Taxer - submission of the annual report to the pension fund of Ukraine online

Today, exactly one year, as Takser was presented to the public. Our first announcement took place on Habré and, therefore, a year later we are here again. Like the very first post , this publication will be devoted to the annual report to the pension fund. But if a year ago we just reminded Ukrainian entrepreneurs of the need to submit this report, now we have all the necessary tools to send it electronically directly in the browser. This year is the last day of delivery - April 2nd.

In this article we will briefly describe our work over the past year, about the nearest plans. More details about the process of electronic reporting and electronic digital signature in Ukraine in general and our web service in particular. We set out in detail the instructions for submitting an annual report to a pension fund online. At the end of the article, the most patient is waiting for the distribution of promotional codes to activate the almost free subscription to Tucker.

What was done

During this year we have done a lot of work: we implemented the delivery of electronic reports, received investments, took legal shape, monetized, assumed obligations in accordance with Ukrainian laws and with our burden of perfection.

')

Now the web service Takser is represented by the company Takser of the same name, which has an office in the center of Kharkov. A trademark was registered, and very soon we will move to the .ua domain zone. Every day we have more than 30 registrations of new users, and for all the time we have processed more than a thousand electronic receipts.

In the nearest plans we have the preparation of everything necessary (calendar and reports) for entrepreneurs with employees, a little later - the introduction of accounting accounts. And one of our most audacious ideas - paying taxes via the Internet - has moved into the implementation stage. To do this, we have compiled full reference books of all requisites for paying business taxes throughout Ukraine and are already negotiating with several financial companies.

But back to the topic of electronic reporting.

How the electronic reporting system works

Electronic reporting in Ukraine is governed by several laws and a number of private orders for individual departments. The main legislative acts are: the Law of Ukraine “On Electronic Documents and Electronic Document Flow” and the Law of Ukraine “On Electronic Digital Signature” .

Currently, electronic reporting is accepted by the following regulatory bodies:

- State Tax Service of Ukraine

- Pension Fund of Ukraine

- State Employment Center

- State Committee of Statistics of Ukraine

- Unified State Register of Legal Entities and Individuals - Entrepreneurs

User identification and verification of the integrity of the sent report are achieved by using an electronic digital signature. The EDS is implemented according to the state standard DSTU 4145-2002 , adopted back in 2002. EDS keys are issued by accredited keys certification centers. The accreditation of the CSK is carried out by the Central Certifying Authority under the Ministry of Justice of Ukraine. In total, there are about 20 ACSSCs ; however, the keys of much fewer centers will be suitable for reports to the regulatory authorities. So, for example, the State Tax Service "understands" the keys of all six ADCSs . This is due to the fact that the ADSSK, who wants to allow its customers to use keys for electronic reporting, must conclude a special contract with the supervisory authority and place decoding software on the central gateway of this authority. More on this later.

EDS keys are a public key cryptosystem. By purchasing an EDS, the user receives two files on a removable medium: a private key and a public key (certificate). Without going into details of the work of the infrastructure with the public key , we note that you can sign an electronic document with a private key, and encrypt it with a public key. To decrypt the document, you need the corresponding private key, to verify the signature, it is enough to have a user certificate.

In practice, this is applied as follows: on the generated report document (most often it is an XML document), the electronic signature of the person who gives it is superimposed. The signed document is encrypted using the public key of the authority to which the report is intended, and is sent to the central gateway email. Each regulatory authority has its own email gateway. After receiving an electronic report, the gateway determines which ADSC keys are signed by the document and sends it to be decrypted to the appropriate ADSK software. There the document is decrypted, the sender's signatures are verified and the report is transmitted for further processing.

The processing of the document itself is specific for each control authority, but in general it takes place in two stages: processing by the central server and processing at the district level. The central stage of processing is automatic and consists in the validation of the report file. For XML files, validation is applied to the corresponding XSD. It also checks for the presence of signatures and the compliance of the signature with the depositor. The document that passed the test at the central level is sent to the territorial controlling authority in which the person who submitted is registered. So in the case of tax your report will be sent to the local tax office, in the case of a pension fund - to the local pension fund management. The report may be sent to the local authority in a form more similar to a paper copy. The file comes to the tax office as a PDF document. At the district level, the report is viewed by the operators and is accepted or denied admission at different speeds. Acceptance at the district level is legally equivalent to a successful report.

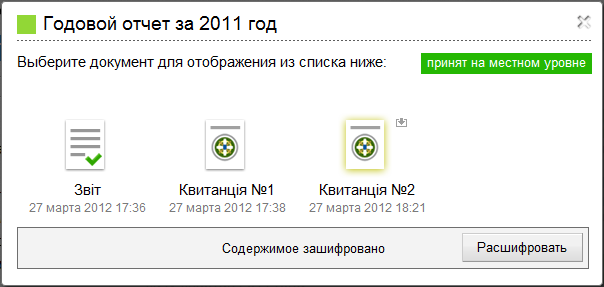

The results of the travel and processing of the electronic report are reflected in the response receipts sent by the gateway of the controlling authority. Their number and content depends on the authority itself and even on the ADCS software installed on the gateway. It is common to receive a receipt No. 1 on the results of processing at the central level and a receipt No. 2 on the results of processing at the local level. It is receipt No. 2 that brings the coveted "report accepted at the local / district level." The text of the receipt is encrypted with your public key and signed by the controlling authority's EDS.

Such a chain provides:

- data protection (the report can be decrypted only on the side of the controlling authority; only the person who sent the report can decrypt the receipt)

- data integrity (electronic signature ensures that there are no distortions in the report file)

- identification of the parties (the electronic signature of the donor uniquely identifies him as a business entity; the electronic signature of the controlling body guarantees the authorship of the receipt)

At this introductory course in the system of electronic reporting in Ukraine will be considered complete. Let's go to how it works in Tucker

Electronic reports in Tucker

To organize electronic reports, we use licensed crypto-libraries of the Institute of Information Technologies under a license. Libraries written in pure java were prepared for us, which allows them to be used in a special applet embedded in a web page. This solution is as cross-platform and easy to use. All the benefits of a web service on the face: accessibility from anywhere in the world, from any computer with a modern browser, no need to be constantly updated - all edits are made to the server and are available instantly and to everyone.

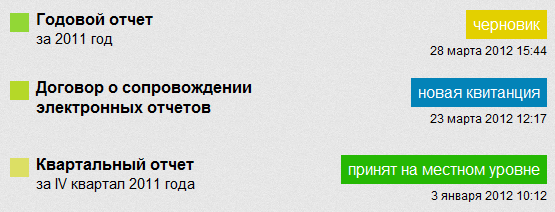

A little bit about how we store data on the server. The report in our system goes through several life stages. The very first one is a draft. The document is in the draft state when the user decided to save the edited report to the office or send it to the supervisory authority. In draft status, the report is encrypted using a passphrase based on the user's password. There is a problem with the restoration of such documents: when changing the password, draft reports cannot be restored.

If the user is ready to send an electronic report, then he goes to the EDS overlay page. At this stage, the report is cloned into two instances, which are encrypted in different ways. So the first copy is encrypted using the user's public key, and the second - according to all the rules, as required by the gateway of the controlling authority. Being sent, the document moves to the second stage with the same name “sent”. The draft of the report is deleted, its place is taken by the document encrypted by the user certificate. The second copy is sent to the regulatory authority from our mail-server. The first copy of the report remains in the user's office and is available to him at any time for viewing. Viewing is available after the decryption procedure, which also uses a special applet that performs inverse crypto-transformation. The sent report is not lost after password recovery, as it is encrypted using the user's EDS.

Our mail-server dynamically creates unique e-mail boxes for each user, from which reports are sent and to which receipts are received.

Receipt receipt is processed automatically: they are placed in the office to the appropriate report, after which the user receives an email notification. Sometimes the receipts contain service fields with a header, according to which it is possible to determine the status of the receipt (No. 1 or No. 2, accepted or not accepted). In this case, the status of the report will change automatically. In cases where the receipt is encrypted in its entirety, an attempt to determine the status of the report is made at the time of decrypting the receipt by the user.

Both the report and the receipts are stored on our servers in the original encrypted form, which ensures their maximum security. All crypto-transforms are held locally on the user's computer. If the report is encrypted, the report text is given to the applet via the https channel, after which it is transmitted back in encrypted form. In the opposite case, the text of the document is downloaded by the applet in encrypted form, after which it is decrypted locally and, again, displayed locally in the browser. Neither the decrypted text nor the user's keys are ever transmitted to the server.

And now a specific example with screenshots.

Instructions for submitting the annual report to PFC online

First of all, if you want to report electronically, you need to perform two steps:

- purchase EDS keys

- conclude an agreement with the supervisory authority.

Keys can be purchased at the ADC office in your city. The whole procedure takes no more than 30 minutes. Takser supports keys from ATsSK "І" and "Masterkay". Read more about getting keys .

The contract is in electronic form. The procedure is most similar to the procedure for sending a report. Usually the contract is concluded on the same business day that it was sent. Read more about entering into an agreement with the PFC .

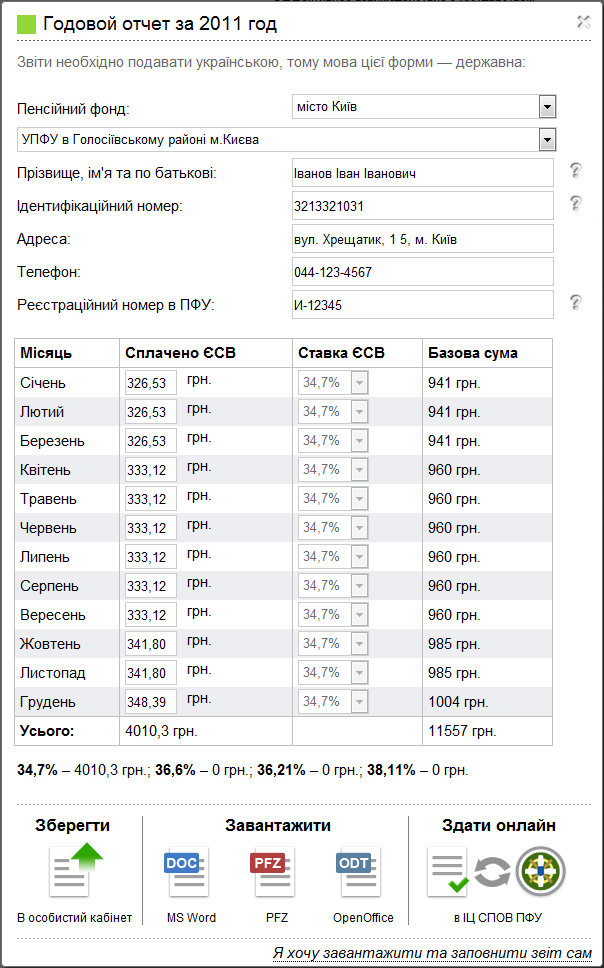

If you have completed both steps, then submitting an annual report will not be a problem. You need to fill in just a few fields in this short form . The form is pre-filled with values corresponding to the minimum payments of the single social contribution. Our practice shows that the overwhelming majority of entrepreneurs paid the minimum contributions. If you paid a tax in a larger amount, simply enter the required amount in the desired field of the month.

Important note: the form is suitable for entrepreneurs on a simplified tax system, not participating in voluntary insurance, without employees and family members involved in entrepreneurial activity.

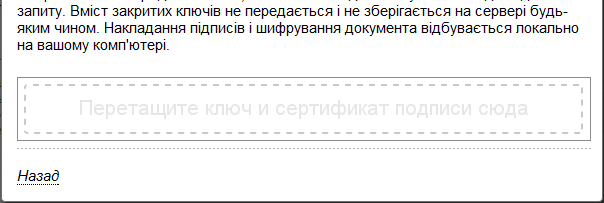

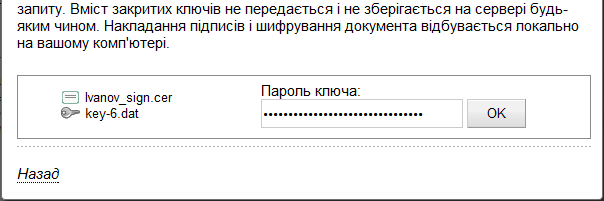

After filling in all the fields, you can go to the preview and the imposition of a signature. Following the prompts, discard the private and public key files in the indicated field.

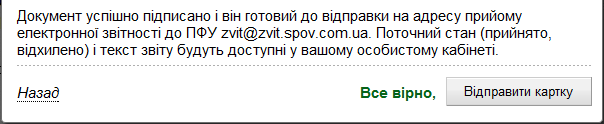

Final confirmation. If everything is correct, click "Send".

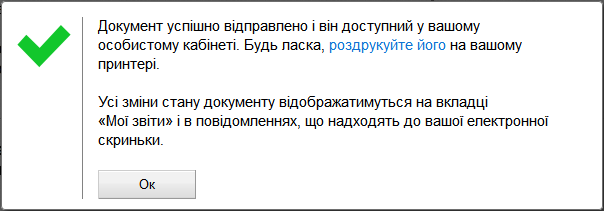

Receipt number 1 should come almost immediately. Receipt number 2 will come during business hours after verification by the operator. PFC receipts are encrypted in their entirety, so upon receipt of the receipt, the status of the report will change to "New receipt". Decipher it, and the status will change automatically.

As a result, the report page will look like this:

Congratulations! Your annual report to the pension fund is successfully adopted! And now let Estonians envy us with their state portal .

One final note: according to the law, an electronic report is considered to be sent on time if it arrived at the gateway before midnight on the last day of delivery. This year is April 2nd (since March 31 falls on a day off). However, no one guarantees the work of the gateway during off-hours, and we strongly advise you to send a report before the weekend!

Dessert

For a sweet promise of promotional codes. Or rather just one promo code, but which is valid for all: HABRAHABR . Enter it on the payment page, and you will see the option "quarterly subscription for 5 UAH.". We check the site from which the transition was made, so for the promo code to work correctly you need to open Takser using one of the links in the article.

We hope to see you among our users! Next week, the delivery of an electronic report for the first quarter to the tax office will be available.

Source: https://habr.com/ru/post/141062/

All Articles