How to start your personal account

Tell me, did you try to keep your personal records?

How many attempts have you made, and how many times have you abandoned this activity?

')

How many tools and ways have you tried?

I will be among you the champion. I can not even give an exact figure of how many times, starting from the beginning of the 90s, I tried to keep my personal records. You can appreciate the zeal and great inspiration from which it all begins, and passive disappointment when you realize that you once again abandoned this occupation. After a while, inspiration comes again, but each time it starts to get worse. This is akin to trying to manage your business and time.

For me, every attempt was a step in finding a solution.

Continue asking questions:

Can you tell exactly how much your fortune is worth? How much did it cost a year ago, and when and what size of your condition do you want to achieve? (a negative state is also a state that is more than positive to be evaluated and constantly monitored)

You may ask, what does accounting have to do with it?

We are accustomed to taking account of the record of our income and expenses. But judge for yourself, all revenues and expenses change our state, increase or decrease accordingly .

Usually in a rush to start a personal account, we want to know where and how much we spend, where and how much we earn. The goal is to understand where you can save.

But why save?

We all want to live better. Better accommodation, recreation, entertainment, food and more. We want to spend more.

To spend or save? Some nonsense is obtained.

I propose to look at this problem from the other side. The more our state (the richer we are), the better we live (we can spend more). Axiom, is not it? At some point, passive income appears: stocks, property leasing, funds, deposits, business, MMM ... (Who likes more). At some point, this income begins to suffice, in order not to work, but to do what he likes. In the end, to make this world better (well, or worse, to whom that).

It means that it’s not the income and expenses, but the sum of our wealth.

Although, as I said, these things are interrelated.

Example:

You want to buy an apartment. For this you need money. You are trying to keep a record of income and expenses, to understand where you can save money in order to collect the necessary amount to buy an apartment (in a modern credit society it is still much more difficult, but more about that another time).

In fact, the future apartment is a part of your future state. In fact, you need to understand, first of all, the size of this state to translate this desire into life. It is better to set a time frame, for example, in two years. And control the growth of your condition. There is only one way to ensure growth:

1. Spend less.

2. Earn more.

This is a fool and understandable. If after a month you do not fit into the planned growth, then you need to kill the costs, or look for new sources of income.

As a result, it’s not personal income that pays the way for income.

It's funny, but unlike accounting for income and expenses, it is much easier to control and account for your condition.

Take a piece of paper today. Count and write down the following things in succession:

1. All money (cash, on accounts and deposits, in any currencies), bring them into a single expression at the current rate, for example, in rubles or dollars.

2. All their valuables (apartments, cars, securities , jewelry, etc., all that can be sold for money). Rate in the same expression as money, for example, rubles or dollars. Use some very simple principle for evaluation. For example, how much money I get, offhand, if I decide to sell this item within a month.

3. Also, in a single expression, all the debts that someone owes you. Term deposits I recommend to write here. And do not be fooled, consider only real debts that can be repaid with money in clear terms.

4. Also, in a single expression, all the debts that you owe.

Then add the first three values and subtract the last, get your status. In other words, how much are you worth .

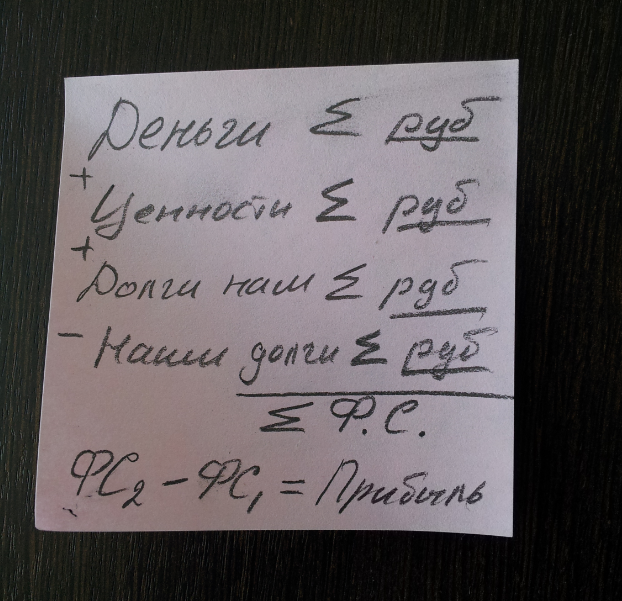

- Personal fortune = Money + Values + Debts to us - Our debts.

Put this piece of paper in a safe place.

For example, in a month do this operation again. You will get another digit. The difference between the first and second will be your exclusively calculated profit, i.e. revenues minus expenses.

- State 2 - State 1 = Income and Expense (for the period)

You can draw a graph. The point of the goal, and the point of the existing state. By putting new points on the chart, current calculations, you will control the progress towards the goal of buying an apartment. Accordingly, it is necessary to decide whether to save or not.

To be honest, each of us, without taking into account income and expenses, knows what, he can save

You can set and global life goals. For example. What should be my condition at the age of 60 in order not to work and have nothing to refuse?

I ask to pay attention. We didn’t use any accounting programs , no complicated schemes, and didn’t spend a lot of time on collecting figures in the system every day, and then collecting them from the system into reports, and trying to understand what, where, from where. We only once a month live considered their condition. But, at the same time, the general situation is under control!

In fact, we came to the conclusion that the periodic monitoring of the state of life is the initial and obligatory function of accounting (and not only personal). We must begin with it. And if this is enough, and everything suits, then stop there.

Well, if you want to understand and analyze in detail where you spend and where you earn, and why you have become poorer or richer for a certain period of time, then you need to carefully and daily record all your income and expenses.

Here are just some nuance. Revenues and expenses are not the receipt and payment of money. Often we do not realize that income or expense is happening as well as in the case of the movement of money when it is obvious.

A simple example:

You are an employee and receive a salary. When do you get income? Not at all when you receive money, but every day when you work, your employer becomes more and more indebted to you until it compensates for this debt by repaying money.

We must try to understand that the movement of money on the one hand, as well as income expenses on the other, form mutual debts that are part of your financial condition.

A simple example:

You worked for half a month, and quit. The employer must pay you for the time you have worked. So? In any current moment this is so, whether you quit or not.

Accounting for cash flow is quite simple. All existing personal accounting programs (home bookkeeping) are based on this. But taking into account the correct income and expenses is not an easy task. A lot of income and expenses are hidden from our eyes, and we must somehow understand that they are happening. This requires not just adequate computer programs, but the correct methodologies, and most importantly, their good understanding.

Therefore, I recommend starting with the first step. Monitor your condition live. Set goals measurable financially and in time. Monitor progress towards these goals. And if you are engaged in business, then you need to figure out taking into account income and expenses. But it will already be a minor function.

In the last article, we said that a business owner must control his business from the big picture to details. Conducted an analogy with the natural way of control, which does not need to learn. To some extent, each person personally is a business, the family is a business, if evaluated financially. And it is likewise necessary to control your financial condition from the big picture to detail. The overall picture will just be your well-being, which is usually not difficult to calculate live. The results for the time interval is not difficult to assess the difference of the state. And then, if necessary, you can deal with the details. When it is necessary and where it is necessary.

Many people to whom I told about this approach today have taken control of their welfare and clearly understand what they want in the future. Personal accounting is not specific to the activities of our company, but the methods and approaches created by us can be useful for each person personally. Therefore, I decided to write this article. The more people understand this approach and take their prosperity under the digitized control, the more happy and wealthy people will be.

I wish you all a good growth of welfare!

Source: https://habr.com/ru/post/173987/

All Articles