tma (Part 3) Why you can't automate financial accounting

The second part of

Three years ago I gave a presentation at a large real estate holding. Among the audience was the financial director of the holding, who said:

“Financial accounting cannot be automated!”

This statement is based on the fact that even with serious ERP systems, financiers have to deal with the formation of financial statements after the end of the reporting period almost manually.

')

In the first two articles, the tma-system was described by me as an instrumental-applied methodology, which allows automating in a single system not only management, but also financial accounting, and hence the work on the formation of financial statements, as well as the work on keeping accounts (accounting) .

Why, in the face of modern realities, is the above mentioned CFO right? After all, we can not refute the facts on which his statement is based.

To answer this question, you need to deal with the most basic fundamentals of accounting (financial) accounting, and at the same time “mock up” over financiers from an IT point of view. After all, it is the financiers who provide technical tasks for the automated solution of their special tasks, and as a result, they themselves use the computer only as a typewriter.

Assuming that many Habr's readers are unfamiliar with the basics of accounting / financial accounting, I will sign for more and more detail from a technical point of view. Conclusions will follow.

To begin, consider the concept of accounting form as a technical device.

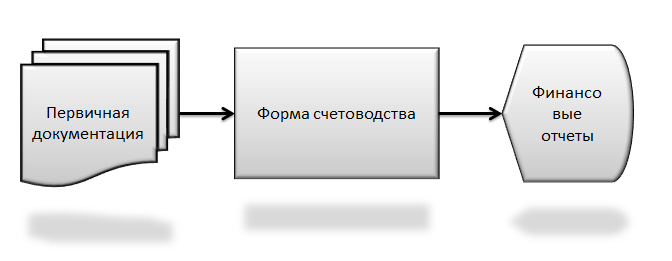

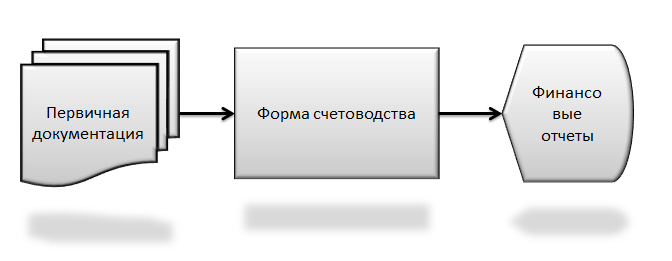

In essence, the form of bookkeeping is all that lies between the primary documents and the accounts. This provision assumes that the data of the primary documents form the input form, and the accounting (financial) statements - its output. For all but accountants, the form is a black box, ...

Sokolov I.V.

It is in this device and there are some problems for automation. IT specialists have long spat on this “black-cheek” device and are trying to assemble the top of the pyramid (financial reports), aggregating the values of various management reports. There are many achievements, but the formation of financial reports still causes great difficulties. Let's deal with thisdevice black box.

From the point of view of IT, these are electronic source documents. They reflect all financial and business transactions. Moreover, in one document of such operations there can be both one and many.

In fact, the entry into the accounting form is not the primary documents themselves, but financial and business operations (any single operation of an enterprise or an individual that changes its financial condition).

In actual practice, entry into the form occurs at the time of the “holding” of the document (usually manually :)), i.e. when on the basis of the primary document form the so-called "accounting entries".

In English, this part of the accounting process is called “bookkeeping” (the only word where three letters in a row are duplicated). This process originated in the "paper" account, and migrated to the computer without much automation.

Who is not familiar with this concept, you can read more here .

Oh, great and mighty double recording! All accountants pray to her as the greatest value received from above.

Oh, great debit with credit! The sums of the values of which are always equal thanks to this gift from above - double entries.

Accountants are unaware that they have long been working not with books and paper tablets, but with relational databases.

Enter the search query "double entry flaws" or "disadvantages of double entry". All that you find there is written 100 years ago.

What kind of automation of financial accounting can we talk about in such a scenario?

The only real significant disadvantage of an omnipotent double entry is its inability to take into account changes in value over time.

Here you can throw a stone in the IT garden. For example, open for accounting any modern ERP or other system with financial functions and the first thing you need to specify is what accounting currency you will keep your records in. After entering the first operation, changing this setting is impossible (well, or very difficult). And it is precisely in this that the heritage obtained from the double record, which has more than five centuries (if not to count the ancient Incas with nodular script), manifests itself.

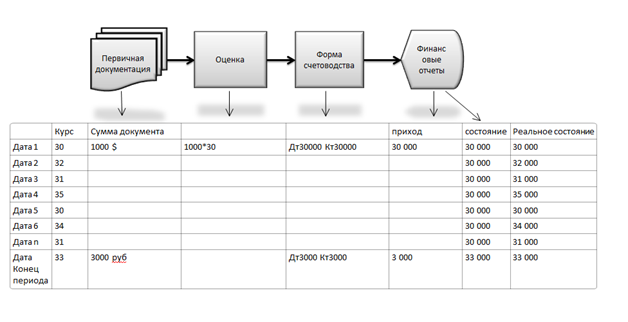

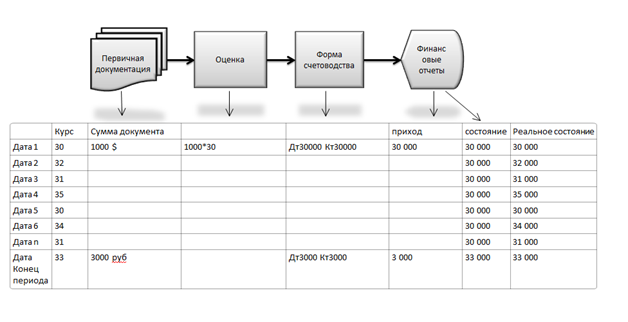

In order for the debit amounts to be equal to the loan amounts (read: all positive values in the account are equal to all negative), the accounting is conducted in a single accounting currency. Before the data enters the black box of the accounting form, it is necessary to evaluate them (to bring into the value of the accounting currency). If the cost changes over time, then everything in the black box remains the same.

I will give an example:

You took out a loan of $ 1,000, but the bank transferred rubles to you at the rate of the Central Bank ($ 1 = 30 rubles) on the day of the transaction. (let it be the primary document)

Your accounting currency is rubles (we live in Russia).

According to the principle of double entry, a positive amount (to the debit of the account) and a negative (to the credit of another account) must be recorded in the account, these amounts must be in the accounting currency.

30,000 rubles arrived on the Money account, and 30,000 rubles lost on the settlement account with the bank. Now you have money and debt, and this is reflected in the financial statements.

The next day, the dollar exchange rate for the Central Bank changed: 1 dollar = 31 rubles. But after all, nothing will change in your account. So you will have 30,000 rubles of money and 30,000 rubles of debt, although you have $ 1,000 in debt, which means that after a change in the course you should owe 31,000 rubles.

From this point on, the accounting department will continue to live until the end of the reporting period, when it becomes necessary to generate correct financial reports.

In order to reflect in the accounting of the actual state, it is necessary to form a primary document reflecting the financial and business transaction, which in reality was not. In the case of money, you must enter the exchange rate adjustment; in the case of values and debts, revaluation.

It would seem that this procedure can be automated, but there are difficulties with preserving the integrity of the data. It is necessary to maintain the relationship between the value on which the revaluation is accrued and the revaluation itself. Since in the case of adjusting the amount itself, it is necessary to adjust all revaluations for this amount.

In practice, at the end of the reporting period, all these exchange rate adjustments turn into a real headache for all financiers.

But that's not all.

Since we have to (in accordance with the principle of double entry) evaluate everything in the accounting currency before recording (black box), then when values move, the notion of cost price arises, which is “crammed” into accounting. Here you and FIFO, and batch accounting, and the mass of everything else. But why is this all in automated accounting, if it refers to the calculated values?

Example:

You bought a unit of goods for 100 rubles. She lay in your warehouse for 2 months, and then you sold it for 150 rubles. At that moment, the supplier was selling the same product at 120 rubles.

Question: Your profit from the sale of 50 rubles or 30 rubles.

According to all the canons of modern accounting methods, the answer, of course, is 50.

But there is common sense! If you had this unit in stock, you would have bought it from a supplier for 120 and sold it for 150 with a surcharge of 30. Consequently, you received 20 rubles of income not from the sale, but from the fact that this unit simply lay in you in stock. In other words, this is a reappraisal, which double entry cannot account for, and all the canons are constructed taking into account its lack .

It should be possible to look at the cost of values from different points of view: FIFO; average method; the actual cost of the supplier, etc. For the shortcomings of a double record, we keep records not only in a single accounting currency, but also in a single system of cost values .

From a seemingly one small flaw - the fundamental principle of double-entry, heavy, slow-moving accounting automated systems emerge, which in reality do not cope with their task, and the financiers continue to do their work (generating financial reports) virtually by hand.

We introduce the concept of Total Management Accounting (TMA) to determine the class of systems that will be deprived of the above disadvantages.

The tma class system should have the following properties:

- In accounting there is no concept of accounting (reference currency);

- The triad of financial statements is formed in any currency or other accounting unit, while exchange rate corrections and revaluations in reports must be formed equivalent to this currency as accounting;

- Course corrections and revaluations are taken into account systematically, i.e. no need to enter them as additional operations;

- "Conducting" documents in the account should be automated;

- Ability to calculate reports in various cost options.

We believe that tma will open up new, expanded financial management capabilities, allowing all interested parties to control the business in real time and real values and make the right management and strategic decisions.

In all three articles, the definitions of some terms were given in order to clarify what is meant in context. I do not claim to refute or amend the definitions already made in various sources. Therefore, please do not argue about terms.

I am pleased to answer all questions in the comments or in a personal.

Three years ago I gave a presentation at a large real estate holding. Among the audience was the financial director of the holding, who said:

“Financial accounting cannot be automated!”

This statement is based on the fact that even with serious ERP systems, financiers have to deal with the formation of financial statements after the end of the reporting period almost manually.

')

In the first two articles, the tma-system was described by me as an instrumental-applied methodology, which allows automating in a single system not only management, but also financial accounting, and hence the work on the formation of financial statements, as well as the work on keeping accounts (accounting) .

Why, in the face of modern realities, is the above mentioned CFO right? After all, we can not refute the facts on which his statement is based.

To answer this question, you need to deal with the most basic fundamentals of accounting (financial) accounting, and at the same time “mock up” over financiers from an IT point of view. After all, it is the financiers who provide technical tasks for the automated solution of their special tasks, and as a result, they themselves use the computer only as a typewriter.

Assuming that many Habr's readers are unfamiliar with the basics of accounting / financial accounting, I will sign for more and more detail from a technical point of view. Conclusions will follow.

To begin, consider the concept of accounting form as a technical device.

In essence, the form of bookkeeping is all that lies between the primary documents and the accounts. This provision assumes that the data of the primary documents form the input form, and the accounting (financial) statements - its output. For all but accountants, the form is a black box, ...

Sokolov I.V.

It is in this device and there are some problems for automation. IT specialists have long spat on this “black-cheek” device and are trying to assemble the top of the pyramid (financial reports), aggregating the values of various management reports. There are many achievements, but the formation of financial reports still causes great difficulties. Let's deal with this

Source documents

From the point of view of IT, these are electronic source documents. They reflect all financial and business transactions. Moreover, in one document of such operations there can be both one and many.

In fact, the entry into the accounting form is not the primary documents themselves, but financial and business operations (any single operation of an enterprise or an individual that changes its financial condition).

In actual practice, entry into the form occurs at the time of the “holding” of the document (usually manually :)), i.e. when on the basis of the primary document form the so-called "accounting entries".

In English, this part of the accounting process is called “bookkeeping” (the only word where three letters in a row are duplicated). This process originated in the "paper" account, and migrated to the computer without much automation.

Double entry

Who is not familiar with this concept, you can read more here .

Oh, great and mighty double recording! All accountants pray to her as the greatest value received from above.

Oh, great debit with credit! The sums of the values of which are always equal thanks to this gift from above - double entries.

Accountants are unaware that they have long been working not with books and paper tablets, but with relational databases.

Enter the search query "double entry flaws" or "disadvantages of double entry". All that you find there is written 100 years ago.

What kind of automation of financial accounting can we talk about in such a scenario?

The only real significant disadvantage of an omnipotent double entry is its inability to take into account changes in value over time.

Here you can throw a stone in the IT garden. For example, open for accounting any modern ERP or other system with financial functions and the first thing you need to specify is what accounting currency you will keep your records in. After entering the first operation, changing this setting is impossible (well, or very difficult). And it is precisely in this that the heritage obtained from the double record, which has more than five centuries (if not to count the ancient Incas with nodular script), manifests itself.

In order for the debit amounts to be equal to the loan amounts (read: all positive values in the account are equal to all negative), the accounting is conducted in a single accounting currency. Before the data enters the black box of the accounting form, it is necessary to evaluate them (to bring into the value of the accounting currency). If the cost changes over time, then everything in the black box remains the same.

I will give an example:

You took out a loan of $ 1,000, but the bank transferred rubles to you at the rate of the Central Bank ($ 1 = 30 rubles) on the day of the transaction. (let it be the primary document)

Your accounting currency is rubles (we live in Russia).

According to the principle of double entry, a positive amount (to the debit of the account) and a negative (to the credit of another account) must be recorded in the account, these amounts must be in the accounting currency.

30,000 rubles arrived on the Money account, and 30,000 rubles lost on the settlement account with the bank. Now you have money and debt, and this is reflected in the financial statements.

The next day, the dollar exchange rate for the Central Bank changed: 1 dollar = 31 rubles. But after all, nothing will change in your account. So you will have 30,000 rubles of money and 30,000 rubles of debt, although you have $ 1,000 in debt, which means that after a change in the course you should owe 31,000 rubles.

From this point on, the accounting department will continue to live until the end of the reporting period, when it becomes necessary to generate correct financial reports.

In order to reflect in the accounting of the actual state, it is necessary to form a primary document reflecting the financial and business transaction, which in reality was not. In the case of money, you must enter the exchange rate adjustment; in the case of values and debts, revaluation.

It would seem that this procedure can be automated, but there are difficulties with preserving the integrity of the data. It is necessary to maintain the relationship between the value on which the revaluation is accrued and the revaluation itself. Since in the case of adjusting the amount itself, it is necessary to adjust all revaluations for this amount.

In practice, at the end of the reporting period, all these exchange rate adjustments turn into a real headache for all financiers.

But that's not all.

Since we have to (in accordance with the principle of double entry) evaluate everything in the accounting currency before recording (black box), then when values move, the notion of cost price arises, which is “crammed” into accounting. Here you and FIFO, and batch accounting, and the mass of everything else. But why is this all in automated accounting, if it refers to the calculated values?

Example:

You bought a unit of goods for 100 rubles. She lay in your warehouse for 2 months, and then you sold it for 150 rubles. At that moment, the supplier was selling the same product at 120 rubles.

Question: Your profit from the sale of 50 rubles or 30 rubles.

According to all the canons of modern accounting methods, the answer, of course, is 50.

But there is common sense! If you had this unit in stock, you would have bought it from a supplier for 120 and sold it for 150 with a surcharge of 30. Consequently, you received 20 rubles of income not from the sale, but from the fact that this unit simply lay in you in stock. In other words, this is a reappraisal, which double entry cannot account for, and all the canons are constructed taking into account its lack .

It should be possible to look at the cost of values from different points of view: FIFO; average method; the actual cost of the supplier, etc. For the shortcomings of a double record, we keep records not only in a single accounting currency, but also in a single system of cost values .

Conclusion:

From a seemingly one small flaw - the fundamental principle of double-entry, heavy, slow-moving accounting automated systems emerge, which in reality do not cope with their task, and the financiers continue to do their work (generating financial reports) virtually by hand.

We introduce the concept of Total Management Accounting (TMA) to determine the class of systems that will be deprived of the above disadvantages.

The tma class system should have the following properties:

- In accounting there is no concept of accounting (reference currency);

- The triad of financial statements is formed in any currency or other accounting unit, while exchange rate corrections and revaluations in reports must be formed equivalent to this currency as accounting;

- Course corrections and revaluations are taken into account systematically, i.e. no need to enter them as additional operations;

- "Conducting" documents in the account should be automated;

- Ability to calculate reports in various cost options.

We believe that tma will open up new, expanded financial management capabilities, allowing all interested parties to control the business in real time and real values and make the right management and strategic decisions.

In all three articles, the definitions of some terms were given in order to clarify what is meant in context. I do not claim to refute or amend the definitions already made in various sources. Therefore, please do not argue about terms.

I am pleased to answer all questions in the comments or in a personal.

Source: https://habr.com/ru/post/134357/

All Articles