Who, Why and How looking for startups

Consider the main scenarios for the search for startups by players of the venture market in Runet

Consider the main scenarios for the search for startups by players of the venture market in RunetWho is looking for startups: investors, mentors, business incubators, corporations, consultants and even startups are looking for startups.

How to look before? (on the example of investors)

1. Create an incoming project stream, i.e. so that the startups themselves come to the investor. To do this, you need to advertise yourself a lot, sponsoring conferences, publishing news of the venture capital market, telling startups how to start up, showing how much money you have.

The most striking example of the successful creation of the incoming stream - Farminers. For 6 months they collected about 2 thousand projects.

2. Create an outgoing project stream, i.e. find startups yourself and invite them to a meeting. To do this, you need to monitor the news about startups, the section "I am promoting" on Habré, start-ups catalogs, contests, be sure to go to events where startups are presented. Any investor can do this, but he will have to devote many months of work to this.

3. Work on the recommendations. When you have a name on the market, other investors can send you interesting startups with an offer to co-invest. No name? No recommendations.

')

By the way, when a large flow of projects is created, the next even more “interesting” task arises - to filter the flow of projects and select the best ones. We will tell more about this next time;)

Now months of work can be reduced to a couple of hours of “sighting” search on StartupPoint.ru.

Consider who and why looking for startups.

Startups are looking for competitors

Before investing your time, money and energy in the work on the project, the entrepreneur must conduct a competitive analysis. Oh, how rarely is this done. 3 years ago there were hundreds of social clones. networks. Last year - hundreds of Groupon clones.

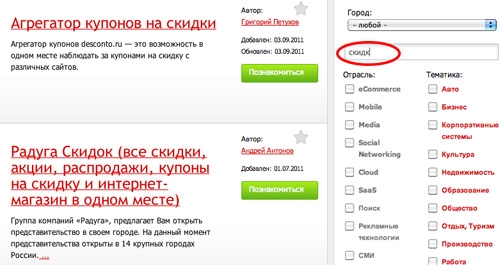

In order not to reinvent the wheel, now it’s enough to use the search by branches on SP . For example, if you enter “discount” in the search (yes, we are not yet as technologically advanced as Yandex and endings matter), then the site issues 95 (!!!) projects related to discounts.

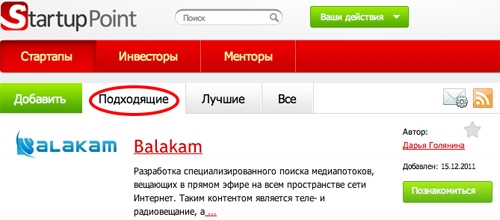

Investors are looking for Facebook

those. startups in which you can invest $ 1M, and then sell your share for $ 100M. Each investor has his own set of criteria: the subject matter (market), geography (an investor from Perm will most likely be looking for Urals startups, and not, for example, southern or Siberian), a development stage (sid investors invest at the idea stage from $ 10K to $ 150K, funds consider startups from $ 1M, etc.) and especially for investors we have the “Eligible” tab, where we show the best startups that fit exactly their investment criteria.

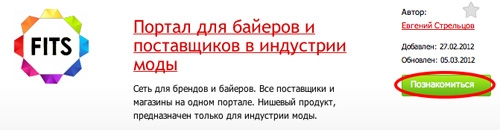

Moreover, we have reduced the process of acquaintance with a startup to the 1st click. No need to invent the text of the letter, look for contacts of a startup. A click on the “Get Acquainted” button - and we represent an investor and a startup in the mail.

Corporations are looking for technology

Corporations such as Yandex, Google and many other large Internet companies are looking primarily for technology start-ups to reduce the time to develop technologies on their own.

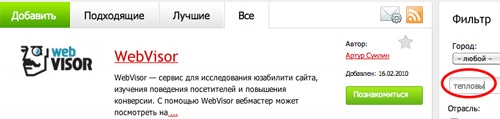

Consider our favorite example of buying WebVisor by Yandex. Favorite because we helped Yandex with the search for this wonderful startup.

Suppose a Yandex employee knows that he is looking for analytics technology to visit a site using heat maps. He starts typing “heat maps” in the search and sees WebVisor. Ta-dam.

Search all technology startups without specifying a specific technology coming soon, he needs to contact us.

Mentors, Service Providers, Start-up Contests are looking for the best.

They invest their time and resources and it is extremely important not to make a wrong choice. We have already done this work. Use.

What's next?

If you have a cool startup and you want to be found, add the project to the directory .

If you are looking for a startup, register on the site and choose the role of "investor" to get an individual selection of projects.

And we will have a great event on March 29th , where we will show investors and mentors the best projects.

Source: https://habr.com/ru/post/139513/

All Articles