Course lectures "Startup". Peter Thiel. Stanford 2012. Session 10

In the spring of 2012, Peter Thiel ( Peter Thiel ), one of the founders of PayPal and the first investor of Facebook, held a course in Stanford - “Startup”. Before starting, Thiel stated: "If I do my job correctly, this will be the last subject you will have to study."

One of the students of the lecture recorded and laid out a transcript . In this habratopic I translate the tenth lesson.

Session 1: Future Challenge

Activity 2: Again, like in 1999?

Session 3: Value Systems

Lesson 4: The Last Turn Advantage

Session 5: Mafia Mechanics

Activity 6: Thiel's Law

Activity 7: Follow the Money

Session 8: Idea Presentation (Pitch)

Lesson 9: Everything is ready, but will they come?

Lesson 10: After Web 2.0

Session 11: Secrets

Session 12: War and Peace

Lesson 13: You are not a lottery ticket

Session 14: Ecology as a Worldview

Session 15: Back to the Future

Session 16: Understanding

Session 17: Deep Thoughts

Session 18: Founder — Sacrifice or God

Session 19: Stagnation or Singularity?

After Web 2.0

Marc Andressen, co-founder and senior partner of the venture capital investment company Andreessen Horowitz, joined the guest session as a guest. All thanks for the good stuff to him and Peter. I tried to be precise, but keep in mind - this is not a literal transcript.

')

I. Hello World

It all started about 40 years ago with ARPANET. Everything was asynchronous, the speeds were low. Going online, in fact, began in 1979 with the introduction of the CompuServe model. In the early 80s, AOL joined in, implementing a closed model of services, offering games, chats, etc. Having laid the foundations of the modern web, the two companies merged in 97th.

Mosaic Browser (Mosaic) began to be developed in 1993. Netscape announced it on October 13, 1994, and in less than a year it launched an IPO. This started the world wide web (World Wide Web), which largely determined the 90s.

“Web 1.0” and “2.0” are terms that are rather difficult to define accurately. Speaking about the transition from 1.0 to 2.0, basically, we mean the changes that occurred during the change of the decade. When it all began, the content was mostly static. Now the main focus is on data created by users, social networks and collaboration in one form or another.

There have been changes in the patterns of network usage. In the early 90s, people used FTP. In the late 90s, web access or p2p connections were mainly used. In 2010, the network was more than half used for video transmission. These rapid changes inevitably raise the question of what will happen next. Will the next era be a shift towards mobile devices, as many think? It sounds convincing, there are many perspectives. But it should be borne in mind that by itself this relative shift does not show the picture as a whole. The overall use of the Internet has increased significantly. Now, about 20 times more users than it was in the late 90s. The ubiquity of the network has significantly changed everything.

II Wild West

In the past 20 years, the Internet has been very similar to the Wild West. It was an advanced line, a kind of huge open space, where people could do almost anything. By and large, there were no hard and fast rules and restrictions. You can bet it is good or not. There are some interesting questions. What made it possible for the Internet to become what it is? Does the ghost of regulation hang over us? Should everything change?

The last 40 years, even more, the ordinary world was rather tightly regulated. The world of bits and bytes was much less regulated. It is unlikely that anyone will be surprised that the world of bits - computers and finance - has been the best place for the last 40 years. These sectors were extremely innovative. In fact, finances were probably too innovative. Regulators have taken this into account, and now, probably, you will not really turn around. But what about computers? Should we expect more innovations or less in the future?

Some rather large events in the world of the development of the Internet come into the view of everyone. Everyone has heard of recent, high-profile debates, such things as PIPA and SOPA. But other changes may be just as dangerous, but less obvious. The patent system, for example, is what you really need to worry about. Software patents create many restrictions for small companies. No one can shut you down just because you are small. But that's exactly what patents do. Large scale economies can either afford to pay for patents or bypass restrictions.

III When will the future come?

No one knows exactly when the future will come. But there is no reason not to think about it. Of course, you can find many examples where visionaries painted the future significantly different from what happened in the end. Knowing how and why things did not happen as people predicted is very important. If you hope to achieve something, you must understand how it happened that people who were "in your place" failed. Instead, for some reason, we tend to completely ignore thoughts about the future.

Predictions of Villemard (1910) about what the school will be like in 2000. Lessons will be digitally loaded into the brain of children, but there is still a teacher here. There are still desks. And the machine is powered by a crank.

Just a few decades ago, people predicted chemical food and home heating on radium. There is nothing new in the mistakes of predicting the future. In 1895, Lord Kelvin declared that "the creation of an aircraft is heavier than air is impossible." US patent commissioner Charles H. Duell was convinced in 1899 that "everything that can be invented is already invented." All this, of course, was erroneous.

Sometimes the “bad predictors” were extremely optimistic. In the 60s, people thought that soon everything would work on nuclear fuel. We will have flying cities. Why some predictions did not come true is an interesting question. But even more interesting are the cases when people were right about the future, making mistakes only in time. Many times people made the right conclusion, but it took more time to reach the future.

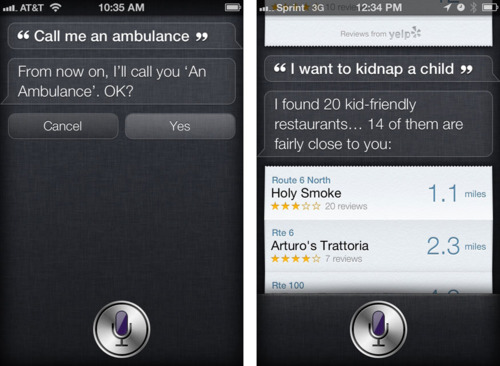

These are examples in which the AI is still not working.

Translation of inscriptions on the smartphone screen

Phone : From now on, call you Ambulance?

(A play on the words: “Call me an ambulance” by ear can be understood as “call me Anna Embyuans”)

Phone : Found 20 restaurants that you can come with children. 14 of them are in close proximity to you. OK?

Left screen

Man : Call me an ambulance.Phone : From now on, call you Ambulance?

(A play on the words: “Call me an ambulance” by ear can be understood as “call me Anna Embyuans”)

Right screen

Man : I want to kidnap a child.Phone : Found 20 restaurants that you can come with children. 14 of them are in close proximity to you. OK?

Take a look at mobile technology. People have invested in this area for many years. Mostly too early. All those who worked on mobile systems before 99 failed. No one thought that buying Apple stock would be the best investment in mobile technology.

There are many more similar examples. The first rockets were invented in China in the 13th century. But it was still too early to try to fly to the moon. It was a good idea to fly there - you just had to wait a few more hundred years. Apple created the Newton mobile device back in 1993, but it took another 15 years to arrive at the iPhone. Napster first appeared. It was too early for him, and he probably broke too many rules. And now we have Spotify. If we draw the right conclusions, the future that does not come from the past will be able to come back and be realized.

Iv. Software eats up the world?

The most famous saying of Marc Andreessen: "software eats the world." Of course, there are a certain number of areas that have already been eaten. Telephone directories, journalism, brokerage are just a few examples. It is likely that the music will be eaten too, now distribution is mostly happening online. Industrial players do not always see when this happens, and do not always accept when it happened. In 2002, the New York Times (The New York Times) stated that the Internet had exhausted itself, all this was just a distraction, and we should go back and continue to enjoy the print newspapers. The record industry exulted when Napster was defeated. The triumph was premature.

If it is true that the software absorbs the world, a reasonable question arises: what else is absorbed or will be eaten in the future. There are several candidates. A lot of things are happening in the health field. Many significant improvements in electromagnetic radiation technology, medical analysis and general openness of the area. But there are still a lot of unresolved issues related to regulation and bureaucracy. Education is another candidate for food. People are trying in every possible way to computerize and automate the learning process. There is also a lab sector in which startups, such as Uber and Taskrabbit, bypass traditional regulated models. Another promising area is jurisprudence. Ultimately, computers could replace people in most legal services. But so far there is no significant progress, because people, which is very strange, trust lawyers more than computers.

It is difficult to say when these areas will be absorbed. It is enough that you should not bet against computers in these areas. It may not be the best idea to become a doctor or a lawyer, as technology can change everything beyond recognition.

In the more distant future, there is another group of candidates ready to replace technology. Media and space / transportation are two examples. Biology should turn from experimental science into information science. In the field of intellectual work and public administration, there is still room for software maneuver. This may still be far away, but there definitely is something to improve.

How should industry and opportunities be assessed if programs really eat up the world? Consider a 2x2 matrix. There are two options in the vertical axis: to compete with computers, to cooperate with computers. In essence, this is an anti-technological and technological approach. On the horizontal axis you have 2 options: to compete with China or cooperate with China. Anti-globalization and pro-globalization.

On the axis of globalization, it is probably better to cooperate. It's too hard to compete. People will never make money that way. They will beat each other until they pass blood. Do not compete with China, even if you can win. It will be a Pyrrhic victory.

Similarly, with the technological axis, it is likely to be wise to avoid competition. Even if you can extract square roots faster than computers, which was quite realistic several decades ago, you should not compete with them. Computers will catch up and overtake you. The chess confrontation between man and computer ended badly enough for a man as early as the year 1997

Returning to the axis of globalization, where we stopped at the cooperation with China, I would like to note. Cooperation is better than competition, but maybe this is not an area that needs to be addressed. Too many people now work with China. In this sense, cooperation with China may be too competitive. Almost everyone is now focused on globalization instead of technology.

On this indirect evidence is complete: it remains only to cooperate with computers. Of course, indirect evidence is quite deceptive. Everything seems to be pointing in one direction, but the direction may be wrong. When you change the point of view or input, the direction may change to the opposite. But circumstantial evidence is still a useful tool. If it seems that nothing else works, you need to use what is.

V. Conversation with Mark Andressen

Peter Thiel : Mark, you have been in the high-tech industry for two decades. How did you imagine the future in 1992? In 2002? Now?

Mark Andressen : My colleagues and I created Mosaic in 1992. It is difficult to overestimate the controversy of this undertaking at that time. Belief in the very idea of the Internet was then rather the exception. At that time, the “information superhighway” was the dominant metaphor. People have seen the advantage of additional information. In a sense, we got 500 TV channels instead of 3. But the idea of interactive television seemed much better than just more TV channels. It seemed that this was to be the next "big shift." The main leaders of the media industry were fully involved in ITV. Bill Gates, Larry Ellison, everyone thought that interactive television was the future. Large companies would have to (continue) to prevail. Oracle (Oracle) would develop interactive software for TV, and information superhighways, on the contrary, would have to remain passive. It was not supposed that it would be anything special to differ from the old traditional media. In 1992, the Internet was as muddy, unclear and academic as it was since 1968.

To be honest, in 1992 it was still deaf. Much of the huge skepticism about the Internet seemed justified. All you had to do to log in is to have a degree in computer science. Everything had to develop slowly. But it was probably not worth clinging to this skepticism and not engaging in new developments. Larry Alison said in 1995 that the Internet will go nowhere, because development is too slow. This was puzzling, since in theory the Internet could be connected via the same wires that were already carried to people's homes. Modems worked quite well. In fact, the main reason for prejudice against the Internet was the same as it is now. People fear the Internet because it is unregulated, decentralized and anonymous. He looks like the Wild West. But people do not like the Wild West. People are not comfortable. Therefore, it was very controversial in 1992 to assert that it is the Internet that will be the next “big shift”.

Still strongly depended on the path itself. Technical fanatics who popularize the web were neither oracles nor prophets and did not have access to the Absolute Truth. Honestly, if we had access to large power structures and could easily go to Orakl, many of us would have failed. But we were just technical fanatics who did not have such access. So we just made a web browser.

Peter Thiel : What did you think would actually happen to the Internet?

Mark Andressen : We were greatly helped by what we saw as it all works in computer research universities. In 1991-92, a 45-megabit high-speed campus connection operated in Illinois. We had modern workstations with network connection. There was streaming video and real-time collaboration. All students had email. All this is simply limited to the boundaries of the university. When you finished your studies, it was assumed that you simply stop using mail. It could have lasted a long time, and it immediately became obvious that all these things should not remain only in research universities.

And then it worked. The mosaic was released at the end of 92, at the beginning of 93. It was launched in 93rd. Then there was the classic exponential growth. The mailboxes to which incoming licensing requests should have been received were completely packed. And at some point, only a fool could not notice that this is the very big shift.

Peter Thiel : Did you think in the 90s that the future would come sooner than it really did.

Mark Andressen : Yes. And there is a large share of irony in the fact that the ideas of the 90s were mostly true. It was just too early. We all thought the future would come very soon. And very much because of this was a failure. Only now all those ideas are being realized. Timing is everything. But it is also the most difficult to control. It is difficult, as entrepreneurs are inherently too energetic to wait. It is also worth noting that “too early” - for an entrepreneur it is even worse than to make a mistake in choosing a direction. It is very difficult to just sit and wait until the time comes. It almost never works. You run out of capital. By the time the “right” time comes, your architecture is already aging. You destroy the company culture.

Peter Thiel : At the beginning and in the mid-2000s (2000-2010), people were very pessimistic about the ideas of the 90s. Is it the same now?

Mark Andressen : There are two types of people: those who experienced the crisis of 2000, and those who did not. Those who have experienced have deep psychological scars. They were irretrievably hurt. These are people who like to talk about bubbles. Always and everywhere they must find a bubble. They are now 30, 40 or 50 years old. And they are burned from the inside. If they are journalists now, they describe the massacre. If they are investors, they suffer terribly. If they are ordinary workers, they are gaining worthless shares. They promised themselves that they would never go bankrupt again. And now, 12 years later, they are still determined to fulfill the promise.

All these scars do not go anywhere, although they should have gone. The people who survived the collapse of 1929 never again believed in the stock market. The market began to grow in fact only after the generation of professional investors changed. Now we are somewhere in the middle of the generational change after the dot-com crash.

This is good news for students and young entrepreneurs. They missed the events of the late 90s, and therefore, at least with regard to this crisis, are in good psychological shape. When I somehow mentioned Netscape (Netscape) in a conversation with Mark Zuckerberg (Mark Zuckerberg). He asked: “What did Netscape have done yet?” - I was shocked, but he looked at me and said: “Buddy, I was in 7th grade then, I didn’t pay attention to it.” And that’s good. Entrepreneurs from 20 to 30 are in good shape. But people who went through the crisis are not so lucky. Most have scars.

Peter Thiel : You argued that software is eating up the world. Tell us how it will be in the next 10 years.

Mark Andressen : there are three options for development: weak, strong and very strong.

The basic, weak version is that the software will eat the technical / computer industry. The value of computers is increasingly in software and hardware. The shift to the cloud computing area is a confirmation. It was a transition to larger, less expensive models where software is key. All this is very different from the old model.

In the "strong" version of the development software will eat many other areas of industry that have not yet been the object of rapid technological change. Take, for example, newspapers. Newspaper production has not undergone significant technological changes for about 500 years! Production was about the same from the 15th century - and then suddenly - bang! There was a digital revolution, and the industry was forced to adapt and change.

In the strongest form, companies like the software companies of Silicon Valley will absorb everything. Companies of the type that we create in the Valley will become dominant in almost all areas of industry. These companies are at the core of their software. They know how to develop software. They understand the economics of software. They put design and development first — which is why they will win.

All this is reflected in the theses of the company Andreessen Horowitz. We do not deal with purification technologies or biotechnologies. We undertake only what is based on software. If the software is the heart of the company, if everything shatters if the team of key developers leaves, it’s great. Companies that will dominate most areas of industry are companies with the same set of management practices and characteristics that are used in Facebook or Google. This, of course, will not be easy, and will meet strong resistance. But dinosaurs are now not in high esteem, and are already being ousted by birds.

Peter Thiel : Are there any areas of the industry that are in a subversive state? As you know, child bullies are summoned to the director, and subversive companies like Napster can be destroyed. Can you succeed in open competition, even if you use the Silicon Valley model in other ways?

Mark Andressen : Look at what Spotify does — it's not at all the same thing that Napster did. Spotify writes a huge number of checks to the owners of music labels. And they take it. Spotify decided to write checks from the very beginning. They were launched in Sweden, because there was no developed CD market here. Yes, they use a subversive model, but they have found a way to soften the explosion. When you start a conversation with the phrase: “by the way, we have some money for you here,” things tend to go a little better.

They still come under high pressure. They seem to run through the ranks. Finally it is not clear whether all this will work or not. The guys from the interested party are very nervous. Things can go wrong in a thousand different ways. Both Spotify and Netflix certainly know this. The danger of paying an interested party is that these people can take money, and then just throw you out of business. If you play correctly, you win. If you make a mistake, you will be left with nothing.

Peter Thiel : A little backstory: Netflix ran into a problem a year ago when content providers raised prices. Spotify attempted to protect itself from this by entering into a package of agreements that expire at different times so that the main players could not unite and at the same time raise prices.

Mark Andressen : And record companies are trying to counter this by entering into short-term deals, and, in some cases, by getting an “insoluble” share in the share capital. It may happen that in the end they will receive all the money and all the shares. Spotify and Netflix are spectacular companies. But by the very nature of their business, they are forced to flee through the ranks. Basically, you need to use an indirect path wherever possible. If you are compelled to compete, try to do it in an indirect way, bring in innovations, and you may be able to get ahead.

Peter Thiel : What areas do you think are the most promising in the very near future?

Mark Andressen: Probably retail. We are now witnessing an onslaught of e-commerce 2.0, e-commerce not only for freaks. Version 1.0 was heavily searchable. You went to Amazon or eBay, found the product you wanted and bought it. This works well if you know exactly what you are looking for. Model 2.0 is associated with a much deeper understanding of consumer behavior. These are companies such as, for example, Warby Parker and Airbnb. Changes capture one product vertical after another. And this will continue in the retail world, if only because starting a business from retail is bad. Very high fixed costs for store maintenance and accounting. Too low margin to start with. Only 5-10% can destroy everything. Best Buy, for example, has 2 problems. First, almost everyone can buy online. And secondly, if you even want to buy something like bricks and mortar, the software will swallow these areas along with everything you can buy at Best Buy.

Peter Thiel : Pet food companies are an example of this paradigm.

Mark Andressen : Yes, now this is not such a bad idea! Diapers.com bought Amazone for $ 450 million. Golfballs.com turned out to be a good business. Even Webvan is back! Online grocery companies sadly burned out in the 90s. But now, city by city, they are returning, trying to master new delivery schemes. The market has now grown significantly. In the 90s there were about 50 million people online. Now there are about 2.5 billion. People are accustomed to e-commerce. By default it is considered that everything can be bought online.

Peter Thiel plays the role of a real hedge fund. Andreessen Horowitz plays the role of a hedge fund. And if someone adheres to the hedge fund similarity strategy, it is necessary to focus on retail in the short term, and on e-commerce in the long term.

Peter Thiel : What new perspectives did you have as a venture capitalist that you lacked as an entrepreneur? Do you have any new insights on the other side of the table?

Mark Andressen : A big, almost philosophical difference arose in the matter of time perception. For an entrepreneur, time is a huge risk. You have to innovate at a specific right time. You may be too early. And this is really dangerous, because in fact you made a one-time bet. It rarely happens that someone starts the same company 5 years after having once tried and made a mistake with time. Jonathan Abrams made Friendster, but not Facebook.

Everything is different with venture capital. To be in business for 20 years or more, you need to use an approach in terms of the structure of a project portfolio. Ideas, not one-time rates. If you believe in some idea and finance a company that failed, this is probably still a good idea. If someone wants to do the same after 4 years, it will probably be a good investment. Most venture capitalists will not go for it. They will be too deeply affected by the previous failure. But a systematic failure analysis is very important. Take a look at Apple's Newton in the early 90s. Mobile technology was the main obsession of many advanced venture capitalists in the Valley. But it was another 2 decades early. But instead of abandoning this idea permanently, it made more sense to put it off temporarily, to wait to implement it in the future.

Peter Thiel : When people invest and something does not work, the best thing to do is adjust the course. And when people do not invest and something works, they remain attached to their initial views and tend to be very cynical.

Macr Andressen : Right. The more investment we lose, the better we understand what was wrong. (Hell!)

But seriously - if you think you can re-launch an idea that someone has already tried to launch 5-10 years ago and failed - good venture capitalists are open to such initiatives. You just have to be able to prove that the time has come.

Peter Thiel : Is there anything young entrepreneurs should know that they don’t know?

Mark Andressen : The number one reason why we all become entrepreneurs is that we all want to focus on the product - less so on everything else. We tend to cultivate and glorify this way of thinking in the Valley. We are all crazy about the model of "lean" startups. Design and product are key factors. There are many people who are talented in this, and this helps to create high-quality companies. But there is a dark side to all this - it seems that entrepreneurs do not need to deal with such difficult issues as sales and marketing. Many entrepreneurs creating good products simply do not have a good distribution strategy. Even worse, when they insist that they don’t need one or call their distribution strategy: “viral marketing strategy”.

Peter Thiel : We discussed earlier why you shouldn’t take it at face value when successful companies say they haven’t used sales or marketing. Since this, in itself, is probably just a publicity stunt.

Mark Andressen : We hear it all every time: “We will act just like Salesforce.com - salespeople are not needed, because the product sells itself”. It is always puzzling. Salesforce.com has a huge, professional sales team. Andreessen Horowitz is very attractive for those who know about sales and marketing.

Peter Thiel : Maybe it is time to rethink their attitude towards integrated sales. People still have scars from the 90s, when businesses led by complex sales have burned out. In the early 2000s, it was very difficult to attract people to business development (BD). But it can be very profitable. Google made phenomenal BD deals with Yahoo. People usually don’t know how beneficial it is for Google. Google does not like to talk about it, because they want to talk only about the design. Yahoo doesn't want to talk about it - uncomfortable.

Audience question : Are there any pitfalls to avoid in thinking about the future?

Peter Thiel : You can be wrong in different ways. You may think that the future is too far away. So, despite the fact that you chose the right area - you can make a mistake in time. Or you can choose the right time, but everyone is already doing the same.

It looks like surfing. The goal is to catch a big wave. If you think a big wave is coming, you are rowing with all your might. Sometimes it turns out that there is no wave, and it sucks.

But you can't just sit around waiting to make sure there is a wave before you start rowing. So you miss it. You need to start in advance, and then let the wave pick you up. The question is how to recognize that the next big wave is on the way.

It's a difficult question. It is better to make a mistake by rowing and not finding a wave, than to start rowing too late and miss a wave. Trying to create another social network right now is trying to catch the current wave. You can row with all your might, but you have already missed this wave. Social networks are not the next wave. Thus, the main approach should be the desire to make mistakes, aiming for the future. And again, in the end, you need to strive to learn not to make mistakes at all.

Question from the audience: We are now in some big wave? Or waves capture one area after another.

Marc Andressen: One after another. Some industries, such as finance, law and health care, have an oligopoly structure, which often has close ties to the government. Banks complain about regulation, but are very often protected by it. Citibank's main advantage is its political flair and ability to overcome bureaucracy. Thus, there is a mass of industries with complex regulation. It's funny to observe which of them are amenable to change, and which are not. There are tremendous legal opportunities, for example. It may seem to you that the industry is already ripe, and maybe it is. But maybe you need to wait a couple of decades. In venture investment, you can never be sure that someone will not appear 22 years old and will not prove to everyone that they were wrong.

Question from the audience: How do patents relate to the phenomenon of "world absorption of software"?

Mark Andressen : The key issue of patents is that patent examiners do not work with it anymore when registering a patent. They just do not know, and they cannot know what is new and what is not. As a result, we have to deal with a bunch of patents. As a high-tech company, you have two extreme opposite possibilities: you can spend the rest of your life fighting with patents, or you can spend all your money on payments for using them. None of these extremes is good. You need to find a balance that allows you to think about patents last. At its core, it is a deterrent regulatory tax.

Peter Thiel: There are four parties to any trial. Two opposing and two teams of lawyers. Lawyers are almost always afraid to lose. Lawyers from the defense almost always try to persuade the client to agree. The question is whether you can achieve something if people are ready to fight to the end, defending their own, even if they have flaws, patents. Or would you rather pay the patent fee? High court costs will pay for themselves if you have to sue only a few times. The danger is that you can fight and win without getting a deterrent precedent, and lawsuits will continue to flow. This is the worst of all.

Marc Andressen: There are such areas of industry - the production of medicines and mechanical equipment, for example - where traditions are fundamental. In this area there are old, historically established norms of how and what to do. But in the software world, things are changing extremely fast. Large companies used to hold a huge patent arsenal to use against small companies. Now they are fighting each other. It seems that the ultimate end state to which big companies are to shoot is when they do nothing at all. Instead, they should simply add 10,000 more patents each year to their portfolio and receive money from licensing. It would be nice if all this did not happen, but this is not a problem of startups, that the patent system is broken.Thus, if you start, you must break through it all. Find your compromise strategy.

Peter Thiel : In a sense, patent issues can be a good sign. If you need any problems, then it is they. They mean that you are creating something really valuable. No one would sue you if you didn’t have good technology. So these are the problems that you need, even if you don’t want to.

Audience question : Has a critical mass of Internet users been reached? Probably, it is harder now to be ahead of time?

Mark Andressen : In general, this is true for the Internet. It is a little harder to be ahead of time, which is, in general, good. Take a look at Golfballs.com. All who play golf today online. This is very different from what it was in the 90s, in the era of dialup connections.

With mobile phones is also not so simple. Someone says that the smartphone market is winding down. We now have 50% penetration. Or maybe the market will still have to be curtailed. Now it seems that in 3 years there will be 5 billion smartphones in the world. The days when you can purchase any phone, “not a smartphone,” are probably numbered. Along with this shift, a new set of regulators appeared that control this area.

Peter Thiel : The big concern about mobile technology is that if a distribution model is successful, it can be banned first, and then copied by Apple and Android. This is a big market, but it’s far from being able to simply unplug the regulators.

Marc AndressenA: Just recently, Apple blocked the ability to use Dropbox in all iOS applications. Motivating this by the fact that interacting with Dropbox encourages people to do less shopping through the App Store. Not like a strong argument. But this is how to deal with bureaucrats in the city council. Even a big and important company like Dropbox can be stopped by Apple.

Audience question : What did you learn about the different types of government coming from several successful companies on the board?

Marc AndressenA: Most importantly, you should try to create a board that can help you. Avoid taking to the board abnormal. This is very similar to marriage. Most people end up in a bad marriage. Board members can be really bad. When something starts to go wrong, it is usually considered that something needs to be done. But this “something” is often worse than the problem itself. Often, board members do not see this.

Peter Thiel: If you want an effective board, it should be small. Three people - the optimal size. The more people you have, the worse your coordination will be. If you want your board to do nothing, make it huge. Non-profit organizations, for example, sometimes have up to 50 people on the board. This brings an incredible profit to any pseudo-dictatorial person who controls this non-profit organization. A board of this size means that it is impossible to control the management. Thus, if you for some reason need an inefficient board, make it very large.

Marc Andressen: I have never encountered problems in the board challenging the results of the voting. What problems did I encounter, but never with problems in voting. The problems we deal with either kill the company or resolve it.

Probably, contract terms and process are all too often discussed. And not enough attention is paid to people. Startups like a sausage factory. People like sausage, but no one wants to watch it cook. Even with the most famous startups the same. The crisis follows the crisis. Everything goes just awful. You fight forward. What does it matter, what processes do you follow? Or who is there with you in the bunker? Entrepreneurs can not think about it for long enough. Nor do they have the ability to sufficiently explore their venture capitalists.

Question from the audience: In businesses like Netflix, things like understanding customer psychology and customer behavior, and not technological innovations, seem key. But you said that you like software companies in your core. Is there any contradiction here?

Mark Andressen : These elements are related to each other as “AND”, and not as “OR”. You may have software at the heart of the company And good marketing with sales. So best of all. Good software companies have good sales and excellent engineering culture at the same time.

The ideal would be if the founder / CEO is product oriented. Sales managers must deal with sales. Salespeople do not create a product! In unsuccessfully launched software companies, the product is created, focusing on sales. Such companies are rapidly turning into consulting. If the company is founded by a product-oriented person, he can simply set his own rules. That is why investors often doubtfully invest in companies that have just hired a new CEO. With a small degree of probability, this CEO is focused on product creation. You can't just take Pepsi's marketing director and replace him with Steve Jobs.

Peter Thiel : Are there any exceptions to this rule? Oracle?

Mark Andressen : No. Larry Ellison is product oriented. Of course, extremely monetary-centric, but product-oriented. He has always been the CEO. Once he broke his back, doing bodysurfing. In the hospital, he continued to manage his company. He was always the assistant number 2, in the likeness of Mark Hurd (Mark Hurd). They were a great many. But Larry always had Cheryl (Cheryl).

Sellers can be very successful in optimizing the company in the 2-4 year period. The position of Andreessen Horowitz on this issue is as follows: after the seller replaces the product-oriented CEO, after 2 years we dismiss.

There are exceptions here. Meg Whitman was often criticized while working in late eBay, but before that, she created it, and, in general, did a fantastic job. John Chambers clearly did a good job creating Cisco, despite the fact that everything got more complicated. Jeff Bezos came from a hedge fund. Good leaders come from everywhere.

Even designers are becoming good CEOs - take a look at Airbnb. They created the whole company, thinking in terms of design. Design has become extremely important. The success of Apple did not come thanks to their hardware. It came from OSX and iOS. The design is in the top layer of all this. There is a lot of talk about internal hardware beauty, but the press does not print it. The best designers are software oriented, those who understand the software device at a very deep level. And the talk here is not about surface aesthetics.

Question from the audience : Web browsers emerged from the university environment. 10 years later, Google came from Stanford. Do you view university research labs in your search for future successful companies?

Marc Andressen: Of course. We invested in a lot of things that were explored 5-10 years ago. We look at the Stanford and MIT research laboratories, looking for technologies that could be a product in the next couple of years.

Synthetic biology is one example. She could be the next big thing. It is based on the creation of biological structures code. It shocks people. Pretty scary thing, agree. But it seems that it works, and will soon be ubiquitous.

Question from the audience : What else is worth knowing about how a good CEO is made?

Marc Andressen: At Andreessen Horowitz, we think that being a CEO is a learning skill. This is a controversial moment in the world of venture capitalists. Most of them believe that the CEO appears so-to-say "fully staffed", in a box tied with a ribbon directly from the factory for the production of the CEO. They talk about the "world-class CEO", which must necessarily have a unique appearance and hairstyle. You should not judge strictly: many very successful venture capitalists have a "do not joke with the post of CEO" mentality, and maybe they are right. Their success speaks for itself. But there is one argument against the “world-class CEO” model; neither Microsoft, nor Google, nor Facebook fit into it. The CEOs of these companies were, of course, just great. But they were the very same guys who were orientedwho founded these companies. In truth, the most important companies are created and managed by people who have never been a CEO before. They are trained on the spot. This scares venture investors. This is risky. But the gain here can be much more.

The question is simple: does a person want to learn how to be a good CEO? This work is not psychologically suitable for some people. Others really want to learn, and they succeed. There is one thing that needs to be understood - managing managers is not the same thing as managing executives. Managing managers is scaling, managing executives is not. Learn how to manage managers, and you're on the right track for a CEO. You will need to learn a little about copyright, so as not to thunder behind the bars, a little finance to get money, and a little about sales to market a product.

But the Valley is infected with Dilbert's vision: everyone believes that management is a bunch of idiots, and engineers are forced to save the situation in spite of them. This is not true. Management is extremely important. We are trying to get the best results on the power law curve. You need to try to see useful practices and adopt them. The best companies are led by people with good managerial characteristics and visions of the product.

Question from the audience : What is more interesting: to establish a company, or to be a venture capitalist?

Marc Andressen: These are quite different things. Basically, company founders would not like to be venture capitalists and vice versa. The classic founder / CEO is a person who wants to keep everything under control. He would hate his job if he were a venture capitalist, because he cannot give direct orders. Instead, the venture capitalist in the arsenal has only indirect influence. But the venture capitalist, most likely, would not want to be a founder either. Venture capitalists have the luxury of expressing their opinions without the obligation to realize it. Realization for them can be hard and unpleasant. So different people, depending on their inclinations, may prefer this or that role. I like both, but this is not common.

Question from the audience: What would you advise students (future entrepreneurs) to start a company with university friends, or go to work in a small (10 people) startup?

Marc Andressen: Establishing a company from scratch is hard. Doing this just by leaving the student bench is even harder. You should go to a small startup and see how young companies work. But in general there are many ways to learn. Maybe it would be better to go, say, to Facebook or Airbnb and see how the work is going on there, because what you take away here is definitely working. It is difficult to be here and give advice - do not base your company. Andreessen Horowitz selects the founders right from school. They can be good founders. But for many people it is really useful to first see how other companies work.

Peter Thiel: The counter argument to this is that the founders of Google, Microsoft and Facebook did not really have much experience. If you look at very successful companies, you will often come across the fact that their founders had never had any such experience before. The question, when we talk about experience, is this: what to adopt? How to use it? If you worked in a startup for 10-20 people and failed, maybe you learned here what not to do. Or maybe he was bent for other reasons, and you did not recognize all the pitfalls. Or you were very scared and can no longer take the risk.

What experience can be learned from working in large companies? The problem is that here, it seems that everything works automatically. It is very difficult to learn to startups, working in Microsoft or Google. These are big companies with phenomenal people. But these people founded too few companies. One theory is that it is too protected places, it is very quiet. They are also too far in process from startups.

It is better not to think about where to go, but think about what to do. This is the key question: what do you believe in? What makes sense? What seems to be working? If company revenues are really subject to a power law, it is important to get into the only company that you think is the best. The question of what stage of development a company is in is less important than the essence of what you are going to do.

Mark Andressen : In 1991 I was an intern at IBM. It was a complete failure. Those familiar with the history of IBM know this period as the era of John Akers. I learned quite well how to destroy a company. I learned everything about dysfunctional companies. It was charming. Once I saw an organization chart. The company had 400,000 employees. I was at the 14th level of subordination from the CEO. Which meant the boss of the boss of the boss of the boss of the boss of the boss of the boss of my boss's boss is 7 levels below the CEO.

The experience you take from IBM is about how to work at IBM. It is absolutely closed. People do not leave from there.

From the translator :

I ask translation errors and spelling in lichku.

Source: https://habr.com/ru/post/170465/

All Articles