Paul Graham: when shaking hands doesn't mean a deal yet

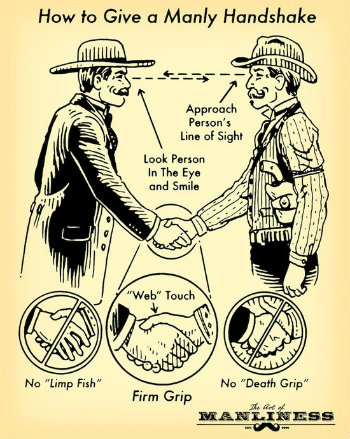

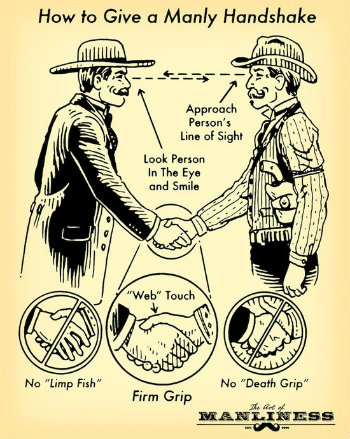

According to Paul Graham (Paul Graham), a business angel and mastermind of many startups, deals in Silicon Valley are usually fixed not by agreement, but by simple handshake. But sometimes the handshake hides not exactly what one of the parties to the agreement expects.

upd: Reading the article, it becomes clear that Paul Graham lives in some completely different reality - he is making deals with investing hands, and confirming his intentions via e-mail, he already considers “a long and redundant procedure”. Nevertheless, many startups are looking at the West in search of investors and accelerators, so it would be useful to look at another world through the eyes of its inhabitants.

Graham, disappointed in simple handshakes, came up with something new in this area.

')

From now on, when entering into a deal with Y Combinator (an investment company of Paul Graham), startups will have to use a protocol consisting of 4 steps that precede a deal:

From now on, when entering into a deal with Y Combinator (an investment company of Paul Graham), startups will have to use a protocol consisting of 4 steps that precede a deal:

According to Paul Graham, the problem is that a lot of transactions, fixed by a handshake, are not transactions at all. The investor could be expressed not quite clearly or the start-up could be so impatient that the investor found a very polite refusal. In any case, novice investors, or simply dishonest investors, can greatly harm a startup:

“The problem is aggravated by the fact that some investors deliberately mislead the founders of startups about how they are really interested in investing. Prospects for a startup can change very quickly. If the investor replied “no” in such a way that it sounded like “yes”, in essence, he gets the right to choose whether to invest or not. Since no agreement has been concluded, it does not cost the investor any money. However, if a startup suddenly turns out to be successful, the investor convinces that his “almost yes” actually meant “yes”, and now the founder of the startup is morally obligated to allow the investor to invest. ”

The process that Graham invented at first glance may seem long, and some of his steps are redundant, however, Paul argues that with mobile phones this procedure can be done in a few minutes while being face to face with the investor. Only in this case there will be a significant difference in the form of an e-mail or message confirming what the investor has agreed to and what the founders of the startup expect from him.

It is also worth noting that Paul Graham is not alone in his judgments and discussed this idea with some business angels and Silicon Valley venture capitalists such as Ron Conway, Ben Horowitz, Chris Dixon before publication. ) and Marc Andreesen (Marc Andreesen) and others.

upd: Reading the article, it becomes clear that Paul Graham lives in some completely different reality - he is making deals with investing hands, and confirming his intentions via e-mail, he already considers “a long and redundant procedure”. Nevertheless, many startups are looking at the West in search of investors and accelerators, so it would be useful to look at another world through the eyes of its inhabitants.

Graham, disappointed in simple handshakes, came up with something new in this area.

')

From now on, when entering into a deal with Y Combinator (an investment company of Paul Graham), startups will have to use a protocol consisting of 4 steps that precede a deal:

From now on, when entering into a deal with Y Combinator (an investment company of Paul Graham), startups will have to use a protocol consisting of 4 steps that precede a deal:- The investor expresses a desire to participate in financing a startup in a certain amount.

- The startup agrees and verbally reports this.

- A startup sends an investor a message or a letter requesting confirmation.

- The investor responds with confirmation.

According to Paul Graham, the problem is that a lot of transactions, fixed by a handshake, are not transactions at all. The investor could be expressed not quite clearly or the start-up could be so impatient that the investor found a very polite refusal. In any case, novice investors, or simply dishonest investors, can greatly harm a startup:

“The problem is aggravated by the fact that some investors deliberately mislead the founders of startups about how they are really interested in investing. Prospects for a startup can change very quickly. If the investor replied “no” in such a way that it sounded like “yes”, in essence, he gets the right to choose whether to invest or not. Since no agreement has been concluded, it does not cost the investor any money. However, if a startup suddenly turns out to be successful, the investor convinces that his “almost yes” actually meant “yes”, and now the founder of the startup is morally obligated to allow the investor to invest. ”

The process that Graham invented at first glance may seem long, and some of his steps are redundant, however, Paul argues that with mobile phones this procedure can be done in a few minutes while being face to face with the investor. Only in this case there will be a significant difference in the form of an e-mail or message confirming what the investor has agreed to and what the founders of the startup expect from him.

It is also worth noting that Paul Graham is not alone in his judgments and discussed this idea with some business angels and Silicon Valley venture capitalists such as Ron Conway, Ben Horowitz, Chris Dixon before publication. ) and Marc Andreesen (Marc Andreesen) and others.

Source: https://habr.com/ru/post/172877/

All Articles