Where does the market of electronic payment systems in Russia go? Part 1. Market statistics

Not so long ago, in one of the magazines, I found a note about how social networks were “boarded”, primarily FB and VK: as it turned out, the millions of budgets invested by market giants in advertising on these resources did not justify themselves, since SMM-agencies wind the voices and likes in all possible and impossible ways. What for? Actually for the sake of those same millions (not votes, of course). In principle, the story is not new, because there were, for example, scandals of this kind with anti-virus companies that wrote malware for their products, if we talk about the Network, and if we recall the recent mortgage crash, we can understand that everything is exactly the same in “real” life: the effect of soap The bubble is peculiar to any new market.

Not so long ago, in one of the magazines, I found a note about how social networks were “boarded”, primarily FB and VK: as it turned out, the millions of budgets invested by market giants in advertising on these resources did not justify themselves, since SMM-agencies wind the voices and likes in all possible and impossible ways. What for? Actually for the sake of those same millions (not votes, of course). In principle, the story is not new, because there were, for example, scandals of this kind with anti-virus companies that wrote malware for their products, if we talk about the Network, and if we recall the recent mortgage crash, we can understand that everything is exactly the same in “real” life: the effect of soap The bubble is peculiar to any new market.Therefore, I decided to test for the tooth the sphere with which I work side by side every day - e-commerce, as well as related areas: payments and their processing.

In short, almost all the articles that have met on the Internet on the subject indicate that the market is 1) fast growing, 2) very promising and, most importantly 3) still not saturated (this is of course the Russian segment) .

')

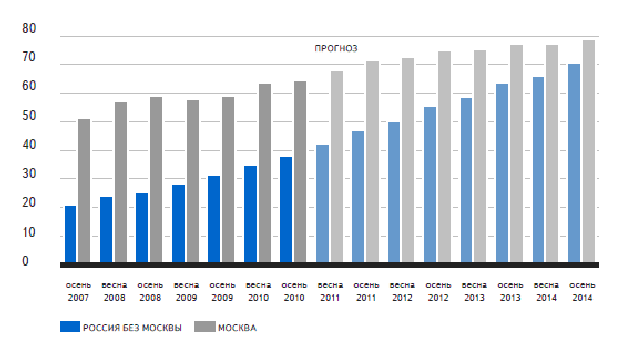

But if you immediately plunge into reality, you should make one, but a very important amendment: the degree of penetration of the Internet in the Russian Federation hardly reaches 50% (to be exact, in 2011 the figure was 47% in Yandex opinion, and in August 2012 - approximately 51%). But, if we take the regions beyond the Urals, the figure will be several times smaller.

Chart 1. Number of Internet users according to Yandex

Therefore, the development of the market, at least for now, is primarily due to:

- the number of new users;

- price reductions for unlimited traffic;

- access speed is also increasing.

Accordingly, those who are ready to go to the store for shopping, clicking the mouse becomes more, as well as those who begin to think in categories of the Web.

On the other hand, of course, there are also quality indicators causing this growth, such as:

- the emergence of new and consolidation of the "old" types of payments (such as mobile payments, virtual and plastic cards, almost obsolete SMS and micro-payments, etc.);

- increasing competition in the market (among payment systems and aggregators, CMS, web studios and other players);

- promotion of online stores in the region;

- increase consumer confidence, etc.

In addition, there are objective factors : the growth of consumers, who were initially educated as “network”, and this is primarily facilitated by social networks and interactivity of web applications as such, oriented to feedback; the arrival of offline sellers in the Network (for example, supermarkets), as well as the emergence of electronic money in the "real" business (the appearance of cards with the same YandexDeneg, Kiwi; NFS payments for processing electronic payment systems; the possibility of paying for travel, movies, etc. p. electronic currency, etc.).

On the other hand, among the objective negative factors are:

- problems with logistics and delivery (and the role of the Post of the Russian Federation is not the last here);

- leaving many small and even medium-sized stores into a semi-legal and even illegal segment due to too high tax burden, as well as slow alignment of legal provisions and market trends (take at least the problem of issuing electronic invoices in the understanding of tax and other government bodies - one of thousands of unsolved problems);

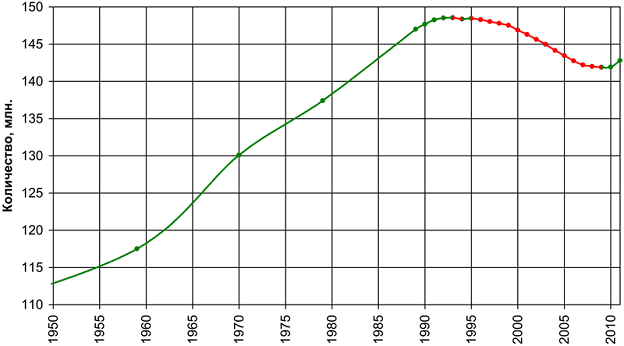

- a sharp decline in consumer generation 1990-2010.

Chart 2. Population of Russia, 1950–2010 (according to Wikipedia)

Separately, I would like to mention the legislation: according to good tradition, the Russian lawmaker decided not to change the generally accepted tendencies and adopted the notorious Federal Law “On the National Payment System”, which slowed down this segment in development. If earlier we had a "VAZ" and others like him, now we have begun to form something similar in the EPS market.

And this happened for many reasons:

- it was necessary to throw out small players, replacing them exclusively with credit organizations (which means turning the mobile business into a formalized business; which, by the way, was often stated pathetically at various conferences);

- The ultimate goal of the law can be read in its name - the National Payment System, i.e. there can be no question about Visa or PayPal, for example: it is important for us to introduce ours, the one and only thing for ages;

- the law is clearly imprisoned for OpSoS'ov and banks (in this sequence), because and the established limits, and the complicated concept of electronic money, and the mass of far-fetched subjects who have nothing to do with the existing order of things, and the status of mobile payments simply do not speak about anything else;

- but the most important thing was that it was necessary to bring the entire “black” market into the legal sphere. Simply put, a freelancer, mini-shops, Hammer lovers and everyone who earned one way or another on the Web will soon realize and accept who had another stone from those who had recently invested in world capital. by investing in a very promising and “unexpectedly” bankrupt mortgage lending industry.

But it is in the near future. In the meantime, you need to present facts and figures. And it is these data that should be studied first.

In order to understand and evaluate all these trends, I turned to the leading figures - NAUET , an organization that was created not so long ago (2003), but in which the titans of on-line sales combined forces (which, however, does not prevent their website from constantly unavailable).

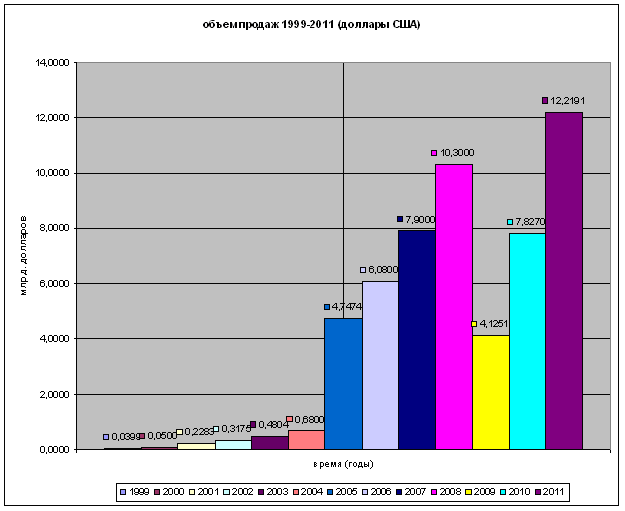

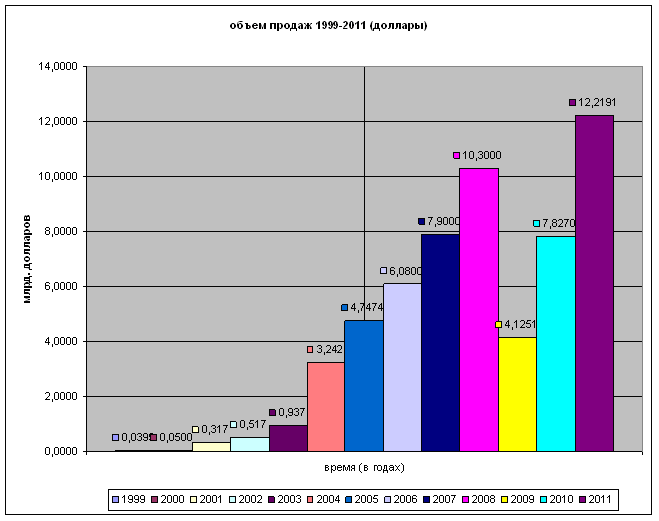

So, according to the data that I managed to get by hard work in Google and Yandex, the volume of payments on the Web can be represented approximately as follows (see graph 3).

Note :

“It should be noted that when preparing data, NAUET uses different sources: indicators of trade with the public sector are taken from the report of the Ministry of Economic Development, and in the case of the individual sector, Oborot.ru statistics are used ...”( source ).

Chart 3. Dynamics of payments from 1999 to 2011, billion USD

As you can see, the graph shows the growth of the market (and in terms of money and in percentage terms). But still there are two features that can not be noted.

The first is that, since 2008, the Association unexpectedly "... turned to settlements in rubles, and not in foreign currency." What is the reason? Of course, with the global financial crisis: to show significant growth rates and “smooth” trends, the exchange rate difference should be leveled, and comparisons should be made not for the whole period, but say, for the first half of 2008 and 2009, or for 2009 and 2010. etc.

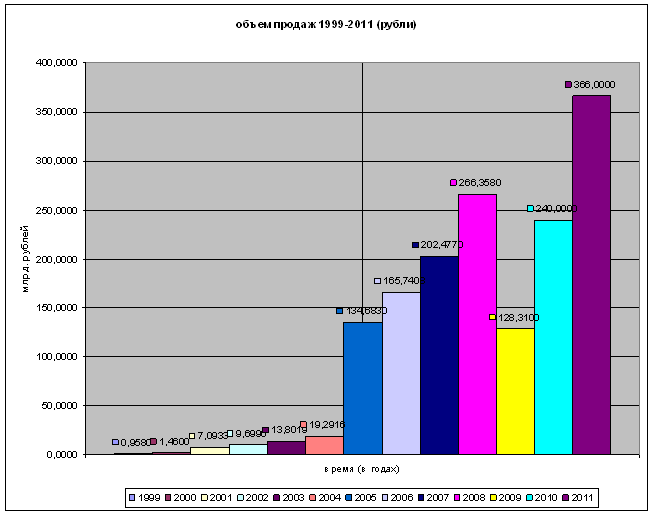

Here's how, for example, the same schedule looks like in terms of rubles (the average dollar rate was calculated as the sum of 12 indicators for the 17th day of each month divided by the total number of months for each year. You can see the data, for example, here . Although you can calculate take any other average course for the year).

Chart 4. Dynamics of payments from 1999 to 2011, billion. rubles

It is very important that in 2005 there is a sharp jump in sales (see graph). And this is in view of the fact that

The NAUET distinguishes between the concepts of “electronic commerce” and “electronic commerce”, excluding from the latter instantaneous (terminal) payments, transactions for purchasing electronic tickets for transport and cultural and entertainment events, transactions of electronic payment systems (payment for goods and services via the Internet through banking maps and systems such as WebMoney), as well as deals that deal with digital content( source ).

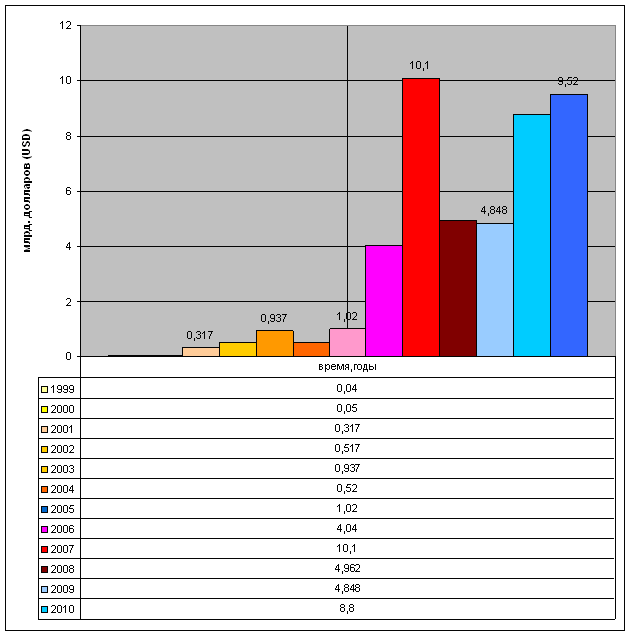

These data were collected from more than 20 sites. If we turn to the information that was presented from the same 2005 market (although it was recorded only in 2007), the schedule will change and change, in my opinion, dramatically.

Chart 5. Payment volume dynamics from 1999 to 2011, billion. rubles

There is no sharp jump here (more precisely, it has been postponed already for 2003-2004, when the NAUET has just started work): certainly, data for 1999-2003. may differ (but they just remain within the margin of error), because no one fully appreciated the market. But the question arises, why change the research methodology, when interest was shown in the market? Indeed, on the basis of such an equilibristic, a conclusion is drawn (and, surprisingly, not one) that “e-business is steadily growing” (in particular, here).

So, one reasonable question arises: who and why needs such a presentation of information ? Of course, those who want to "sell" the market to investors, presenting it in the best possible way. What for? In the first place - for the injection of these same investments. But unresolved in this case remains the main problem of the "bubble", which arose in 1929 with the same probability as in 2008: sooner or later, substitution of the answer to the solution fails, and the market, without knowing objective information, turns out to be in a state of collapse.

Moreover, if you collect information from different (both in time and status) sources and try to unify it somehow, you can build the following graph (it will also differ from the previous 2).

Chart 6. Dynamics of payments from 1999 to 2011, billion dollars

Even if we take into account that the market still reached the level of 12 billion in 2011, then the facts still remain not comforting: for more than 3 years the market was stagnant , not withstanding the onslaught of 2008 figures (By the way, it would be reasonable to notice that electronic sales are gaining the bulk of turnover before the summer, and then closer to the new year, so the crisis did not affect the market immediately, but at the moment when it entered a new phase). At the same time, either the data for 2008 were overestimated, or the market really collapsed, but this was never reflected in official statistics properly. At the same time, if we also look at the figures for 1999–2005, we can say that most likely both these points of view coexist simultaneously.

To understand the meaning of this simple conclusion, let us turn to what provides turnover in e-commerce - to the market of instant payments (hereinafter - MT). This is how it looked in 2006-2011.

Chart 7. The volume of instant payments in 2006 - 2011

Despite an absolutely positive trend, even the players themselves say that the growth rates of instant payments, for example, in 2009 compared to 2008, were estimated at only 21% of the increase, with a declared 50%.

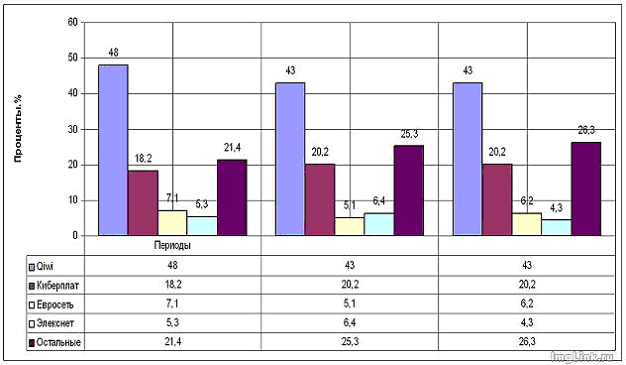

And here we come to another important trend, which speaks for itself, why the market is so biased. More than 40% of this segment belongs to the 1st player and more than 70% belongs to the three leading companies (these are brands such as Qiwi, CyberPlat, and Eleksnet).

Chart 8. The main players in the market MP in 1 square. 2010, 2010 and Q1 2011

This is how the business speaks for itself: “since 2005, the market of instant payments has been developing at a significant pace, even the crisis has not had a significant impact on the dynamics, having reduced only the growth rates. Now the market has come the phase of mergers and acquisitions: small networks come under the control of large structures, due to a decrease in business profitability. ” And this trend continues since 2009. That is. The crisis clearly did not benefit from competition in this area.

Something similar happened after 2008-2009. and in the banking sector: the money allocated to the Security Council of the Russian Federation could not only be restored to the banking sector .., but it was they who started and ended it. As a result, there were fewer players, and the interest rates on deposits decreased by the same amount as they increased on loans. But the main thing: now it is impossible to join this sphere (MP) without colossal injections. And when we say that more than 20% of this market is local players, we again look at banks (in the “best” case - NPOs ), which already means tens of millions, at least, rubles.

Why are the data on the market of EC and MP so much differ from each other? The answer is very simple: a large part (depending on the period - 66% to 80% and higher) of the MP is the payment for the CPS . Therefore, with the growth of STSs subscribers, which in turn is determined by a constant decrease in a) tariffs, b) the average cost of phones and other gadgets, c) commission (up to 0%), and the volume of MPs cannot decrease. Therefore, an objective picture of a qualitative increase in sales in this case cannot be obtained. But we still try.

Consider the example of electronic money, because they (but not only) are used as a means to pay in almost any Internet storefront.

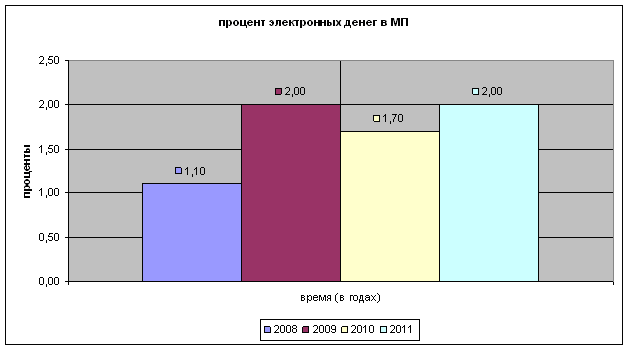

Chart 9. The share of replenishment of electronic wallets in the MP for 2008-2011.

As you can see, the percentage actually varies in the same range. And the reasons for this mass: pay (from 60% and above, depending on the Internet-shop) in the first place in cash; they replenish e-wallets themselves, especially after the Trojan horse from Qiwi, which one day terminated a lot of contracts with EPS , taking the lion’s share of users by invoking registration by attaching a number even for terminal payments, etc.

But the crux of the matter is not this: if the market had really grown by leaps and bounds, this percentage would somehow increase. Not so developed in the Russian Federation are cards (their share is barely 5-10 in the total volume - and this is in the best cases) and Internet banks (for example, Alfa-click, which is popular among Internet users, only 2.5 million people use) therefore, it is not necessary to talk about outflow even in these types of payments. Remain all the same receipts and payment through banks. And so that Pavlov’s dog’s reflex remained, now banks were tied to e-wallets, which could (modifying to NFS and mobile payments, moneysend, etc.) become an alternative, but remained just another form of bank settlements (and, by the way, FZ No. 161 insists on this point of view).

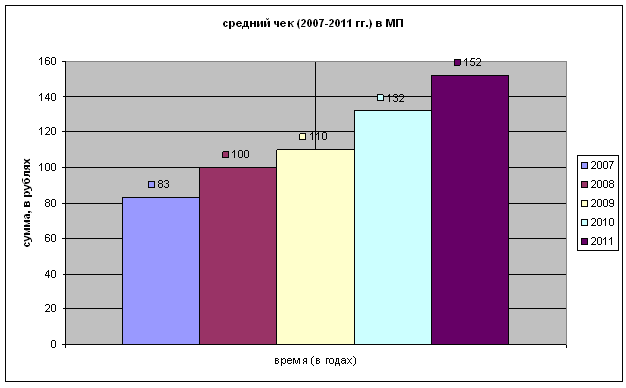

But even more importantly, even the MP market itself is already receiving customer churn: “the number of transactions in the reporting period ( approx. In 2011 ) has decreased by 3.4% compared to 2010 and amounted to 5.7 billion. this amount of the average payment increased by 18% to 156 rubles. " Simply put, it pays a smaller amount but in large amounts. And the average check itself is very interesting here.

Chart 10. Average check in instant payments

As you can see, the average check barely goes beyond 150 rubles. I must say that for many EPSs this indicator is not much higher. What does it mean? This means that the law, which cannot be implemented in less than 1-2 decades in full, already puts a restriction on the basis of what is “in fact”. All anything, but this is the approach of the imperative method, the method of prohibition. Whereas the sphere of EC and MP is a pure and classic example of private law relations. Already from the first minutes of the full entry into force of the Federal Law No. 161, the leading players faced this problem: the poison put a distinction between the electronic money itself and the line of their replenishment, the VM remained in the position of electronic checks / gift certificates (???), Kiwi went into tacit consent and etc. And this is just the beginning.

Before dotting i in the first part of the study, I would like to give an example of another important trend, the cat. for some reason, it is taken into account separately: on the Web, basically those who are between 18 and 34 pay ( very good statistics ).

At the same time, first of all those who are 24-34 pay with electronic money, then those who are from 18 to 24, and then all other categories. If you go back to the beginning of the article, you can make one simple, but very important and, unfortunately, not comforting conclusion: the number of such users due to the low birth rate in 1990-2010 will gradually decrease. For the time being we will leave a dot and summarize the material here.

So, in general terms, I would like to summarize the following trends, a cat. peculiar to the market of EC and MP and the cat. were partially considered in the article (we will try to reflect the rest in the next part of the study):

- The e-commerce market indicators are not exorbitant: 18-20% is “not 2-3 times”. At the same time, an attempt at fraud means that quite a few funds have been invested in the market (and this is so, just look at the momentum of the leading players). As well as the market decline, which occurred in 2008–2009, brought it to growth figures only now, that is, there is clearly no “constant growth trend”.

- The market is chained into the limiting shackles of Federal Law No. 161 and it is not so easy to get out of them. This will affect, firstly, the purchase of luxury goods (that is, this very isolated segment, may not be the lot at all), furniture and other “large-sized” things and any other goods and services. For example, consulting services in the stock market or Forex can cost far less than 5 rubles. And before that it was not a problem. With the advent of the RPF and the Federal Law "On Counteraction ..." the problem appeared, and the Federal Law No. 161 only strengthened it (and there are a lot of such examples, if we consider the laws, as the lawyers say, in their systematic interpretation). But even ordinary consumers, which, of course, more importantly, monopolization cannot fail to affect: EPS will incur organizational, operational and other costs, a cat. previously avoided them; entry into this segment of OpSoSy will also increase competition, but will make it artificial, since these players will (more precisely, have already moved, for example, MTS Bank) to the category of credit organizations; Finally, the most important thing is that the overly rigid framework of the law will eliminate the possibility of exit of small and medium investors from abroad, but will attract large, i.e. capital outflow, a cat. more than once occurred in the history of Russia, and will affect this area. However, in the second part of the study it will be shown that this is already happening. On the other hand, small and medium-sized players are forced to work in one of three ways: a) or as a technical operator; b) or in cooperation with the bank (which, of course, imposes an extra percentage on the consumer); c) either act within a different legal field (this way, looking ahead, the Z-Payment system for receiving and processing payments went, changing the domain to .com , and with it the owner of the company).

- The market growth indicators are primarily quantitative, i.e. They arise due to population growth, which are involved in the Internet. Due to the demographic downturn of the 1990s, a very large segment of users, who in 5-10 years should become the core of consumers, and the distribution by sex and age categories will change dramatically. This means, in particular, that those who are now 22-27 or 30-35 are unlikely to be focused only on the purchase of food, "votes" and pay for mobile. And something more valuable can be offered - the market can only with reservations and difficult juggling with terms. That does not improve it in the direction of flexibility and progressiveness.

- The market is becoming fixated on the same players - banks. This means that the entire development of the sphere will be conducted not from the bottom up, but from the top down. Simply put, in this situation, one should hardly expect a self-born Facebook / PayPal or any other innovative product. In addition, the supply that creates demand in the IT services market is good when your company, say, Apple. But while in the Russian market of EC and MP such players, most likely, cannot be found.

- Finally, these trends will lead to the fact that p2p transfers, exchanges, peer-to-peer networks, anonymous payment systems and everything that somehow allows the Internet to remain Internet: free, independent and self-sufficient will become popular. But as they say, this is another story, a cat. need to tell later.

Also in conclusion, I would like to note that this post is only the first part of studying the market from the inside, so to some extent it can be considered incomplete.

Source: https://habr.com/ru/post/160819/

All Articles