Problems of making payments for airline tickets via the Internet and their solutions

Purpose of the article : saving money when buying air tickets (applicable to other online payments).

The article is devoted to the main problems of buying air tickets through the Internet using debit bank cards on the example of MasterCard. The article described. how to pay with a debit card instead of a credit card and how to return a fee for a non-cash payment.

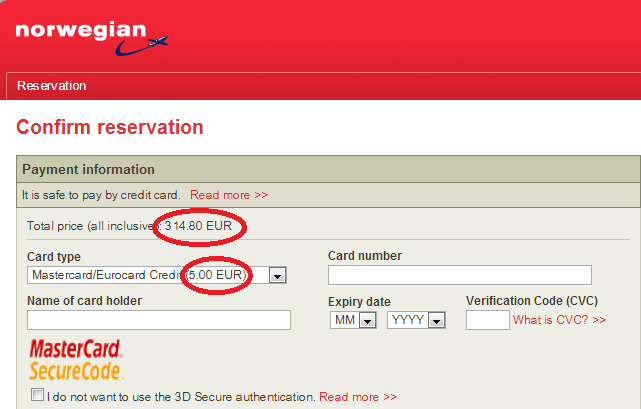

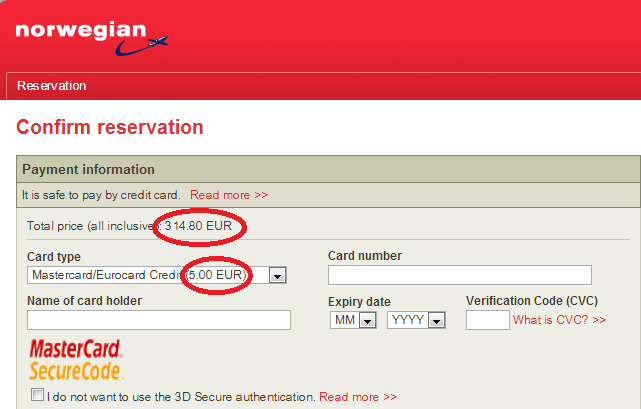

So, the desired flight is selected, personal data is filled in and we go to the ticket payment window:

Here we are waiting for the first surprise: the drop-down list indicates that debit cards such as Visa Debit and MasterCard Debit are not serviced. Many debit card holders at this place stop the payment process and start frantically searching for friends and friends of friends with a not-so-popular credit card in Russia. In fact, the company simply cannot serve only a credit card and does not serve a debit card - since there is no way (apart from manual customer selection) to distinguish them. The restriction is connected more with the psychological approach to debit cards in the West. Therefore, feel free to choose MasterCard Credit (for MasterCard holders) or Visa Credit (for Visa card holders) and continue booking.

After choosing the type of card, observant users may notice that the cost of tickets has increased by 5 Euro. This “Credit Card Surcharge” is a commission for using a credit card.

In some companies, such a commission can reach up to 20 Euro per person. But there is good news: the company has no right to charge this commission. According to the rules of the payment system of both Visa and MasterCard, the fee for non-cash payments is charged from the Seller, not from the Cardholder. The exception is the United States. Since 2013, it is permissible for the United States to charge a fee to the Cardholder for non-cash transactions, but not more than 4%.

Unfortunately, when filling out an electronic payment, we cannot “cancel” the indicated commission, but we will be able to challenge it at our bank later after the transaction.

For this you need:

It is worth noting that the commission does not return with a 100% chance - everything is very dependent on the Bank in which you serve. This is where cardholders of medium-sized Banks win.

')

The main confirmation of the materials presented in the article is the personal and professional (business analyst in a banking software development company) the author’s experience.

Related Links:

The article is devoted to the main problems of buying air tickets through the Internet using debit bank cards on the example of MasterCard. The article described. how to pay with a debit card instead of a credit card and how to return a fee for a non-cash payment.

Debit Card Payment

So, the desired flight is selected, personal data is filled in and we go to the ticket payment window:

Here we are waiting for the first surprise: the drop-down list indicates that debit cards such as Visa Debit and MasterCard Debit are not serviced. Many debit card holders at this place stop the payment process and start frantically searching for friends and friends of friends with a not-so-popular credit card in Russia. In fact, the company simply cannot serve only a credit card and does not serve a debit card - since there is no way (apart from manual customer selection) to distinguish them. The restriction is connected more with the psychological approach to debit cards in the West. Therefore, feel free to choose MasterCard Credit (for MasterCard holders) or Visa Credit (for Visa card holders) and continue booking.

Return of the commission for non-cash payments

After choosing the type of card, observant users may notice that the cost of tickets has increased by 5 Euro. This “Credit Card Surcharge” is a commission for using a credit card.

In some companies, such a commission can reach up to 20 Euro per person. But there is good news: the company has no right to charge this commission. According to the rules of the payment system of both Visa and MasterCard, the fee for non-cash payments is charged from the Seller, not from the Cardholder. The exception is the United States. Since 2013, it is permissible for the United States to charge a fee to the Cardholder for non-cash transactions, but not more than 4%.

Unfortunately, when filling out an electronic payment, we cannot “cancel” the indicated commission, but we will be able to challenge it at our bank later after the transaction.

For this you need:

- To come to the Bank where you serve, you should have a document with data about the operation, in which parts of the payment are listed line by line and the amount of the main service and the amount of the fee for non-cash payments are allocated in a separate line. The necessary extracts are provided by most European companies. If such an extract is not given to challenge the commission will not succeed.

- Under the guidance of a representative of the bank (a specialist of the plastic card department), it is necessary to draw up an application and dispute part of the operation (in no case the whole transaction is left without tickets) for the amount of the commission, attaching a printout with payment data. The item is difficult to implement for Sberbank card holders or another super large bank (these guys rarely bother with such things).

- Nothing more is required of you - the Bank conducts all the claim work. The Bank is also obliged to notify you about the results of work.

It is worth noting that the commission does not return with a 100% chance - everything is very dependent on the Bank in which you serve. This is where cardholders of medium-sized Banks win.

')

Conclusion

The main confirmation of the materials presented in the article is the personal and professional (business analyst in a banking software development company) the author’s experience.

Related Links:

- Internet acquiring "for dummies" - a general description of the work of payment systems and payments Seller - Holder

- How not to lose money when paying via PayPal is another way to save money : savings due to the lack of currency conversion

Source: https://habr.com/ru/post/176811/

All Articles