Default of Greece. Consequences in a nutshell

The cutback plan in Greece is in danger. Political parties opposed to the proposal won the election on May 6 and questioned the continuation of reforms.

But if Greece cannot reduce the public sector, then, most likely, it will not receive cash infusions from its European neighbors. Then she will be forced to default on debts, which will lead to the termination of membership in the European Union and the circulation of the euro in the country. Such a scenario, bitterly joking, is called “Grexit”. Some clients of Greek banks, fearing such a development, have withdrawn from the country about 700 million euros since the beginning of May, according to Bloomberg.

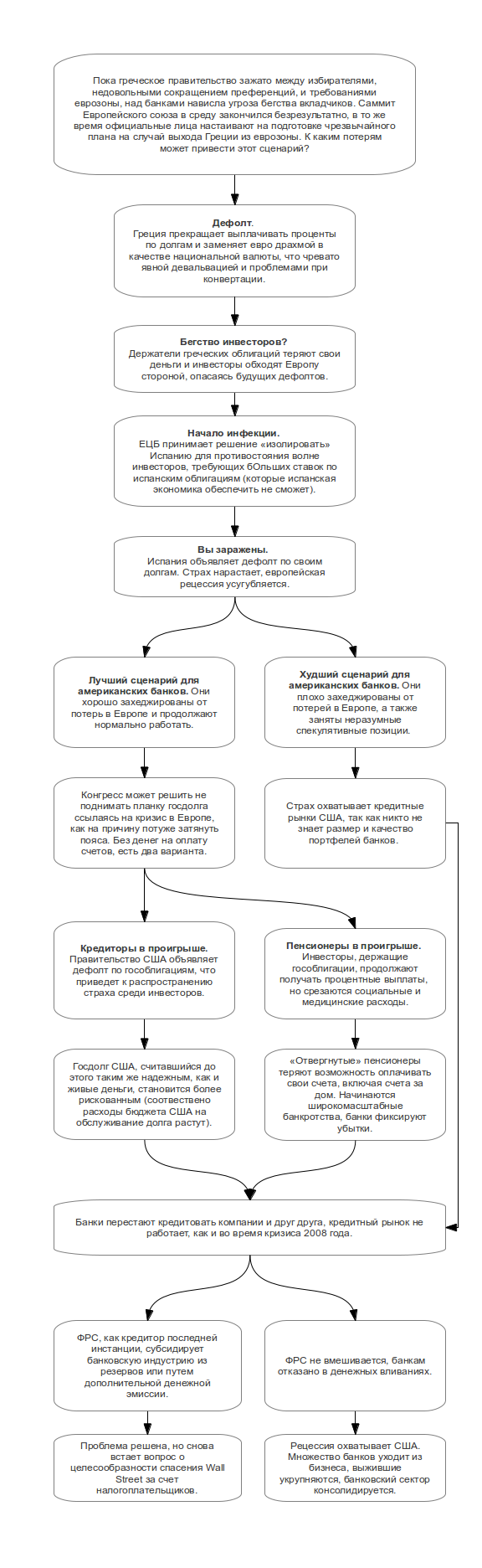

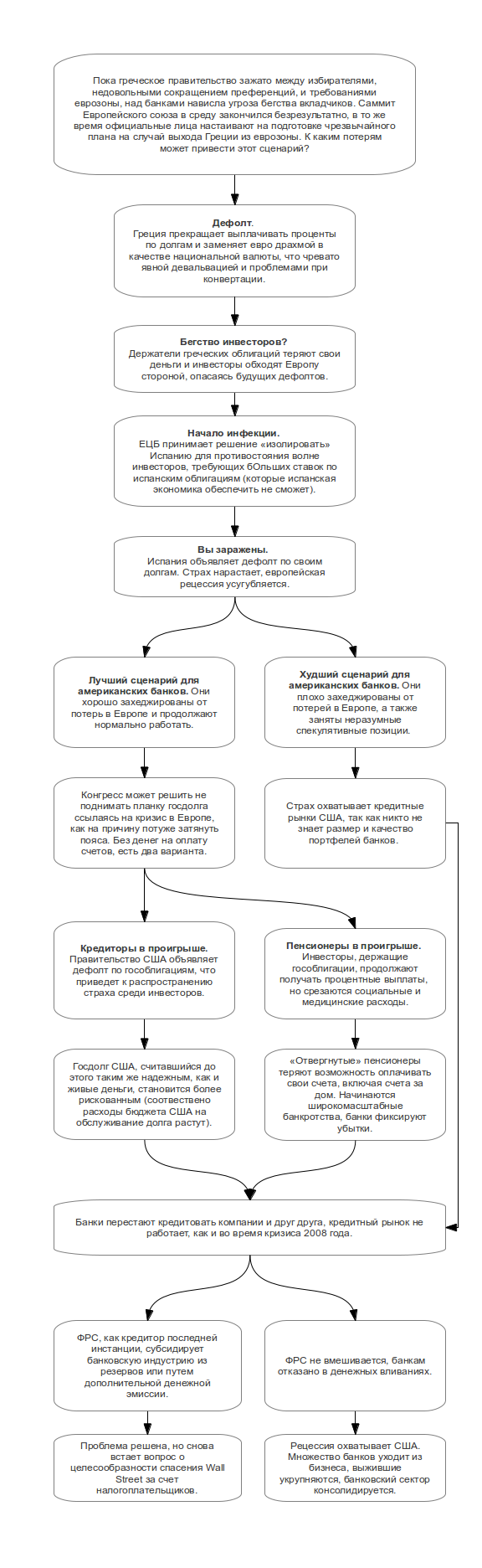

US banks are closely monitoring developments as the default of Greece can cause a chain reaction that will affect the US financial system, as it was during the 2008 financial crisis. The diagram below will help you understand how the default of Greece may affect the global economy.

')

All of the above, as you might guess, is about the USA, but the problems of the US economy are the problems of the whole world. In the case of Russia has its own subtleties. Of course, I am not a strong expert in macroeconomics, but here you can make quite obvious conclusions:

* a slowdown in economies and a fall in oil prices will have a negative impact on the state budget, already bloated with election social promises, as well as on investments in the oil sector.

* the fall of the ruble and, as a consequence, the rise in price of imported goods.

* outflow of foreign investments from Russia due to liquidity problems and the debt crisis in Europe.

* accordingly, problems may arise in the Russian banking sector and, as a result, growth in loan rates.

* well, and as a consequence of all of the above - the rise in prices for us, the final consumers.

dzhe :

petropavel :

Anonymous56 prompted an interesting analyst article by Renaissance Capital about Russia and Grexit. Let me give you interesting moments.

Bambr :

xpurpur :

MaxUp :

Ps. Error messages and adjustments, please, in a personal.

Pps. Upon request - increased the font size in the scheme.

But if Greece cannot reduce the public sector, then, most likely, it will not receive cash infusions from its European neighbors. Then she will be forced to default on debts, which will lead to the termination of membership in the European Union and the circulation of the euro in the country. Such a scenario, bitterly joking, is called “Grexit”. Some clients of Greek banks, fearing such a development, have withdrawn from the country about 700 million euros since the beginning of May, according to Bloomberg.

US banks are closely monitoring developments as the default of Greece can cause a chain reaction that will affect the US financial system, as it was during the 2008 financial crisis. The diagram below will help you understand how the default of Greece may affect the global economy.

')

All of the above, as you might guess, is about the USA, but the problems of the US economy are the problems of the whole world. In the case of Russia has its own subtleties. Of course, I am not a strong expert in macroeconomics, but here you can make quite obvious conclusions:

* a slowdown in economies and a fall in oil prices will have a negative impact on the state budget, already bloated with election social promises, as well as on investments in the oil sector.

* the fall of the ruble and, as a consequence, the rise in price of imported goods.

* outflow of foreign investments from Russia due to liquidity problems and the debt crisis in Europe.

* accordingly, problems may arise in the Russian banking sector and, as a result, growth in loan rates.

* well, and as a consequence of all of the above - the rise in prices for us, the final consumers.

dzhe :

Everything went wild there, the cash from the card could not be removed, the service staff was cut everywhere, tips were extorted almost threateningly, etc. charms of life in anticipation of the collapse of the economy. People have just returned - in shock (rested for 5 years in a row in the same place in Greece, this has never happened before).

petropavel :

Just returned from Greece. Since November, nothing has risen in price. No one even hints at tips. People hanging out and having fun. Restaurants are not cheap, food and taxis are cheap.

Anonymous56 prompted an interesting analyst article by Renaissance Capital about Russia and Grexit. Let me give you interesting moments.

In the case of Greece’s controlled exit from the eurozone (Grexit), economic growth in Russia next year will slow down from 4.5% to 2.8%. Uncontrolled exit of Greece will lead to a decrease in GDP by 0.4%. The most adverse consequences can be when leaving the eurozone Spain (Spexit) - the economy will fall into depression, and Russia's GDP will fall by 5%.

In the case of a controlled withdrawal of Greece, we expect only a moderate recession. If the domino effect covers the periphery of the eurozone, only then will Russia face a depression. However, even in this case, as expected, it will be less deep than in 2009 (-8% of GDP). The price of oil in this case, according to analysts of the company, will be halved - to $ 57 per barrel this year and will be $ 77 in 2013. Now the Russian budget is being balanced at a price of $ 115 per barrel, and a decline in prices to $ 80 promises a catastrophe for our economy.

The lack of analysts of the horror-horror-horror scenario is explained by several reasons that make it possible to survive the next wave of crisis less painfully:

• Course policy. A more flexible exchange rate reduces the impact of external shocks by 40%;

• Interest rate policy. Real interest rates in contrast to 2008 are in the zone of positive values, which gives the freedom of maneuver to quickly reduce key rates;

• Balanced growth. Now in the economy there is no such overheating as four years ago;

• Debt recovery. In the total volume of external debt, the share of short-term debt decreased from 23% to 13%, including from the private sector from 30% to 15%.

Bambr :

They say the way it is - Crete and the central part of Greece are slightly different things. Although I was only in Crete, I can’t say for sure - but when I shared my impressions with my colleagues, it turned out that I consider the Greeks to be a hardworking people who planted everything on olives, and so on, and those who were in the center , claim that the Greeks are lazy seals that do not do a damn thing at all :) That’s something like that.

xpurpur :

just returned from greece (Crete). Compared to last year, nothing went up: gasoline (as it cost 1.7-1.8 and costs), going to a restaurant for two with a small dose of alcohol - 35-45 euros, half a liter of freshly squeezed orange juice - 2 euros. Tips for sure nobody extorted, they sometimes even take offense at it.

MaxUp :

planted with olives and made the conditions for simple cultivation far from the Greeks who are now reaping the benefits. Already generations have passed. I returned literally for a day from another large island - I’m definitely not going to travel to Greece soon. It feels like they have an eternal siesta there. I was in very many countries, and there ... I was reminded of all of Montenegro - the same service, everything is also unhurried, only more and more expensive. And people are somehow soulful in Montenegro.

ps Food prices are more than in MSC.

Ps. Error messages and adjustments, please, in a personal.

Pps. Upon request - increased the font size in the scheme.

Source: https://habr.com/ru/post/144894/

All Articles