there can be a more definite, real version of indefinite optimism; in practice, statistical thinking gives rise to the exact opposite uncertainty and the thinking that depends on what is happening. Aspirations replace plans.

So far, people are skeptical about startups with plans. It is customary to think that detailed plans are useless, because everything tends to change as it should. But having a thought-out plan is key. To convince, I will say that there are cases when success comes, despite the lack of a plan. But one must also take into account the horrific set of failures. Winning without a plan is like getting the jackpot, and most people don't really break it. Since you want to have as much control over the situation as possible, you need a plan.

B. Applied to energy

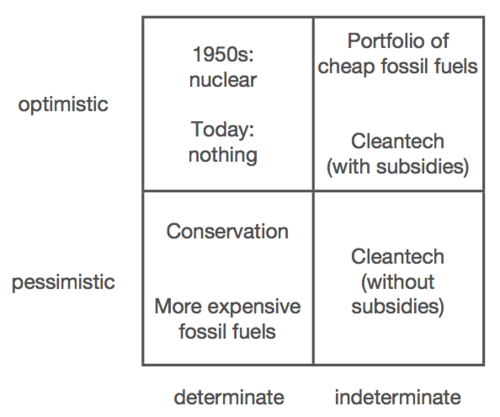

To talk about the future of energy, we can use the same matrix. Quadrants are divided into:

- Definite, optimistic : there is one best kind of energy, and it needs to be developed.

- Definite, pessimistic : there is no technology or energy source, much better than others. You only have what is. Therefore, normalize and save it.

- Uncertain, optimistic : there are better and cheaper sources of energy. We simply do not know about their existence. Therefore, it is better to have a whole set of resources.

- Indefinite, pessimistic : we do not assume which sources of energy are advantageous, but they will probably become worse and more expensive. Operate the portfolio method.

The idea of a certain optimistic quadrant is probably the most meaningful, but the least discussed today.

The energy market is huge. It may be better to think of it as two separate markets. The first is the production of energy: wood, coal, natural gas, nuclear fuel, biomass, water and solar energy - that feeds the power system. The other is the transportation market, consisting mainly of oil and electricity for buses, trains, and so on. In the transportation market, you cannot easily connect to the electricity system; you have to stock up on energy and keep it with you as you use it.

One preliminary question for reflection in all contexts regarding energy will be - what is a valid market. Energy in a general sense? Energy production? Transportation? Or are there smaller markets that can be distinguished within the considered?

C. Energy production

In the 1950s and 1960s, people were optimistic about atomic energy. This was what everyone perceived as something better. President Eisenhower, in his 1953 Atoms for Peace speech, announced that nuclear power would produce energy too cheap to measure. Today, on the contrary, there is no separate technology, generally recognized as the best and cheap. A certain energy optimism is dead.

But this does not mean that people are still not optimistic. Some are optimistic. They are just vaguely optimistic. Thus, the main focus has shifted towards creating a portfolio of cheap fossil fuels. Some also subsidize environmentally friendly technologies, as in some variants of indefinite optimism, clean technologies will actually be cheaper than fossil fuels if you pay attention to the hidden costs of pollution abatement costs when using fossil fuels. But in any case, the future is basically a pie chart made up of various sources.

Pessimistic prospects for energy production identified. Deterministic gaze focuses on energy conservation; the future will definitely not improve, and fossil fuels will only become more expensive. The non-deterministic variant will also focus on a number of attempts in the field of environmentally friendly technologies, since they have proven a slight superiority over fossil fuels.

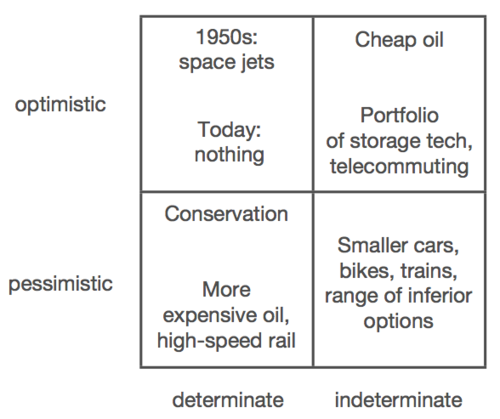

D. Transport Energy

In the 1950s, humanity seriously imagined the future filled with jet aircraft and even faster and cheaper supersonic aircraft. They looked at things optimistically and definitely. Today there is almost no activity in this quadrant. There is no general agreement that any particular technology of transport energy resources will be improved and will prevail.

There is some activity in the quadrant of indefinite optimism. This is a modern approach to the portfolio. It mainly concentrates on a portfolio of various storage technologies. Improving batteries, electric cars, telecommuting, and cheap oil still seem like viable solutions, but none of them seem to be the best or most promising.

In the indefinite pessimism of Japan and Europe, you get a whole range of secondary opportunities. People ride bicycles. If they move on cars, then on miniature. Or, probably, they take the train and get to work longer. The point is that none of this is going to improve.

High-speed railway is the best example of a certain pessimism. The only way to implement high-speed rail traffic is to rebuild the habitat so that everyone lives and works in much smaller cities. The planning of the city and the efforts to re-arrange it are enormous and take a long time. Gone are the days when Robert Moses could independently re-plan the state of New York. We no longer live on this level. Instead, we think about future uncertainty. All we know is that oil is likely to rise in price, and the only thing we can do is ensure high-speed rail traffic, and it’s almost impossible to postpone.

Today, the United States is in the upper right quadrant of optimistic determinism. Republicans are defending a number of, hopefully, the best deals, and we need to get rid of all settlements in order to get them. Democrats are protecting a number of other innovations, and we need to finance environmentally friendly technologies to get them.

China is located in the lower left quadrant of pessimistic determinism. The future is coal and oil. The plan is to buy oil fields in Africa and within the country — and extract as much coal as possible. About 3,000 to 5,000 people die each year from accidents in coal mines in China. They actually start a small war every year to get enough coal.

Ii. Brief history of energy

A. Return of the exponential law

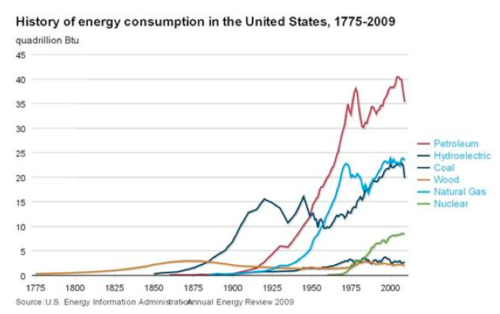

One argument against the indefinite approach is that the history of energy consumption in the United States was very determined. A single source of energy has always prevailed. Until the middle of the XIX century, these sources were wood. One reason why America had a higher standard of living than Britain was because they had more wood. People have more or less exhausted the stock of trees in Britain and therefore they would freeze at night. Coal became popular in the middle of the 19th century and prevailed until the beginning of the 20th century. Oil took the lead as an energy source in the 1930s and 1940s. Natural gas just appeared and caught up with coal in second position. Nuclear power began to approach them as a third source of energy.

Gasoline prevailed in transport energy. Coal prevailed in the production of electricity, although, apparently, natural gas could replace it. But, as a rule, one of the energy sources prevails in any considered period of time. There is a logical reason for this. It would hardly be possible to dictate to the Universe to equate the cost of such various types of energy sources. Solar energy is different from wind energy, which is very different from atomic. It would be very strange if the prices and efficiency of different types of fuel actually turned out to be identical. Therefore, the expected reason is quite obvious, why we expect to see one dominant source of energy.

This can be represented as a function of the exponential law. Energy sources are probably not normally distributed values for cost and efficiency. It is very likely that one is significantly better than all the others. Perhaps the second and third sources of energy on this list will succeed and fill an important niche. The rest are probably less useful. But as far as observing the action of the exponential law in other contexts, people tend to ignore energy altogether. We still tend to think about energy through the lens of a statistical view, the method of portfolio. You cannot predict the future. Everything is uncertain. It does not make sense to believe that everything is or can be unique.

B. The appearance of complex tasks

Another problem with uncertainty becomes apparent when you look at global energy demand trends. Electricity consumption in the United States is growing at a modest pace. China has overtaken the US in total consumption. India is still far enough, but is growing tirelessly. China’s GDP growth and energy consumption increase is 1: 1. The consumption of each type of fuel has increased by 8% annually over the past decade. This is amazing. This means that, at least with respect to energy, there is no improvement. This is a story of little efficiency gained. You only get more if you spend more.

Transport energy development trends are also strange. In China, more cars are now sold than in the USA. World oil consumption is 85 million barrels per day. The US consumes about 18 million - just below 25% of total consumption. China consumes 9 million barrels per day. But China has 4 times the population than the United States. If China consumed as much oil as Americans per capita, it would be 72 million barrels per day. But this is about the whole world production. There is a feeling that something must happen at some point in time. Even if everyone suddenly changes to “smarts”, this figure will decrease only to 45 million barrels.

It is also worth noting that the inflexibility of oil prices can be represented as a 10: 1 ratio. If the demand for oil increases by 10%, prices will rise by 100%. Together with universal globalization, the combination of disproportionate pricing and the difficulty of finding direct substitutes suggests that we are on the verge of new challenges that we will face in the next few decades.

C. Resource Limits

There have always been concerns about finite resources. Everyone is familiar with the Malthus case. In the early 1970s, an international public organization dedicated to the study of the prospects for the development of the biosphere, called the Club of Rome , published the book “The Limits to Growth”, which became the biggest bestseller in the environment. The main thesis of this book was the idea that there are plenty of ways to exhaust all energy capacity, either at the expense of resources, or at the expense of the population.

Paul Ehrlich wrote a book called The Population Bomb in 1968. In it, he argued that the world significantly exceeds its allowable energy capacity, even with 3.5 billion people. This turned out to be completely wrong. Now there are twice as many people on earth. Resource constraints are thus more realistic than population constraints. Of the 7 billion on earth, only 1 billion live in developed countries. It will take a significant increase in energy costs for the remaining 6 billion to live in the same conditions as the first billion.

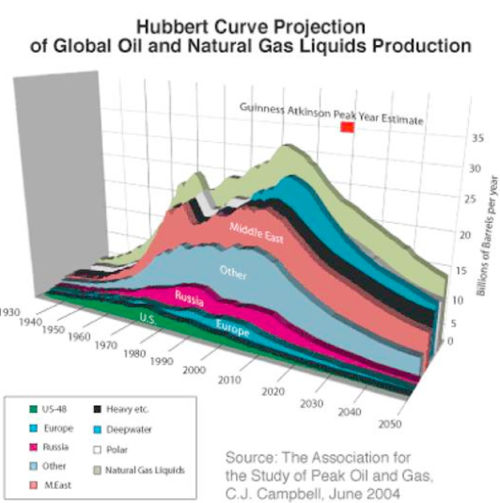

The theory of peak oil production is an interesting look at resource constraints. In 1956, the geophysicist of Shell Company Marion King Hubbert (M. King Hubbart) noticed a slowdown in the pace of the discovery of new oil wells. He found a delay of 20-30 years between the opening of the well and the depletion of production. Hubbert predicted that US oil production would peak in the mid-70s and then begin to fall. No one believed him at the time, because it seemed that there would be no problems with oil. The United States resembled Saudi Arabia today and was a very large exporter. The Texas Railroad Commission effectively set the world price for oil. Things went well. But Hubbert's prediction came true, more or less accurately. In 1970, the Texas Railroad Commission did not impose any quotas, supply and demand were in balance. But by 1973 there were shocks in the oil market. US production fell. The commission was replaced by the OPEC cartel.

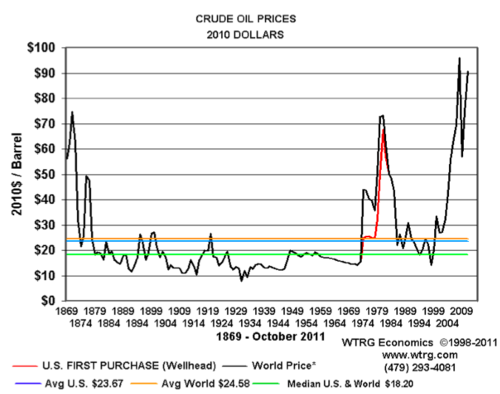

Then OPEC went very far, increasing prices by 4 times, from $ 3 to $ 12 per barrel. Then the price increased fourfold again in 1989, reaching $ 40 a barrel. Then Alaska entered the game. But we started to run into problems again over the past decades. Based on global indicators, Hubbert prediction says that the world is now in the position of the United States in 1970, production has already reached its peak or will soon reach.

Many crises of the last decade can be seen as energy crises. People may be too focused on the financial aspect of the so-called 2007 financial crisis. What if we just reached the peak of Hubbert? The price of oil has risen to $ 140 per barrel. The only way to restrain it is the destruction of most companies. This happened. The price of oil fell to $ 32. But now, several years later, the price has returned to the level of $ 100 per barrel. This cynical game of "musical chairs". If we live in a deterministic pessimistic world, then who will fly out next? Southern Europe or China are the most likely candidates. In the world of lack of resources, they simply will not be enough for everyone. Financial crises and problems of central banks can concern not only finance and central banks.

Even if you do not believe in the theory of the oil peak, oil has always been associated with problems. Oil spill in Alaska in 1989 and the explosion of the Deepwater Horizon oil platform in 2010. Widely known images of burning oil fields in Kuwait in 1991. There is talk that 9/11 is somehow connected with the US oil interests abroad.

The working hypothesis is that the main conflicts in the 2000s concerned energy. The oil trade and embargo contributed to the tension that provoked the Pacific theater of operations during World War II. As secretary of the British naval forces, Winston Churchill nationalized the Anglo-Persian oil fields within the redistribution of today's Iraq two months before the start of World War II. If you go further into the past, then one of the most important events of the Civil War was the separation of West Virginia from Virginia. It was a big step, because it gave the northern states 20 times more coal than the south had, which played a significant role in the outcome of the war.

Consider prices are not oil over the last century. Prices were very high at the end of the 19th century, when oil was first discovered. But later oil became rather cheap, up to the 1970s, when OPEC overshadowed the Railway Commission as an economic entity setting oil prices. The mild climate of the following years ideally covers the completely uncertain US optimism from 1982 to 2007. And now, when oil prices are at around $ 100 a barrel, the problem has confirmed itself.

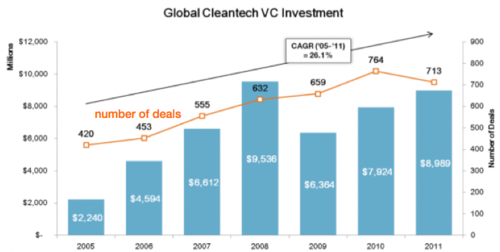

Investing in environmentally friendly technologies has accelerated massively in 2010. Since then, it has decreased slightly. But much more funding has been realized in cleaner technologies than in the development of the Internet over the past decade. Without a doubt, the main catalyst for this was environmental concerns. Al Gore won the Nobel Prize for attracting people's attention to climate change.

In 2007, venture capitalist John Dorr ( John Doerr ) spoke at the TED conference on climate change and investing in alternative energy:

(16 minutes later ...)

The main idea was that we should bring economic sense to investing in environmentally friendly technologies, so that the correct results become profitable and, therefore, likely. Obviously, Dorr was very emotional. Of course, we can understand why he is waiting for his conversation with his daughter in 20 years. If you are cynical, you can consider it a tearful story. But the feeling that we have to do something, of course, prompted people to really try to make environmentally friendly technologies work. Many dollars in investments poured into clean technology are not just waiting for good returns, but were due to many social and environmental factors.

Iii. The failure of clean technology

Even if taken for granted that all these fears are extremely justified and very real, something went wrong anyway. Benevolent desires and noble goals did not make investments in clean technology profitable. So what happened? And are clean technologies still questionable?

A. Nature of the problem

One problem was the ambiguity of people as to what was considered scarce and problematic. Is there a lack of resources? Or are the main problems environmental? Of course, the environment can be a resource in some sense. But people tend to combine both factors, without thinking about them. There is an argument that both the resource and the environment could be scarce and problematic. But people tend to focus on the environment more than on resource scarcity. This is probably a mistake.

Think about how this ends. If you are convinced of an environmental problem, but not a problem of resources, you will support the subsidization of clean technologies. Traditional sources of energy, like oil, will always be in excess and they will be cheaper than their alternatives, so that you will be forced to artificially support alternative sources. If, on the contrary, you are convinced of the problem of lack of resources, and not of the environment, you will probably want to rationalize traditional resources.

Often the solution will be similar, both when solving the problem of resources and of the environmental problem. But sometimes they point in completely different directions. Joseph Stiglitz noted that the theory of peak oil production could have been invented and imposed by environmentalists who opposed climate change; the problem of carbon dioxide emissions, after all, will be resolved as soon as oil runs out (you convince people of this).

B. List of errors

, , . :

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

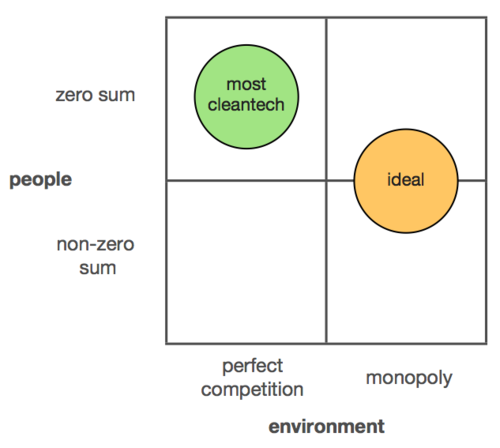

– , , — . , 0 1 10. , , 10; 8 10 « », 5 10 2.

C.

, , , , . , . . , , .

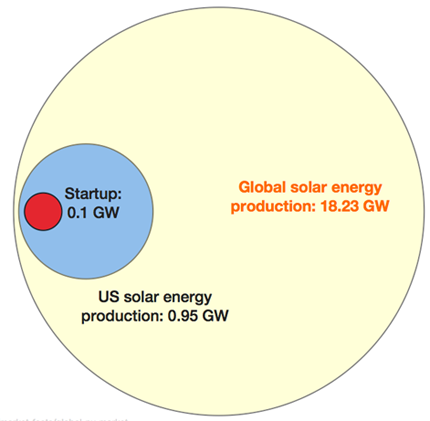

, , . . , — Solyndra. 1000 100 . 950 . , 10.5% , .

? ? 18 . , — – 1% .

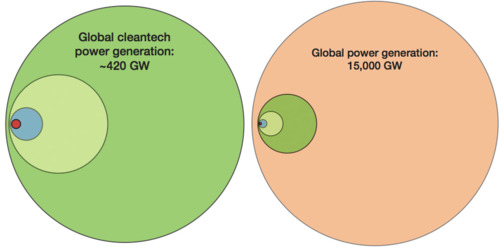

. , , ? 420 . . 15000 — .

, , , . . , , , . , -, , -.

, . , . , . , . ?

, , , , . , . , . , .. . - . . . ? ? . , , , , . . . , . , . .

D.

, . , -, . , 10-15 , . , . , , . . , . .

E.

. . . . . . . , . , , . 20-30 . , ? , , . . 1980-, . , .

F.

. . , , , . - . , , . . . , , , , , . , . , – , .

G.

, . ; , . , , -? . , . .

. (Peter Orszag), , , , . , . , , , . .

H.

, . . : , . 4-5 , . , , , . , , , . , , . , , .

I.

, . , 10- . Solyndra, , 1.65 . , , . , , 1 1 . , . , . , 1 , , . , .

J.

. , , , , . . - (Asperger), , . . , .

:

- : . . . . , .

- : . . : « . . - — . .» , . , , , .

- : . . , .

K. Solyndra

Solyndra — , , . , Solyndra. , , , . , , . , . , .

, , . , , . , . , . . , « 2 3 , , , » . . , , , . Solyndra . HP.

Iv.

. . , - , , , .

A. Optimistic determinism and software

It is fair to admit that the Internet has been the closest relative of environmentally friendly technologies over the past decade. eBay is basically a waste management company.

Amazon is the way to get rid of the sprawling suburbs. And Airbnb helps to avoid excess costs when building hotels.

Certain pessimism simply will not work in the energy sector. Saving and rationing energy consumption may help, but they are completely inadequate. Even if Americans seriously begin to save energy, even if everyone buys a much smaller refrigerator, the developing world will relentlessly consume more. Even if every citizen has a refrigerator in Uttar Pradesh, it will only nullify our energy conservation efforts in our country.

Thus, the question is whether there is any way to realize the idea of generating energy that would be so cheap that it would not even make sense to measure its consumption.

Software can play a significant role in finding the answer to this question. We would be able to find ways to use information technology to optimize energy efficiency. A serious problem is the incredible fluctuations in electricity prices during the day due to the fact that at this time consumed the most energy. Devices like smart home appliances and smart thermostats would be able to reduce daytime electricity consumption.

There are very interesting ways of applying computer technology to transport issues. Things like self-driving cars and finding optimal routes during peak hours in order to reduce traffic jams can have a very large impact.

B. God of thunder

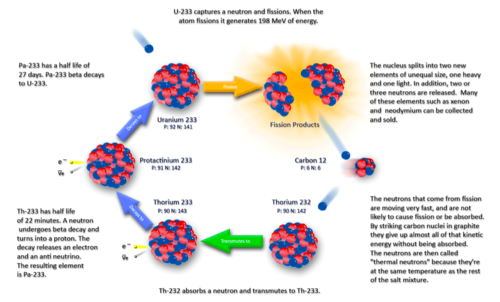

But suppose we would like to move into the quadrant of optimistic certain decisions. How do we do this? One option is to examine the power of thorium very carefully. Thorium is a big secret. When the government became interested in nuclear technology in the 1940s, it discovered that nuclear energy can be obtained from three chemical elements: plutonium, uranium and thorium. The problem with thorium is that it does not contain fissile isotopes, which means that it cannot be used in armaments. And the government was interested in building bombs, not energy production. Eisenhower's speech in 1953 “The Peaceful Atom” was originally intended to warn of the dangers of a thermonuclear era, where everyone could be destroyed instantly. When it turned out too grim, the doctrines on the peaceful use of nuclear energy were reformulated. Energy production certainly was not the focus of the state during intensive research and development in the 1940s. But today there is an opinion that we really do not need nuclear weapons. From this point of view, the energy of thorium looks promising and requires revision.

Thorium looks promising for the following reasons:

- Thorium is significantly more than uranium. It is enough to supply the world with energy for a million years at the current level of consumption.

- Thorium is relatively pure material. In the case of uranium, you use only 0.7% and get a lot of waste during the enrichment process. With thorium, on the contrary, significantly less waste, since the production cycle is self-sufficient.

- You can build a reactor that will work on thorium, and it does not require hundreds of atmospheres, like uranium.

- You cannot get an uncontrolled thorium reaction for the very same reason that you cannot use it for military purposes.

- Thorium costs about 10% of the cost of other forms of nuclear energy. The construction of a thorium processing plant will cost $ 250 million, while a uranium processing plant will cost $ 1.1 billion.

If you add up all these advantages, the energy of thorium will be several orders of magnitude better than now available.

Of course, some difficult problems remain. How does anyone really build it? There are significant problems in terms of management and distribution. There is also the problem of regulation. But let's go back to the list of the top 10 factors to get it right.

Unlike all venture enterprises associated with environmentally friendly technologies, where the number of factors was initially 0 out of 10, with thorium energy you immediately have 6 out of 10 points:

1. You solve the problem of imitation / competition, avoiding the most popular forms of competition. There are a lot of companies producing solar energy. Companies using thorium are simply no more.

2. The big secret is that thorium has not been sufficiently investigated for political reasons.

3. Thorium energy production is definitely not incremental.

4. The duration of the idea of production is due to the fact that thorium is an order of magnitude cheaper than other materials. Achieve success in this direction, and you will conquer the electricity market.

5. For this, the time has come.

6. Venture capital will be expensive, but not excessive. Taking into account all investments in environmentally friendly technologies, investing $ 250 million over several years to overcome the target milestone seems justified.

Market, team, distribution and luck percentage are harder to calculate. It will be reasonable to calculate them before the start of active actions. Are there certain countries or markets that need to be considered as targeted for this technology? Are there any nuclear power engineers left who can work for you? Solve these problems and you can assume that you did everything you could, so that your competence outweighs your luck.

It must be said that the above case with thorium is not the only way to use alternative energy. This was not our goal; we are not going to start a thorium energy company. Rather, it’s just an idea of how someone can talk about alternative energy activities. We have experienced 10 years of failure in the field of environmental technology. All plans were good. Twenty years later, John Dorr should have told his daughter that progress had been made. But intentions alone cannot move progress. People should seriously consider the ten points indicated above.

V. Government issue

Fortunately or not, you can’t talk intelligently about clean technologies without mentioning the government. In recent years, the government has interfered strongly in the field of energy and environmental technologies. Thus, it is important to comprehend this experience and try to understand what happened and what did not.

A. Sale / Capture / Substitution

You can view the relationship of technology with the government as one of three:

- what is sold to the government

- that is subsidized by the government

- and that replaces the government.

It turns out that all these points are strongly interconnected. Venture capitalists usually do not invest in enterprises dependent on sales to the government, as it is rather difficult to sell something to the government. Receiving subsidies from the government - at least in large amounts - is even more difficult. And the third point, the replacement of the government - is difficult to implement, as the government is trying to prevent it. If your secret plan for technology is to replace the government, it’s best to keep it secret.

An important generalized fact to consider is that the US budget deficit is now estimated at 10% of GDP. Optimistic forecasts say it will drop to 2%. Less optimistic predict 6-7% and then an increase again in 2020 and beyond. This can be regarded as a big secret, hidden from the ordinary look. Since no one knows what to do with this, we are not allowed to spread about this.

But thinking about this issue offers a strong argument against dependence on government subsidies. Math budget means that it may not be when you need money. Money will be even harder to get in the future. Let's compare SpaceX with Solyndra. At the very least, SpaceX’s focus on selling technology to the government (and, possibly, replacing it; the government is now decommissioning rocket production programs). The risk in the case of SpaceX is that the government is running out of money, and even cheaper and more efficient space programs are not destined to come true. But this risk is minimal compared to the risk of substantial subsidies in the future, when government funds are very likely to be depleted.

B. The future of clean technology?

Perhaps the best place for productive thinking about the future of energy is the quadrant of a certain optimism. The key questions are the same as for Internet companies: What can be done better and cheaper? Can you do more for less? This, of course, is the classic definition of technology.

So can we do more for less money in environmentally friendly technologies? It is possible that we can. But we need to think about everything in the same way as we do in the computer industry. Is there a major breakthrough in the use of thorium? Or something else? We definitely need great achievements. Only then does it make sense to work on a consistent improvement in technology. The first step, as usual, is a broad and bold look into the future.

Note :

I ask translation errors and spelling in lichku. Translated f1yegor and astropilot , all thanks to them.

Source: https://habr.com/ru/post/181858/

All Articles