Second dotcom bubble or new era?

Watching the emergence of a huge number of IT startups around the world, most of which are concentrated in North America, Europe and Asia, and seeing their explosive growth in value, often tens of times the original size in short periods of time, it becomes interesting for me to understand the reasons for this phenomenon. Having economic training and some knowledge in this area, I always tried to comprehend the basic mechanisms inherent in such phenomena. What is the engine in these events, and where does the fuel come from for more and more acceleration of this phenomenon? Where does such enthusiasm in forecasts come from and why do venture investors so willingly invest in a young, fragile business, firmly convinced that someday it will bring them profits that are much higher than the profits from investing in other investment tools? In the end, where do the money from these same venture capitalists come from to invest so generously in startups? And the most important question - are the cries of the “IT bent over” alarmist TM , which I constantly heard before, do not have a real basis?

The crisis of the first wave of dotcoms for a long time scared potential investors from the field of information technology. Realizing that the promise of high profitability of business on the Internet hides the usual financial pyramid and the main source of profit is still the real sector of the economy, investors have shifted their focus to other investment tools. In fact, the real volume of the market for goods and services that existed at that time on the Internet was extremely small, and the services themselves were underdeveloped and did not anticipate such growth that the advocates of the “new” economy predicted for them. This led to the collapse of the bubble and the bankruptcy of those companies that, in fact, engaged in public relations themselves. At the same time, such giants as Amazon and eBay survived, and still exist.

Later, as it turned out, investing in housing construction with the subsequent sale of it into a mortgage and related financial speculation on the stock exchange also did not become a panacea and allowed to win only to those participants who managed to withdraw their money to the realization of this fact and invest it in something real. They were not looking for the guilty for a long time, and declared malicious defaulters as such, most of whom were African Americans accustomed to such accusations. Ben Bernanke scolded a little and complained about the high prices for raw materials, and also condemned several Wall Street financiers, who particularly maliciously introduced investors into error. In general, the standard of living of the largest capitalists did not fall, but a huge number of failed small investors and producers appeared, who then blamed the world financial system for all sins for a long time and asked the government to intercede for them in front of the largest business sharks. The financial crisis led to a brief recession, the bottom of which was reached on March 2, 2009. After this day, growth began, they all announced that the recession had been successfully completed, the indices confidently crawled upwards and the investors, realizing that it was time to stop calculating losses and we had to start investing in something, rushed to the market.

The amount of free money in the world is large, since the size of the money supply has long exceeded the amount of real goods and services sold on the world market. Constantly accelerated inflation and the idea of constant growth laid in the fundamentals of capitalism do not allow keeping this money without movement, forcing to invest in something, counting on a percentage of future profits.

')

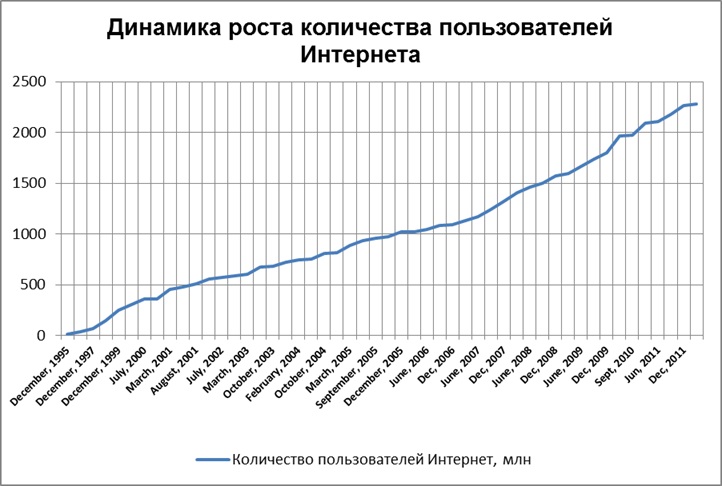

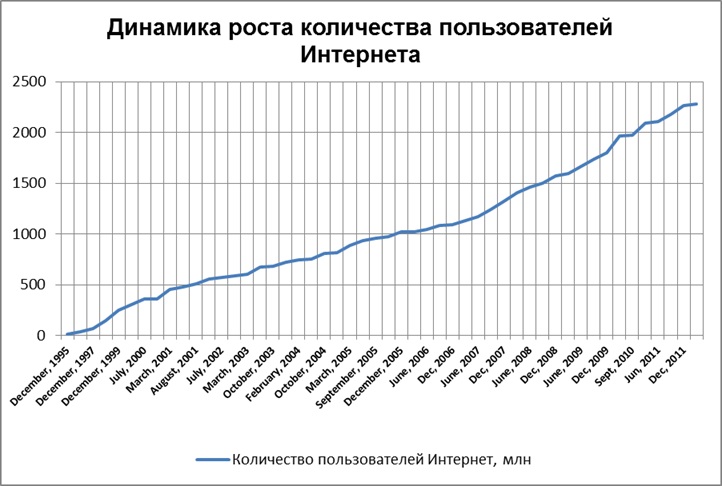

The search for a suitable investment tool did not last long. After a simple analytics, which consists in counting the number of Internet users, as well as an example of Apple’s ingenious marketing policy, which showed that with the help of the Internet, you can make a profit for selling almost everything (media content, services, applications, etc.), investors decided that the Internet and its related IT start-ups are the best area to invest. Investors were also encouraged by the growth in the number of Internet users over the past few years, which gives hope that even if a small proportion of these users can be involved in the process of purchasing certain goods and services, the profits from these operations will exceed the current level of sales. The number of Internet users has grown 5 times over the past 10 years and currently stands at 32.7 percent of the total number of people living on Earth. If we consider that the percentage of the Earth’s population between the ages of 15 and 64 is 65.9, then we can say that the Internet has the potential to grow twice. Until now, the dynamics of growth in the number of users has been constant, and there is no evidence that she will stop there. Accordingly, with an increase in the number of users, the number of goods and services provided via the Internet will also increase. Some services are becoming global - it’s not unusual for anyone to order a product located in another corner of the world. The rapid development of services provided through applications and the Internet on mobile devices, and at the same time, the increase in the number of such devices causes rapid enthusiasm among analysts in this area. All this forces investors to invest in the IT sector, as the most promising in the near future.

There are new types of services - cloud services (xaaS, where x is Infrastructure, Database, Software, Platform, etc.), there are high hopes that most companies will give up their infrastructure and transfer a significant part of their services to cloud structures . This assumption allows us to hope that the value of companies providing this kind of service will grow. It also pushes investors to invest in these companies — although the recent example of the Amazon cloud has led many to think about the degree of readiness of such technologies for business.

The development of data processing technologies has allowed Internet advertising to become more focused - now the company can find out what exactly you need at the moment, and also with the help of predictive analytics, make assumptions about what you will need in the future. Without a doubt, the collection of detailed information about the consumer through social networks, reports on purchases, as well as using the history of visited sites, geo-targeting technologies, etc. will help to offer him exactly what he wants and thereby increase sales. All this also allows us to hope that the Internet will be the main engine in the growth of the economy in the future.

Of the most notorious examples, Pinterest.com, launched in closed beta testing in March 2010, and already in May 2012, sold for $ 100 million. The Russian-language analogue Pinme.ru has not yet achieved such success. Such profitability of investments does not allow many investors to fall asleep peacefully and awakens in them the desire to invest in something that has at least the ability to conduct business over the Internet in the distant future.

To carry out such an investment, so-called venture funds have begun to be created, designed to find and invest in innovative enterprises and IT start-ups. Under the charm of the prospects that can bring innovation, horrible and the top leadership of our country, embraced the idea with enthusiasm and created "Rosnano", "Russian Technologies" and "Skolkovo".Rosnano was headed by A. B. Chubais, who did not lose youthful ardor and enthusiasm during his fruitful work activity, which, coupled with skillful leadership and fantastic abilities in budgeting, led to a well-deserved result - the Order of Merit for the Fatherland, IV degree.

The growth in the number of transactions in the US venture capital market in the information technology segment was 19%, while a decline was observed in the business and consumer services segment. In the IT industry, in the first quarter of 2012, 257 transactions were made for a total of $ 2 billion, which is higher than the result for the same period of the previous year, as well as for the 4th quarter of 2011. Like last year, the software segment was the largest in the venture capital industry, receiving almost two thirds of the investment. In Europe, against the background of a reduction in the total volume of venture investment, the share and number of transactions in the information technology segment is increasing. If you look at the distribution of users by region, then 44 percent of all Internet users live in Asia, and it is quite clear that they will be the market with the highest growth rates and, therefore, the most attractive place to invest for investors.

From this we can conclude that the volume of investments in the field of information technology has not reached the saturation threshold and, presumably, will continue to grow. If this growth continues to grow along with the volume of the market for goods and services provided via the Internet, then it is quite possible that the investment will be justified and we will not wait for the next bubble. If the market overheats, then the end is predictable - the bubble will burst, leaving only really profitable companies on the market. Whether the Internet can become the main place for the sale of goods and services is a separate issue, depending on many economic factors.

Analyst of venture investments for the 1st quarter of 2012

Analytics of venture investments for 2011

Data on the number of Internet users since 1995

World population data

Top Asian startups at Echelon 2012

Top 25 Hottest Russian Start-ups

The crisis of the first wave of dotcoms for a long time scared potential investors from the field of information technology. Realizing that the promise of high profitability of business on the Internet hides the usual financial pyramid and the main source of profit is still the real sector of the economy, investors have shifted their focus to other investment tools. In fact, the real volume of the market for goods and services that existed at that time on the Internet was extremely small, and the services themselves were underdeveloped and did not anticipate such growth that the advocates of the “new” economy predicted for them. This led to the collapse of the bubble and the bankruptcy of those companies that, in fact, engaged in public relations themselves. At the same time, such giants as Amazon and eBay survived, and still exist.

Later, as it turned out, investing in housing construction with the subsequent sale of it into a mortgage and related financial speculation on the stock exchange also did not become a panacea and allowed to win only to those participants who managed to withdraw their money to the realization of this fact and invest it in something real. They were not looking for the guilty for a long time, and declared malicious defaulters as such, most of whom were African Americans accustomed to such accusations. Ben Bernanke scolded a little and complained about the high prices for raw materials, and also condemned several Wall Street financiers, who particularly maliciously introduced investors into error. In general, the standard of living of the largest capitalists did not fall, but a huge number of failed small investors and producers appeared, who then blamed the world financial system for all sins for a long time and asked the government to intercede for them in front of the largest business sharks. The financial crisis led to a brief recession, the bottom of which was reached on March 2, 2009. After this day, growth began, they all announced that the recession had been successfully completed, the indices confidently crawled upwards and the investors, realizing that it was time to stop calculating losses and we had to start investing in something, rushed to the market.

The amount of free money in the world is large, since the size of the money supply has long exceeded the amount of real goods and services sold on the world market. Constantly accelerated inflation and the idea of constant growth laid in the fundamentals of capitalism do not allow keeping this money without movement, forcing to invest in something, counting on a percentage of future profits.

')

The search for a suitable investment tool did not last long. After a simple analytics, which consists in counting the number of Internet users, as well as an example of Apple’s ingenious marketing policy, which showed that with the help of the Internet, you can make a profit for selling almost everything (media content, services, applications, etc.), investors decided that the Internet and its related IT start-ups are the best area to invest. Investors were also encouraged by the growth in the number of Internet users over the past few years, which gives hope that even if a small proportion of these users can be involved in the process of purchasing certain goods and services, the profits from these operations will exceed the current level of sales. The number of Internet users has grown 5 times over the past 10 years and currently stands at 32.7 percent of the total number of people living on Earth. If we consider that the percentage of the Earth’s population between the ages of 15 and 64 is 65.9, then we can say that the Internet has the potential to grow twice. Until now, the dynamics of growth in the number of users has been constant, and there is no evidence that she will stop there. Accordingly, with an increase in the number of users, the number of goods and services provided via the Internet will also increase. Some services are becoming global - it’s not unusual for anyone to order a product located in another corner of the world. The rapid development of services provided through applications and the Internet on mobile devices, and at the same time, the increase in the number of such devices causes rapid enthusiasm among analysts in this area. All this forces investors to invest in the IT sector, as the most promising in the near future.

There are new types of services - cloud services (xaaS, where x is Infrastructure, Database, Software, Platform, etc.), there are high hopes that most companies will give up their infrastructure and transfer a significant part of their services to cloud structures . This assumption allows us to hope that the value of companies providing this kind of service will grow. It also pushes investors to invest in these companies — although the recent example of the Amazon cloud has led many to think about the degree of readiness of such technologies for business.

The development of data processing technologies has allowed Internet advertising to become more focused - now the company can find out what exactly you need at the moment, and also with the help of predictive analytics, make assumptions about what you will need in the future. Without a doubt, the collection of detailed information about the consumer through social networks, reports on purchases, as well as using the history of visited sites, geo-targeting technologies, etc. will help to offer him exactly what he wants and thereby increase sales. All this also allows us to hope that the Internet will be the main engine in the growth of the economy in the future.

Of the most notorious examples, Pinterest.com, launched in closed beta testing in March 2010, and already in May 2012, sold for $ 100 million. The Russian-language analogue Pinme.ru has not yet achieved such success. Such profitability of investments does not allow many investors to fall asleep peacefully and awakens in them the desire to invest in something that has at least the ability to conduct business over the Internet in the distant future.

To carry out such an investment, so-called venture funds have begun to be created, designed to find and invest in innovative enterprises and IT start-ups. Under the charm of the prospects that can bring innovation, horrible and the top leadership of our country, embraced the idea with enthusiasm and created "Rosnano", "Russian Technologies" and "Skolkovo".

The growth in the number of transactions in the US venture capital market in the information technology segment was 19%, while a decline was observed in the business and consumer services segment. In the IT industry, in the first quarter of 2012, 257 transactions were made for a total of $ 2 billion, which is higher than the result for the same period of the previous year, as well as for the 4th quarter of 2011. Like last year, the software segment was the largest in the venture capital industry, receiving almost two thirds of the investment. In Europe, against the background of a reduction in the total volume of venture investment, the share and number of transactions in the information technology segment is increasing. If you look at the distribution of users by region, then 44 percent of all Internet users live in Asia, and it is quite clear that they will be the market with the highest growth rates and, therefore, the most attractive place to invest for investors.

From this we can conclude that the volume of investments in the field of information technology has not reached the saturation threshold and, presumably, will continue to grow. If this growth continues to grow along with the volume of the market for goods and services provided via the Internet, then it is quite possible that the investment will be justified and we will not wait for the next bubble. If the market overheats, then the end is predictable - the bubble will burst, leaving only really profitable companies on the market. Whether the Internet can become the main place for the sale of goods and services is a separate issue, depending on many economic factors.

Analyst of venture investments for the 1st quarter of 2012

Analytics of venture investments for 2011

Data on the number of Internet users since 1995

World population data

Top Asian startups at Echelon 2012

Top 25 Hottest Russian Start-ups

Source: https://habr.com/ru/post/148587/

All Articles