Yes-Credit.ru - a new service for online stores

Go to the point. Our task was to create a system that allows you to take a loan to buy something in the online store, without leaving your home, simplifying this process as much as possible, both for buyers and for owners of online stores. This is how the service http://yes-credit.ru and the button “Buy on credit” appeared.

The button looks like this:

')

Today it is installed in about 100 stores. For example: apple-credit.ru

It was difficult

Developing payment solutions for online stores, we came up with a credit service on websites. We understood the demand immediately, but the creation of a legal model and a technical platform took 8 months.

It began with the development of a legal model with each bank, we had to create a technical platform for processing automatic processing of a loan application, which allows us to receive a solution from 8 banks in real time. And 8 banks are not the limit.

The most difficult thing was to decide how to sign a loan agreement outside the bank. But the road will be mastered by walking. And, despite the fact that at the start we were told “This is impossible!”, We managed to create such a team that did it.

About the team

The team was based on hard principles:

- honesty in relations with partners and colleagues

- positive thinking

- work on the result

In May 2011, the team consisted of only 9 people who worked without weekends and holidays. In January 2012 it is more than 80 people.

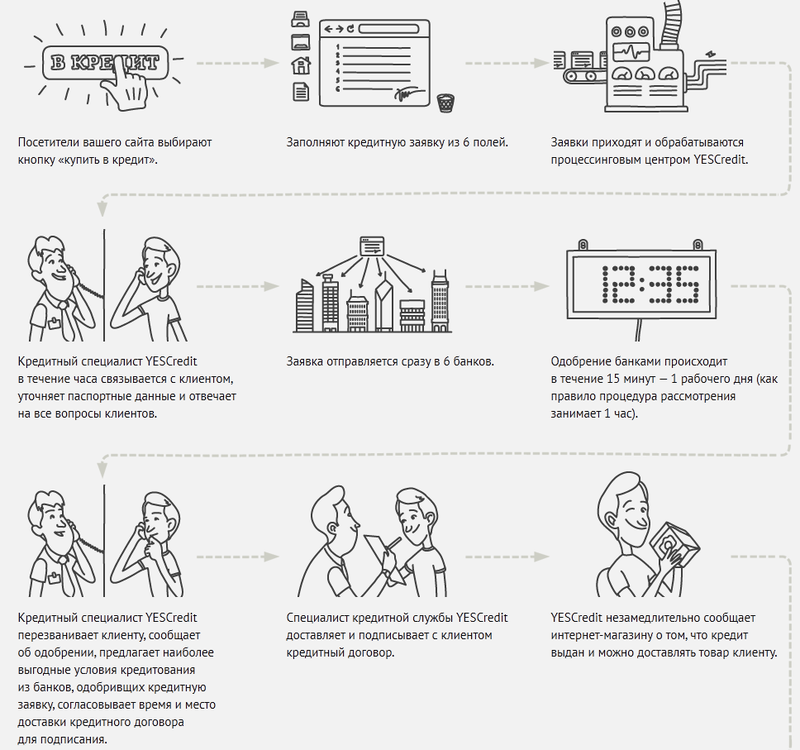

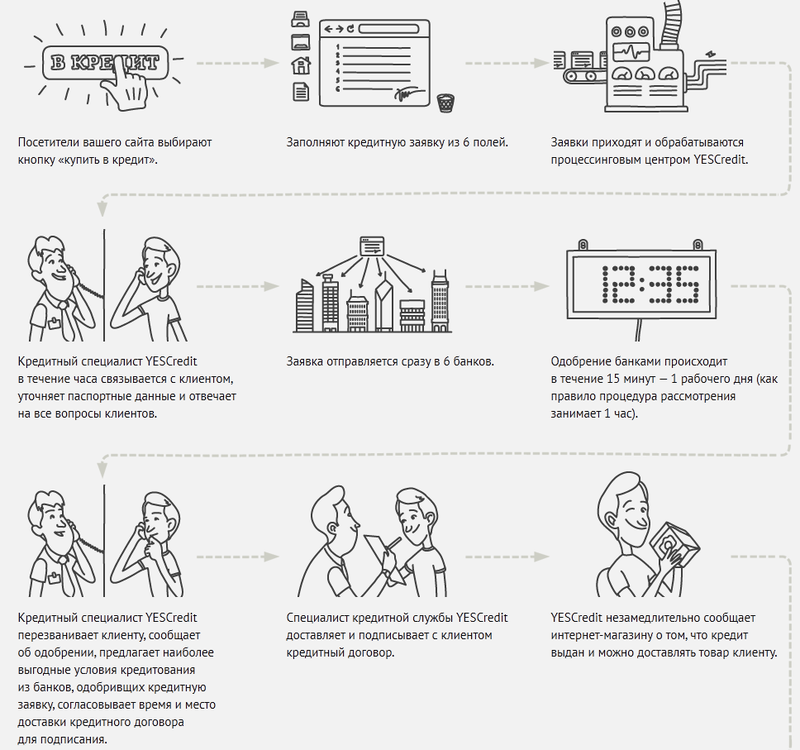

The process of selling on credit looks like this

To date, the system processes about 500-1500 applications per day from both online stores and retail stores. Beta testing ended December 31, 2011. During testing, the issues of service failure at high loads were resolved.

According to the results of beta testing, we have statistics from 30 stores from different industries: sales growth due to the connection of a credit service amounted to 34.8%. During the testing period, we paid over 120 million rubles to our partners (online shopping). An additional effect of connecting a credit service, according to online stores, is an increase in loyalty and trust in the site.

We have entered the stage of mass connection of online stores. For this purpose, an API was created that allows you to quickly and efficiently connect online stores on any platform.

Important: to fill in the loan application the client remains on the website of the online store. In February-March, we plan to connect 80-150 stores and process up to 10 thousand loan applications.

How does this happen from the point of view of the owner of an online store?

From the point of view of the owner of an online store, the system looks like an interface that allows you to monitor the life cycle of a loan application from the time it arrives until the loan agreement is signed with the customer in real time, plus data for statistics, application history, confirmation of product availability.

Conclusion

So, having entered into an agreement and installing the service on your website, the online store receives a reliable partner of YES-Credit, which turns loan applications into purchases, and bureaucratic problems, the correctness of filling out documents, taking money from banks takes over.

The online store team is engaged in marketing to increase the number of loan applications and ship the goods on time, and follow the dynamics of sales growth in your personal account YES-Credit.ru

The button looks like this:

')

Today it is installed in about 100 stores. For example: apple-credit.ru

It was difficult

Developing payment solutions for online stores, we came up with a credit service on websites. We understood the demand immediately, but the creation of a legal model and a technical platform took 8 months.

It began with the development of a legal model with each bank, we had to create a technical platform for processing automatic processing of a loan application, which allows us to receive a solution from 8 banks in real time. And 8 banks are not the limit.

The most difficult thing was to decide how to sign a loan agreement outside the bank. But the road will be mastered by walking. And, despite the fact that at the start we were told “This is impossible!”, We managed to create such a team that did it.

About the team

The team was based on hard principles:

- honesty in relations with partners and colleagues

- positive thinking

- work on the result

In May 2011, the team consisted of only 9 people who worked without weekends and holidays. In January 2012 it is more than 80 people.

The process of selling on credit looks like this

To date, the system processes about 500-1500 applications per day from both online stores and retail stores. Beta testing ended December 31, 2011. During testing, the issues of service failure at high loads were resolved.

According to the results of beta testing, we have statistics from 30 stores from different industries: sales growth due to the connection of a credit service amounted to 34.8%. During the testing period, we paid over 120 million rubles to our partners (online shopping). An additional effect of connecting a credit service, according to online stores, is an increase in loyalty and trust in the site.

We have entered the stage of mass connection of online stores. For this purpose, an API was created that allows you to quickly and efficiently connect online stores on any platform.

Important: to fill in the loan application the client remains on the website of the online store. In February-March, we plan to connect 80-150 stores and process up to 10 thousand loan applications.

How does this happen from the point of view of the owner of an online store?

From the point of view of the owner of an online store, the system looks like an interface that allows you to monitor the life cycle of a loan application from the time it arrives until the loan agreement is signed with the customer in real time, plus data for statistics, application history, confirmation of product availability.

Conclusion

So, having entered into an agreement and installing the service on your website, the online store receives a reliable partner of YES-Credit, which turns loan applications into purchases, and bureaucratic problems, the correctness of filling out documents, taking money from banks takes over.

The online store team is engaged in marketing to increase the number of loan applications and ship the goods on time, and follow the dynamics of sales growth in your personal account YES-Credit.ru

Source: https://habr.com/ru/post/138115/

All Articles