Broker Factor Revealed

About trade

Everyone knows that the price of currency pairs is directly dependent on demand (the level of interest of traders in a given currency) and supply (roughly - “amount of currency”). And naturally, between them there is an inversely proportional relationship.

Such a system is ideal because it would provide honest (market) relationships, in which there are practically no random parameters, which is absolutely not beneficial to the broker’s side.

After quarterly studies aimed at studying the behavior of prices and the market as a whole, along with supply and demand, a third factor was identified - “Broker factor” .

Famous Brokers Trick

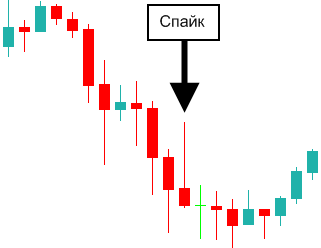

At the moment, the concept of “ Spike ” is known (a sharp price spike , which aims to “hook” automatic stop levels, or pending orders, and then return the price to its previous level, thereby driving traders to loss).

')

It is not technically difficult to deal with Spikes; it is enough to monitor price levels on several brokers at the same time and refrain from trading during periods of price differences. But it's not about them.

About broker factor

It turns out that brokers not only create artificial “ breakthroughs ” of prices, but also actually “dictate” it. This fact was revealed by the template method with the help of a huge heap of statistical data.

With an even macroeconomic situation in the world, when there are no major changes in the indices, theoretically the price should depend only on supply and demand, but not. Here mathematics formulas are taken on the brokers side. They create additional price fluctuations, before the release of any global news. Although the formulas make a small amount of randomness, the principle of their action remains constant for certain periods of time.

Based on these statements, an indicator program was developed for the MetaTrader4 platform. Its main task is to analyze historical data in order to identify similar situations with the situation at a given point in time. These situations I defined as - the state of the market . It is almost unique at any time. In my case, the number of such states is limited to a very large number and is approximately 2 ^ 78 on a particular bar (If we take into account the sequence of bars, then the number will be much larger).

- For the state of the market, I took a binary mask, like: 101011110111000011 ...

- Each mask value corresponds to the indications of standard indicators ( MA, EMA, RSI, BB ...).

After the first pass through the whole story, I was already desperate, because The program did not find an exact match between the current situation in history. But the decision came in an hour, I introduced two additional concepts - mask accuracy (in percent) and mask length (in bars).

Having calculated the percentage of similarity of each state in history to the current state of the market, with a given accuracy, I was able to find situations in which the current state of the market is duplicated. As you have already guessed, if it turned out to find duplicate states, then we can answer the question “What will happen next?”. Based on the history, with the same given accuracy, we can predict the further price movement.

Approaching completion

The first public express forecast for 2 days, I left on the Ideas Contest on 03/15/2012 . There is also a screenshot with an open position. As a result, the forecast came true, and everyone who opened a small option, in the same direction, was able to earn more than 1500 points for a pair of Euro-Dollar. At the same time, the drawdown was only 2 spreads.

The second forecast was not so public (only friends heard it), but in confirmation of it is the screenshot below.

At the most dangerous time for traders - Friday, evening, an option for 1 lot was opened. At this time, the markets close at the weekend, and the price may make unpredictable jumps. Nevertheless, today, on Monday, the second public forecast in a row was justified.

The third public forecast was given (in comments) at the request of the readers of my article on Habré: Forecasting currency fluctuations by statistical methods

Lucky? - I do not think. In the process of testing, more than two hundred orders were opened. And 95% of them were closed with a positive result.

Conclusion

Taking into account the current development trends of the exchange, in particular of London, the broker's factor will gain more and more momentum. With such a pace, predicting market behavior will become more accessible to most traders. But still, you should not forget that in spite of the good performance of forecasting systems, trading on exchanges is a risk.

And I would like to end with the words of the classics: “Risk is a noble cause, but only if life or well-being depends on its outcome . ”

Source: https://habr.com/ru/post/140349/

All Articles