How to run a startup at the university

Almost all students still from the college bench dream of launching their own startup, which will fire no worse than that of Zuckerberg or, at least, at Durov. Social networks, games, new services are opening here and there. Which way to go, what form of business to choose, how to develop at the most important initial stage and break less firewood? I will tell about one tested version.

I would like to devote this article to why we set up LLC in cooperation with SPbGETU (LETI) and what we got in the end. I would be happy to share experiences that I hope will help to realize your ideas.

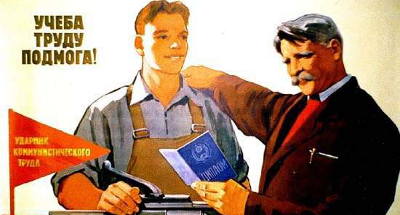

In any business there is a “sole proprietorship” stage, but a moment comes when you understand that there will be no further development without opening a legal entity. The solution of organizational problems when opening may cover you so much that you may not have time and energy to develop the business idea itself. Help may come from a completely unexpected side - go to the institution that you graduated from (or are graduating from). 10 years ago, our team did so, the laboratory at 30 meters became our first office, and the staff began to teach at the department of information technology. Since then, a lot of water has passed and much has changed.

')

Over the past two years, there has been a sharp increase in the activity of Russian universities in the direction of creating economic societies together with business structures and individuals. One of the reasons for this was the entry into force of Federal Law N 217-FZ on August 15, 2009.

Business interest

Creating together with the university an innovative enterprise carries a number of great opportunities. On the one hand, a university is a monstrous, cumbersome and extremely bureaucratic structure, in the best traditions of Soviet state institutions. On the other hand, it is an organization with a formed infrastructure that includes hundreds of premises, thousands of pieces of equipment, LANs, power networks, etc. Even if you do not take into account the benefits of 217-FZ, cooperation with the university provides a number of advantages:

- The university can offer rental of premises on preferential terms,

- University can provide equipment

- The university has a law department, accounting, marketing and other departments that you can contact for advice and help.

- In the end, the university can assist in the registration of a company.

In addition, a number of advantages offers 217-FZ:

- First, it is preferential taxation. According to the Federal Law N 310-, the companies established under 217-, can use the Simplified Taxation System (STS). This means that the company has no VAT (18%), the total rate for insurance premiums is only 14% (against 34 organizations operating for other organizations) and when choosing an object of taxation - “Income”, the tax rate will be 6%, which can be reduced until 3%.

- Secondly, the law makes it possible without long competitions to rent a room in your university or research institute.

Our selfish interest

After reading the above information in mid-2011, we decided to open a joint venture for new business areas. Our aspirations were as follows (some will explain):

- Legalization of commercial activities in the university

For a long time, our team "sat" on the areas of the department as a group of acting teachers. Most of the questions arose from the commissions checking the activities of the department. More recently, doing business in the walls of the alma mater was shameful. - Optimization of rental costs

- Tax burden reduction

Salary taxes - the most serious item of expenditure of the company. The savings can be spent at least on the development or simply to increase the salaries themselves. - Access to university projects

- Access to equipment

It upsets the fact of not using expensive hardware and software purchased by educational institutions under various grants and targeted programs. A small business at a university needs it and can find the right application for it. - The opportunity to participate in state competitions and programs

For example, before the establishment of an enterprise with a university, we did not have access to the Minobrov projects, we did not work with many government departments, including the military industrial complex. Now the situation is changing for the better. And finally, we have the opportunity to participate in various regional and federal programs and competitions aimed at supporting innovative small business and subsidizing its expenses.

University interest

Do you need it for universities? Yes, it is necessary, and there are several reasons. For a start - not the most positive, but typically Russian moment. The adoption of the 217-FZ was accompanied by loud speeches by Dmitry Medvedev and Andrey Fursenko, who called on universities to create small innovative enterprises together. In Russia, the wishes of senior officials are usually perceived as orders. Accordingly, the Federal Education Agency has put some pressure on the universities in this direction, demanding the creation of companies. The situation was aggravated by 83-, according to which state institutions are now obliged to earn money and conduct commercial activities.

Further more obvious reasons:

- Universities got the opportunity to commercialize their scientific developments, to attract extra-budgetary investments.

- Universities can carry out custom R & D through small enterprises in order to use tax breaks and target use of profits.

- Through small enterprises, universities can purchase equipment and materials without conducting long-term competitive procedures.

- A small business is a higher paying job than teaching for university staff and students.

- Universities have a great experience in participating in contests, they know how to knock out projects. But, unfortunately, many universities lack project performers. Small businesses also have the resources to carry out projects, and they could perfectly close this “hole”.

- Finally, universities can use the activities of a small enterprise in the educational process. So when teaching students there is more practical training, more “life examples”. On the basis of the enterprise, students can do practical work, perform certification work.

How to open a company?

The founders of a small innovative enterprise are 2 sides: university and business. The latter can be represented by two options:

- Commercial company (legal entity)

- Private founders (individuals)

Having a formed business (and for some political reasons), we became the founder of a small innovative enterprise as a legal entity.

Formation of a package of documents

After reviewing the 217-FZ and other regulatory documents on the topic, having enlisted the support of two key persons (the head of the department and the vice-rector for scientific work), we began to prepare documents. Operational work was carried out with the head of the university's innovation department, who oversaw the work of opening both our and previously created companies. Having received from him a package of “blanks” of constituent documents, we edited them for our tasks and sent us to register an LLC with a third-party company.

Overview of required documents:

- A memo to the Rector of the University with a request to consider the proposal of the department and the co-founder company on the establishment of a limited liability company at SPbETU is the very first document. On the basis of the memorandum, the rector brings this issue to the meeting of the Academic Council.

- Presentation of the enterprise . It is necessary to conduct a presentation of the enterprise being created at a meeting of the Academic Council. To do this, we have prepared a short, rigorous and nondescript presentation on the form of the university and the accompanying speech to it. The academic council of the university approves the proposal to establish the enterprise.

- Minutes of the meeting of the founders of the company . The document lists the decisions of the founders on the essential aspects of the company, including the decision to create a company, conclude an agreement on the establishment and agree on the company's charter.

- Agreement on the establishment of the company .

- Charter of the company . A detailed description of all facets of society.

- License agreement for the transfer to the newly created company of non-exclusive rights to use the REED.

What should pay attention

- According to 217-FZ, the share of the university in the authorized capital of the company should be more than 33.3%

- Rights to the result of intellectual activity made by the university as a contribution to the share capital must necessarily belong to the university.

The choice of location (ex. Yradres)

Considering that in the future the company will be located on the territory of the university and will officially rent the premises, it is advisable to indicate the address of the university as the location of the company, as we did.

Taxation

When opening a company, you must immediately report to the tax (separate statement) the type of taxation that will be used by the company (simplified STS or general DOS). Here we must consult with accountants - start-up companies recommend choosing a simplified text.

Bank account

It was necessary to provide notarized copies of the statutory documents of all the founders. The documents of the institute can be obtained in the legal department or, as in our case, make notarial copies of originals issued on receipt to an employee of the university. The lack of a lease agreement for premises caused a hardship (there is such a requirement of the Central Bank of the Russian Federation to counter laundering and terrorism). As a temporary solution to the issue, a letter of guarantee from the university to provide premises for rent helped. The fact of opening an account must be reported to the tax and funds, otherwise there will be huge fines.

Letter to TsISN

The decision on the compliance of the established enterprise with the Federal Law 217- is made by the Center for Research and Statistics of Science . Until the enterprise is included in the registry of business companies established under 217-FZ, the company will not be able to enjoy the benefits and advantages prescribed by law. Therefore, a very important step will be the preparation and sending of a Letter of Notification to the TsISN on the establishment of a small enterprise. Together with the letter you need to send a pack of certified copies of constituent and some other documents. By the way, it is not necessary to certify them with a notary (in order not to spend money): copies of all constituent documents can be certified by the general director of the established company, and copies of documents relating to the university are certified by the rector.

The room

In order for your company not to be virtual and the staff were not scattered around the department, it is necessary to resolve the issue of placement. Direct, but not the best option - to enter into a lease agreement with the university. By the way, the economic and administrative service of the university will not like it, because you are eligible for benefits and they will not receive extrabudgetary funds. An option that will suit everyone is the creation of a specialized teaching and research laboratory at the department. The cathedral premises are not included in the rental turnover, business managers have no complaints, and it is easier to agree with the department by partially closing the educational and scientific process, improving reporting, not to mention contractual works.

The procedure for the formation of the laboratory in the documents: Memo note on the creation of the educational and scientific laboratory UNL → Cooperation Agreement → Order of the Rector → Regulations on the UNL

Results in accordance with the tasks

- Commercial activity within the university is legalized by a joint LLC and a number of cooperation agreements.

- Premises: gave 100-meter rented premises, received 140-meter in the form of UNL.

- Tax burden reduction

- Access to university projects have already been received: they began to develop a system for recording and registering scientific and innovative activities of the university. We will tell about it in detail in a separate post.

- Access to equipment. We were lucky: the new UNL institute decided to equip it with the latest multimedia and server hardware, with us the repair of the premises.

- The possibility of participating in state contests and programs is still ahead.

PS New company called URANSOFT

I thank staskin1 for help in preparing the article.

Source: https://habr.com/ru/post/135533/

All Articles