Coinbase wants to make Bitcoin payments available to the mainstream user.

Until now, Bitcoin cryptocurrency has been popular only in relatively narrow circles. One of the reasons for this is to understand the principles of its work, install the client, wait for the loading of the chain of blocks — all this is long enough and nontrivial, at least for non-geek. Coinbase's goal is to make working with Bitcoin more simple and similar to the usual means of payment. What is even more interesting, this startup grew up in the well-known and respectable business incubator Y Combinator. And this suggests that bitcoin is becoming interesting not only for drug dealers from Silk Road and for crypto-anarchist enthusiasts.

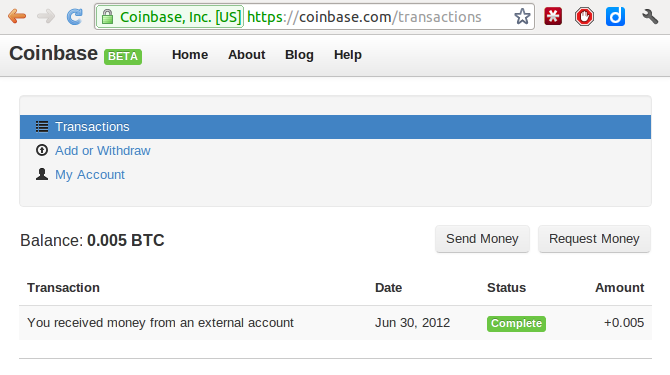

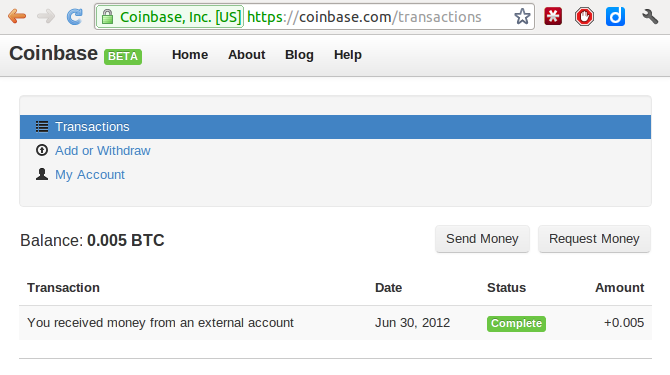

Coinbase has a nice and simple interface and so far quite limited functionality. The most important thing is that you can start accepting and sending payments in just a few seconds after registering, and even a baby can deal with Coinbase. Transfers between wallets are free, depositing and withdrawing funds will cost 0.5%. The service already has multifactor authentication (one-time passwords sent to the phone). At first glance, this completely contradicts the ideology of Bitcoin, as an anonymous and decentralized means of payment. However, this greatly reduces the entry threshold and contributes to the popularization of cryptocurrency. This can play a decisive role in her fate.

The fact is that now, it seems, the second wave of Bitcoin popularity is starting. This wave originates in Europe, where the Euro is in a state of fever, and countries like Greece or Spain hardly keep afloat. Europeans began to trust their currency less and are actively looking for alternatives . One of them is bitcoin. However, the complexity of working with an official client and the security risks associated with storing wallets on your computer can scare away a fair amount of people. Coinbase takes care of this.

')

Bitcoin gained relatively wide popularity a little over a year ago. In June 2011, the price on the MtGox exchange reached $ 30 per bitcoin. Many feared that this bubble would burst, leaving no stone unturned in cryptocurrency, but bitcoin survived, stabilized and costs about $ 6 for about half a year. Money loves silence, and such stability is a much more encouraging signal for market participants than dizzying jumps that attract only speculators.

Stability is especially important on the eve of how the “equator” will be reached in generating new coins - 10.5 million bitcoins will be generated in December of this year - exactly half of the total, after which the mining profitability will fall by half. For each block found, not 50, but 25 coins will be given. What consequences this will have for the course and stability of the network as a whole, no one knows for sure. Optimists believe that nothing special will happen, as the number of freshly mined bitcoins is small compared to the usual daily trading volume. Pessimists fear that a sharp decline in mining profitability will lead to a sudden decrease in the network's computing power, which theoretically could destabilize its operation.

Coinbase has a nice and simple interface and so far quite limited functionality. The most important thing is that you can start accepting and sending payments in just a few seconds after registering, and even a baby can deal with Coinbase. Transfers between wallets are free, depositing and withdrawing funds will cost 0.5%. The service already has multifactor authentication (one-time passwords sent to the phone). At first glance, this completely contradicts the ideology of Bitcoin, as an anonymous and decentralized means of payment. However, this greatly reduces the entry threshold and contributes to the popularization of cryptocurrency. This can play a decisive role in her fate.

The fact is that now, it seems, the second wave of Bitcoin popularity is starting. This wave originates in Europe, where the Euro is in a state of fever, and countries like Greece or Spain hardly keep afloat. Europeans began to trust their currency less and are actively looking for alternatives . One of them is bitcoin. However, the complexity of working with an official client and the security risks associated with storing wallets on your computer can scare away a fair amount of people. Coinbase takes care of this.

')

Bitcoin gained relatively wide popularity a little over a year ago. In June 2011, the price on the MtGox exchange reached $ 30 per bitcoin. Many feared that this bubble would burst, leaving no stone unturned in cryptocurrency, but bitcoin survived, stabilized and costs about $ 6 for about half a year. Money loves silence, and such stability is a much more encouraging signal for market participants than dizzying jumps that attract only speculators.

Stability is especially important on the eve of how the “equator” will be reached in generating new coins - 10.5 million bitcoins will be generated in December of this year - exactly half of the total, after which the mining profitability will fall by half. For each block found, not 50, but 25 coins will be given. What consequences this will have for the course and stability of the network as a whole, no one knows for sure. Optimists believe that nothing special will happen, as the number of freshly mined bitcoins is small compared to the usual daily trading volume. Pessimists fear that a sharp decline in mining profitability will lead to a sudden decrease in the network's computing power, which theoretically could destabilize its operation.

Source: https://habr.com/ru/post/146839/

All Articles