4 life hacking for investing in a startup: hooray, there is a fast and simple legal model

Hello!

I have been involved in investment issues for 8 years already, and of which the last 2 years have been the possibilities of quick, simple and mass investing in startups. Simply put, my task is to get a platform where you can click on the “pay 1000 rubles” button - and this 1000 rubles will immediately become a full-fledged investment with all the necessary legal binding.

Previously, I already wrote that the only method tested so far is the opening of an open joint-stock company or a closed joint-stock company to a startup. This requires a lot of time, resources and does not allow to run small projects. Now the method is found much, much easier. I will tell about it below.

This is an analogue of the revenue share from English law.

')

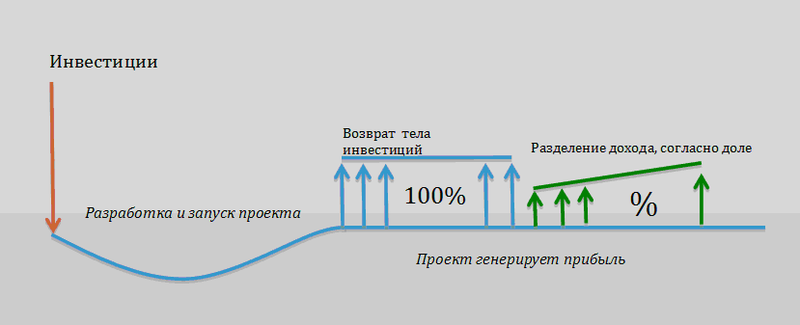

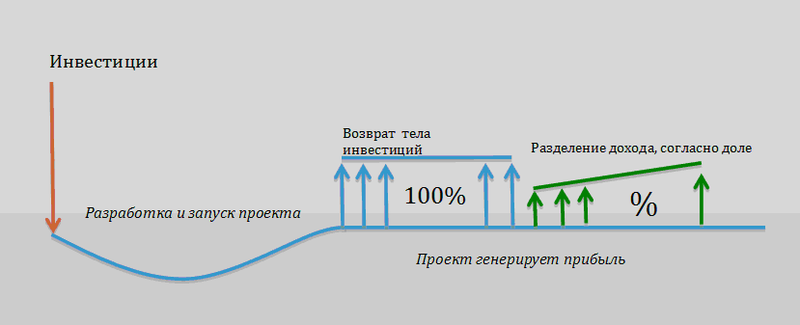

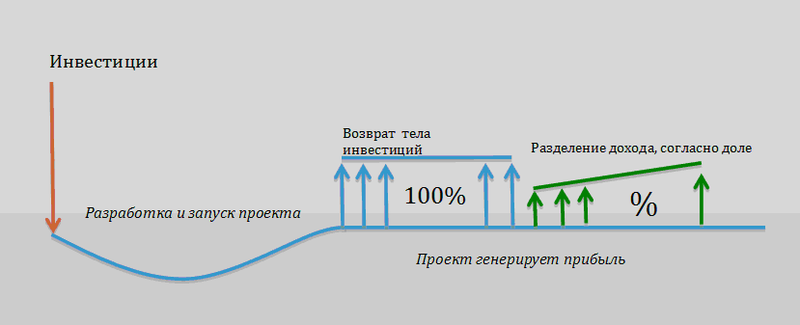

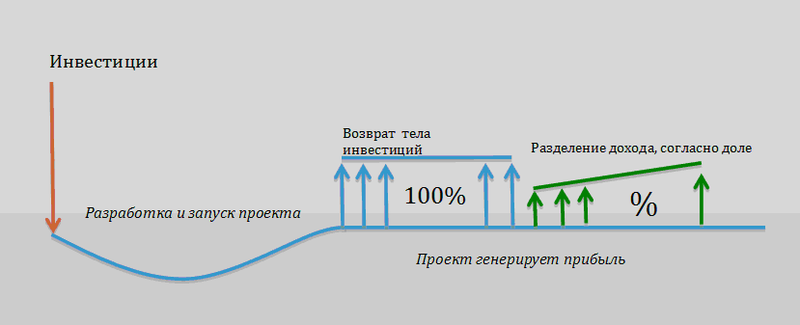

The bottom line is the possibility of concluding an investment contract with a share in the profit, and not in the company as such . At the same time, payments to investors are made not from dividends, but from profits, that is, without any unnecessary complications and with a much greater level of protection. Perhaps this is a feature of the economy of our country - you need not to trust the owner of the company, but directly bind his profits to payments.

Now let's see how a large investor works:

On this chart, the following: roughly speaking, five people gathered in the garage, developed a new piece of metal. Six months later, success came, and the investor became interested in the project. He paid everyone a good reward and bought out the company.

The beauty is that now these two charts can be combined - and also so that a couple of people from the starting team will be in equal share with a large investor.

1. A startup comes and shows a business plan, plus all the justifications.

After a brief check by experts and the banking security service, we proceed to the next stage.

2. Startup registers LLC

It is highly desirable - with simplified taxation. The SP is not suitable for us, and the company or JSC is already too complex for the level of simple start-up and accumulation of funds at startups with an amount of up to one million dollars. There is a service for registering an LLC with an external contractor, that is, for example, if you invented a piece of metal - the fuss with the pieces of paper will end in the first stage after the security service.

3. An investment contract is made.

That it will accept all members of the crowdinvesting. Lifehack number 1: given that this agreement is aimed at a share of the profits, the main restriction about the 50 participants LLC is not imposed on investors. This agreement is later laid out as a public offer, which completely removes all the difficulties of signing.

The main points of the contract are what exactly is included in the project, how the funds will be allocated, what the reporting will be, what investors will have access to in terms of information (for example, to statistical systems), what will be the amount of payments to investors. The contract is “customized” by the owner of the startup, we only give recommendations. Then everything is checked by the lawyers of the site.

This is a key point, because earlier the restrictions of LLCs were very pressured: there is an extremely “holey” system of division of shares, which is designed for trust between the participants. From examples of complex interactions, it is almost impossible to exclude from the composition of the participants any one by one all at once, until he voluntarily agrees.

4. A startup signs an agency agreement with our site.

This contract involves placing in a crowdfunding ecosystem and working with large investors known to us. If the amount is collected at the end of the placement, it comes to the current account in the bank of the startup owner. The principle is like a Kickstarter for a couple of differences:

5. Development

The project develops a year or two and returns either full investment plus profit, or investment and part of the profit.

6. Large investor

At this moment, when the project is already large and successful, a second-level investor is looking for. As an example - companies of the Google or Yandex level, redeeming startups. This is an optional step, but characteristic of the development of the company.

At the same time, each investor of the first round receives an offer for cancellation of investment contracts - that is, everything that the startup owes you on profit is immediately paid, and the contract is closed. Here there is a natural desire to leave key investors of the first level: for example, it could be a big friend of the project, a developer who invested himself and came into the team, and so on. In this case, life hacking number 3 is in effect: targeted sale of options is done: you can buy out a percentage already in the company (and not just in profit). Options (including options of large investors) are distributed in the amount of up to 50, until OJSC or CJSC appears.

The result for a startup - you can start almost immediately without any hemorrhoids. The result for the investor - you can click on the button on the site and pay, say, from 1000 rubles, then to get a profit from it, access to full information about the project and the ability to influence its development.

Now back to the chart:

The beauty is that you can invest in a project, and then receive deductions from its profits, and only then, if necessary, sell everything to a large investor (Google level, if it was a man-made startup, for example). And best of all, you, as a microinvestor, are much more protected than in the first case, because if there is a profit, you can not pay dividends (this will be decided by large investors), but you must pay the deductions for the investment contract. This is life hack number 4, which guarantees, in conjunction with the clause on the mandatory redemption of a contract by a second-round investor, that if the project succeeds, you will receive the money absolutely for sure.

Summary : we have the opportunity to start an extremely fast and simple mechanics of raising funds for various projects from the opening of a cafe to the development of iron. Taking into account the network specifics, first of all we will talk about IT-projects. A few weeks later we are launching the “first swallows”.

I have been involved in investment issues for 8 years already, and of which the last 2 years have been the possibilities of quick, simple and mass investing in startups. Simply put, my task is to get a platform where you can click on the “pay 1000 rubles” button - and this 1000 rubles will immediately become a full-fledged investment with all the necessary legal binding.

Previously, I already wrote that the only method tested so far is the opening of an open joint-stock company or a closed joint-stock company to a startup. This requires a lot of time, resources and does not allow to run small projects. Now the method is found much, much easier. I will tell about it below.

This is an analogue of the revenue share from English law.

')

The bottom line is the possibility of concluding an investment contract with a share in the profit, and not in the company as such . At the same time, payments to investors are made not from dividends, but from profits, that is, without any unnecessary complications and with a much greater level of protection. Perhaps this is a feature of the economy of our country - you need not to trust the owner of the company, but directly bind his profits to payments.

Now let's see how a large investor works:

On this chart, the following: roughly speaking, five people gathered in the garage, developed a new piece of metal. Six months later, success came, and the investor became interested in the project. He paid everyone a good reward and bought out the company.

The beauty is that now these two charts can be combined - and also so that a couple of people from the starting team will be in equal share with a large investor.

It works like this

1. A startup comes and shows a business plan, plus all the justifications.

After a brief check by experts and the banking security service, we proceed to the next stage.

2. Startup registers LLC

It is highly desirable - with simplified taxation. The SP is not suitable for us, and the company or JSC is already too complex for the level of simple start-up and accumulation of funds at startups with an amount of up to one million dollars. There is a service for registering an LLC with an external contractor, that is, for example, if you invented a piece of metal - the fuss with the pieces of paper will end in the first stage after the security service.

3. An investment contract is made.

That it will accept all members of the crowdinvesting. Lifehack number 1: given that this agreement is aimed at a share of the profits, the main restriction about the 50 participants LLC is not imposed on investors. This agreement is later laid out as a public offer, which completely removes all the difficulties of signing.

The main points of the contract are what exactly is included in the project, how the funds will be allocated, what the reporting will be, what investors will have access to in terms of information (for example, to statistical systems), what will be the amount of payments to investors. The contract is “customized” by the owner of the startup, we only give recommendations. Then everything is checked by the lawyers of the site.

This is a key point, because earlier the restrictions of LLCs were very pressured: there is an extremely “holey” system of division of shares, which is designed for trust between the participants. From examples of complex interactions, it is almost impossible to exclude from the composition of the participants any one by one all at once, until he voluntarily agrees.

4. A startup signs an agency agreement with our site.

This contract involves placing in a crowdfunding ecosystem and working with large investors known to us. If the amount is collected at the end of the placement, it comes to the current account in the bank of the startup owner. The principle is like a Kickstarter for a couple of differences:

- This is an investment, not a purchase of something, that is, everyone makes a profit from the success of the project.

- Layfkhak number 2: the owner of a startup also receives increased attention from serious investors, and for this he does not need to walk on each.

5. Development

The project develops a year or two and returns either full investment plus profit, or investment and part of the profit.

6. Large investor

At this moment, when the project is already large and successful, a second-level investor is looking for. As an example - companies of the Google or Yandex level, redeeming startups. This is an optional step, but characteristic of the development of the company.

At the same time, each investor of the first round receives an offer for cancellation of investment contracts - that is, everything that the startup owes you on profit is immediately paid, and the contract is closed. Here there is a natural desire to leave key investors of the first level: for example, it could be a big friend of the project, a developer who invested himself and came into the team, and so on. In this case, life hacking number 3 is in effect: targeted sale of options is done: you can buy out a percentage already in the company (and not just in profit). Options (including options of large investors) are distributed in the amount of up to 50, until OJSC or CJSC appears.

The result for a startup - you can start almost immediately without any hemorrhoids. The result for the investor - you can click on the button on the site and pay, say, from 1000 rubles, then to get a profit from it, access to full information about the project and the ability to influence its development.

Now back to the chart:

Show

The beauty is that you can invest in a project, and then receive deductions from its profits, and only then, if necessary, sell everything to a large investor (Google level, if it was a man-made startup, for example). And best of all, you, as a microinvestor, are much more protected than in the first case, because if there is a profit, you can not pay dividends (this will be decided by large investors), but you must pay the deductions for the investment contract. This is life hack number 4, which guarantees, in conjunction with the clause on the mandatory redemption of a contract by a second-round investor, that if the project succeeds, you will receive the money absolutely for sure.

Summary : we have the opportunity to start an extremely fast and simple mechanics of raising funds for various projects from the opening of a cafe to the development of iron. Taking into account the network specifics, first of all we will talk about IT-projects. A few weeks later we are launching the “first swallows”.

Source: https://habr.com/ru/post/171007/

All Articles