Nokia, Elop Effect and Burning Platform

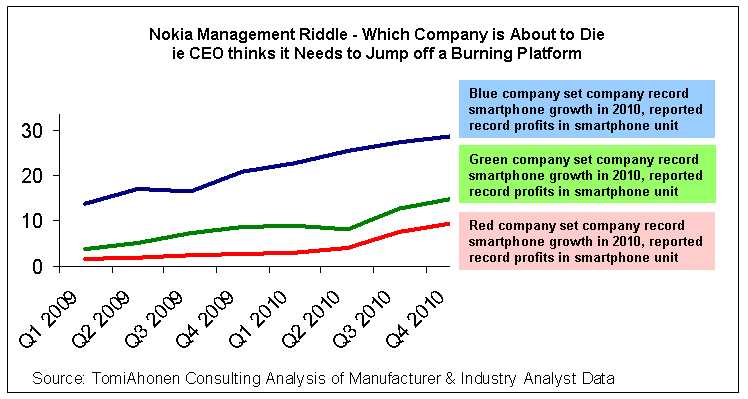

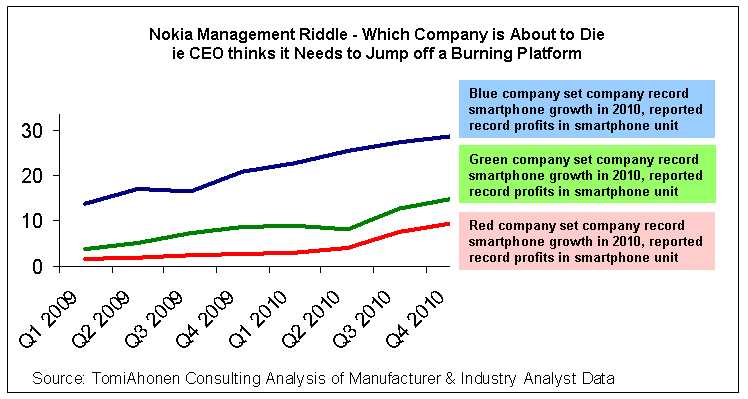

And immediately begin with a little riddle.

* on the vertical axis - millions of smartphones sold

Which of these companies is on the verge of death?

Do you think blue? Congratulations, you are Stephen Elop, the man who replaced Olli-Pekku Kallasvuo as Nokia CEO on September 21, 2010. In February 2011, you issued an appeal to employees of a company called “Burning Platform” . And now let's see why you are considered the worst CEO of all times and peoples.

')

I want to initially warn you that everything that is described in words can always be challenged. Therefore, if you wish, you can immediately flip the post down to the charts . They are already enough to prove the original thesis, everything else - just an explanation of how exactly Elop managed to snatch the defeat from the jaws of victory .

Let's start with a trip to the past. Imagine that we are in two thousand and ten. The Symbian operating system installed on Nokia smartphones is gradually giving way to the Android position, developed by MeeGo has not yet been completed, in 2011 it will be possible to release only one phone on it. More recently, Symbian led the smartphone market, but in the last quarter of 2010, its share fell to 29-32%, according to various estimates. Development for Symbian is complex, the interface carries the legacy of smartphones without a touch screen, it is not adapted to modern hardware, it cannot be called fully a modern system. Isn't it a catastrophic situation?

Not. Not true.

First, despite the decline in market share, Symbian-smartphones showed a steady growth in absolute terms. The fall in the share is due only to the fact that the smartphone market has grown even faster. For the two-year period (2009-2010) before the arrival of Elop and the release of the Burning Platform, the production of Symbian smartphones increased from 15 million (Q1 2009) to 28.8 million (Q4 2010). Now it's hard to believe, but then Symbian grew one and a half times faster than iOS! The difference between Q4 2009 and Q4 in 2010 with Symbian is 34 million smartphones, with iOS - 23 million. There are no prerequisites for a reduction in growth (and, especially, for a reduction in production), the projected market share at the end of 2012 is 15-25% for Nokia, up to 35% for Symbian as a whole.

Secondly, Nokia is far from static. After the release of MeeGo, the market will be divided into high-end smartphones on MeeGo and low-end on Symbian, while the development tools will be the same - Nokia acquired Trolltech as early as 2008 and has since been working on integrating Qt tools with its OS. Symbian still has no competitors in the low-end sector, and although Chinese MTROs will soon pour there, it will take a long time before they even become equal in speed, and by that time, Symbian has been seriously reworked will be able to compete with Android even at the same price.

Thirdly, MeeGo is a really big step forward. Yes, in 2011, if you believe Elop, you can release only one MeeGo-smartphone (we ignore the existence of the N950, which is not destined to go on sale). But I think you all know one company that produces one smartphone a year and does not regret it at all. And here we turn to the role of Elop in the fate of N9 in particular, and MeeGo in general.

So, in February of 2011, Elop pre-buried MeeGo with his “Burning Platform”. But the company was obliged to release at least one MeeGo-smartphone by agreement with Intel, so Elop did everything to minimize sales of this smartphone. In June 2011, immediately after the announcement of the N9, which caused Nokia to grow by 5% for the first time after a long fall, he said that Nokia would not continue the series of smartphones with MeeGo even if N9 becomes a hit. The N9 did not go on sale in the USA, in Canada, in Great Britain, in France, in Italy, in the Netherlands, in Spain, in Germany (Der Stern magazine advised readers to buy it in Switzerland or in Austria, so good it was). Critics took the N9 with a bang , Ahonen claims that the N9 is the only smartphone that consistently won comparisons with the iPhone in reviews. He met no less warm reception among the people - even a weak advance did not prevent him from overtaking the cheaper and diligently promoted Lumia 800 and Lumia 710 combined (although here the estimated data did not provide accurate data on N9). Mobile operator Verizon was interested in returning Nokia to the US market with the Sea Ray smartphone on MeeGo, but Elop refused and chose to release Sea Ray on Windows Phone as Lumia 800, which Verizon was not interested in.

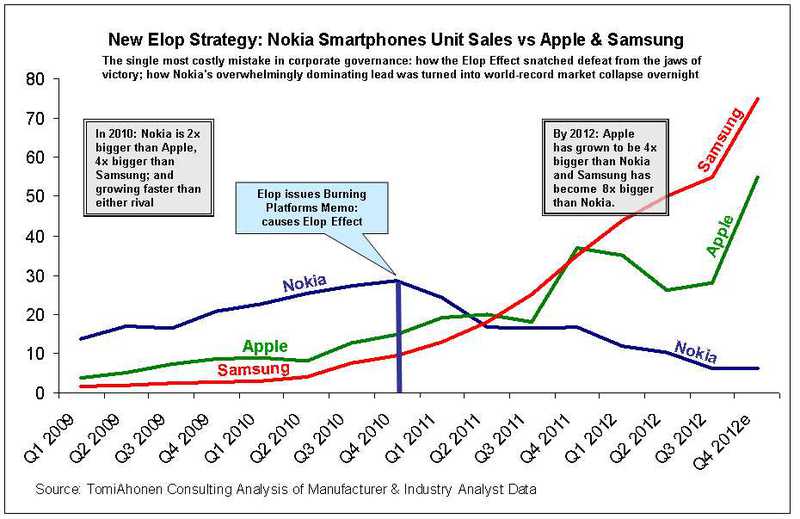

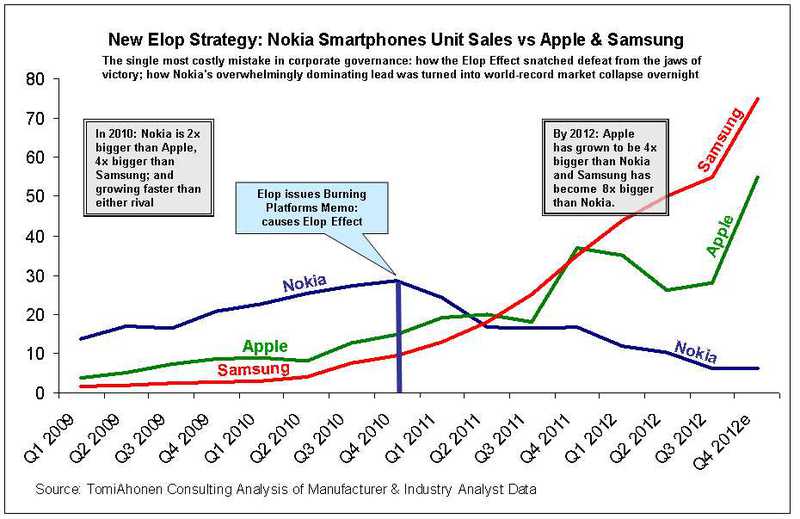

Well, enough words, let's get down to business - that is, to statistics. To begin with, let's see how the graph continues at the beginning of this publication:

Significant, isn't it? Just on the Burning Platform, the trend breaks, and Nokia begins to roll down, bouncing on the bumps. Want specifics and numbers? You are welcome:

Q1 2009 - 13.7 million smartphones, 39% market share

Q2 2009 - 16.9 million smartphones, 41% market share

Q3 2009 - 16.4 million smartphones, 40% market share

Q4 2009 - 20.8 million smartphones, 38% market share

Q1 2010 - 21.5 million smartphones, 39% market share

Q2 2010 - 24 million smartphones, 37% market share

Q3 2010 - 26.5 million smartphones, 32% market share

Q4 2010 - 28.6 million smartphones, 29% of the market share (Nokia's first quarter, Nokia, the smartphone division sets a record in sales, revenue and profits) - Nokia is twice as good as Apple and four times as much as Samsung.

Q1 2011 - 24.2 million smartphones, 24% market share (Elop effect since February)

Q2 2011 - 16.7 million smartphones, 15% market share (smartphone division becomes unprofitable)

Q3 2011 - 16.8 million smartphones, 14% market share (N9 comes out with MeeGo, Elop buries MeeGo)

Q4 2011 - 19.6 million smartphones, 12% market share (Lumia out) - After a sudden fall, Nokia’s share is half the share of Apple and Samsung.

Q1 2012 - 11.9 million smartphones, 8% market share

Q2 2012 - 10.2 million smartphones, 7% market share

Q3 2012 - 6.3 million smartphones, 4% market share (a loss of 49% for each smartphone sold)

Q4 2012 - 6.6 million smartphones, 3% market share (new Lumia since WP8 are released) - Apple exceeds Nokia by 7 times, Samsung - by 10

The numbers differ slightly in places (for example, for Q4 2010, sales of 28.6 million smartphones are for some data, 28.8 million for others), but the overall picture is quite clear: stable growth (twice in two years) before Elop, stable decline ( four times in two years) with Elop. Why did the market share fall ? It's simple: the smartphone market as a whole grew even faster.

Now let's look at the share of Windows Phone in Nokia-made smartphones. Elop promised a lossless translation from Symbian to Windows Phone. What happened?

In this situation, the orange share (disgruntled owners of Lumia) seems to reflect the share of disgruntled owners of Windows Phone according to a report by Bernstein Research, which shows that only 37% of owners of Windows Phone smartphones are planning to stay on this platform, the remaining 63% are planning to migrate.

Even if you ignore this report (since, firstly, Windows Phone Lumia, users may be more dissatisfied with competitors and to a lesser extent Lumia; secondly, polls as such do not seem to me a reliable form of research) to conclude that the lossless transfer, to put it mildly, did not succeed: only 17% of the previous number of Symbian users switched to Windows Phone. If we still consider this report to be true, then it turns out that two thirds of these 17% are not going to buy a device on Windows Phone in the future, so they can also be considered lost.

Another illustration shows the dynamics of switching from Symbian to Windows Phone:

And, finally, a few words (and not only words) about the results of the last quarter of 2012. It is considered to be successful , since it sold 0.3 (according to other data, 0.4) million more smartphones (4.4 million Lumia and 2.2 million Symbian devices). True, firstly, this is due to the standard Christmas increase in demand. Secondly, the forecasts for 2012 were initially much more optimistic:

In general, Lumia sales growth can be called insignificant against the background of the market growth:

Thus, it is too early to rejoice: at best, one can say that the year ended not with complete failure, but simply failure. And even more sad is the picture, if we compare it with the production of Nokia smartphones two years ago.

So, let's evaluate the results of Elop. Tomi Ahonen estimates that this is four billion dollars in lost profits in the first year after the release of the Burning Platform (that is, Q2 2011 - Q1 2012). Four billion dollars a year ago. What is four billion dollars? Well, it's more than the annual profit of Nissan Motors, or UPS, or Boeing, or Walt Disney. Of course, the idea of calculating lost profits is somewhat dubious, and the only excuse is that the situation at Nokia in the two years preceding Elop was stable, which allowed for fairly accurate predictions. And, apparently, if it were not for Elop, the real profit would correspond to the predicted.

Look at Nokia stocks , which have fallen by 64% since then. On the production of smartphones, which has fallen four times (and this is with the frantic growth of the market). On the market share, which fell ten times. Is it possible to somehow justify? The mere decline in production would be enough to call the actions of Elop destructive.

An aggravating circumstance can also be called the fact that Elop deliberately lied, claiming that Symbian is on a downward trajectory, since he could not but be aware of the steadily growing sales of Symbian smartphones. Did Nokia have a problem? Of course they were. The company has lost a significant market share, profits have fallen significantly compared with previous years. But they were not fatal, and generally fade against the background of the problems that arose after the “Burning Platform”.

It would seem that there are no more questions left about the role of Elop in the fate of Nokia - this role is certainly negative. This statistics says with confidence. Nevertheless, there is one question: isit whether his actions to destroy Nokia are deliberately intentional, or is it just a consequence of flagrant incompetence? Alas, the statistics, of course, is not capable of an unequivocal answer to this question. But something and she can tell us: in the first five months with Elop at the head of Nokia, Nokia’s shares have risen by 11%, which can speak about competent management (or just a coincidence).

I hope this article (in fact, a brief summary of certain aspects of Nokia’s history over the past four years) helped you better understand the current situation, or at least entertained.

Sources: first of all, of course, the blog of Tomi Ahonen. Perhaps this is the best source of information about Nokia - in particular, its forecast for 2012 was the most accurate. From it were taken all the images used in the article. Gartner and IDC reports, press releases from Nokia were also used. Special thanks to Google and one holivarnom topic.

* on the vertical axis - millions of smartphones sold

Which of these companies is on the verge of death?

Do you think blue? Congratulations, you are Stephen Elop, the man who replaced Olli-Pekku Kallasvuo as Nokia CEO on September 21, 2010. In February 2011, you issued an appeal to employees of a company called “Burning Platform” . And now let's see why you are considered the worst CEO of all times and peoples.

')

I want to initially warn you that everything that is described in words can always be challenged. Therefore, if you wish, you can immediately flip the post down to the charts . They are already enough to prove the original thesis, everything else - just an explanation of how exactly Elop managed to snatch the defeat from the jaws of victory .

Let's start with a trip to the past. Imagine that we are in two thousand and ten. The Symbian operating system installed on Nokia smartphones is gradually giving way to the Android position, developed by MeeGo has not yet been completed, in 2011 it will be possible to release only one phone on it. More recently, Symbian led the smartphone market, but in the last quarter of 2010, its share fell to 29-32%, according to various estimates. Development for Symbian is complex, the interface carries the legacy of smartphones without a touch screen, it is not adapted to modern hardware, it cannot be called fully a modern system. Isn't it a catastrophic situation?

Not. Not true.

First, despite the decline in market share, Symbian-smartphones showed a steady growth in absolute terms. The fall in the share is due only to the fact that the smartphone market has grown even faster. For the two-year period (2009-2010) before the arrival of Elop and the release of the Burning Platform, the production of Symbian smartphones increased from 15 million (Q1 2009) to 28.8 million (Q4 2010). Now it's hard to believe, but then Symbian grew one and a half times faster than iOS! The difference between Q4 2009 and Q4 in 2010 with Symbian is 34 million smartphones, with iOS - 23 million. There are no prerequisites for a reduction in growth (and, especially, for a reduction in production), the projected market share at the end of 2012 is 15-25% for Nokia, up to 35% for Symbian as a whole.

Secondly, Nokia is far from static. After the release of MeeGo, the market will be divided into high-end smartphones on MeeGo and low-end on Symbian, while the development tools will be the same - Nokia acquired Trolltech as early as 2008 and has since been working on integrating Qt tools with its OS. Symbian still has no competitors in the low-end sector, and although Chinese MTROs will soon pour there, it will take a long time before they even become equal in speed, and by that time, Symbian has been seriously reworked will be able to compete with Android even at the same price.

Thirdly, MeeGo is a really big step forward. Yes, in 2011, if you believe Elop, you can release only one MeeGo-smartphone (we ignore the existence of the N950, which is not destined to go on sale). But I think you all know one company that produces one smartphone a year and does not regret it at all. And here we turn to the role of Elop in the fate of N9 in particular, and MeeGo in general.

So, in February of 2011, Elop pre-buried MeeGo with his “Burning Platform”. But the company was obliged to release at least one MeeGo-smartphone by agreement with Intel, so Elop did everything to minimize sales of this smartphone. In June 2011, immediately after the announcement of the N9, which caused Nokia to grow by 5% for the first time after a long fall, he said that Nokia would not continue the series of smartphones with MeeGo even if N9 becomes a hit. The N9 did not go on sale in the USA, in Canada, in Great Britain, in France, in Italy, in the Netherlands, in Spain, in Germany (Der Stern magazine advised readers to buy it in Switzerland or in Austria, so good it was). Critics took the N9 with a bang , Ahonen claims that the N9 is the only smartphone that consistently won comparisons with the iPhone in reviews. He met no less warm reception among the people - even a weak advance did not prevent him from overtaking the cheaper and diligently promoted Lumia 800 and Lumia 710 combined (although here the estimated data did not provide accurate data on N9). Mobile operator Verizon was interested in returning Nokia to the US market with the Sea Ray smartphone on MeeGo, but Elop refused and chose to release Sea Ray on Windows Phone as Lumia 800, which Verizon was not interested in.

Well, enough words, let's get down to business - that is, to statistics. To begin with, let's see how the graph continues at the beginning of this publication:

Significant, isn't it? Just on the Burning Platform, the trend breaks, and Nokia begins to roll down, bouncing on the bumps. Want specifics and numbers? You are welcome:

Q1 2009 - 13.7 million smartphones, 39% market share

Q2 2009 - 16.9 million smartphones, 41% market share

Q3 2009 - 16.4 million smartphones, 40% market share

Q4 2009 - 20.8 million smartphones, 38% market share

Q1 2010 - 21.5 million smartphones, 39% market share

Q2 2010 - 24 million smartphones, 37% market share

Q3 2010 - 26.5 million smartphones, 32% market share

Q4 2010 - 28.6 million smartphones, 29% of the market share (Nokia's first quarter, Nokia, the smartphone division sets a record in sales, revenue and profits) - Nokia is twice as good as Apple and four times as much as Samsung.

Q1 2011 - 24.2 million smartphones, 24% market share (Elop effect since February)

Q2 2011 - 16.7 million smartphones, 15% market share (smartphone division becomes unprofitable)

Q3 2011 - 16.8 million smartphones, 14% market share (N9 comes out with MeeGo, Elop buries MeeGo)

Q4 2011 - 19.6 million smartphones, 12% market share (Lumia out) - After a sudden fall, Nokia’s share is half the share of Apple and Samsung.

Q1 2012 - 11.9 million smartphones, 8% market share

Q2 2012 - 10.2 million smartphones, 7% market share

Q3 2012 - 6.3 million smartphones, 4% market share (a loss of 49% for each smartphone sold)

Q4 2012 - 6.6 million smartphones, 3% market share (new Lumia since WP8 are released) - Apple exceeds Nokia by 7 times, Samsung - by 10

The numbers differ slightly in places (for example, for Q4 2010, sales of 28.6 million smartphones are for some data, 28.8 million for others), but the overall picture is quite clear: stable growth (twice in two years) before Elop, stable decline ( four times in two years) with Elop. Why did the market share fall ? It's simple: the smartphone market as a whole grew even faster.

Now let's look at the share of Windows Phone in Nokia-made smartphones. Elop promised a lossless translation from Symbian to Windows Phone. What happened?

In this situation, the orange share (disgruntled owners of Lumia) seems to reflect the share of disgruntled owners of Windows Phone according to a report by Bernstein Research, which shows that only 37% of owners of Windows Phone smartphones are planning to stay on this platform, the remaining 63% are planning to migrate.

Even if you ignore this report (since, firstly, Windows Phone Lumia, users may be more dissatisfied with competitors and to a lesser extent Lumia; secondly, polls as such do not seem to me a reliable form of research) to conclude that the lossless transfer, to put it mildly, did not succeed: only 17% of the previous number of Symbian users switched to Windows Phone. If we still consider this report to be true, then it turns out that two thirds of these 17% are not going to buy a device on Windows Phone in the future, so they can also be considered lost.

Another illustration shows the dynamics of switching from Symbian to Windows Phone:

And, finally, a few words (and not only words) about the results of the last quarter of 2012. It is considered to be successful , since it sold 0.3 (according to other data, 0.4) million more smartphones (4.4 million Lumia and 2.2 million Symbian devices). True, firstly, this is due to the standard Christmas increase in demand. Secondly, the forecasts for 2012 were initially much more optimistic:

In general, Lumia sales growth can be called insignificant against the background of the market growth:

Thus, it is too early to rejoice: at best, one can say that the year ended not with complete failure, but simply failure. And even more sad is the picture, if we compare it with the production of Nokia smartphones two years ago.

So, let's evaluate the results of Elop. Tomi Ahonen estimates that this is four billion dollars in lost profits in the first year after the release of the Burning Platform (that is, Q2 2011 - Q1 2012). Four billion dollars a year ago. What is four billion dollars? Well, it's more than the annual profit of Nissan Motors, or UPS, or Boeing, or Walt Disney. Of course, the idea of calculating lost profits is somewhat dubious, and the only excuse is that the situation at Nokia in the two years preceding Elop was stable, which allowed for fairly accurate predictions. And, apparently, if it were not for Elop, the real profit would correspond to the predicted.

Look at Nokia stocks , which have fallen by 64% since then. On the production of smartphones, which has fallen four times (and this is with the frantic growth of the market). On the market share, which fell ten times. Is it possible to somehow justify? The mere decline in production would be enough to call the actions of Elop destructive.

An aggravating circumstance can also be called the fact that Elop deliberately lied, claiming that Symbian is on a downward trajectory, since he could not but be aware of the steadily growing sales of Symbian smartphones. Did Nokia have a problem? Of course they were. The company has lost a significant market share, profits have fallen significantly compared with previous years. But they were not fatal, and generally fade against the background of the problems that arose after the “Burning Platform”.

It would seem that there are no more questions left about the role of Elop in the fate of Nokia - this role is certainly negative. This statistics says with confidence. Nevertheless, there is one question: is

I hope this article (in fact, a brief summary of certain aspects of Nokia’s history over the past four years) helped you better understand the current situation, or at least entertained.

Sources: first of all, of course, the blog of Tomi Ahonen. Perhaps this is the best source of information about Nokia - in particular, its forecast for 2012 was the most accurate. From it were taken all the images used in the article. Gartner and IDC reports, press releases from Nokia were also used. Special thanks to Google and one holivarnom topic.

Source: https://habr.com/ru/post/168097/

All Articles