tma (part 2) - Daily financial reports and automated monitoring of key success indicators

First part.

Imagine such a situation. You have invested and founded a business. In total, the invested capital amounted to 10 million rubles.

We exaggerate to the “ideal situation” when a business works as a well-established mechanism, brings income and does not require your participation (the dream of any business owner). You can sunbathe on the beach and spend the money received.

Throughout the year, the management of the company regularly pays you good dividends, which are enough to carelessly spend time at your own pleasure.

It is a terrible day when suddenly they do not pay the money due and argue it with various current difficulties. And this is repeated again and again, month after month.

When you returned and dealt with the affairs, it turned out (again I was exaggerating) that the business was working at a loss, and the dividends were paid, diluting the assets. There are neither assets, nor invested capital, nor, in principle, the business itself. An eternal Russian question arises: Who is to blame and what to do?

')

In order to prevent this from happening, it is necessary to monitor the condition of the assets and the success of the business. The question is how to do it while sitting on the beach?

The main thing that needs to be controlled in the first place is the return on invested capital. Probably every business owner knows the target return on their capital. You can use other indicators of business success, but for example we use this.

Your success rate is 40% per year. Those. You will be satisfied if the business will earn at least 4 million a year. Half, for example, you are ready to leave for business development, and half to take away in order to spend carefree time on the beach. You know for sure that you need to intervene in the business if this figure drops below 20%.

Most likely you will be satisfied with such an automated system that calculates this figure daily for the past 365 days (the more days, the less sensitivity). If on any of the days the indicator specified above falls below the critical level, you will receive an SMS to your mobile phone and begin to deal with the situation without delay, without waiting for the end of the reporting period. At this very moment you will be able to watch the full financial reports, to detail and analyze in order to find the reasons for the decline in the key success rate.

If the control of financial indicators is automated, then you can monitor dozens or even hundreds of indicators, initially setting the minimum critical values.

A couple of examples:

- The amount of customer receivables should not be more than 30% of the amount of assets

- The ratio of own and borrowed capital should not be more than 50%

- Money, on average, should not be less than 1 million rubles.

There are hundreds of such examples.

In normal practice, we can set target values for the future. At the end of the period when financial statements are ready, you can compare the plan with actual performance. The “trick” is that if you have such a system, you can really lie on the beach, enjoy your mojito and at the same time keep abreast of the status of your assets - that is, monitor your business success.

This is how clients during the crisis behaved :) (Schedule from life)

Revolutions began to fall. The money was paid with a long delay, respectively, receivables began to grow. As a result, a decrease in the turnover ratio of receivables.

If you adjust the daily registration of all financial and business operations in the tma-system, then thanks to the fully automated accounting process, a triad of financial reports can be received every day.

The problem is that the very format of financial statements does not allow to adequately reflect these reports in real time. Data not suitable for analysis.

In the tma system, the period can be determined by the number of days. Then the financial statements will be formed at the end of each day for the specified non-calendar period . At the same time, for the purpose of analysis, the balance sheet data is averaged over the values at the end of each day in the period, and the values of the income statement and cash flow are summed over the entire period.

It can look like this

Presentation of such data in the form of graphs will allow to achieve the most effective results. Here you have a tool for high-quality vertical and horizontal analysis.

An example of a balance (statement of financial position (condition)) in graphical form with a billing period of 31 days:

Example of a schedule of income and expenses for a billing period of 31 days:

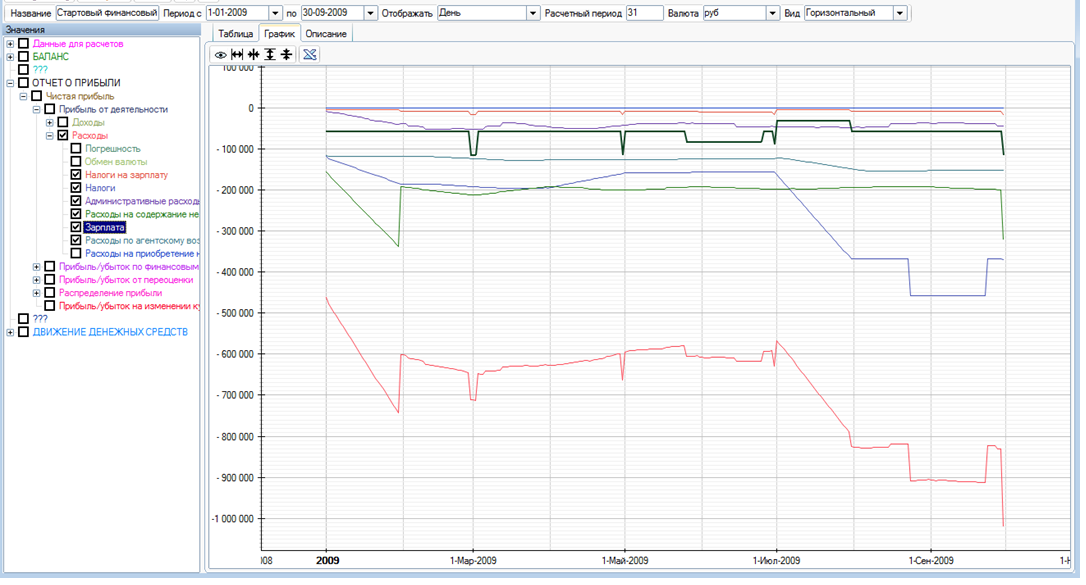

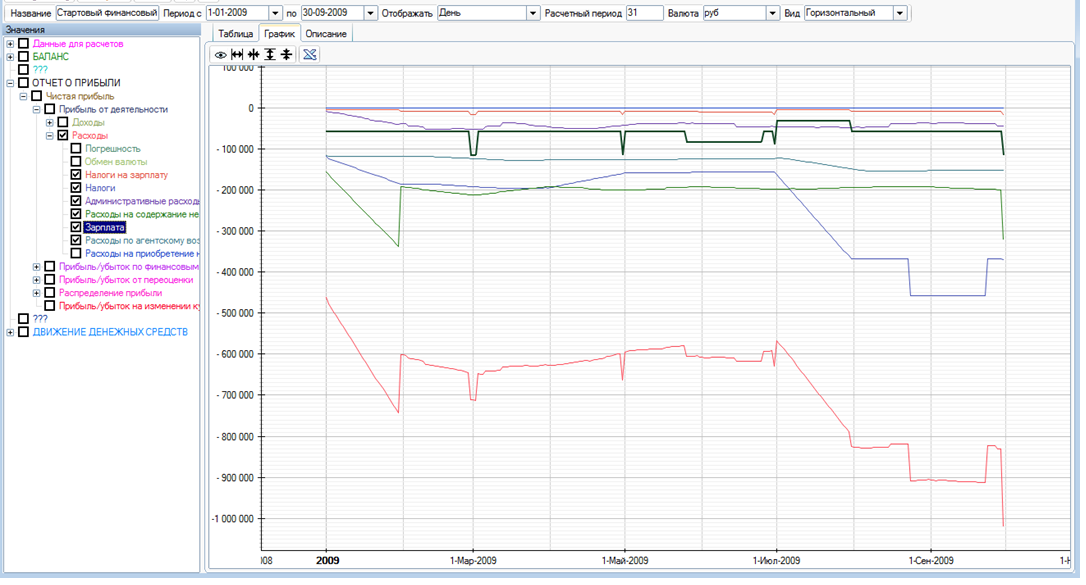

But the detail of the cost of the estimated period of 31 days:

In addition to using the tma-system for the purpose of automated day - to-day monitoring of key indicators of business success, it is necessary to ensure the daily operational process of registering financial and business operations.

Example:

The organization leases space and "sits" on a simplified tax system. USN is calculated and charged in the accounting once a quarter. But in fact, the company bears the cost of this tax every day under the lease agreement. Thus, the primary document “lease agreement” must not only charge the respective rental amount daily, but also the estimated USN.

The final STS at the end of the quarter will not converge with the accounting. (that is life :)). Therefore, you need to enter into the system a correction document at the time of receipt of the exact quarterly amount from accounting.

Despite the fact that the process of launching daily financial accounting at an enterprise is extremely complicated, it is really worth it. Anticipated opinion that this is only suitable for small businesses, I note that the size of the business does not matter.

In practice, we are faced with a terrifying situation with the lack of monthly financial reports on most enterprises. Therefore, it should be noted that first of all it is necessary to achieve adequate monthly reports and only then go on to everyday ones.

In the next article I will reveal the main complexity of the automation of financial accounting to the level of everyday life. It will be a question of revaluations and course corrections.

The system of beach management company or automated monitoring of key indicators of success.

Imagine such a situation. You have invested and founded a business. In total, the invested capital amounted to 10 million rubles.

We exaggerate to the “ideal situation” when a business works as a well-established mechanism, brings income and does not require your participation (the dream of any business owner). You can sunbathe on the beach and spend the money received.

Throughout the year, the management of the company regularly pays you good dividends, which are enough to carelessly spend time at your own pleasure.

It is a terrible day when suddenly they do not pay the money due and argue it with various current difficulties. And this is repeated again and again, month after month.

When you returned and dealt with the affairs, it turned out (again I was exaggerating) that the business was working at a loss, and the dividends were paid, diluting the assets. There are neither assets, nor invested capital, nor, in principle, the business itself. An eternal Russian question arises: Who is to blame and what to do?

')

In order to prevent this from happening, it is necessary to monitor the condition of the assets and the success of the business. The question is how to do it while sitting on the beach?

The main thing that needs to be controlled in the first place is the return on invested capital. Probably every business owner knows the target return on their capital. You can use other indicators of business success, but for example we use this.

Your success rate is 40% per year. Those. You will be satisfied if the business will earn at least 4 million a year. Half, for example, you are ready to leave for business development, and half to take away in order to spend carefree time on the beach. You know for sure that you need to intervene in the business if this figure drops below 20%.

Most likely you will be satisfied with such an automated system that calculates this figure daily for the past 365 days (the more days, the less sensitivity). If on any of the days the indicator specified above falls below the critical level, you will receive an SMS to your mobile phone and begin to deal with the situation without delay, without waiting for the end of the reporting period. At this very moment you will be able to watch the full financial reports, to detail and analyze in order to find the reasons for the decline in the key success rate.

If the control of financial indicators is automated, then you can monitor dozens or even hundreds of indicators, initially setting the minimum critical values.

A couple of examples:

- The amount of customer receivables should not be more than 30% of the amount of assets

- The ratio of own and borrowed capital should not be more than 50%

- Money, on average, should not be less than 1 million rubles.

There are hundreds of such examples.

In normal practice, we can set target values for the future. At the end of the period when financial statements are ready, you can compare the plan with actual performance. The “trick” is that if you have such a system, you can really lie on the beach, enjoy your mojito and at the same time keep abreast of the status of your assets - that is, monitor your business success.

This is how clients during the crisis behaved :) (Schedule from life)

Revolutions began to fall. The money was paid with a long delay, respectively, receivables began to grow. As a result, a decrease in the turnover ratio of receivables.

Daily financial reports.

If you adjust the daily registration of all financial and business operations in the tma-system, then thanks to the fully automated accounting process, a triad of financial reports can be received every day.

The problem is that the very format of financial statements does not allow to adequately reflect these reports in real time. Data not suitable for analysis.

In the tma system, the period can be determined by the number of days. Then the financial statements will be formed at the end of each day for the specified non-calendar period . At the same time, for the purpose of analysis, the balance sheet data is averaged over the values at the end of each day in the period, and the values of the income statement and cash flow are summed over the entire period.

It can look like this

Presentation of such data in the form of graphs will allow to achieve the most effective results. Here you have a tool for high-quality vertical and horizontal analysis.

An example of a balance (statement of financial position (condition)) in graphical form with a billing period of 31 days:

Example of a schedule of income and expenses for a billing period of 31 days:

But the detail of the cost of the estimated period of 31 days:

In addition to using the tma-system for the purpose of automated day - to-day monitoring of key indicators of business success, it is necessary to ensure the daily operational process of registering financial and business operations.

Example:

The organization leases space and "sits" on a simplified tax system. USN is calculated and charged in the accounting once a quarter. But in fact, the company bears the cost of this tax every day under the lease agreement. Thus, the primary document “lease agreement” must not only charge the respective rental amount daily, but also the estimated USN.

The final STS at the end of the quarter will not converge with the accounting. (that is life :)). Therefore, you need to enter into the system a correction document at the time of receipt of the exact quarterly amount from accounting.

Despite the fact that the process of launching daily financial accounting at an enterprise is extremely complicated, it is really worth it. Anticipated opinion that this is only suitable for small businesses, I note that the size of the business does not matter.

In practice, we are faced with a terrifying situation with the lack of monthly financial reports on most enterprises. Therefore, it should be noted that first of all it is necessary to achieve adequate monthly reports and only then go on to everyday ones.

In the next article I will reveal the main complexity of the automation of financial accounting to the level of everyday life. It will be a question of revaluations and course corrections.

Source: https://habr.com/ru/post/134085/

All Articles