Visually about the form of investment convertible note and the marginal evaluation of a startup in it

In the Silicon Valley convertible note is a very popular form of seed investment in a startup. Many Russian venture business angels have recently also been quietly involved in such deals. Unlike the sale of a share in a company that everyone understands, it is not always easy to figure out the convertible note scheme.

General principle: an investor gives money to a startup without a primary valuation of the company; in return, he receives a discount on the purchase of shares in the next round of investments with an investment amount on the terms of this round. Roughly speaking, if you were given a $ 10,000 convertible note, and in the next round they want to invest $ 100,000 for 10% (that is, a company valuation of $ 1 million), then the first investor receives 1% of the company (as invested $ 10,000 in the estimated million). discount (for risks on the seed round), he will receive a larger percentage.

But it is worth starting to delve into the details, the head is spinning. For example, there is a cap - a restriction that guarantees an investor that he will receive at least a certain percentage of the company (otherwise, with a very large estimate in the next round, his share may turn out to be arbitrarily small). A dozen articles read may never help to understand how the valuation cap and the convertible note itself work. I chose to translate the most obvious of the articles I found to tell you about this convenient format of cooperation with the investor.

In search of financing, entrepreneurs are faced with a huge amount of legal and financial jargon, which can take a lot of valuable time - time that you do not spend on what is really important (product improvement, attracting new users, etc.).

')

But with a good explanation, this is not all that difficult, and the diagrams help to figure it out. I would like to explain to you how the valuation cap works in convertible notes (the limitation of company valuation in a convertible note). Attempting to figure this out took me several hours, and I want to save you those hours.

I assume that you have a basic understanding of the convertible note: instead of buying a share in your startup, the investor simply lends money at a formal interest rate. In exchange, you agree that when you raise the next round of investment, this debt is converted into shares for contributing to your company in this round, as if the money had been invested right now, during a new round of investment. Since The investor has incurred additional risks by giving you money earlier; he receives shares at a discount regarding the conditions of the new round of investments (the first investor receives more shares than the one who invested the same amount of money in this round). This discount is fixed, and it is agreed upon at the time of the conclusion of a convertible note. It usually ranges from 15% to 30%.

The convenience of a convertible note is that they require less paperwork (therefore, these transactions are faster), and, in theory, do not require initial evaluation of the startup, because the value of the shares will be determined in the next round of investment. However, many investors do not like a convertible loan. If the company is really successful (as everyone hopes) and the rating for the next round is very high, investors do not get anything from this increased rating - they just get their discount, that's all.

Some large investors increase the value of the company only because of its name. Of course, the investor also wants to benefit from such an increase in the company's valuation, otherwise he will not have the initiative to participate and help.

This helps the valuation cap (limit of assessment), which has already become the standard points in terms of convertible notes, at least in Silicon Valley. Cap is when an investor says: “If things are going well, I’m quite satisfied with my 20% discount. But if things are going fine, I want it to be thought as if I bought the shares initially along with you. ”(And due to this, I gained more from a very high valuation of the company.)

You used a convertible note, expecting that you would not need to evaluate a startup at the seed stage. But if you have a valuation cap, you still have, if not an estimate, then at least a range of ratings: the company is clearly worth at least X, but definitely cheaper than Y.

As a result, some assessment of the company will still need to be made, and for this, unfortunately, there are no exact mechanisms. How to come to adequate numbers? For this you need something like a business intuition.

It is best to start by thinking about the various scenarios, their consequences, and the numbers that are associated with them. Then discard the invalid scripts, and work with the remaining ones.

Let us consider an example. Suppose you have a small startup team that is looking for seed investments, and you plan to get round A investments in the future (the first major investments in a startup after the seed stage). Your source variables are:

There are a few more parameters (like the interest rate on the loan, and the time that passes between the seed round and series A), but they will not have a significant impact.

The hardest thing to predict is how much money you will get in the next round of investment, so let's look at different scenarios in this variable, and fix the rest.

There are two implications of these numbers that are worth considering.

1. What percentage of the company will the investor receive a convertible note after round A?

We assumed above that after Series A an investor of a new round will receive 30% of the company. But how much will the seed stage investors get after the conversion?

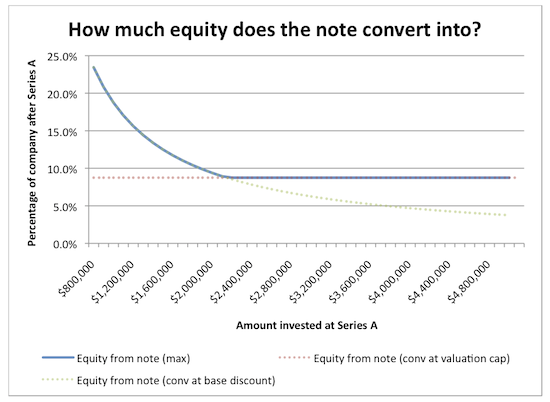

Horizontally, the amount of investment in stage A, the vertical percentage of the company, which will receive an investor convertible note.

Without a valuation cap, the first investor gets the smaller the share, the greater the company's valuation. The effect of the assessment limit for them is that from some point they get the minimum guaranteed interest in the company, even if the estimate is like four square (tens of millions of dollars).

This minimum percentage is calculated as follows: (1 - [percent of investor series A]) * [amount of money invested as conv note] / [valuation cap]. (the first factor takes into account the blurring of the share of Series A) In our example, the loan is converted at least into (1–0.3) * $ 0.5m / $ 4m = 8.75% share in the company.

2. What discounts do investors get for a convertible note compared to Series A investors?

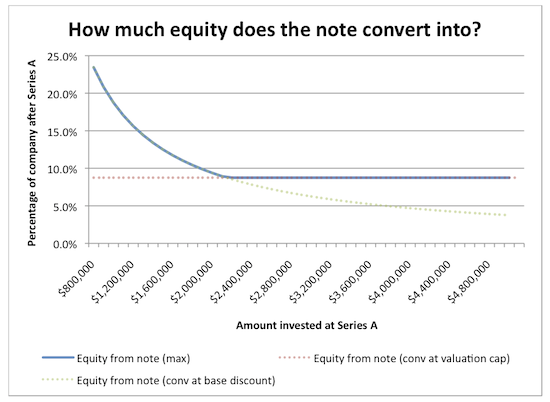

Without a cap, you simply give a fixed discount (ex. 20%) at the moment when the note is converted into promotions. But when you have a cap, and your estimate during Series A exceeds the cap, you fix the share price for the previous investor, while the new investor will probably pay a lot more money for each share. It turns out that in this case you give a big discount than 20%.

Vertical is the actual discount that an earlier investor receives compared to a new one.

This chart is very interesting: it reflects how annoying the venture investors of the new round are so that you have a convertible note. Imagine that you are at the cinema, and you know that you paid 2 or 3 times more for the exact same ticket than the guy who sits next to you. You will not be happy because it looks unfair. If your score significantly exceeds the limit from note, then the difference in share value may be significant for investors.

Of course, if you have a great startup, investors will want to participate in it, and this will not be a problem. And of course, this difference will be fair if the first investor has helped significantly to add value to the company. But this is still worth remembering. At least with this graph, we can begin to think more closely at the numbers.

None of this answers the question “what should we write in the agreement of intent for a convertible note?”, But now you can already think about comparing the valuation cap of different business angels.

Disclaimer: I am not a lawyer and I do not have much experience in this area, so my explanation may be very inaccurate, or completely wrong.

You can download the Excel spreadsheets that I used to create these graphs. As an interesting alternative view, you could fix the amount of funds received on the Series A, and see what happens if you change the size of the valuation cap. Let it be your exercise, dear readers.

General principle: an investor gives money to a startup without a primary valuation of the company; in return, he receives a discount on the purchase of shares in the next round of investments with an investment amount on the terms of this round. Roughly speaking, if you were given a $ 10,000 convertible note, and in the next round they want to invest $ 100,000 for 10% (that is, a company valuation of $ 1 million), then the first investor receives 1% of the company (as invested $ 10,000 in the estimated million). discount (for risks on the seed round), he will receive a larger percentage.

But it is worth starting to delve into the details, the head is spinning. For example, there is a cap - a restriction that guarantees an investor that he will receive at least a certain percentage of the company (otherwise, with a very large estimate in the next round, his share may turn out to be arbitrarily small). A dozen articles read may never help to understand how the valuation cap and the convertible note itself work. I chose to translate the most obvious of the articles I found to tell you about this convenient format of cooperation with the investor.

In search of financing, entrepreneurs are faced with a huge amount of legal and financial jargon, which can take a lot of valuable time - time that you do not spend on what is really important (product improvement, attracting new users, etc.).

')

But with a good explanation, this is not all that difficult, and the diagrams help to figure it out. I would like to explain to you how the valuation cap works in convertible notes (the limitation of company valuation in a convertible note). Attempting to figure this out took me several hours, and I want to save you those hours.

Pros and cons convertible note

I assume that you have a basic understanding of the convertible note: instead of buying a share in your startup, the investor simply lends money at a formal interest rate. In exchange, you agree that when you raise the next round of investment, this debt is converted into shares for contributing to your company in this round, as if the money had been invested right now, during a new round of investment. Since The investor has incurred additional risks by giving you money earlier; he receives shares at a discount regarding the conditions of the new round of investments (the first investor receives more shares than the one who invested the same amount of money in this round). This discount is fixed, and it is agreed upon at the time of the conclusion of a convertible note. It usually ranges from 15% to 30%.

The convenience of a convertible note is that they require less paperwork (therefore, these transactions are faster), and, in theory, do not require initial evaluation of the startup, because the value of the shares will be determined in the next round of investment. However, many investors do not like a convertible loan. If the company is really successful (as everyone hopes) and the rating for the next round is very high, investors do not get anything from this increased rating - they just get their discount, that's all.

Some large investors increase the value of the company only because of its name. Of course, the investor also wants to benefit from such an increase in the company's valuation, otherwise he will not have the initiative to participate and help.

This helps the valuation cap (limit of assessment), which has already become the standard points in terms of convertible notes, at least in Silicon Valley. Cap is when an investor says: “If things are going well, I’m quite satisfied with my 20% discount. But if things are going fine, I want it to be thought as if I bought the shares initially along with you. ”(And due to this, I gained more from a very high valuation of the company.)

You used a convertible note, expecting that you would not need to evaluate a startup at the seed stage. But if you have a valuation cap, you still have, if not an estimate, then at least a range of ratings: the company is clearly worth at least X, but definitely cheaper than Y.

As a result, some assessment of the company will still need to be made, and for this, unfortunately, there are no exact mechanisms. How to come to adequate numbers? For this you need something like a business intuition.

How to determine the assessment limit

It is best to start by thinking about the various scenarios, their consequences, and the numbers that are associated with them. Then discard the invalid scripts, and work with the remaining ones.

Let us consider an example. Suppose you have a small startup team that is looking for seed investments, and you plan to get round A investments in the future (the first major investments in a startup after the seed stage). Your source variables are:

- The amount you want to receive within the framework of a convertible note (say, $ 500k)

- The percentage of the discount, which gives a convertible note (eg, 20%)

- Valuation cap convertible loan (for example, $ 4 million)

- The percentage of the company that a venture capital investor will take in the next round (albeit 30%)

- The amount you expect to receive in round A (suppose between $ 1 and $ 5 million)

There are a few more parameters (like the interest rate on the loan, and the time that passes between the seed round and series A), but they will not have a significant impact.

The hardest thing to predict is how much money you will get in the next round of investment, so let's look at different scenarios in this variable, and fix the rest.

There are two implications of these numbers that are worth considering.

1. What percentage of the company will the investor receive a convertible note after round A?

We assumed above that after Series A an investor of a new round will receive 30% of the company. But how much will the seed stage investors get after the conversion?

Horizontally, the amount of investment in stage A, the vertical percentage of the company, which will receive an investor convertible note.

Without a valuation cap, the first investor gets the smaller the share, the greater the company's valuation. The effect of the assessment limit for them is that from some point they get the minimum guaranteed interest in the company, even if the estimate is like four square (tens of millions of dollars).

This minimum percentage is calculated as follows: (1 - [percent of investor series A]) * [amount of money invested as conv note] / [valuation cap]. (the first factor takes into account the blurring of the share of Series A) In our example, the loan is converted at least into (1–0.3) * $ 0.5m / $ 4m = 8.75% share in the company.

2. What discounts do investors get for a convertible note compared to Series A investors?

Without a cap, you simply give a fixed discount (ex. 20%) at the moment when the note is converted into promotions. But when you have a cap, and your estimate during Series A exceeds the cap, you fix the share price for the previous investor, while the new investor will probably pay a lot more money for each share. It turns out that in this case you give a big discount than 20%.

Vertical is the actual discount that an earlier investor receives compared to a new one.

This chart is very interesting: it reflects how annoying the venture investors of the new round are so that you have a convertible note. Imagine that you are at the cinema, and you know that you paid 2 or 3 times more for the exact same ticket than the guy who sits next to you. You will not be happy because it looks unfair. If your score significantly exceeds the limit from note, then the difference in share value may be significant for investors.

Of course, if you have a great startup, investors will want to participate in it, and this will not be a problem. And of course, this difference will be fair if the first investor has helped significantly to add value to the company. But this is still worth remembering. At least with this graph, we can begin to think more closely at the numbers.

P.S

None of this answers the question “what should we write in the agreement of intent for a convertible note?”, But now you can already think about comparing the valuation cap of different business angels.

Disclaimer: I am not a lawyer and I do not have much experience in this area, so my explanation may be very inaccurate, or completely wrong.

You can download the Excel spreadsheets that I used to create these graphs. As an interesting alternative view, you could fix the amount of funds received on the Series A, and see what happens if you change the size of the valuation cap. Let it be your exercise, dear readers.

Source: https://habr.com/ru/post/156547/

All Articles