How do NFC payments work

Someone will see this post as captaincy, but in fact even on Habré one has to meet comments like a

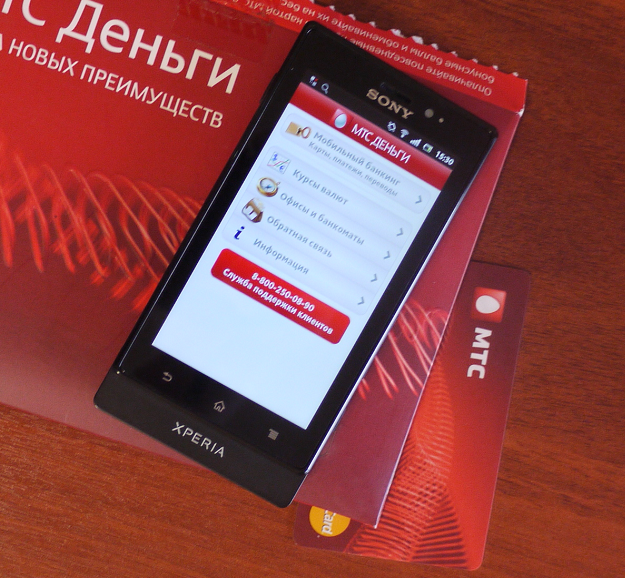

The idea of this article arose immediately after the announcement of the partnership MTS, promoting its service "NFC-payments" and Sony Mobile Communications. The first officially tested smartphone supporting this service was Sony Xperia Sola, which I just took to the test. Therefore, I went to the nearest MTS salon for the NFC payments package, which includes an MTS-Money bank card and a special SIM card. For owners of phones without NFC support, another NFC antenna is given out, which is attached directly to the SIM card - thanks to this, owners of various phones without integrated NFC can take advantage of the joys of contactless payments (but not all of them - there are more details on the MTS money website).

For smartphones with embedded NFC chips, the situation is even more complicated: at present, the following models are tested for compatibility with the NFC payments set: Sony Xperia sola, HTC one X, LG Prada, Samsung galaxy S3, Sony Xperia S, Sony Xperia P, Sony Xperia ION. There is no such information on the site yet, so it’s possible to say it’s exclusive - only for Habr (: Compatibility checking implies that the set may theoretically not work with some phones - in this case, experts modify the software. Therefore, for phones with NFC -chips from this list could not guarantee compatibility with 100% probability.

')

How to connect

Owners of SIM cards MTS will simply be replaced with a new one with the preservation of the number. MTS-Money card is drawn up on the spot. The options, as usual, are two: debit and with a credit limit. In the second case, they will call you back - almost immediately, within fifteen minutes (if they don’t get through the first time - they will call back later; I didn’t hear the call and I was rediald in half an hour) for a small telephone questionnaire. Then, within an hour, an SMS will arrive with the notification of the decision of MTS-Bank about opening a credit limit to you. Pitfalls, as usual - the cost of the loan. 55% per annum is, to put it mildly, a lot. Therefore, it is better not to leave the minus or issue a card without a credit limit at all. In this case, MTS Bank will charge you 5% per annum on the balance amount.

Owners of SIM cards MTS will simply be replaced with a new one with the preservation of the number. MTS-Money card is drawn up on the spot. The options, as usual, are two: debit and with a credit limit. In the second case, they will call you back - almost immediately, within fifteen minutes (if they don’t get through the first time - they will call back later; I didn’t hear the call and I was rediald in half an hour) for a small telephone questionnaire. Then, within an hour, an SMS will arrive with the notification of the decision of MTS-Bank about opening a credit limit to you. Pitfalls, as usual - the cost of the loan. 55% per annum is, to put it mildly, a lot. Therefore, it is better not to leave the minus or issue a card without a credit limit at all. In this case, MTS Bank will charge you 5% per annum on the balance amount.The card is issued immediately, in place, so it is not personalized. The PIN code connects the user by calling a special number. The control code for connection comes in SMS and is valid for 48 hours. Also in the SMS come a link to the mobile application MTS Money Mobile Banking, the login and password for the application and the login and password for the Internet client. Password, of course, you need to change, but with the login all the more difficult. Neither the mobile application nor the web client login can not be changed. If in the application the login (8 digits) is at least saved in the input form, then on the personalbank.ru website the login form is disabled in the login form, and the “Remember login” option (as in the Alpha Click, for example) is absent as a class. As a result, 10 digits of the Internet login have to be searched every time in that sms. It is not comfortable.

How it works

The MTS Money SIM card itself is a payment tool, and in your account it is displayed as a SIM MasterCard card (as opposed to a regular mastercard, which was also given to you at the MTS office). The balance on the SIM MasterCard has access to the same card account as just MasterCard - and, accordingly, they are always the same balance, which, however, is not equal to the balance on the phone bill. This is one of the most common misconceptions that I had: the balance of the phone was, is and will be separate from the balance of your card. When paying by NFC, the funds are debited not from the phone account, but from the linked bank account.

Where and how to pay

This is the most interesting. NFC-payments in Russia are developed by the MasterCard payment system, the MasterCard PayPass terminals of which are quietly populating our vast spaces. A partial list of retail, pharmacy and restaurant networks that support the technology of NFC payments can be found on their website - as you see, not only Moscow is far from there. This list is incomplete because there is no, for example, the mention of the Burger King chain in restaurants where you can now pay with a card for a burger; I also saw the PayPass terminals at the Oktyabr cinema (I did not check the other cinemas of the Karo-Film network). They appear literally before our eyes.

The process of payment itself is very quick and easy: you hold the phone for a couple of seconds to the terminal, then it is processed and then the payment passes (if you have enough money in the account, of course). If the amount is more than 1000 rubles, then you will need to enter a PIN code. For NFC micropayments, the most convenient option is now, even a bank card is more convenient - after all, the phone is always at hand.

Source: https://habr.com/ru/post/151826/

All Articles