Project Economics (start a project or not) - version two

More than a year ago I published a post about the economics of projects . I was approached by habrayuzer with a request to help in the assessment, and over time I realized that the post is not very good. Therefore, I propose to get acquainted with a more detailed approach.

Under the cut there will be financial methods tested on IT projects, in particular - how to draw up a roadmap, how to work with a planning horizon, how to calculate indicators, how to analyze risks.

To decide whether or not to start a project, you should go through several steps that will answer various questions. The following steps - you first need to figure out the idea of the project and product, with how it will generate money (its business model). The next step will be the definition of the “strategy” of the project - what should be done and when, then you need to decide on at what time intervals the project is assessed (for different intervals different approaches to the assessment), after which all the risks are calculated and analyzed. You can add / repartition steps, but the sequence as a whole is such, it is due to the fact that the next step uses the information of the previous one. Next, each step will be discussed in more detail.

')

Description of the project idea, product, service, some profit earning system. The description and the project should be reduced to how the profits will be earned, and what investments it will be accompanied. Since the ideas are all different, and even unique, it is difficult to advise something concrete here, but the case should contain information about events and decisions on the project that will occur in the future.

The simplest example of a case could be:

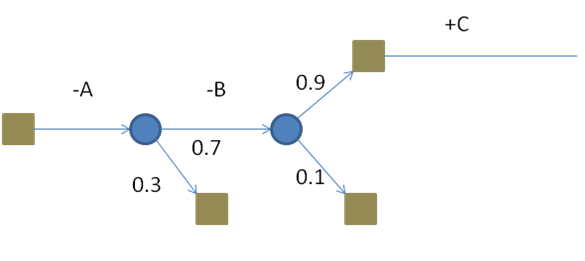

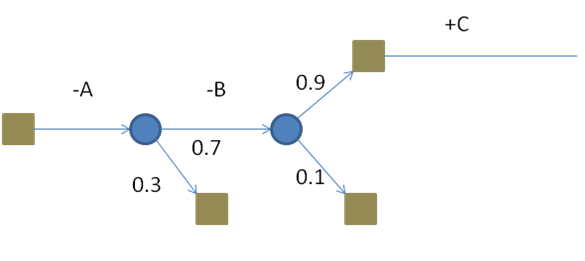

Imagine a project to develop a software package that implements a set of useful functions for the end user. Suppose that we previously have the opportunity to carry out market research for future demand, and then, this complex will need to undergo certification after development. If the demand estimate is unsatisfactory (with a probability of 0.3), we abandon the project. If the complex does not pass certification - with a probability of 0.1 - we abandon the project.

The next step will be the compilation of a “roadmap” for the project - a tree of events and decisions that will allow us to move from description to calculating final indicators.

Road maps are different, but for us to evaluate the project it is important that it contains the following information:

The main type of solution that is most often considered is the refusal to continue the project. In this case, in the worst case, we can count on zero revenues, at best - on the proceeds from the liquidation of accumulated assets (equipment, customer base, for example, etc.).

An example of a roadmap may be as follows (for our case):

The project’s roadmap will consist of two events (the result of an assessment of demand and certification), and four decision points (at the start of the project, failure to implement if there is a low estimate of demand, failure to sell if not certified, and successful certification).

In this case, A is the current expenditure on research of demand, B is the current (investment) development expenditures, and C is the net income to date (net is revenues minus expenses, that is, profit) .

Looking ahead, the NPV of such a project will be obtained as a result of the folding of this tree from the “leaves” to the “root”. NPV = -A + 0.7 * (- B + 0.9 * C) = - A - 0.7 * B + 0.63 * C. About what NPV is and what “money brought to the present moment” is a bit later.

The starting point of the planning horizon is always the present moment. It does not make sense to take into account past costs when evaluating a future project - because for all scenarios they are the same, this is first, and secondly, they only distract (do not provide any additional information).

For the end point of the planning horizon, the terminal value is determined (project cost beyond the horizon) and there may be two cases:

After determining by which option the project will be calculated, that is, the assumptions that should actually be calculated. For our example, working with a planning horizon can be the following:

the sales and support phase © does not require investment costs, and lasts, say, 5 years, sales are charged at the end of the period. The liquidation of assets (sales of equipment or accumulated data / components) is not. Research demand (A) even if it requires one year (costs at the beginning of the period), and investment in development (B) may take two years (expenses at the beginning of the period).

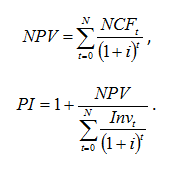

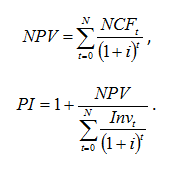

Now it's time to talk about the calculation of those indicators by which you can make a decision about the start. We consider two indicators - NPV (Net Present Value) and PI (Profitability Index). They are consistent, that is, they give out the same information for decision-making, but are used in different cases.

In these formulas: NCF - Net Cash Flow - net cash flow, Inv - investment, t - time, and i - discount rate. You can talk about the discount rate for a long time and to no avail, so I’ll say briefly and in the case - this is the cost of capital (as a percentage) for a project, which should not be lower than the return on alternative investments with the same level of risk. In an amicable way, this should be a WACC , which in the case of borrowed capital is still clear how to calculate it (cost is the percentage of the loan), and in the case of your own capital, you must rely on what the owners of capital will say. In any case, the discount rate in the calculations should be made a parameter.

NPV thus shows how much net profit, given that future payments are cheaper now (than in the future), we have. In the case of an unlimited investment budget, for NPV> 0 the project should be accepted, if NPV <0 - reject, in the case of zero - reconsider later, after changing any of its factors. In the case of a limited budget, projects should be ranked by PI, and, cutting back on the amount of investment projects, begin to recruit projects in the portfolio with the highest PI - this guarantees the maximum NPV portfolio.

Now how to calculate NCF. NCF is the sum of two streams - investment and operational. For IT projects, investment is the cost to develop a product / service, and operations are the production and sale of a product (as well as its support).

An example of the calculation can be found in the file .

If you look at the file, there you can find the Tornado tab. The Tornado chart shows how a certain indicator (in our case, NPV) changes depending on changes in project parameters, such as sales or price. Selected worst parameter values can lead a project to a zone of negative NPV, which means that something is hidden behind this parameter, and it should at least be further investigated, and then monitored.

This is only one of the methods of risk analysis (sensitivity analysis), but the most frequently used. Others are an order of magnitude more complicated, or do not provide as much information as this.

Overboard left taxes. On profit, VAT, unified social tax and others. How to take them into account depends on the project, if the project is evaluated within the company, then you need to talk with an accountant or economist.

Overboard there is inflation accounting - in an amicable way, it should be taken into account both in prices and in the discount rate. Usually, inflation is already sitting at the rate, and prices should not just be indexed for a certain percentage, but simply set future prices.

Having passed all the indicated steps, we have some information about the project, on the basis of which it is possible to make an economically sound decision on whether or not to start. In my opinion, it is not so difficult that it cannot be done, except for the problem of the initial data - sales estimates and other things. As for the fact that costs float - this can be considered as a risk. As for sales, you can advise the following: if the market is not viewed, then either after additional squats (studies), it still has to look over, or you can put scenarios in a roadmap (high-medium-low demand, and, for example, take probabilities on the basis of distribution by survey) . And yet, a project with a decision to refuse is not cheaper (NPV is equal or more) to a project in which it is impossible to refuse losses.

In general, not only the final indicators are important, but also this entire step-by-step process: it allows you to structure the future of the project, and work out alternatives that may not be obvious at first glance.

Under the cut there will be financial methods tested on IT projects, in particular - how to draw up a roadmap, how to work with a planning horizon, how to calculate indicators, how to analyze risks.

To decide whether or not to start a project, you should go through several steps that will answer various questions. The following steps - you first need to figure out the idea of the project and product, with how it will generate money (its business model). The next step will be the definition of the “strategy” of the project - what should be done and when, then you need to decide on at what time intervals the project is assessed (for different intervals different approaches to the assessment), after which all the risks are calculated and analyzed. You can add / repartition steps, but the sequence as a whole is such, it is due to the fact that the next step uses the information of the previous one. Next, each step will be discussed in more detail.

')

Business case

Description of the project idea, product, service, some profit earning system. The description and the project should be reduced to how the profits will be earned, and what investments it will be accompanied. Since the ideas are all different, and even unique, it is difficult to advise something concrete here, but the case should contain information about events and decisions on the project that will occur in the future.

The simplest example of a case could be:

Imagine a project to develop a software package that implements a set of useful functions for the end user. Suppose that we previously have the opportunity to carry out market research for future demand, and then, this complex will need to undergo certification after development. If the demand estimate is unsatisfactory (with a probability of 0.3), we abandon the project. If the complex does not pass certification - with a probability of 0.1 - we abandon the project.

The next step will be the compilation of a “roadmap” for the project - a tree of events and decisions that will allow us to move from description to calculating final indicators.

Road map

Road maps are different, but for us to evaluate the project it is important that it contains the following information:

- What money will be received / spent as a result of the stage

- With what probability after some event we get into some scenario of the further development of the project

- What decisions can be made after events occur.

The main type of solution that is most often considered is the refusal to continue the project. In this case, in the worst case, we can count on zero revenues, at best - on the proceeds from the liquidation of accumulated assets (equipment, customer base, for example, etc.).

An example of a roadmap may be as follows (for our case):

The project’s roadmap will consist of two events (the result of an assessment of demand and certification), and four decision points (at the start of the project, failure to implement if there is a low estimate of demand, failure to sell if not certified, and successful certification).

In this case, A is the current expenditure on research of demand, B is the current (investment) development expenditures, and C is the net income to date (net is revenues minus expenses, that is, profit) .

Looking ahead, the NPV of such a project will be obtained as a result of the folding of this tree from the “leaves” to the “root”. NPV = -A + 0.7 * (- B + 0.9 * C) = - A - 0.7 * B + 0.63 * C. About what NPV is and what “money brought to the present moment” is a bit later.

Planning horizon

The starting point of the planning horizon is always the present moment. It does not make sense to take into account past costs when evaluating a future project - because for all scenarios they are the same, this is first, and secondly, they only distract (do not provide any additional information).

For the end point of the planning horizon, the terminal value is determined (project cost beyond the horizon) and there may be two cases:

- End of product life cycle and liquidation of accumulated assets. The terminal value in this case is the value of the assets sold.

- The point at which it is believed that after it the project’s cash flows are the same (the project goes to “capacity” and generates the same money flow). The terminal value in this case is the value of these cash flows reduced to this point.

After determining by which option the project will be calculated, that is, the assumptions that should actually be calculated. For our example, working with a planning horizon can be the following:

the sales and support phase © does not require investment costs, and lasts, say, 5 years, sales are charged at the end of the period. The liquidation of assets (sales of equipment or accumulated data / components) is not. Research demand (A) even if it requires one year (costs at the beginning of the period), and investment in development (B) may take two years (expenses at the beginning of the period).

Calculation of indicators

Now it's time to talk about the calculation of those indicators by which you can make a decision about the start. We consider two indicators - NPV (Net Present Value) and PI (Profitability Index). They are consistent, that is, they give out the same information for decision-making, but are used in different cases.

In these formulas: NCF - Net Cash Flow - net cash flow, Inv - investment, t - time, and i - discount rate. You can talk about the discount rate for a long time and to no avail, so I’ll say briefly and in the case - this is the cost of capital (as a percentage) for a project, which should not be lower than the return on alternative investments with the same level of risk. In an amicable way, this should be a WACC , which in the case of borrowed capital is still clear how to calculate it (cost is the percentage of the loan), and in the case of your own capital, you must rely on what the owners of capital will say. In any case, the discount rate in the calculations should be made a parameter.

NPV thus shows how much net profit, given that future payments are cheaper now (than in the future), we have. In the case of an unlimited investment budget, for NPV> 0 the project should be accepted, if NPV <0 - reject, in the case of zero - reconsider later, after changing any of its factors. In the case of a limited budget, projects should be ranked by PI, and, cutting back on the amount of investment projects, begin to recruit projects in the portfolio with the highest PI - this guarantees the maximum NPV portfolio.

Now how to calculate NCF. NCF is the sum of two streams - investment and operational. For IT projects, investment is the cost to develop a product / service, and operations are the production and sale of a product (as well as its support).

An example of the calculation can be found in the file .

Risk analysis

If you look at the file, there you can find the Tornado tab. The Tornado chart shows how a certain indicator (in our case, NPV) changes depending on changes in project parameters, such as sales or price. Selected worst parameter values can lead a project to a zone of negative NPV, which means that something is hidden behind this parameter, and it should at least be further investigated, and then monitored.

This is only one of the methods of risk analysis (sensitivity analysis), but the most frequently used. Others are an order of magnitude more complicated, or do not provide as much information as this.

What is overboard

Overboard left taxes. On profit, VAT, unified social tax and others. How to take them into account depends on the project, if the project is evaluated within the company, then you need to talk with an accountant or economist.

Overboard there is inflation accounting - in an amicable way, it should be taken into account both in prices and in the discount rate. Usually, inflation is already sitting at the rate, and prices should not just be indexed for a certain percentage, but simply set future prices.

Finally

Having passed all the indicated steps, we have some information about the project, on the basis of which it is possible to make an economically sound decision on whether or not to start. In my opinion, it is not so difficult that it cannot be done, except for the problem of the initial data - sales estimates and other things. As for the fact that costs float - this can be considered as a risk. As for sales, you can advise the following: if the market is not viewed, then either after additional squats (studies), it still has to look over, or you can put scenarios in a roadmap (high-medium-low demand, and, for example, take probabilities on the basis of distribution by survey) . And yet, a project with a decision to refuse is not cheaper (NPV is equal or more) to a project in which it is impossible to refuse losses.

In general, not only the final indicators are important, but also this entire step-by-step process: it allows you to structure the future of the project, and work out alternatives that may not be obvious at first glance.

Source: https://habr.com/ru/post/150145/

All Articles