Build a business, not a “exit strategy”

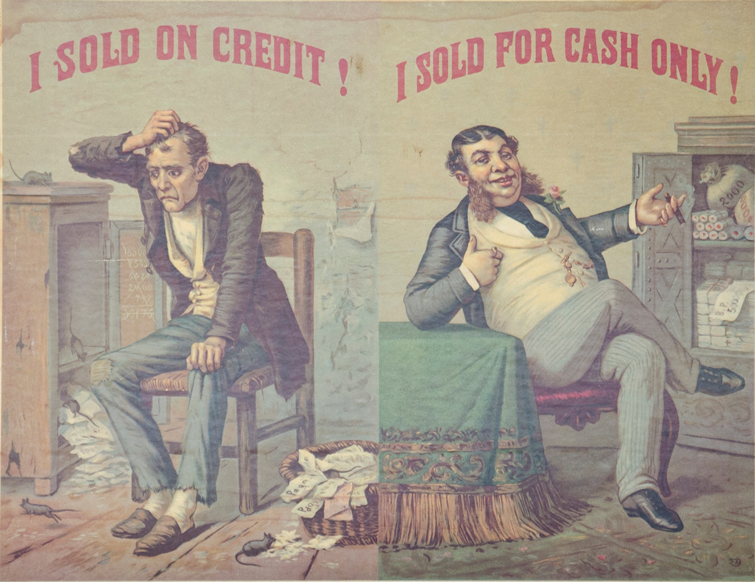

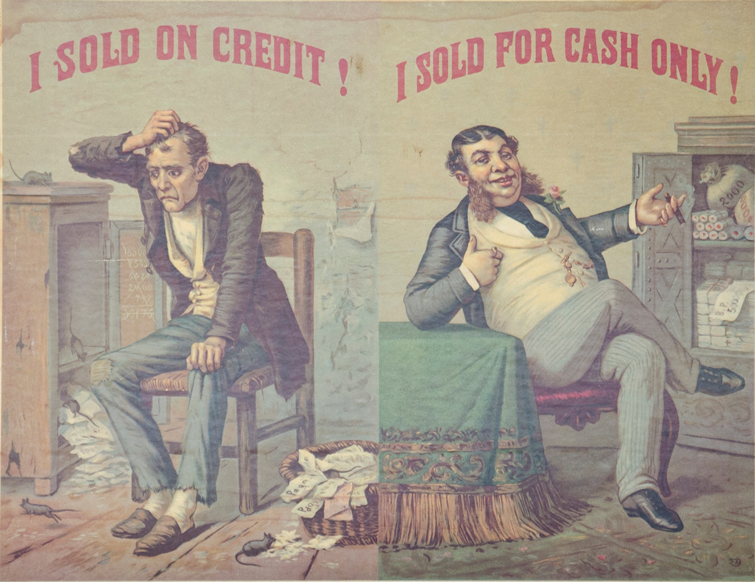

Young startups often dream of a million dollars in cash. They are often not even particularly interested in what they do (the specific idea is not important), but in the interest of “cutting the dough in a fast way and dumping it” (hit and run). Quickly make a prototype, get financing, finish something on a fading interest, sell your share. If it does not work out quickly (and the matter is not nice to the heart), the startup is bent, and the young startuper, maybe not the first time, but turns into the old one.

So we in Alconost often think about it: “Maybe, well, him, these muddy startups and cranes in the sky? Maybe real business brings more happiness? ”

This is exactly what Melanie Io argues in his article.

')

How many people reading this text have their own startup? How many people reading this text are trying to raise capital for their startup?

Let me count the odds. Only one percent of companies will ever be able to attract venture capital. And only 2% of companies that received investments will be sold for $ 100 million or more. But even if such a sale takes place, most likely the founder will own only a third of the property, or even less. Because by the time the company can be sold profitably, investors will have time to invest their money 3-4 times and get shares for this. It turns out that in 0.02% of cases the founder of a startup has a chance to carry home 30 million dollars. And if the origins of the company stood a few people? We divide the sum by 2 or 3. Now you probably say "but 30 million is a lot" or "to hell, 15 million is a lot." But to assess the ratio of risk and possible profit in this way will be wrong. Instead, we need to look at the expected value of our fifteen million.

For those who do not know: “expected value” is the probability of an event, expressed in monetary terms. For example, if you choose between a 5% chance to win $ 1,000 and a 20% chance to win $ 300, then it will be statistically more advantageous to choose the last, because the expected cost of the second option is $ 60, while the first is only 50.

Let's calculate the results: multiply $ 1 million by 1% (this is a chance to attract venture capital), then by 2% (probability of selling for $ 100 million or more), then by 33% (the founder of the company receives, on average, after the sale) and we divide the amount in half, assuming that the company has two founders. Expected cost is 3300 dollars. Three jokes".

Now let's say that you started a small software development business, your web applications solve an existing problem of a certain market segment and you provide them as a service. For example, your programs allow entrepreneurs to pay less tax than an accountant would charge.

Suppose you have been working on your business for 10 years, and it becomes profitable after 2 years, and the revenue is 1 million dollars a year. Your profitability, say, is at the level of 20%, and in 10 years you sell a company for $ 2 million, or two annual revenues. You are the only founder and have never taken money from other people. It is possible that at the start you paid your employees salaries in promotions, however, you still own at least 90% of the company.

This is also not an easy task, however, it is clearly not impossible. According to the Office of the US Small Business Affairs, the percentage of survival among small businesses is 44%. I understand that this sounds unexpected, because many of us are used to thinking that 95% or 99% of companies are being burned through. In fact, only 56% of small firms cease to exist during the first five years. Not all profitable companies generate income of over a million dollars a year — about 25% of the top firms show such a return.

Let's count the odds in this version. We add up 2 million dollars received during the sale, and the total profit of 1.6 million dollars over the entire existence of the case. The resulting 3.6 million dollars will be multiplied by the probability of survival for small businesses (44%), then by the company's share in this situation (90%). We get the expected cost of 356 thousand dollars. This is more than a hundred times the expected value of a fast-growing, high-tech startup created with the money of investors. Yes, $ 3.6 million is not the amount with which you can send everyone to hell, but this is definitely more money than I have ever seen.

Suppose so far my arguments sound convincing. Let's see what it takes to build this mythical, profitable web-based business that brings in $ 1 million a year.

To do this, you actually need to do two things. First, create a product that is needed at least a small segment of the market. Yes, this is easier said than done, but if you direct your efforts into one area, preferably familiar to you, you are likely to find a problem that you can solve in a unique way. Your business idea should not be the most remarkable in the world, it doesn’t even have to be revolutionary - it’s quite enough for it to solve the problem of a certain number of people. The size of the target audience required for your product depends entirely on the second stage.

Now attention: there will be important information further. It sounds a little crazy, but believe me, this is the key to building a successful business: you must SELL your product, in a sense, for real money. How much will it cost? Well, it depends on the goods. Do you sell a subscription to a program in the B2B sector, and does this program help small businesses count taxes? Then you probably pay $ 30 a month. Do you sell luxury goods that only a few can afford? In this case, you can charge a price of thousands of dollars. In any case, the formula is simple: revenue is the number of purchases multiplied by the price of the goods.

Here you have a web application that considers taxes for small firms, and you get from them for $ 30 a month. This means that for revenue of $ 1 million per year, you need to serve only 2,800 customers. Yes, 2800 buyers. And how to achieve this in two years? You have to find 3-4 clients every DAY. 4 people per day. This can be achieved simply by promising existing customers six months of free service if they bring in a new customer.

I don’t want you to think that it’s easy to build a reliable, profitable business that brings in millions of income - but it’s actually much easier than other owners and investors try to imagine. That's what is REALLY difficult - it is to organize a business that will bring billions, or invest in a company that will write a new Instagram. The probability of success here is 0.02%.

But, since it is SO difficult, why do owners and investors continue to strive to get "all or nothing"? To understand this phenomenon, you need to imagine a system of motivation for venture funds. A venture fund is an organization, the same as a private fund or a private investor company. Such a fund has partners - most often these are large insurance companies, pension and university funds, on which accounts for decades lie many billions of dollars. Partners usually invest a small portion of their money in the form of high-risk venture capital. They make decisions about which companies to support. The only parameter that determines whether the organizers of the venture fund will keep their work is the profit. Ideally, an incredibly large profit. All of these funds are actually the same task. For 10 years, the entire amount in the account, for example, $ 100 million, is invested in the business, after which the business is sold and the money is returned to the investor. The task of the fund is to increase its capital at least three times in 10 years. This situation gives rise to very interesting, albeit vicious, systems of motivation.

To begin with, in order to have time to sell most of the companies that received investments in just 10 years of the fund’s existence, it is necessary to invest the bulk of the funds in existing companies for the first 4 years. Most funds write only 10-12 checks per year. Given the initial fund size of $ 100 million, the partners, naturally, will not offer money to small businesses, even profitable and steadily growing ones, because they would have to invest in hundreds of companies to place all the capital. And for the first 4 years of the foundation’s life, 4-8 partners simply cannot physically carry out such work.

Secondly, the partners expect a minimum of threefold profit from the amount of the fund's investments until the end of its ten-year work. Here you need to consider that, on average, 80% of investments will be unprofitable. Another 15% will show two or three times profit. And only 5% of the fund's best investments will pay off at a rate of tenfold or more. In a few years, the fund will increase investments in the most profitable companies in order to stimulate their further growth, and organizations left behind will not receive additional funding so that the fund does not lose its money on them. Even taking into account this process, the bulk of the existing funds will not multiply the owners' money by three times. The only way to win the race is to invest in a super profitable company at an early stage of its development, because in this case the fund will be able to survive, even having lost the bulk of the investment.

As soon as you understand this scheme, it will become obvious to you why investors should repeat the mantra “choose a large market segment” and “focus on the network effect” - they earn money on it! I do not claim that investors are bad people and manipulate you. I just explain that they are doing the most reasonable thing they can: they follow their motivation, because that is the nature of man. You do not need to think that investors are suggesting to you the best solution for your business or give you the only chance to get a big win. Just the opposite.

Choose a lifestyle that suits you and set goals that are important only to you. Many in this industry believe that if you do not work 80 hours a week, falling asleep under your desk, you are doing something wrong or simply “not born to become a businessman.” Well, I'm here to report that this is bullshit. Listen, if your business is the subject of your passion and you can not wait for the morning, get up at 6 and fly to the office to work there for 14 hours - go ahead! But you do not need to do this just because you are expected to have such a lifestyle. If you have a life outside of your startup - do not think that by this you condemn yourself to failure, because you are trying hard. It is desirable that you can devote 4-5 hours a day to your work - and this is quite enough. Maybe shortly before launch you will need to invest more time, but people actually have not yet figured out a way to constantly work for 14 hours in a row and stay productive at the same time.

Here's a funny story for you: a friend of mine founded a fairly well-known startup in New York. He literally LIVES in the office. I'm not kidding, he moved there. And before that, almost every night he slept there on the couch. Guess how much profit his startup brings after two years of hard work? Not at all. Not a single pitiful cent - and this is in two years! No, I understand, they are trying to build a huge user base with a network effect, and so on, la-la-la, but this is a complete madness, damn it. I would never want to live like him. I'm just not like that. To spend years of my life, thousands of hours of work, to burn out with a high probability - for me it is a madness of pure water. But if you are reading high-tech articles, you might think that my friend’s startup is one of the coolest in New York!

The moral of this story is: don't let high-tech noodles hang on your ears, it is not at all useful. She's not even tasty. If you constantly read about the funds, the funds there and the funds here - you start to believe that this is the only way to become the owner of a successful startup. How many times have you read how one person built a company without investment, quietly worked for 2-3 years and now receives 3 million dollars in income? Let me guess: never. This is probably not interesting. A newspaper with such an article can not be sold. But you know what? Only a person who has spent years to build a stable and successful business almost without help and start-up capital can be called a truly successful entrepreneur. Examples: the founder of the Subway eateries chain still owns all the shares of the company, which is now the largest franchise in the world; Sarah Blakely turned 5 thousand dollars and the top of tights in the company Spanx, which is now worth billions. We should talk about such people, praise them and focus on their success.

Unfortunately, I had to understand it in my own experience. In 2009, I served my term as an investment bank manager and founded my first company called ToVieFor. This company was supposed to work in the fashion industry and it was fucking shipwrecked.

I think at that moment I was bored with my career and I really wanted to launch a cool startup, and not build a real business. And things went well for a while. We won the business plan competition at the University of New York and received a grant of $ 75,000. Our company was one of only 25 companies that was invited to the TechCrunch Disrupt demonstration in San Francisco. And our most impressive achievement was that we were one of 11 companies invited to participate in the TechStars start-up development program in New York. From nearly a thousand applications, the organizers chose 1% of the best. I still consider this fact to be one of the most serious achievements in my career.

TechStars is a really awesome program where you can meet people you could hardly meet in your normal life and make friends with them for life. But TechStars, as promised advertising, only develops. The program can push your company in the direction you were going to. Is there a little tension between the founders? Expect that at least one of them will leave the program. Do you invest too much money in advertising? Get ready for the fact that investors will tear you to shreds, doubting your competence. Have you hired a programmer who is not very interested in success? He will quit at the first difficulties. TechStars, like other development programs, develops both good and bad. It’s like getting an investment - rocket fuel, which could blow up your company even at take-off if you are not well prepared.

So it happened to us. An impressive explosion in the eyes of the admiring public: a quarrel between the founders, terrible rumors in the press, and caring operators, filmed everything for a reality show on television. Pretty little.

Then I had two options: to go back to the warm caring hands of Corporate America, or learn the lessons learned and use them to build a real business. I think you can guess that I chose the latter.

I started my last company, Elizabeth & Clarke, one and for several months for a part of the shares I hired a programmer to help me make the first product. My starting capital was 75 dollars. We developed a viable program for 1 month, after which it began to generate income. Now, a year later, the company has become profitable. According to my estimates, that year I spent 5 thousand dollars from my personal savings. But this is all, I own 95% of the company, I did not take money from anyone and get an income that grows by 20% per month.

What benefits can you get from my post? Firstly, if you manage to do the same thing as me, you can build a small profitable online business in just a couple of years, get a good income and work 30 hours a week. But remember, my message to you is not “do as I do,” but “follow your path.” Do not pay attention to investors, journalists and even me. Listening to smart people is useful, but keep doing what you want. And do not feel bad just because you will not be "successful" in someone's eyes. And another thing: solve your problems. Whatever path you choose, whether you are big or small, this is really the path that will lead you to success. The most important thing - keep your ears from noodles! In this matter, you can trust me.

About the translator

The article is translated in Alconost.

Alconost is engaged in the localization of applications, games and websites in 60 languages. Language translators, linguistic testing, cloud platform with API, continuous localization, 24/7 project managers, any formats of string resources.

We also make advertising and training videos - for websites selling, image, advertising, training, teasers, expliners, trailers for Google Play and the App Store.

Read more: https://alconost.com

So we in Alconost often think about it: “Maybe, well, him, these muddy startups and cranes in the sky? Maybe real business brings more happiness? ”

This is exactly what Melanie Io argues in his article.

')

How many people reading this text have their own startup? How many people reading this text are trying to raise capital for their startup?

Let me count the odds. Only one percent of companies will ever be able to attract venture capital. And only 2% of companies that received investments will be sold for $ 100 million or more. But even if such a sale takes place, most likely the founder will own only a third of the property, or even less. Because by the time the company can be sold profitably, investors will have time to invest their money 3-4 times and get shares for this. It turns out that in 0.02% of cases the founder of a startup has a chance to carry home 30 million dollars. And if the origins of the company stood a few people? We divide the sum by 2 or 3. Now you probably say "but 30 million is a lot" or "to hell, 15 million is a lot." But to assess the ratio of risk and possible profit in this way will be wrong. Instead, we need to look at the expected value of our fifteen million.

For those who do not know: “expected value” is the probability of an event, expressed in monetary terms. For example, if you choose between a 5% chance to win $ 1,000 and a 20% chance to win $ 300, then it will be statistically more advantageous to choose the last, because the expected cost of the second option is $ 60, while the first is only 50.

Let's calculate the results: multiply $ 1 million by 1% (this is a chance to attract venture capital), then by 2% (probability of selling for $ 100 million or more), then by 33% (the founder of the company receives, on average, after the sale) and we divide the amount in half, assuming that the company has two founders. Expected cost is 3300 dollars. Three jokes".

Now let's say that you started a small software development business, your web applications solve an existing problem of a certain market segment and you provide them as a service. For example, your programs allow entrepreneurs to pay less tax than an accountant would charge.

Suppose you have been working on your business for 10 years, and it becomes profitable after 2 years, and the revenue is 1 million dollars a year. Your profitability, say, is at the level of 20%, and in 10 years you sell a company for $ 2 million, or two annual revenues. You are the only founder and have never taken money from other people. It is possible that at the start you paid your employees salaries in promotions, however, you still own at least 90% of the company.

This is also not an easy task, however, it is clearly not impossible. According to the Office of the US Small Business Affairs, the percentage of survival among small businesses is 44%. I understand that this sounds unexpected, because many of us are used to thinking that 95% or 99% of companies are being burned through. In fact, only 56% of small firms cease to exist during the first five years. Not all profitable companies generate income of over a million dollars a year — about 25% of the top firms show such a return.

Let's count the odds in this version. We add up 2 million dollars received during the sale, and the total profit of 1.6 million dollars over the entire existence of the case. The resulting 3.6 million dollars will be multiplied by the probability of survival for small businesses (44%), then by the company's share in this situation (90%). We get the expected cost of 356 thousand dollars. This is more than a hundred times the expected value of a fast-growing, high-tech startup created with the money of investors. Yes, $ 3.6 million is not the amount with which you can send everyone to hell, but this is definitely more money than I have ever seen.

Suppose so far my arguments sound convincing. Let's see what it takes to build this mythical, profitable web-based business that brings in $ 1 million a year.

To do this, you actually need to do two things. First, create a product that is needed at least a small segment of the market. Yes, this is easier said than done, but if you direct your efforts into one area, preferably familiar to you, you are likely to find a problem that you can solve in a unique way. Your business idea should not be the most remarkable in the world, it doesn’t even have to be revolutionary - it’s quite enough for it to solve the problem of a certain number of people. The size of the target audience required for your product depends entirely on the second stage.

Now attention: there will be important information further. It sounds a little crazy, but believe me, this is the key to building a successful business: you must SELL your product, in a sense, for real money. How much will it cost? Well, it depends on the goods. Do you sell a subscription to a program in the B2B sector, and does this program help small businesses count taxes? Then you probably pay $ 30 a month. Do you sell luxury goods that only a few can afford? In this case, you can charge a price of thousands of dollars. In any case, the formula is simple: revenue is the number of purchases multiplied by the price of the goods.

Here you have a web application that considers taxes for small firms, and you get from them for $ 30 a month. This means that for revenue of $ 1 million per year, you need to serve only 2,800 customers. Yes, 2800 buyers. And how to achieve this in two years? You have to find 3-4 clients every DAY. 4 people per day. This can be achieved simply by promising existing customers six months of free service if they bring in a new customer.

I don’t want you to think that it’s easy to build a reliable, profitable business that brings in millions of income - but it’s actually much easier than other owners and investors try to imagine. That's what is REALLY difficult - it is to organize a business that will bring billions, or invest in a company that will write a new Instagram. The probability of success here is 0.02%.

But, since it is SO difficult, why do owners and investors continue to strive to get "all or nothing"? To understand this phenomenon, you need to imagine a system of motivation for venture funds. A venture fund is an organization, the same as a private fund or a private investor company. Such a fund has partners - most often these are large insurance companies, pension and university funds, on which accounts for decades lie many billions of dollars. Partners usually invest a small portion of their money in the form of high-risk venture capital. They make decisions about which companies to support. The only parameter that determines whether the organizers of the venture fund will keep their work is the profit. Ideally, an incredibly large profit. All of these funds are actually the same task. For 10 years, the entire amount in the account, for example, $ 100 million, is invested in the business, after which the business is sold and the money is returned to the investor. The task of the fund is to increase its capital at least three times in 10 years. This situation gives rise to very interesting, albeit vicious, systems of motivation.

To begin with, in order to have time to sell most of the companies that received investments in just 10 years of the fund’s existence, it is necessary to invest the bulk of the funds in existing companies for the first 4 years. Most funds write only 10-12 checks per year. Given the initial fund size of $ 100 million, the partners, naturally, will not offer money to small businesses, even profitable and steadily growing ones, because they would have to invest in hundreds of companies to place all the capital. And for the first 4 years of the foundation’s life, 4-8 partners simply cannot physically carry out such work.

Secondly, the partners expect a minimum of threefold profit from the amount of the fund's investments until the end of its ten-year work. Here you need to consider that, on average, 80% of investments will be unprofitable. Another 15% will show two or three times profit. And only 5% of the fund's best investments will pay off at a rate of tenfold or more. In a few years, the fund will increase investments in the most profitable companies in order to stimulate their further growth, and organizations left behind will not receive additional funding so that the fund does not lose its money on them. Even taking into account this process, the bulk of the existing funds will not multiply the owners' money by three times. The only way to win the race is to invest in a super profitable company at an early stage of its development, because in this case the fund will be able to survive, even having lost the bulk of the investment.

As soon as you understand this scheme, it will become obvious to you why investors should repeat the mantra “choose a large market segment” and “focus on the network effect” - they earn money on it! I do not claim that investors are bad people and manipulate you. I just explain that they are doing the most reasonable thing they can: they follow their motivation, because that is the nature of man. You do not need to think that investors are suggesting to you the best solution for your business or give you the only chance to get a big win. Just the opposite.

Choose a lifestyle that suits you and set goals that are important only to you. Many in this industry believe that if you do not work 80 hours a week, falling asleep under your desk, you are doing something wrong or simply “not born to become a businessman.” Well, I'm here to report that this is bullshit. Listen, if your business is the subject of your passion and you can not wait for the morning, get up at 6 and fly to the office to work there for 14 hours - go ahead! But you do not need to do this just because you are expected to have such a lifestyle. If you have a life outside of your startup - do not think that by this you condemn yourself to failure, because you are trying hard. It is desirable that you can devote 4-5 hours a day to your work - and this is quite enough. Maybe shortly before launch you will need to invest more time, but people actually have not yet figured out a way to constantly work for 14 hours in a row and stay productive at the same time.

Here's a funny story for you: a friend of mine founded a fairly well-known startup in New York. He literally LIVES in the office. I'm not kidding, he moved there. And before that, almost every night he slept there on the couch. Guess how much profit his startup brings after two years of hard work? Not at all. Not a single pitiful cent - and this is in two years! No, I understand, they are trying to build a huge user base with a network effect, and so on, la-la-la, but this is a complete madness, damn it. I would never want to live like him. I'm just not like that. To spend years of my life, thousands of hours of work, to burn out with a high probability - for me it is a madness of pure water. But if you are reading high-tech articles, you might think that my friend’s startup is one of the coolest in New York!

The moral of this story is: don't let high-tech noodles hang on your ears, it is not at all useful. She's not even tasty. If you constantly read about the funds, the funds there and the funds here - you start to believe that this is the only way to become the owner of a successful startup. How many times have you read how one person built a company without investment, quietly worked for 2-3 years and now receives 3 million dollars in income? Let me guess: never. This is probably not interesting. A newspaper with such an article can not be sold. But you know what? Only a person who has spent years to build a stable and successful business almost without help and start-up capital can be called a truly successful entrepreneur. Examples: the founder of the Subway eateries chain still owns all the shares of the company, which is now the largest franchise in the world; Sarah Blakely turned 5 thousand dollars and the top of tights in the company Spanx, which is now worth billions. We should talk about such people, praise them and focus on their success.

Unfortunately, I had to understand it in my own experience. In 2009, I served my term as an investment bank manager and founded my first company called ToVieFor. This company was supposed to work in the fashion industry and it was fucking shipwrecked.

I think at that moment I was bored with my career and I really wanted to launch a cool startup, and not build a real business. And things went well for a while. We won the business plan competition at the University of New York and received a grant of $ 75,000. Our company was one of only 25 companies that was invited to the TechCrunch Disrupt demonstration in San Francisco. And our most impressive achievement was that we were one of 11 companies invited to participate in the TechStars start-up development program in New York. From nearly a thousand applications, the organizers chose 1% of the best. I still consider this fact to be one of the most serious achievements in my career.

TechStars is a really awesome program where you can meet people you could hardly meet in your normal life and make friends with them for life. But TechStars, as promised advertising, only develops. The program can push your company in the direction you were going to. Is there a little tension between the founders? Expect that at least one of them will leave the program. Do you invest too much money in advertising? Get ready for the fact that investors will tear you to shreds, doubting your competence. Have you hired a programmer who is not very interested in success? He will quit at the first difficulties. TechStars, like other development programs, develops both good and bad. It’s like getting an investment - rocket fuel, which could blow up your company even at take-off if you are not well prepared.

So it happened to us. An impressive explosion in the eyes of the admiring public: a quarrel between the founders, terrible rumors in the press, and caring operators, filmed everything for a reality show on television. Pretty little.

Then I had two options: to go back to the warm caring hands of Corporate America, or learn the lessons learned and use them to build a real business. I think you can guess that I chose the latter.

I started my last company, Elizabeth & Clarke, one and for several months for a part of the shares I hired a programmer to help me make the first product. My starting capital was 75 dollars. We developed a viable program for 1 month, after which it began to generate income. Now, a year later, the company has become profitable. According to my estimates, that year I spent 5 thousand dollars from my personal savings. But this is all, I own 95% of the company, I did not take money from anyone and get an income that grows by 20% per month.

What benefits can you get from my post? Firstly, if you manage to do the same thing as me, you can build a small profitable online business in just a couple of years, get a good income and work 30 hours a week. But remember, my message to you is not “do as I do,” but “follow your path.” Do not pay attention to investors, journalists and even me. Listening to smart people is useful, but keep doing what you want. And do not feel bad just because you will not be "successful" in someone's eyes. And another thing: solve your problems. Whatever path you choose, whether you are big or small, this is really the path that will lead you to success. The most important thing - keep your ears from noodles! In this matter, you can trust me.

About the translator

The article is translated in Alconost.

Alconost is engaged in the localization of applications, games and websites in 60 languages. Language translators, linguistic testing, cloud platform with API, continuous localization, 24/7 project managers, any formats of string resources.

We also make advertising and training videos - for websites selling, image, advertising, training, teasers, expliners, trailers for Google Play and the App Store.

Read more: https://alconost.com

Source: https://habr.com/ru/post/166569/

All Articles