Where is the market of electronic payment systems in Russia? Part 2. Plastic cards

In the last article we talked about where the electronic payments market is going, or rather even falling. But the topic turned out to be much wider, and therefore today I would like to address it again. Or rather, to the payments that were left out: for payment with bank cards.

As is known, Russia always has its own, special and often very difficult development path. And the sphere of electronic money and even wider - electronic payments - is no exception, but rather one of the best examples of this.

')

After all, when a person wants to go out in e-commerce, he somehow asks the question: “ what do they pay online ?”. This question has been asked more than once by us and all those who are interested in the e-commerce market . To answer this question is not so simple:

- First, payment in large and even medium-sized online stores and small shops is not the same thing. And this is the peculiarity of many CIS countries, Russia first of all.

- Secondly, “regionality” can also be traced very clearly: if federal stores work with all types of payments (from terminals and cash to mobile payments), then small regional storefronts, by contrast, can opt for those methods that are closest to them. And, often, many do not understand, but why need more. Suffice it to say that many stores have 2 methods of payment: “non-cash” and manual transfer to one of the wallets (Qiwi, ID Money, Z-Payment, VM, etc.)

- Many companies in Russia hide real numbers . And there are many reasons for this: starting from fierce competition and ending with “tax optimization”.

There are more reasons, of course, but they are more than enough described to understand the complexity of an objective assessment of the market. The main thing that needs to be emphasized is that many trends in the Western market (that is, and only we have to be guided by it) do not justify themselves in Russia or, at least, are not fully justified.

Take the most "simple" and obvious example - checks and credit cards. In Russia, in contrast to the same States or Western European countries, the payment period for checks was virtually absent (excluding the minimum percentage of using those in banks, for example, at check-out). We immediately switched to "plastic" . For Internet sales, of course, checks are archaic, but the question here is that the end user missed a whole layer of payments. If we add to this the peculiarities of mentality, historical and economic development, we can get a very strange and eclectic mix of innovations and a lagging way of thinking on the consumer’s side.

But, as research shows, the card only becomes a means of payment, since the majority, receiving the so-called “salary”, goes to the ATM and receives cash, leaving only the amount for food and other small purchases on the card.

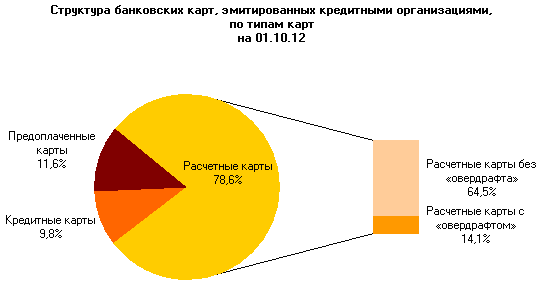

You can look at the structure of the maps, which is offered by the CBR itself (and only stars are above it in Russia)

Schedule. 1. The structure of bank cards in the Russian Federation

It is not difficult to notice that payment cards more than prevail. At the same time, credit cards, which boomed just in 2012, are negligible. But it is precisely the loan - no matter how negatively we treat it, it is the basis of any economy based on market relations.

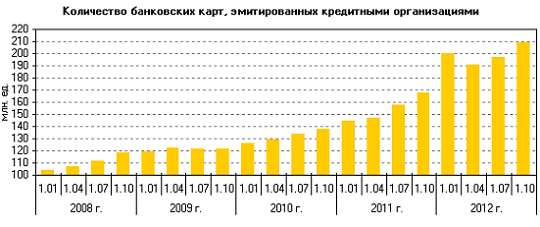

At the same time, in quantitative terms, the growth of maps is obvious: let's look again at the data of the Central Bank of the Russian Federation.

Chart 2. The number of bank cards in the Russian Federation in 2008-2012.

It is worth noting that the Federal Law “On the National Payment System”, which recently entered into full legal force, enslaved the lion’s share of market participants, including such giants as Yandex Money (which, surprise! Sold the Security Council of the Russian Federation), VM, Kiwi and others. On the other hand, the two largest international players - Visa and MasterCard (especially the last one) took up a continuation of the USSR: Visa made a brand wallet with Kiwi, Yandex released MasterCard in collaboration with TCS, and Kukuruza, SvyaznoyBank " etc.

And with all this, the picture from the beginning of the 2000s, when the Internet market came to life, did not change much.

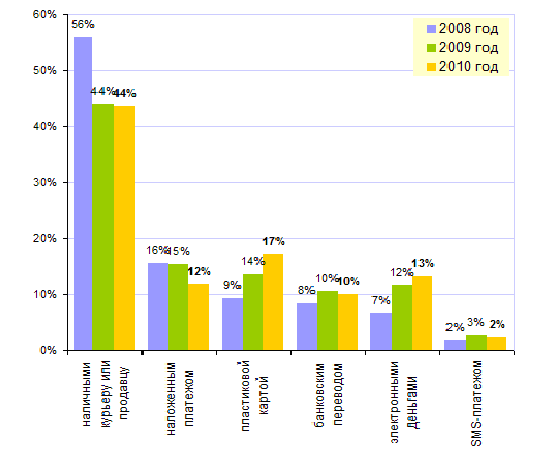

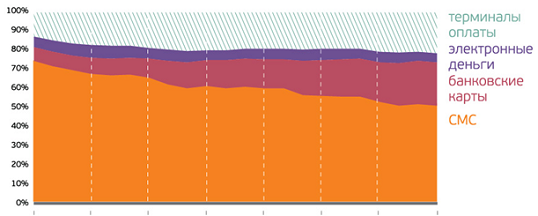

Chart 3. How to pay online

(See here for more details).

The picture looked like this in 2008-2010. Did something change after 2-3 years? Not. In 2012, we have only slightly increased interest rates, but the relative distribution is about the same. The only thing is that the share of SMS payments due to the popular, but very expensive “Mobile Payment” has slightly increased.

Moreover, in small stores, the share of cash was and remains at the level of 95-97%.

Why are people afraid to pay with cards? There are only a number of reasons:

- They are afraid of fraud and theft of money from the card;

- Do not possess the necessary knowledge (and do not want to get it);

- It is not possible to pay for the 1st time for any reason, and the second - they already doubt whether it is necessary;

- Payment of excess interest.

Again, when writing this article, we are faced with the fact that there are too many reasons and they are very different, but their essence boils down to one, but important point: the consumer is still not ready to buy on the web 100%. Why? Firstly, there is no proper information field. Exactly: if on Habré, for example, they are collected according to the principle “understands (not bad / good / excellent) something from IT ...”, in most cases everything is much more pitiable. This is especially true of the people of the so-called older generation.

On the other hand, today there is a core of customers who are willing to pay more, but under certain conditions:

- improving the quality of service in general ( 40%) ;

- simplicity and access to information before making a purchase ( 35% );

- ease of return of goods ( 32% );

- convenience of online search and site ( 21% );

- more personalized service ( 21% ).

Source (the total number is more than 100, since the respondents had multiple choices possible ).

In addition, there is another niche where cards are being paid more and more - these are social networks. Here's how, for example, the distribution for 2012 looks like.

Chart 4. Different types of payments in social. networks

That is, the development prospects, of course, there is. But, you need to understand that today cards have got a serious competitor - mobile payments, which are certainly very expensive and extremely doubtful for large purchases, but nevertheless their volume is already approaching millions of dollars. Moreover, today we can observe various symbioses: mobile payment (for example, in the RU-RU system) by issuing a virtual card, linking the card to a phone number (the so-called “mobile banking” or “sms banking”), etc. forget about contactless payments that are just emerging on the Russian market.

At the same time you should not flatter yourself: at least for one simple reason - you need to look at the numbers. In particular, this is how the audience of mobile payments for 2010 looks like (for 2012, the picture has changed, but not for many - we will tell about this in the next article).

Chart 5. Ratio of growth of the “classic” and mobile Internet in the Russian Federation

Another factor that will greatly affect the growth of "plastic" payments is the entry of foreign players (primarily E-Bay and PayPal) to the market. At the same time, in connection with the same Federal Law “On the National ...”, the Post of the Russian Federation became another major player who has already started issuing “free” postal cards in cooperation with the Russian Standard Bank, and he, as we know, first of all loans.

Finally, another area that will give a powerful impetus to the growth of “plasticity” and which has proven itself positively in 2012 will be online lending.

And yet, even the research conducted by VISA shows that "about 46% of respondents only looked at the goods on the Internet, but made a purchase in a regular store ...", and this is a direct evidence of the market’s unreadiness. True, there are positive trends here too: “as the survey showed, 87% of Internet users who participated in the survey in Russia at least once tried to shop on the Internet. In 2012, their number increased by 30% compared with the previous 2011, when only 57% of the respondents made online payments. ”

The problem also lies in the fact that about 45-70% of payments made on the Internet fall into the “Bill Payments” category: this is, first of all, replenishment of the balance of mobile, utilities services, prepayment for tickets, etc. Simply put, people still pay in small amounts and for not wanting to do so in the operator’s office, in Sberbank’s queues, and so on.

Here, for example, what the “spread” between the money entered and those that pay for goods / services according to the data of the Central Bank of the Russian Federation for 2008 looks like

Chart 6. Ratio of input and output operations, 2008

And here is the same ratio, but in 2011

Chart 7. Ratio of input and output operations, 2011

On the other hand, the volume itself (and, as we said in the previous article, depends primarily on the influx of new Internet users), of course, is growing:

Chart 8. Amount of payments for 2008-2011

And in general, this growth is due to a general increase in card payments:

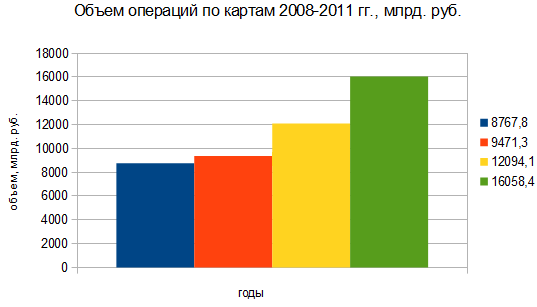

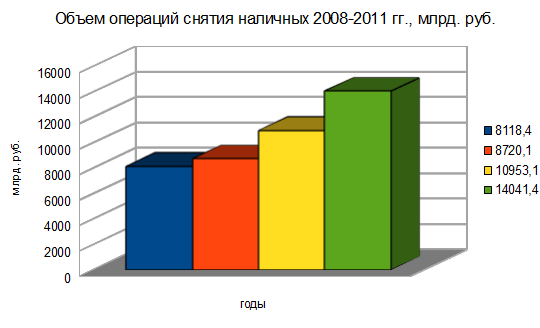

Chart 9. The volume of payments by cards for 2008-2011.

But, of course, we should not forget about the “classic” method of withdrawing funds from the card - their cash out.

Chart 10. Volume of cash withdrawal operations for 2008-2011

To evaluate the full significance of these figures, we present a comparative diagram of operations (blue is output, red is input):

Chart 11. Ratio of payment and withdrawal operations for 2011

That is, if we take the relative indicators, say, with the same 2008 (that is, the year of the crisis, then there is no obvious and large increase):

Chart 12. Ratio of payment and withdrawal operations for 2008

Another “paradox” (or tendency?) In the Russian Federation can be called the fact that:

- there is a complete monopolization of the market, since “small” players are removed from the road, and the larger ones are more and more often seizing the vacant space. The most striking of the latest examples is MTS Bank.

- In connection with the first regularity, the second arises when there are fewer banks issuing cards than those who provide acquiring (and even Internet acquiring even more).

Turn again to the graphs.

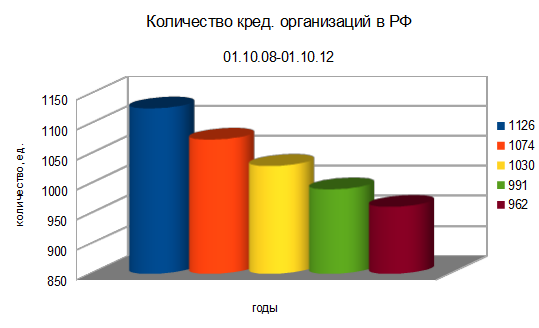

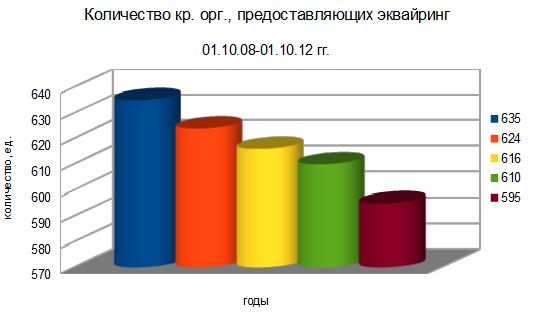

Here, for example, the number of credit institutions in the Russian Federation from 2008 to 2012.

In order to more clearly show how this fall affects emissions and acquiring, we turn to the following graph:

Chart 13. Number of credit institutions in the Russian Federation

That is, if we take into account the error, the dependence is actually linear. Which is logical. Another issue is that the lack of competition in the market is always, sooner or later (and sometimes too late) without a clear planned economy - a crisis. But our article is not intended to solve economic problems. We just want to point out what the market is alive today and what it can lead to in the near and medium term.

It is thanks to the gradual "consolidation" that the percentage increase of the main players in the card issue / acquiring market occurs.

Chart 14. Number of organizations issuing / acquiring in the Russian Federation, 2012

But ultimately, you need to understand, these are just numbers. Since in practice it is important who exactly provides the same acquiring. And here everything is not so good (rather, quite the contrary).

Chart 15. Number of organizations performing acquiring in 2012

In order to fully understand the full value of this paradox (which banks can “easily” explain by many factors, ranging from complex certification procedures to regional characteristics, etc.), consider the following figures:

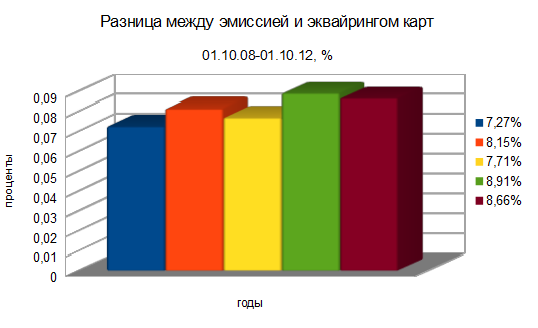

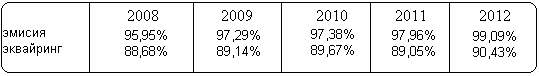

Chart 16. Difference between emission and equiuring of cards in 2008-2012.

And in order to make the schedule more obvious and understandable, we’ll give the numbers:

Those. If in 2008 of the total number of all credit institutions was approx. 96% of those involved in card issuance and approx. 89%, a cat. Were engaged in acquiring, in 2012 this ratio was 99.09% and 90.43, respectively. Those. The gap from 7.27% increased to 8.66%, i.e. no one removes dissonance, on the contrary, it is made more and more tangible, because more “competitive” win.

This is how it looks visually (blue color - emission, red - acquiring):

Chart 17. Relationship between emission and acquiring, 2008

Results

At the end of the article, I would like to highlight a number of obvious tendencies peculiar to our market today: we saw some of them in the graphs above, some accompanied them and will be covered in more detail in the following articles:

1) The number of credit institutions is declining , the number of Internet payments, including bank cards, on the contrary, is growing, that is, there is a clear monopolization of the sphere for the sake of a clear economic benefit - profit;

2) Competition in the market is rather internal , between large players, while regional organizations and other smaller ones remain outside the market and at best can count on an infusion into one or another payment system;

3) Despite the promotion of the National Payment System, the market continues to be won by Visa and Mastercard (a small percentage, American Express - see the next article for more details). But the point is that in no study is there even a hint of the appearance of their own analog Visa and Mastercard. The situation is paradoxical: the market is monopolized, but at the same time, it is clearly not “Russified”. A reasonable question arises, is it beneficial for the end user ? After all, the commission that he (or the seller) pays is nothing more than bank commissions + payment systems ?;

4) The market in the Russian Federation still remains the cash market . Yes, the maps have won their niche and continue to conquer new peaks, but so far for rapid growth, about which we have been hearing for 5-7 years, there is no main springboard - the proper technical and information equipment from the governing structures;

5) The Russian market is at the stage of an obvious rise, but how is it ensured? Only quantitative indicators, more precisely - for the most part by them. Quality (improvement of services, the introduction of new technologies, etc.) is much less.

6) Mobile payments and cards in the Russian Federation are beginning to unite. Sometimes it translates into something worthwhile. In any case, the growth of mobile gadgets, the development of technologies for contactless payments and "mobile" wallets and banks - all this will lead to another distribution of profits between players that already exist on the market. And it is unlikely that in the near future a positive impact on the "pocket" of the consumer. In the next article we will dwell on this, but for now - you can just look at the tariffs of the operators.

7) It seems that the most important conclusion from all the collected statistics is the presence of one single tendency, which, in fact, determines all the others: the creation of a strictly unified, strictly regulated market , the activity of which will be subordinated to one state governing structure. What is the difference between banks and any other organization? That's right, a clear procedure for action, which is prescribed to them by the RPF, the Central Bank and their ilk. Is it good for us? The answer, I think, lies somewhere in the field of p2p technologies, and, perhaps, somewhere completely outside the legal field of the Russian Federation.

Source: https://habr.com/ru/post/177781/

All Articles