Taxes in the USA. Part 1. Introduction, income tax, federal tax, state tax, Social Security taxes

Introduction

Last months on Habré to me discussions of taxes in the USA often come across. As a rule, this happens in topics where the discussion for some reason has slipped to the eternal topics “everything is bad for us - they are good”, “we are good - they are all bad”, “it’s time to get out of here”, “Yes to US taxes are such that it is not clear how poor people generally survive there, ”etc.

Once again I stumbled upon such a discussion, I asked right there in the comment and even asked the appropriate habravopros - the people, and maybe instead of randomly arguing about taxes in the United States in a bunch of different topics, let me write a separate detailed post on this topic, and there and we will argue? For this comment and habra questioning, I received a fair amount of karma and habrazila, and, in fact, I could stop at this

Discussing taxes in such topics are divided, as a rule, into three notable groups:

')

- Those who know about taxes in the United States know little, but would like to learn more first-hand, and also ask all your questions in one place and get answers

for only $ 0.99 for one answer! - Those who really understand the subject (in 90% of cases these are people who work and live in the United States). The discussions usually involve short remarks, since the question is complex and it’s lazy to write everything in detail every time and in general it is ungrateful.

- Those who know about taxes in the United States know from various dubious sources, such as blog posts of sofa analysts, but they have an opinion.

For the first, I decided to write this post. From the second, I gratefully accept comments and additions. Still others may not worry.

In the first part, I will write about taxes in general, about federal and state taxes and how they are calculated and about Social Security / Medicare tax.

In the second part (coming soon) - about the annual tax cycle and various forms - W-2, W-4, 1040NZ, and so on and so forth.

In the third part (coming soon) - about the process of filing a Tax Return, about sites that help fill out huge forms, about applying tax deductions, and, most importantly, about taxes in the US - if there is a reason, you can get back a substantial part of taxes withheld. Therefore, when reading this post, keep it in your head - most people pay significantly lower taxes than those that I calculate here for an example without taking into account possible deductions.

Go.

What taxes are we talking about?

I will only talk about the taxes that are most interesting to 95% of people - taxes on personal income, and mostly - the salary tax that people who work in organizations as hired employees receive.

Corporate income tax is a completely different topic; I will not even touch upon it. Other types of taxes on individuals (income taxes on dividends, tax on income from the rental of real estate, taxes that self-employed people pay) - I will touch them in passing, since I never paid them myself and have no practical experience here .

There will be a lot of links in the text, both to official documents on the IRS website and to Russian-language articles that I have read and found useful.

A bit of general theory and numbers

The main democracy of the planet is constantly in need of money, one of the main sources of which are taxes. US GDP in 2011 is about 15 trillion dollars.

Tax fees of all levels (federal, state and local) account for approximately 27% of this amount. For comparison, in Sweden taxes make up 48% of GDP, in the UK - 39%, in Russia - 37%, in China - 17%. 33% of all taxes are personal income tax (income tax), 24% is collectively all ad valorem taxes (i.e. those calculated as a percentage of the value of goods — customs duties, sales tax, etc., are significant part of this tax is also paid out of the pocket of US residents), 20% - social security tax (

If you look at the revenues of the federal budget , the situation is as follows. In the sources that I found, the numbers differ slightly, but the general order of magnitude: 45% of the federal budget is individual income tax, i.e. a tax levied on personal income, 10% is corporate income tax, corporate income tax. And 34% is social security tax.

A little more about the structure of Social Security / Social Insurance Tax. Part of it is deducted from the salaries of employees, part - from employers, described in more detail here , in brief:

- If a person works for an employer, then 4.2% of his gross income (wages before taxes) is deducted from him, and 6.2% of this employee’s wages are deducted from the company's profit, and 1.45% are deducted equally from both to Medicare tax. Note - the maximum taxable income for Social Security (SS) tax cannot exceed 110k $ per year, i.e. you can not keep more than $ 4,624 dollars a year of this tax. 110 thousand (for 2012) is the amount set each year acc. authorities depending on inflation, the state of the economy and other factors.

- If a person works for himself (self-employed), then 10.4% of income is deducted from him as a Social Security Tax, and 2.9% as a Medicare Tax.

Medicare is a program of providing affordable medical care in hospitals to poor and elderly people.

Those interested in the history of tax rates in the United States will find a lot of information here - for example, how the taxes in the United States changed during the 20th century.

There are three levels of taxes. Federal taxes set by the federal government (all pay them), taxes regulated by state governments and local taxes in counties and cities (set by local authorities)

All issues related to the payment of taxes, deals with the Internal Revenue Service (IRS) - the US Tax Administration. Tax Administration website www.irs.gov .

Read more about taxes that are deducted from your hard-earned money.

There are 3 or 4 taxes that are deducted from the money you earn - federal personal income tax, state tax (paid in all states except 8), social security and medicare tax - is a federal tax and is paid on salary everywhere.

Federal tax

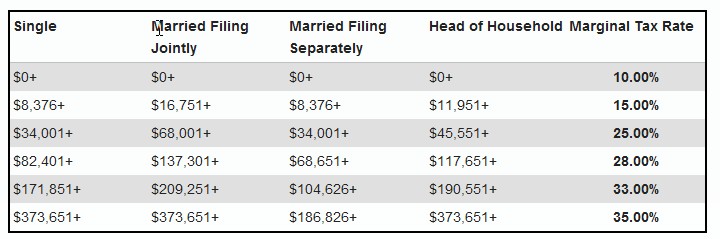

As the name suggests, it is paid in all states in favor of the federal budget. It is calculated using the following table (the left column is for people without spouses, the second is for spouses who file tax returns together, the third one - if two people are married, but for some reason they file the declaration separately, the right column is tax percentage in this bake):

according to the following algorithm.

May I live in Texas, i.e. I don’t pay the state tax, my salary is 75 thousand dollars (high enough for Texas, for California or New York it is a small salary), I want to know my federal tax. I take my salary, and first of all I subtract from it a standard deduction for all single people, it will be $ 5,800 from my salary, i.e. it remains $ 69,200.00 - this is my taxable income (assuming that I do not have any other deductions for the mortgage, the education of children, the cost of medicine, etc.). I put this amount to the minimum tax bucket - from 0 to $ 8,376, for this part of my salary I pay 10% tax. The rest I put on the next bakuet, from $ 8,376 to $ 34,001, for these (34,001 - 8,376 = $ 25,625.00) I will pay a 15% tax. I apply to the next baket, to the upper limit of which ($ 82,401) my salary is not enough. I count as $ 69,200.00 - $ 34,001.00 = $ 35,199.00, for this part of the income I will pay 25% tax. The total is $ 8,376.00 × 0.1 + $ 25,625.00 × 0.15 + $ 35,199.00 × 0.25 = $ 13,481.10 . Divide by 75,000, we get that I will pay about 18% of my salary.

In practice, however, these formulas are rarely used - everyone uses detailed tables, where everything is already counted, and with a granulation up to 100 dollars of income, the tax percentage is described exactly, for example, if your income is from 75,000 to 75099 dollars, up to your federal tax (if you alone and have no other deductions) - 17.97%, something like that.

It will look something like this:

Now let's see how things are with Social Security / Medicare tax.

As we remember, SS tax - 4.2%, medicare tax - 1.45% of taxable income. SS tax will be 69,200 x 4.2% = $ 2,906, medicare tax - $ 1,003.

Those. the total tax will be $ 17.390 / $ 75,000 = 23.2%.

State tax

State tax is paid in all states except the following , and is charged in addition to federal taxes:

- Alaska, Florida, Nevada, South Dakota, Texas, Washington (Washington state, the one in the north-west of the country, north of Oregon and California - not to be confused with the city of Washington, which is located on the east coast in Columbia!) And Wyoming . These states do not have taxes on personal income. Why - the reasons for each state are different. For example, in Alaska, and so no one lure, so there is not only that there is no income tax, so also after two years of living in the state and complying with certain conditions, begin to pay special dividends from the state government. In Nevada, all of a sudden, a kind and generous government does not need a tax on income, since it has enough taxes on gambling tax and sales taxes. Perhaps this is somehow related to the fact that Las Vegas is located in Nevada.

- In another two states (New Hampshire and Tennessee) there is no payroll tax, but there is a fixed 5-6% tax on dividends on stocks and on bank deposit profits.

Another 7 states (Colorado, Illinois, Indiana, Massachusetts, Michigan, Pennsylvania, Utah) tax on income is flat (the same percentage, regardless of the amount of income, is charged in the following amount:

- Colorado - 4.63%

- Illinois - 5.0%

- Indiana - 3.4%

- Massachusetts - 5.3%

- Michigan - 4.35%

- Pennsylvania - 3.07%

- Utah - 5.0%

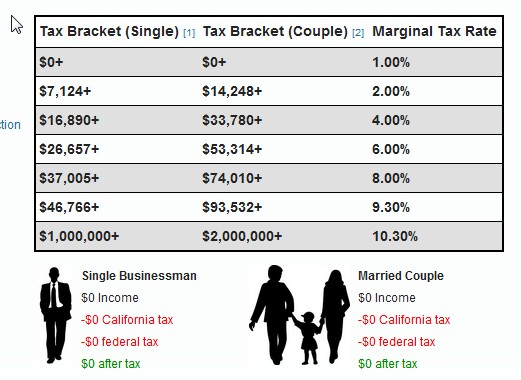

In other states, income tax is levied on a progressive scale; the higher the income, the higher the tax percentage. One of the highest taxes in California, as many probably know, is up to 9.3% of taxable income, + in addition, so that life does not seem like honey, 1% of Mental Health Services (!) Tax on those whose taxable income exceeds one million dollars a year .

Let's look at the example of state progressive tax.

Here you can see the tax calculation table for California, with the algorithm the same as for the federal tax, i.e. first we go to the lowest tax buck, and for the part of the salary that goes into it, we pay acc. the percentage indicated in the first line in the column to the right (1%), if after that there is still something left of our salary, then we proceed to the next tax buck, and we try on the corresponding part of the salary accordingly. 2%, and so on.

The only difference - in the states where there is a state tax, from the size of the salary is deducted, in addition to the standard federal deduction another state deduction. Those. The taxable amount will be $ 100,000 - $ 5,800 (federal standard deduction) - $ 7,009.76 (standard state deduction) = $ 87,190.24

An example for the salary of a single person, $ 100k. In this example, both federal and state taxes are calculated.

Tax buckets. The first column is for lonely people, the second is for those who have a spouse (s), the last is the tax percentage for a part of the salary in acc. baket:

As we see, we will have 18.1% federal tax, 7% state tax, a total of 25.1% income tax.

Now let's see how things are with Social Security / Medicare tax.

As we remember, SS tax - 4.2%, medicare tax - 1.45% of taxable income. SS tax will be 87,190.24 x 4.2% = $ 3,661, medicare tax - $ 1,264.

Those. the total tax will be $ 30,057 / $ 100,000 = 30%.

All calculations were done on the site http://www.tax-rates.org/california/income-tax , you can go and play with numbers.

Fuh ... The second part is coming soon.

Source: https://habr.com/ru/post/144820/

All Articles