Course lectures "Startup". Peter Thiel. Stanford 2012. Session 13

In the spring of 2012, Peter Thiel ( Peter Thiel ), one of the founders of PayPal and the first investor of Facebook, held a course in Stanford - “Startup”. Before starting, Thiel stated: “If I do my job correctly, this will be the last subject you will have to study.”

One of the students of the lecture recorded and laid out a transcript . In this habratopic, shellx translates the thirteenth lesson, the astropilot editor.

Session 1: Future Challenge

Activity 2: Like in 1999 again?

Session 3: Value Systems

Session 4: Last Turn Advantage

Session 5: Mafia Mechanics

Lesson 6: Thiel's Law

Lesson 7: Follow the Money

Session 8: Idea Presentation (Pitch)

Lesson 9: Everything is ready, but will they come?

Lesson 10: After Web 2.0

Session 11: Secrets

Session 12: War and Peace

Lesson 13: You are not a lottery ticket

Session 14: Ecology as a Worldview

Session 15: Back to the Future

Session 16: Understanding

Session 17: Deep Thoughts

Session 18: Founder — Sacrifice or God

Activity 19: Stagnation or Singularity?

I. Mrs. Luck

A. The crux of the matter

The most important philosophical question about startups is: what role does luck play in achieving success? No matter how important this question is, good luck or exclusive competence of the founders, nevertheless, it is rather difficult to choose a method for solving it. Statistical methods are useless if you have only one case in the sample. It would be great if you could put a number of experiments. Let's say, run Facebook 1000 times under the same conditions. If it worked 1000 times out of 1000 we would decide that the matter is in competence. If it worked only once - we would decide that it was a matter of luck. But of course it is obvious that such experiments are impossible.

')

Opinion on this issue is almost always biased. Some people tend to explain everything by luck. Others believe that competence is more important. It depends on whose story you believe. The insider's story will be that talented people have gathered, have worked a lot and achieved results, while an outside observer will reduce everything to a good choice of place and time. Your opinion on this matter may change, because it is rather difficult to have a valid, confirmed point of view for or against one of these versions.

Most people tend to believe that the thing is in luck. However, the level of competence probably plays a much more important role than is commonly thought. We will soon talk about some thoughts and arguments in favor of this version. But the main thing I want to say is: there is no definite answer to this question.

B. Arguments against the theory of luck

Not the most convincing argument against the theory of luck involves the use of disparate data as evidence of the repeatability of success. Several people have successfully founded many companies worth over a billion dollars. Steve Jobs (Steve Jobs) created Next Computer, Pixar, and, perhaps, both: the first Apple Computer and modern Apple. Jack Dorsey (Jack Dorsey) founded Twitter and Square. Elon Musk - PayPal, Tesla, SpaceX, and SolarCity. In favor of the theory of luck, it is said that all these examples are only examples of one great success; it is obvious that the success stories of these people flow one from the other. Nevertheless, it would be foolish to say that these people are just lucky.

C. Time stamp

It is worth noting how many points of view have changed in all the time. I will quote the famous words of Thomas Jefferson: “I firmly believe in luck. And I noticed: the more I work, the more successful I am. ” From the 18th century until the 1950s or the 60s, luck was perceived as something that can be improved and controlled. She was not some kind of incomprehensible external force that was impossible to comprehend.

Today's usual perception of luck is more like that of Malcolm Glawell than of Thomas Jefferson; success, as we are told, "depends as much on your environment as on your personal qualities." You cannot control your fate. You just need to be in the right place at the right time. Everything is a series of coincidences.

D. Applied to startups

The idea that luck plays a big role also prevails in the startup community. Paul Graham attributes startups to great success to luck. Robert Cringely wrote the book Random Empires. I do not want to find fault with these people, they are obviously very skilled and quite successful. The point is that they determine the dominant point of view of the majority on startups.

This again shows what would have happened if a successful entrepreneur had publicly stated that his success was entirely related to his skills. Such a statement would be perceived as absurd, arrogant and erroneous. The strength of the evidence and the validity of the arguments would not matter. When we know that a successful person is an expert in his business, we try not to attach importance to this or not to notice it. Luck always plays a big role. No one has the right to show how he actually handles everything.

It is worth saying that one of the main reasons why this course of lectures exists in general and the desire to read it is to support the point of view in which luck is not the main factor for success. A course of lectures on startups would be useless if it were just a retelling of heaps of stories in which people won the lottery. It would be very strange to teach someone to play slot machines. In the event that everything depends on luck - there is no point in learning for a long time. But it's not just simple luck. Something we can manage. Note that this is lecture number 13. We are not going to be like people who build buildings without the thirteenth floor and superstitiously miss the thirteenth lecture. Luck is not something that you need to outwit or fear. Therefore, we have lecture number 13. We will manage luck.

E. Past vs. Future

One of the useful ways to think about luck is to divide it into luck with the past and luck with the future. The part that is about the past basically asks: “How did I get here?”. If you are successful, you were probably born in the right country. You won the geographic / genetic / hereditary lottery. This is quite a long-standing argument: did you have to work hard and that is what led you to success, or you are just fooling yourself, believing that this aspect did not contribute to your success.

But still, it would probably be more fruitful to focus on the future. Let others argue about the past. A much more interesting question is: does luck prevail in shaping the future? Is the future predetermined?

Ii. Is it possible to manage the future

In our society, we tend to explain events more by their accidental origins than by someone else's skill or intention. This dynamic is necessarily abstract, it is very difficult to explain it empirically. All that we can do here is to realize that we have strongly deviated towards good luck and suggest that it may make sense to return to a balanced state.

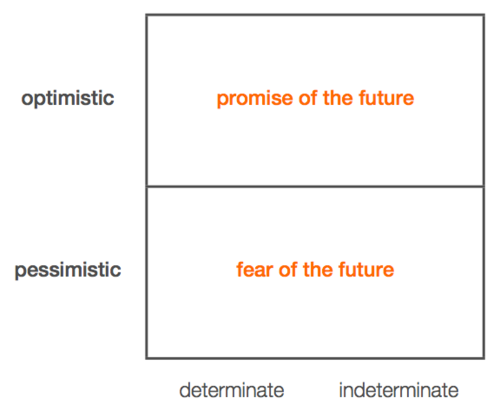

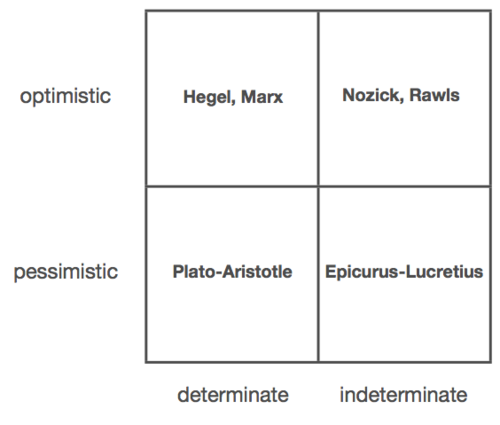

We can use a 2x2 matrix that will help us think about the future. On the vertical axis, we will have optimism and pessimism. On the horizontal axis we will have certainty and uncertainty. Defined future means that things are known in it, and you can manage them. In an uncertain future, things are unknown and out of control. In such a future, just a lot of random events.

What would you do if you were in this quadrant? If you believe that the future is not definable - you would be amazed at the huge diversity of events. The statement is true for both cases: you are an optimist or a pessimist. And indeed, to envisage all the ways of development of events in life - this seems to be something that almost everyone is busy. People go to school, take part in various activities, and during this time enter different communities. They, in fact, spend 10 years to build a resume suitable for all possible cases. They are preparing for a completely unknown future. From whatever side the wind blew in their versatile resume, you can find something for further work.

Compare this with the designated version of the future. If the future is determined, there is a lot more sense to have strong beliefs. You will not enter into dozens of communities or take on any activity. There is only one goal - the best goal you need to achieve. This is clearly not the way people build their resumes these days.

We impose certainty / uncertainty quadrants optimism / pessimism on the quadrants, and you will see an even greater clarification. Whether you look to the future with confidence or are afraid of it, in the end, is of great importance.

A. Definiteness and optimism

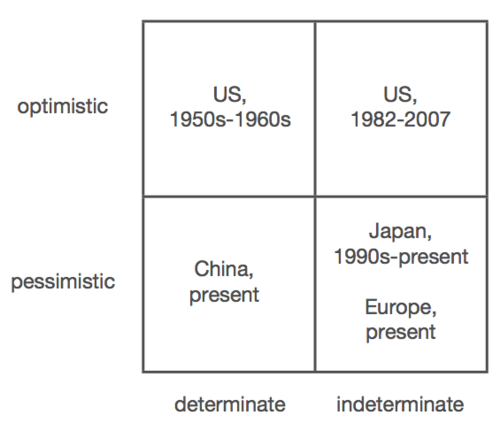

Up until the 1950s and 60s, the prevailing view about the future was determination and optimism. There has always been a relatively well-defined path according to which people thought that the future would be much better than the present. You could go west and get 640 acres of land. Concrete projects to improve society were undertaken. There was a general orientation of society to work to make the future better.

B. Uncertainty and optimism

But the US has shifted from this quadrant. Prospects, at least, even during 2007 were optimistic. But, since 1982, they have also become much more uncertain. The idea was that the future would be better, but not necessarily the way you think. Unlike a certain future in the past, in which there were many secrets, today the future does not contain much of them. Now the future is full of mystical secrets. God, nature and the market are unknown and incomprehensible. But the universe is still generous to us. Thus, it is better to just continue to study it and wait for progress in the future.

C. Pessimism

Or you can assume that the future will not be very good at all. Oddly enough, China falls right into a quadrant with a definite pessimistic future. This is the exact opposite of a quadrant with an uncertain, optimistic future in the United States. China’s point of view is that it is possible to calculate the actions necessary to improve the life of society. Everything is quite certain. But when you make these calculations, it becomes clear that there are no reasons for optimism. China will age before it gets rich. He is forever doomed to be a poor version of the United States. Maybe he will copy everything. But he simply does not have time to catch up with the United States, even if he tries hard. This explains why, in the end, all these measures are applied that seem draconian in terms of optimistic quadrants; for example, the policy of the only child in the family, the total pollution of the environment, and the thousands of people who die every year in coal mines. The main point of view is pessimistic, but it is for a very definite reason, amenable to calculation.

And finally, the pessimistic indefinite quadrant. This is apparently the worst of all worlds; the future is not so good and you have no idea what to do. An example would be Japan in the early 1990s or Europe today.

There is a widespread opinion that the US is shifting from the right upper quadrant of optimistic uncertainty to the lower left of pessimistic certainty. The argument, in other words, is that we are moving towards China. This is the future, where everything goes to hell, and not only in a metaphorical sense.

D. Financial picture

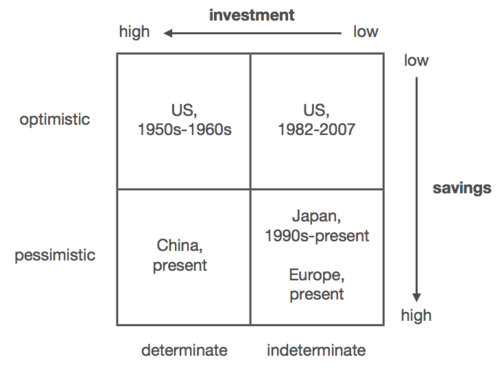

Here we can impose a financial picture to better illustrate this all. Let's start with some definitions. Investing is investing in the values you believe in, such as stocks or a company. You expect a high rate of return. Savings, in contrast, is when you keep your money with the hope of spending it in the future. As a rule, receiving in this case a very low yield.

If you look to the future with optimism - you will have little savings. No need to save money. The future will be better, and everything will be formed by itself. But if you are pessimistic, your savings level will be higher. Because you expect the future to be worse than the present, and you want to have savings when that day comes.

E. Savings

The US has a savings rate, it is not much higher than zero. It is about 4%. If, however, include the level of public savings -10% of GDP, the savings rate will be -6%. It's funny, but it means that the USA looks into the future with great optimism (although there is a suspicion that the level of government spending is not as well thought out as the rate of savings). The USA has a very low savings rate.

China's savings rate is about 40%. This state of affairs is often criticized because it seems wrong that poor people save money, while rich people in the US spend it. This creates a trade deficit, it is believed that China should start to consume more and save less. Such criticism misses one important factor determining China’s course of savings growth; It’s very hard to spend money when your view of the future is pessimistic, and you believe that you’ll grow old rather than grow rich.

F. Investments

The world of certainty is full of things that people can do. Many things you can invest in. You can spend a significant amount of capital on investments. In the world of uncertainty, the rate of such capital is much less. It is not clear where to invest money, so no one invests. In the US, a very low investment rate. The main investors are corporations. But instead of investing, companies today generate a huge cash flow - about one trillion dollars a year. They accumulate money because they have no idea what to do with them. By definition, you would not have free cash flow if you knew where and how to invest. The average consumer is no different. People have no ideas. Thus, we have a low investment rate, a low savings rate, and we are optimistic about a completely uncertain future.

Pessimistic quadrants are always kind of stable. This is particularly true of the quadrant with uncertain pessimism; if you think that things are going to hell and you think that you cannot influence this in any way, then most likely it will be. You will stagnate over a long period of time. In the quadrant of a certain pessimism, you will be like China - stop developing, methodically copying objects without any hope for a radically better future.

The good question is whether or not uncertain optimism — which characterizes the United States from 1982 to 2007 — can become a stable quadrant in general. The fact that the USA has a low savings rate and a low investment rate is strange in itself. If you have a low investment rate and a low savings rate, it’s time to ask yourself what kind of future you have. What no one thinks about the future is manifested in a low investment rate. So how can people be optimistic (without having any savings) about the future, if no one wants to do this?

G. Calculations and statistics

There are several schemes that we can use to deal with the question “certainty versus uncertainty”, and from the point of view of mathematics, “calculations versus statistics”. Calculations dominate the world of certainty. You can calculate any things accurately and definitely. When you send a rocket to the moon, you must accurately calculate where and at what time it will be. This is not like a startup developing by iterations when you launch a rocket, and then focus on the situation. Are you flying to the moon? Or on Jupiter? Are you lost somewhere in space? In the nineties, there were many companies that had great starts, but there were no successful landings.

The uncertain future is such that mainly statistics fill his world with meaning. Bell curves and Random walks (a mathematical model of the process of random changes) determine the future development paths. Standard pedagogical argument: in high school, you need to get rid of the analysis and replace it with statistics, which is actually important and useful. The idea that the statistical way of thinking will be the locomotive of the future has gained much popularity.

Using mathematical calculus, you can calculate the future in advance. You can calculate the position of the planets for decades to come. But no such specifics will not give you the theory of probability or statistics. In these areas, all you know about the future is only that you don’t know. You cannot influence the future. Larry Summers once said about the economy: “I don’t know what will happen, and even if someone says he knows, he has no idea what he is saying.” Today all the prophets are false prophets. This can only be true if you look at the future from a statistical point of view.

H. Matter and process

Another way to look at the question “certainty versus uncertainty” is through the prism of matter and process. What people do and what technologies they develop will depend on their perspective for the future. In terms of uncertainty, they will not know what to develop. There is nothing that looks promising if everything around is the result of a statistical sample. You want a good method to manage this statistical distribution. It reminded me of the HP board discussion that we talked about earlier: Tom Perkins' old school matter versus Patricia Dunn processes. If everything is vague, it will be presumptuous to think that the board of directors could have known something about the future.

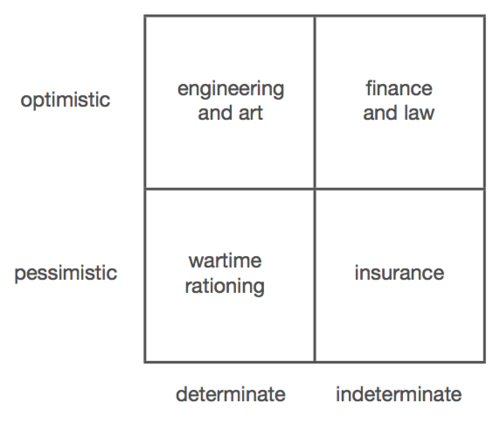

How each quadrant works in practice looks like this:

- optimistic, definite: engineering and art. Very accurate definitions.

- optimistic, indefinite: jurisprudence and finance.

- Jurisprudence is the process of applying specific rules with essentially undefined results. In jurisprudence, you assume that, following a certain process, you will end up with a positive result. And finances also have a completely statistical basis.

- You will not make money, but you can protect yourself from expected losses.

pessimistic, certain: rationing products during the war.

I. Death of ambitious projects

The United States used to be in a certain optimistic quadrant. Previously, we had any kinds of ideas relating to ambitious projects, which would take many years to implement, but the result from the implementation of which would be quite impressive. An example from the 19th century is the transcontinental railroad. An example from the 20th century is Robert Moses, who in the 1920s held twelve high-ranking government posts at the same time. He started out as a parks commissioner. But in order to build parks - on such a scale that Moses wanted to do this - you have to equate whole blocks with the ground, build roads and highways, and implement other facilities. Moses got enough power to do all these things. Moses had more power than the mayor or governor of New York. He rebuilt a lot of things in the state of New York in the 30s-40s.

Today we would call it insanity. Of course, Moses had too much power. Such ambitious projects, especially with a single person as an architect, would lead nowhere. The difference was that, unlike today, people believed in a defined future. Future can be planned. Moses seemed quite clever and ethical enough. Instead of asking whether to implement the project, people asked who could implement this project better than anyone.

It all ended in 1965, when Moses planned a highway that would pass through Greenwich Village. Quite a large number of people believed that the old buildings, which were to be demolished, should be saved, and contested the construction. This was the last time that a new highway was built on the state.

A more recent example is the Ribe plan. John Reber was a teacher and fan of theater productions in San Francisco. In the 1940s, he came with the intention of radically reconstructing San Francisco. The basic idea was to build two large rocky dams, one between San Francisco and Oakland and the other between Marin Country and Richmond. They would have to be dried and filled with fresh water. 20,000 acres of land would be flooded and a 32-lane highway would be built. And the skyscrapers would be scattered around a completely reconstructed city.

The details are not even as important as the fact that this plan was not just a fantasy. According to this plan, congressional hearings were held, and its viability was examined. It turned out that it is not feasible for a number of reasons, for example, lakes with fresh water would evaporate too quickly, but people did spend time considering this project. Today, on the contrary, such an idea would be considered insane. Especially if it came from a man like John Reber. What powers does a teacher have to rebuild a whole San Francisco neighborhood? These Johns Reber have long learned to keep their ideas to themselves. So safer not to implement any grand ideas at all.

J. Uncertain optimism and finance

In the future, a certain optimism in your city under water and in space. In the future of uncertain optimism you have - finance. Such a contrast can not please. The basic idea in the field of finance is that the stock market is fundamentally random. It's just Brownian motion. All that you know is that you know nothing. And it all depends on diversification. There are clever ways to combine different investments to get higher returns and lower risk, but the benefits of such tweaks are negligible. You may not know anything significant about any particular business. But you are still optimistic; finances can not work if you are pessimistic. You assume that you are going to make money.

Uncertain optimism can be really strange. Think about that. What happens if someone in Silicon Valley builds a successful company and sells it. What will the founders do with the money? Under conditions of uncertain optimism, events will develop as follows:

- The founder does not know what to do with the money and puts their bank.

- The bank does not know what to do with the money and gives them to an investment fund in order to diversify deposits.

- The investment fund also does not know what to do with the money and invests them in securities for the purpose of diversification.

- Companies are ranked by how much money they generate. Therefore, they are trying to generate free cash flows. And when and if they do it - the money goes back to the investor again. And so on.

What is really strange about this chain is that at any of the stages no one has any idea what to do with the money. Obviously, this is an exaggerated example. But it reflects a strange phenomenon. Money plays a much more important role if the future is uncertain. In such a future, owning funds is better than investing in some specific projects. In a certain future, on the contrary, money is simply a means to an end.

One must ask whether such circulating investments work at all? Can such a system be self-sufficient? Can this work if no one thinks about real things and brings new ideas to the system? The era of uncertain optimism, perhaps, is coming to an end.Look at government bonds, which, in essence, are just another money option. Profitability continues to fall. People hold them simply because they do not know what else to do. Today you can earn 1.8% on government bonds. But the expected inflation will be 2.1%. The expected return over the next decade will be -0.3%. You get negative returns when people run out of ideas.

Uncertainty has reoriented the investment point of view. If earlier investors had ideas, now they are focusing on risk management. Very rarely in a hedge fund, people wonder what will happen in the future. They are not so much interested in “What are we going to do”, as in “How to manage risks”. The process prevails on the essence. Venture capital fell victim to the same phenomenon. Instead of forming sound ideas for the future, the main question for today is how to get access to profitable deals. At least in theory, venture capital should have very little in common with this kind of statistical approach to the future.

K. Uncertainty and politics

If you think that the future is not determined, then the most important people for you are statistics. Sociologists are becoming more important than politicians. In the past 30 years, polls have been in an incredible trend. We have polls for almost everything. We believe in their authenticity. No wonder then that politicians pay more attention to polls than they care about the future. This helps explain the strange fact that John McCain chose Sarah Palin as his partner in 2008. The McCain people have studied all the polls concerning the governors and senators. Most of them were very unpopular. Palin's popularity rating, by contrast, was 89% in Alaska (which is apparently due to annual payments to Alaska residents at $ 1,000 + as payment for oil). After a simple analysis of the polls, Palin became the obvious choice. It did not work as expected.This had nothing to do with Palin's merits as a candidate; this case simply shows how statistical survey data can dominate common sense in politics. Our leaders are not going to defend unpopular points of view.

We can extend this idea to the whole government. Over the past 40-50 years, the size of the government apparatus has not changed significantly. But it itself has changed radically. In the past, the government pursued and implemented specific ideas. Think about the space program. Today, the government does not implement so many specific projects. Basically, it just moves money from one person to another. What are you doing with poverty? We do not know.So let's give people money, let them decide what to do with them and let's hope that this helps. If you are not able to solve problems, then the only thing you can do is simply to distribute money.

L. Uncertainty and literature

Science fiction also confirms the hypothesis of a shift toward uncertainty. 50-60 years ago, science fiction described the future in certain specific conditions. In 1968, Arthur Clark described the consumption of information in the future 2001 as follows. “2001: A Space Odyssey”:

The text was automatically updated every hour ... you could spend a lifetime without doing anything other than reading constantly updated information from news satellites.

In this world, information will be updated automatically. It was a very definite idea of the future. But what is interesting is that the future in this future was uncertain. In it you will have a constantly changing stream of information about which you could not know anything in advance. Prediction seems surprisingly prophetic.

Compare this with the book “Neuromantic” by William Gibson, written in 1984,:

The sky above the port was the color of the TV screen tuned to an empty channel.

Here, 14 years after 2001, described by Clark, is a future in which you see nothing. All around - a cloud of random probabilities.

M. Uncertainty and Philosophy

There is a philosophical version of this theory. Marx and Hegel predominate in the optimistic certain quadrant. The future will be better, and you can plan life for 5 years ahead. Rawls and Nozick are also optimistic, but not certain. In the socialist version, you should have a socialist state, because this is what people want, and even if they themselves do not realize it. In the libertarian version, no one really knows anything, people should have the freedom to do anything, and then they will come across success. Plato and Aristotle are completely pessimistic and definite. You can find out the nature of things, but there is no reason to be excited about the future. Epicurus and Lucretius present pessimistic uncertainty. The universe is empty. The bodies collide with each other randomly. Sometimes uniting, sometimes decaying.You can not control it. Therefore, you should simply stoically take a stance of calmness. Try to enjoy life, despite the fact that everything around will collapse in the end.

Our society is probably moving in the direction of Epicurus and Lucretius. This trend has recently been seen in financial crises. While until 2007 the society was vague and optimistic, now pessimism seems to be getting closer and closer. It is difficult to say whether the situation will continue to develop in this direction. But indefinite pessimism has never been the dominant phenomenon in America.

N. Uncertainty and death

Another area dominated by uncertainty is insurance and death. None of us knows exactly how long we will live. But we often turn to statistical systems to find out the likelihood of death in a particular year. The probability of a student dying is one in a thousand. With age, the probability changes. In people at the age of 100, the probability of dying this year is 50%. Only one in 10,000 lives to 100 years. Only one in 10 million lives to 110 years. We have pretty good statistics on this subject, and this is in the order of things, we simply have no other way to predict such things.

Therefore, the idea of extending life does not enjoy special confidence. Society considers probability theory to be the last resort in this case, so much so that even ideas for extending life are perceived as strange and even extravagant. Society believes that you just need to submit to statistics. This perception is very different from the perception of 1600-1850, when people were delighted with the prospect of discovering a magical cure for death and even looked for the source of eternal youth. The viewpoint changed when people stopped believing in the existence of a literal source. The conviction that society can radically change the nature of things died with this belief. So no one else is trying. In a world in which luck plays a big role, chance is too important. It deprives people of their will. Belief in secrets has an effect.Belief in a case has no effective effect; on the contrary, it keeps you from doing anything.

“ ” , .

.

— .

.

Uncertainty is in cosmology. Look at the rise of the theory of parallel universes in quantum mechanics in 1970. The basic idea is that every time something happens, the universe splits. Each of the branches represents a new world in which an event has come or has not come. Reality is the set of branches of a tree in which any event — every quantum outcome — actually occurred. 55% -60% of theoretical physicists today adhere to the multiverse theory. 50 years ago there were only 10-15% of those. There have been no experiments confirming this theory. Probably, such experiments are impossible. So why do so many physicists stick to a theory that cannot be proven? If you ask them, they will answer: "This theory is just mathematically more beautiful."But is it true? Are infinite universes really better than one? Or is it just an echo of the shift towards the future uncertainty quadrant?

All these examples illustrate the massive transition to uncertainty that we have experienced in the last 30-40 years.

Iii. Is uncertain optimism possible?

Today we are in a kind of uncertainty. Which quadrant will we shift in the future? Can we return to the vague optimism in which we were from 1982 to 2007? Come, are we moving to some other quadrant?

The uncertain future is inherently iterative. You cannot plan it; events unfold one based on the other. The question is whether the iterative process can bring, if not the best of the worlds, then at least to the world with a phased and potentially endless improvement. If this is so, then we may not climb the highest mountain in the world, but at least we will always go up the mountain.

A. Uncertain optimism in the rest of the world

This is Darwin's theory of evolution. At first there are only very simple organisms. After billions of years, an evolutionary tree appears. Not all possible life forms develop. No supersonic birds with titanium wings. Something may be imperfect. We can identify a lot of not the best "design solutions". But this is a trajectory of relentless, endless development. Darwin's theory plays a key role in understanding indefinite optimism.

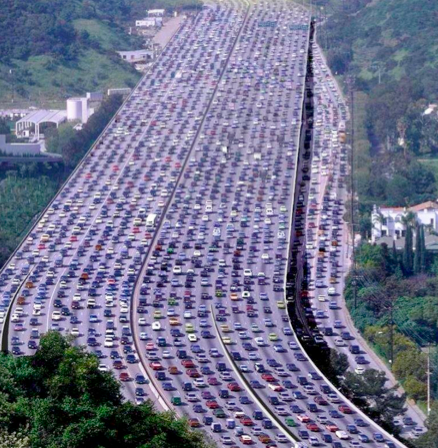

How accurately can the theory of vague optimism be applied to economics? Perhaps not so accurate. Look at the pictures of Los Angeles. It was supposed to be the best city in the world. Los Angeles could be built from scratch at the beginning of the 20th century. It would be great. But at the time there was no grand master plan. And instead, it gradually crawled in all directions. The market has not solved the problem. Los Angeles is still one of the best cities in the world. But this is far from what it could be. The experiment with Los Angeles at least gives reason to be pessimistic when it comes to uncertainty.

An even more serious problem for the residents of the city of São Paulo. The airport was 5 miles from the city center. The whole journey takes 10 minutes by helicopter. But at rush hour by car it takes 3 hours. Traffic jams are terrible. The population of the city is 20 million people. The city is divided into areas with a population of 500k-1M people. Most people live in high-rise buildings. The standard of living is deteriorating every year. Mumbai and Lagos are other examples of large concentrations and urban decline. There is no reason for optimism, giving the right to believe that urban planning can improve the situation in these regions. Here you can draw and arguments against globalization; most developing countries cannot catch up with the developed world because they are bogged down in the past and cannot be rebuilt.

The confrontation between economists and ecologists stems from a confrontation between optimism and pessimism. The market economy solves problems iteratively. The idea is that we don’t have to worry about the environment, because we’ll come up with a solution to the problem as we go along. This is a classic vague optimism. The counter-argument of environmentalists is that we are already late: it is too late, we need to do more than we are able to do. This is also still uncertainty, but definitely pessimistic.

It is worth noting that such things as geoengineering fall into an optimistic certain quadrant. Maybe we could scatter iron filings across the ocean to cause phytoplankton to absorb carbon dioxide. Potential solutions of this kind are not even remotely present in public discussions. Only radically uncertain things are discussed.

B. Applied to startups

In the context of startups, obsession with uncertainty leads to such phenomena:

- Darwinist A / B Testing

- Iterative development

- Machine learning

- No plans for the future

- Short Term Forecasts

I do not say that all these things are fundamentally wrong. If they are not true, then it is not obvious. But it’s not at all true that they are correct. Of course, it is interesting to ask whether these things, like the multiverse theory in quantum mechanics, are a by-product of society on the way to the uncertainty quadrant.

Having passed on these points, it is easy to find flaws in each of them. According to Darwin's theory, it took billions of years to achieve a result. Startups don't have that much time. And even if it were so, Darwinism is optimistic in general, which cannot be said about the participants in the evolution process themselves. During the very process of evolution can be full of slaughter and destruction. When people mention the theory of evolution in the context of a business, they are probably going to do something like that. And developmental iteration and machine learning are excuses for the last two points - lack of plans and short-term forecasts. Of course, there are many counterarguments. But a certain planning, as a rule, is underestimated today in the culture of startups.

Iv. Return design

The sphere of finance, perhaps more than all the others, contains elements of an indefinite way of thinking. The peak of the financial bubble, which came in 2007, thus, can be considered as the peak of an uncertain way of thinking.

Apple is the absolute opposite of finance. He uses design at all levels. This is definitely a design product. Corporate strategy is clearly defined. There is a certain plan for many years to come. Release of products is carried out systematically.

A. Design and Value

This course of lectures does not give investment recommendations. Running now to buy Apple stock may not be the best idea. But over the past decade, people have bent their hands on Apple stocks rather strongly. The indefinite world of finance would ignore anyone who claims to have a secret plan for releasing new products. Steve Jobs received stock for $ 3 apiece. After sales improved with Apple in 2003, shares were trading at $ 6. Investment funds all the time underestimated Apple because they didn’t know what to think about the future. All shares were bought by ordinary people.

Apple came to realize that good product design plays an important role. Airbnb, Pinterest, Dropbox and Path all create an impression of products that are not based on a statistical way of thinking. There is a feeling that there is a certain telepathic connection between these products and what people want. This connection — exceptional design — seems to work better and faster than evolutionary A / B testing or iterative search on an immense field. The return of design is a big part of the opposition going against the dominant spirit of uncertainty.

B. Plans

Accordingly, there is the observation that companies with well-developed plans usually do not sell anything. If your startup has the power of grip, then you will receive offers to buy. In an uncertain world, you will take money, because money is your goal. PayPal had and implemented many great ideas. But in 2002, to be honest, they ended. It was not clear what to do now. Therefore, it was worth selling the company.

But when the company has certain plans, these plans outweigh the benefit of the decision not to sell. There is no reason to stop if you can do more. The company's mission - a secret plan - is able to rally the team around specific ideas that will be implemented over the next few months or years.

In an uncertain world, investors believe that secret missions have no value. But in a world of certainty, the stability of a secret mission is one of the most important metrics. Any company with a good secret mission will be underestimated in a world in which no one believes in secrets and no one believes in a mission. The ability to follow a long-term secret mission is incredibly important.

Today, young people are usually optimistic and uncertain. They add one line to the summary to another. They believe in stories of endless improvement, even if they have no idea what the path to it looks like. Maybe it will work. We do not have to completely discount the uncertain future, because luck always plays a role. But this is too overloaded strategy. It allows luck to dominate too much the realities of life. Something must be said and in favor of a planning alternative.

It is worth noting that you can always have a certain plan, even in the most uncertain of the worlds. If you come into contact with the field of law or finance, you should still have a plan. Most of the partners from companies on Wall Street or law firms work for a while, and then make a horizontal jump diagonally to another company that offers more money. This method of iterative development is a recipe for destruction. It would be much better to work in the same bank or company for 10-15 years. In the end, there would be no one left except you who were aware of all that is happening. You must plan to become a partner or managing director from day one. Your plan may change, but if you don’t have it, you just go with the flow.

C. Designing prospects

For the last quarter of a century, our society has belonged to the quadrant of vague optimism. But this quadrant lives its time. We go down to pessimism. Can we instead move to a certain optimism? Computer science is our only hope. They have a definable nature as much as possible. It would be very strange to look at technology start-ups through the prism of uncertainty. But what you will do now and through what prism to look is your business. An alternative title for this lecture would be “Control Alt Delete”. It is often better to redo everything from scratch than to fix it. And maybe it’s time to start from scratch.

Note :

I ask translation errors and spelling in lichku. With the translation debuted shellx , the astropilot editor, all thanks to them.

Source: https://habr.com/ru/post/179451/

All Articles