Gold Rush in the market of P2P cryptocurrency

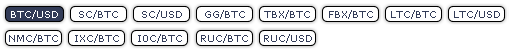

Having recently gone to the exchange to change bitcoins, I was surprised to find in the list of currency pairs not only the standard BTC / USD, but a dozen more strange abbreviations. In the chat next to the quotes, the people vigorously discussed which of the bubbles will last for how many weeks and how quickly to drain the candy wrappers, until the barrel organ died. They lucidly explained to beginners (like me) that all new cryptocurrencies have two ways: either a plentiful pre-mining by the system creator (read, fraud), or a small amount of coins and low complexity in the early cycle, when any strong miner can compromise the system (the so-called "51% vulnerability").

At the same time, "investors" are well aware that the market value of all cryptocurrencies in dollar terms does not exceed the turnover for any one junk share (with a cost of 1 cent per share) in the US stock market. This does not stop them from wanting to get into the first rows of a kind of “pyramid”, that is, quickly minimizing a large number of Coins at the stage of low complexity and have time to sell them before the pyramid collapsed.

It turns out that the discovery of Bitcoin source codes and the relative success of BTC gave rise to the emergence of a whole brood of obscure clones. In miner circles, the Bitcoin system is considered almost a “gold standard”, because it exists for three whole years - a huge period of Internet time - and looks like an unshakable lump compared to new candy wrappers, Bitcoin forks or Bitcoin forks (there is even one Forked fork from fork Bitcoin, that is fork of the third level).

')

In the world, cryptocurrency literally boils life, albeit at the level of microorganisms, but boils. For me, this was some discovery. Although it is clear that most of these undertakings will end in zilch, and the creators obviously set themselves only one goal - to enrich themselves through premining. Otherwise, what's the point of creating something new if BTC works fine. Anyway, here is a list of basic P2P cryptocurrencies modeled on Bitcoin, created to date, with a brief description of the key points (network performance is indicated in October 2011).

- Ixcoin : launch in May 2011, the creator of the system Thomas Nasakioto (Thomas Nasakioto) naynil 580k coins before launching. Looks like a scam. The system competes for GPU resources with Bitcoin. The current network performance is about 2 gigahagesh / s (that is, it can be considered dead).

- i0coin : fork from ixcoin, but without pre-mining. The system did not receive much support from the very beginning after its launch. Dead (~ 5 Gh / s). The domain is already on sale for 35 BTC.

- SolidCoin : an innovative high speed transaction system. The author is considered to be the famous forum character CoinHunter, but the generation of new units under the old protocol was stopped due to security problems, after the release of 2.0, the generation was resumed, however, the author is openly accused of fraud .

- GeistGeld : developer Lolcust mined 7.7 million coins. The system stands out with an extreme block generation rate every 15 seconds. While alive (~ 15 Gh / s).

- Tenebrix : an analogue of the above system, only for mining on a CPU with the innovative use of the scrypt function. Here, too, Lolcust mined 7.7 million coins. Current capacity ~ 0.003 Gh / s.

- Fairbrix : A copy of Tenebrix, but without premining. Initial startup failed due to improper configuration. Restarting tried to disrupt detractors by attacking the system. Currently not listed on the stock exchanges, current activity ~ 0.0001 Gh / s.

- Litecoin : launched in October 2011, a “lightweight” version of Bitcoin with weak crypto-protection (fewer transaction confirmations) and faster transaction times. If Bitcoin is considered the virtual equivalent of gold, then Litecoin developers propose to consider their system as the equivalent of silver.

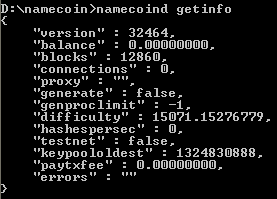

I admired this zoo and noted for myself only one potentially useful Namecoin system (NMC coins), which was created to serve the cryptographically protected domain zone .bit. This “currency” is based on the concept of Bitcoin and is calculated in hashes along with BTC.

The coins themselves are designed to register domains in the .bit zone. Thanks to the Bitcoin cryptographic subsystem, these domains are protected from being changed by anyone other than their owners, and each Namecoin system can raise a DNS server on its PC.

For example, if SOPA is adopted, .bit domains can be a real substitute for the open Internet, some sites can be migrated to this secure P2P DNS system. To date, the number of domains in the .bit zone is 10,048 pieces.

PS About a month ago I was contacted by a colleague who asked me to evaluate the prospects for financing the “mega-project” from Ukrainian developers. The project is positioned as “Bitcoin 2 ” (BTC2) and boasts a mention on TechCrunch. A colleague explained that the BTC2 financial system provides for a “flexible emission machine” and “essentially unlimited emission”. At this conversation could finish. When I asked why creating a new cryptocurrency when there is Bitcoin, the answer was that “the standard Bitcoin algorithm lacks the function of converting into objects with programmable templates (stocks, other currencies, securities, signatures, documents, passports, any objects)” .

There is nothing to add here, because I really do not want to offend the Ukrainian developers by comparing with their countryman by the name of Bender, but for some reason it doesn’t come up with any other comparisons. In general, what is happening on the cryptocurrency market now looks like a real gold rush. It's only the beginning.

Source: https://habr.com/ru/post/135330/

All Articles