How much does Facebook actually cost?

The second quarter of 2012 is already in full swing, the number of rumors around the IPO of social network No. 1 is increasing. Let's remember what happened with this network and try to calculate how much it really costs. Where did the figure of $ 100 billion come from and why, to put it mildly, is it overvalued.

According to Reuters news agency, the company intends to conduct an IPO in the second half of 2012. In 2011, facebook was estimated at $ 100 billion. The truth from this was reported by CNBC, citing unnamed sources. Simply put, CNBC simply took this figure from the ceiling and the very appearance of this figure is already a manipulation of opinion.

')

Money:

Well, let's imagine that FB is worth 100 billion greens. Wikipedia says that last year at the end of October was “7 billion day” - the population of the Earth exceeded this figure. Then it turns out that if the FB would give out all the money, then each user of the planet would have $ 14.28 each. Or if everyone on the planet kicks off at 500 rubles, then we will become the owners of FB. FB claims that its audience is 845 million active users. It turns out, the cost of 1 user $ 120. To me, these numbers seem to put it mildly too high. In general, I am inclined to think that the sum of 100 billion is a psychological estimate, about a hundred thousand miles. A person who did not hold in his hands $ 1 million is difficult to imagine the difference between $ 1 million and $ 100 million. For him, this is just “a lot”. Remember the inhabitants of African tribes, where only 1, 2 and "many" are from numbers. Here we are in fact the inhabitants of these African tribes.

In order not to be such residents, we will try to use at least an abstract understanding of values. According to Google finance, the capitalization (market value) of IT companies already on the market is as follows (prices in billions of dollars are in P / E slash):

apple 560/17

msoft 270/11

google 208/21

amazon 92/147

yahoo 18/18

groupon 12 / -

linkedin 10/872

yandex 8/45

The truth is there is one thing. First, if you start buying shares in unlimited quantities, with unlimited financing, the price will change. And to control the company you do not need 100% of the shares, enough of the controlling stake. Also, do not forget about the P / E ratio. The P / E ratio is the price / earnings ratio (the company's market capitalization to its annual profit). For example, if you rent an apartment worth 3 million rubles (this is your asset) for 30 thousand per month, then its P / E is 8.3. And this is normal, for normal companies, PE hangs around 10. Daimler (Mercedes does) P / E 8.5. Note the P / E ratios for Amazon and Linkedin. Such values suggest that the value of shares of these companies is greatly overestimated. Grupon does not publish P / E at all - there are transcendental values.

Now, when it is clear about where, we calculate FB. Where are we going to get the numbers - of course from the SEC (Securities Commission in the USA).

See the report of the securities commission on facebook .

February 1, 2012 FB appeared a document that is prepared by all companies before the IPO. I always thought that we should first of all look not at the words of people, but at their actions - they show the true intentions. Also with companies. Financial behavior shows where the company actually moves, and PR and marketers can yell anything. The numbers in the hands of people - just a tool. (In my hands, by the way, too!)

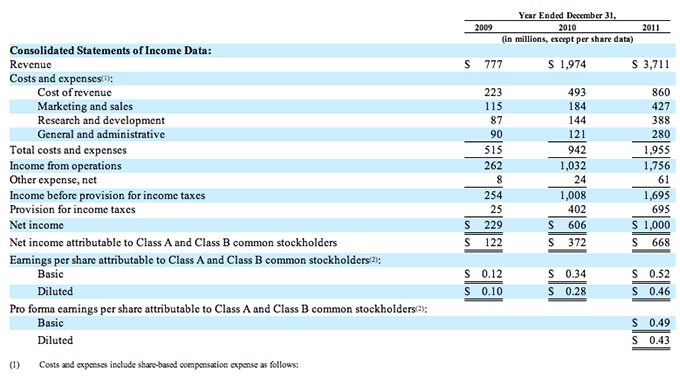

The most interesting is slide 9.

So revenue (this is revenue) - all incoming money in the social network.

Cost of revenue - this is how much you had to spend to organize such income.

Net income is profit. How much is left after taxes, and other payments and expenses.

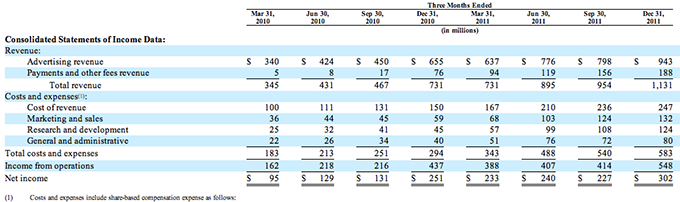

In general, in 2011, FB earned $ 1 billion. True growth rate is quite fast. from 2009 to 2010, the profit increased 3 times, from 2010 to 2011 2 times. Slide 40 has the same information, only in more detail since 2007.

FB 87% of all revenues received from advertising. Slide 54 shows that the growth rate of profits slows down from year to year.

What is in assets? The assets of $ 6.3 billion.

Lecture hall:

In internet business, the audience is a key concept. If you have any site, it is the quantity and quality of the audience that determines how much you can earn on this site. In the case of FB, the audience uses the network, watches advertising, and FB receives money from advertisers. The business model is pretty simple.

FB claims that it has 845 million active users. That is, every seventh inhabitant of the planet Earth is an active user of FB. Forget about other social networks :) It seems to me, to say the least, an exaggeration. I think many people from Habr have their own websites and projects on the Internet. Many also keep statistics on visits through Metrics or Analytics. Each roughly represents how the project audience is stratified. What is active, who is just a reader, and who comes in occasionally. Even if we take into account the social network, where the user constantly “hangs” on the site, and adding the number of bots in this network, then according to my calculations, more than 200 million users fail.

Let's not forget about other social networks. And look at the data on the population of the Earth in January of this year:

If you look at the numbers and try to dial 845 million, then it will be difficult. 200 is a much more realistic figure. If you still take into account the social networks of China, orkut, vk.com, then 845 is a figure from the ceiling.

Let's look at the TNS statistics on VK.com (Project TNS Web Index). The total withered audience: 90 million people. Active audience: 20 million people. 4 times less. I think the numbers are similar with FB. If he says that he has 845 million users, then there are 200 million of them in fact.

As a result, I think that FB growth has come to a level where it does not develop at the same pace as in 2007-2011, but is a mature project with a constant stream of profits. Simply put - FB has nowhere to grow much more. Everyone who could register for FB is already there. Well, if there is no place to grow, then it is possible and it’s time for an IPO - to collect all the cream in full.

Pay attention to the structure of this company. I don't think many people remember the dot-com crash in the 2000s. At least simply because very few people were in the USA at that moment. Internet companies have no assets and rear in the form of intellectual property. Any social network can be copied on the knee for 1-2 months. The whole “cost” of a company in a brand is that it is this network that everyone uses, the cost in the audience. Copy companies like Boeing or Intel will fail. They have assets that cannot be copied or created from scratch.

There are many engineers who can design processors, but there are only a few people on the entire planet who can make the best processors. These people work at Intel. In order to create something high-tech and new you need to have experience in developing previous technologies in order to build on what has been created. Therefore, no matter what anyone says, but the main asset of Intel is not even their supertechnological plants, not legal or marketing departments, but the main asset is engineers and so on in any other manufacturing company. It is they who create products and repeat from the outside will not work.

There is no difficulty in creating an analogue of FB - there are already a lot of clones. So what's the problem? In promotion. Creating an FB clone is easy and simple, but it is difficult to roll out to similar sizes. Ie FB has an asset, the so-called customer base on a global scale. How to monetize it? Contextual, or direct advertising or any paid services, services, games and other unnecessary growths. This is true for the audience that uses FB, and not just registered. I do not believe that they have 845 million active users per month. That's bullshit.

What is the result?

As a result, we have:

1) In the assets of the company: 6.3 billion

2) Revenue: 3.7 billion

3) Profit: 1 billion

Profit growth has slowed, because social network has approached its ceiling in development

How much can such an asset really cost? Well, I think that no more than $ 15 billion, and this is a reserve for development.

This information is official from FB. The good guys from Wall Street have already calculated everything. GS entered the FB asset in 2010, in 2012 they will already receive a profit from it, when people like us and you will buy FB shares in free placement.

Moreover, in 2011 they bought 3 billion worth of securities. I think they would not invest so much if they had seen opportunities for their own growth. Just imagine - you have a business, it brings money, you put the profit back and get even more money. Would you spend money on tools with lower returns? I think it is unlikely. So these expenses are another sign of the FB ceiling in development.

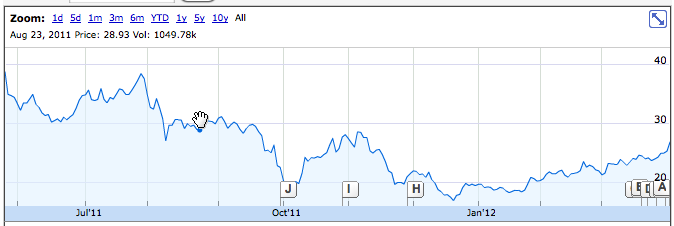

The company's goal in an IPO is to get as many assets from the market as possible by cramming all its shares. If you look at the placement of Yandex (the company I love and respect), then the placement price was $ 40, today the stock costs $ 26.

Grupon, Tsinga and Co. is a new techno bubble. There will be a repeat of the year 2000. Markets have no memory. For for the loss of money on investments, managers are driven out. New people come and do not remember about the mistakes of their predecessors.

A classic example of IPO technology companies: there is a stir, there is a mega positive news flow, investors run after the bankers themselves and ask when, finally, they will open the book of applications. In the first days of the action take off at 50-100%, then a couple of months hang out somewhere above. Insiders go to their maximum. Others shorts. Then the collapse at times, dozens of times. In the floor. Then lying on the bottom for half a year. If a company survives and proves the viability of its business model, then a slow growth to a fair price begins. Then you can buy. But the former heights will probably never happen again.

Yandex is a classic example of IPO techno-companies. His example is clearly visible.

The whole life course of Yandex shares (click there Zoom: All)

Who bought Yandex at the end of March 2011 for $ 40, so it seems to be sitting in it. Excellent investment, yes. And remember - I said that Janedx is a very successful company in the IT market and she, in my opinion, has a great future. Just Yandex and Yandex financiers are different people and they have different goals.

At such IPOs you can raise a good amount of money. But simple guys like us will not be allowed in there. The admission of broad masses to such actions is a signal of a quick fall. They do not need money for the development of operating activities related to the network. So it's time to go to the market and cut down to the maximum.

And yet, all these placements of IT-companies. All of them are traded below the accommodation price. Everything.

The same will happen with FB. In general, look at your monitors in 2012 blockbuster

"FB spuds to the fullest."

Starring Zuckerberg and the guys from Morgan Stanley :)

Well, the movie finally:

Thanks for looking at the market, and information: spydell .

About errors and typographical errors please request.

Want more? You know what to do.

UPD: We have crept into a small inaccuracy about the Yandex IPO . Thanks for clarifying DmitriyAP . The placement price was $ 25 per share. Pruflink . But on the first day, the stock price rose by 55% and closed at $ 38.84. By and large, this fact indirectly confirms my words. Schedule on seriche. I do not think that there were many who bought on the first day, and then immediately went out. Now the price is $ 1 more than the accommodation price. You can buy :)

Source: https://habr.com/ru/post/141244/

All Articles