RHEV 3.0: Alternative Virtualization? No, alternative IT ecosystem

What is RHEV 3.0?

- RHEV 3.0 appeared in February of this year, after two years of intensive development.

- Open source, instead of the common practice of vertical software integration.

- The price is noticeably lower than that of some other virtualization management systems.

- This is not the center of the ecosystem, unlike the solutions of VMware, Microsoft and Citrix.

- A product from a company with a turnover of one billion dollars .

- Strong position as a platform for cloud computing and DBMS.

From the Linux distribution to virtualization.

Red Hat has updated its virtualization management system with the release of the third version of Red Hat Enterprise Virtualization. But instead of retelling the benefits of the product, we decided to provide you with our little analysis of where the company is located in terms of the development of virtualization and how Red Hat's approach differs from competing solutions.

')

Over the past few weeks, we have learned a lot of new information from Phil Andrews (this is the one I spoke with at the Red Hat seminar in February . - Comm. Trans.) During several briefings and telephone conversations.

The Red Hat company is widely known, first of all, as a producer of the Linux distribution. I remember well how I installed one of the first versions of their distribution kit on my home computer. At that time, their main competitor was Suse, which was later absorbed by Novell (and later they bought Novell itself ).

From the very beginning, Linux had very good prospects in the market of server operating systems. Of course, not least because Linux is closely related to Unix and borrowed many features from it that are important for corporate users.

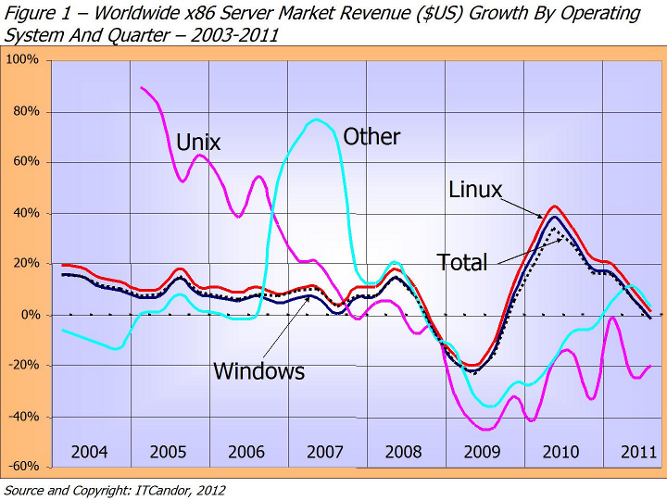

The graph "Figure 1" shows the growth of the market for x86 servers and operating systems from 2003 to 2011. It demonstrates the fact that Linux, Windows, and the x86 server market are “next to that”. During this period: the share of Solaris (the Unix line) was significantly reduced, mainly after the takeover by Oracle of Sun Microsystems .

The size of the Linux market is relatively small (compared to windows) due to the fact that many enterprises have free Linux distributions (which cannot be counted), but increasingly, large organizations consider open source software as the basis for cloud computing and database solutions .

Competition in the IT infrastructure market.

The expansion of Red Hat’s share in the enterprise software market has led to intense competition with VMware. For many years, VMware, in fact, had no competitors, and virtualization solutions from this company helped to significantly reduce server hardware costs. But today, the focus of VMware has shifted from virtualization to infrastructure management, so many of the features of software from VMware and Red Hat have begun to duplicate each other.

Although the ESX hypervisor is relatively independent of operating systems, it is most often used for Windows servers, as evidenced by the excellent financial performance of VMware. Compared to it, Red Hat depends much more on the Linux market. Red Hat says that server virtualization with Linux started much later, because they are used for more resource-intensive tasks, but as the use of virtualization for Linux servers grows, the share of RHEV will increase.

According to representatives of Red Hat, now they have a good chance due to the price of RHEV. Moreover, 80% of its clients use VMware. The task of Red Hat is to convince users that for a lower price they will get the necessary functionality and service.

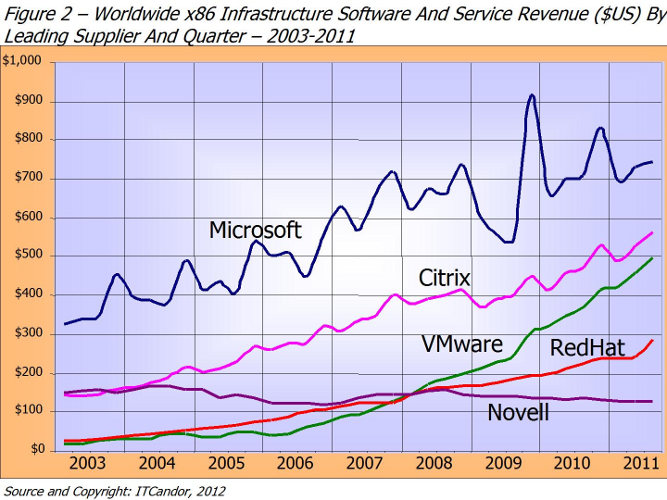

Figure 2 shows the growth in revenues from infrastructure and related services (which make up Citrix, VMware, and Red Hat's total revenues, but only a fraction of Microsoft and Novell's revenues). Citrix has good growth, but it is not only linked to virtualization software based on the Xen hypervisor. Most of the growth of Citrix was associated with desktop virtualization, thanks to the acquisition of the respective software development companies. Red Hat is ahead of Novell, but somewhat behind VMware.

KVM is a relatively young hypervisor.

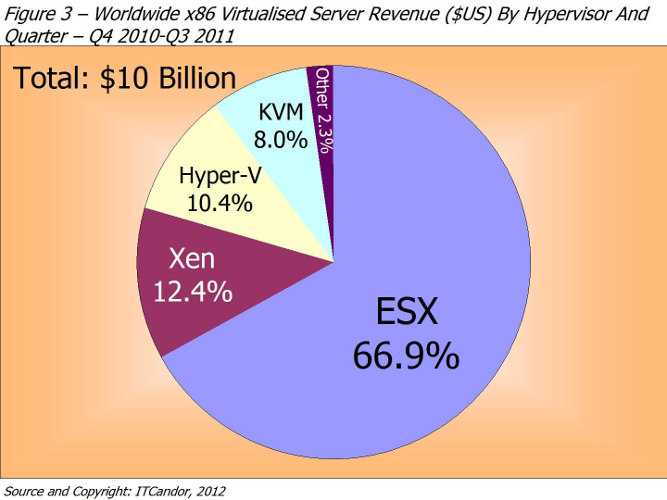

Initially, the KVM hypervisor did not attract as much attention as Hyper-V, ESX, and Xen, although among companies that immediately supported both KVM and RHEV were IBM, HP, Intel, and Cisco. One of the reasons for the lack of attention to the project is that KVM entered the market much later than its rivals. We believe that it is now lagging behind ESX, Xen and Hyper-V in terms of making profit from server virtualization (KVM is used primarily as a free hypervisor).

The graph “Figure 3” shows the distribution of profits in the virtualization market.

Open Source and support subscription model.

Red Hat has always been a player in the open source market, earning money on support and adding customer-critical functionality to OpenSource development. This approach has the advantage of allowing you to focus on solving problems, since only 13% of the code used in the Red Hat software is written directly by the Red Hat developers. But at the same time, Red Hat has to compete with other software makers that can offer the same open source products.

The main profit of Red Hat receives from subscriptions to technical support, which is annually renewed by the company, if they are satisfied with the level of service. By the way, the similar approach tried to apply and Sun Microsystems in the last two years of its “independent” life. But she failed to convince enough Solaris, Java, and other Sun software users to purchase support.

The difference between these two companies was that Red Hat always used a subscription model, while Sun tried to fit its existing solutions into this new business model. Note that this is a significant problem for any IT supplier who would like to transfer the business from license sales to subscription models - it takes time to compensate for the decline in profits from the old scheme.

Next in line are CloudForms and Gluster

In 2012, Red Hat plans to focus on new products, such as CloudForms (just this month there was a big announcement . - Approx. Transl.). In addition, we expect Red Hat to offer software for the data storage market based on the software recently acquired by Gluster . It will be interesting to see what Red Hat will offer to reduce the cost of storing information.

Some findings are a different type of ecosystem.

It is unlikely that the RHEV ecosystem (partners and software vendors) will depend as much on Red Hat as in the case of VMware and Microsoft. As an open source provider, Red Hat itself is part of a community that is by definition multi-polar.

The advantage of Red Hat is that it can enhance existing OpenSource development, and not write everything from scratch, so the cost of Red Hat products will always be lower than proprietary software. This is the reason for the growing importance of the company as a player in the corporate software market. Especially in the field of server virtualization, where the KVM hypervisor is considered to be more simple to implement than many Xen solutions.

So, we see a commercial company that still adheres to the principles of Open Source, while other software vendors are becoming more vertically integrated. Red Hat is in a good position - as a provider of low-cost and reliable solutions, in today's economic downturn.

Source: https://habr.com/ru/post/146419/

All Articles