Business intelligence

I became acquainted with the books of V. Savchuk. many years ago. It was these books that allowed me to understand financial management as a business owner. Today, at the request of the author, I place his article on Habré, the main motto of which: automation of accounting and management begins in people's brains.

I became acquainted with the books of V. Savchuk. many years ago. It was these books that allowed me to understand financial management as a business owner. Today, at the request of the author, I place his article on Habré, the main motto of which: automation of accounting and management begins in people's brains.Business Intelligence: principles, technology, training

V.P. Savchuk

Managing Partner of the group of companies

"Strategic Partner"

In modern conditions, there is a heightened interest of many business owners and managers in Business Intelligence, or more briefly BI. This short term implies an interconnected complex of modern business management methods built on modern information technologies and allowing for maximum business efficiency.

Many top managers of domestic companies associate this concept with the corresponding functionality of modern information systems. And here lies a significant misconception of many domestic managers. The fact is that BI begins in the brains of top managers of companies, and then it is already implemented using an information product . Managers of domestic companies must grow to understand the importance of BI, and then buy adequate software.

What is included in the portfolio of management tools, united by the common name Business Intelligence? .. The article pursues two goals:

1) to formulate the principles of BI,

2) to present the structure and give a brief description of the tools of BI.

I. Basic Business Intelligence Principles

')

In the overwhelming majority of cases, business management is based on the so-called “black box” model. The available resources (money, people, equipment, etc.) come to the model input, and the model gives the result in the form of profit and cash flow. How these inputs are converted to the final result, the model does not fully explain clearly. And this is the main "ambush" for business. Suddenly, a business can lose profit and cease to be solvent, not really understanding why this happened ... The “intelligent” business management model should not be a black box model, it should ensure clarity and transparency of the business processes occurring in it.

So we come to the first principle of BI:

The first principle of BI: Business management should be based on a transparent model that is understandable to the management team and allows you to associate the input resources of a business with its end result over a period of interest.

The format of the final result is determined by the owner or on his instructions by the head of the business. Some may be interested in the total cash flow from operating activities. Someone is more focused on the amount of operating profit - now EBIT and EBITDA are very popular. Some of the most advanced managers operate on the concept of business value, considering the so-called economic value added EVA as the most significant indicator. The owner or manager chooses these indicators on the basis of the goals that he faces in the relevant period of time. This is a significant feature of BI - management should be carried out according to goals. The goal is first set, and then achieved. The latter (i.e., achievement) is not always possible, but the former must be present necessarily. Setting goals and trying to achieve them is a property of any conscious process, but BI treats it with the greatest responsibility. It makes digitize targets.

First you need to understand the important thing that distinguishes goals in general from business goals. The fact is that the goals of a business are ultimately aimed at the main criterion - the amount of money earned, which has a clear quantitative expression. For this reason, all other targets should also be quantified. In business, you can't say: let's increase sales. This goal will not be perceived by management as a guide to action. In order for the manager to strive to achieve this goal, it is necessary first of all for the goal to be more specific, for example, over the next year, sales should be increased by 22% compared to the current year. From this point of view, the effectiveness of the manager will be determined depending on how he achieved this goal.

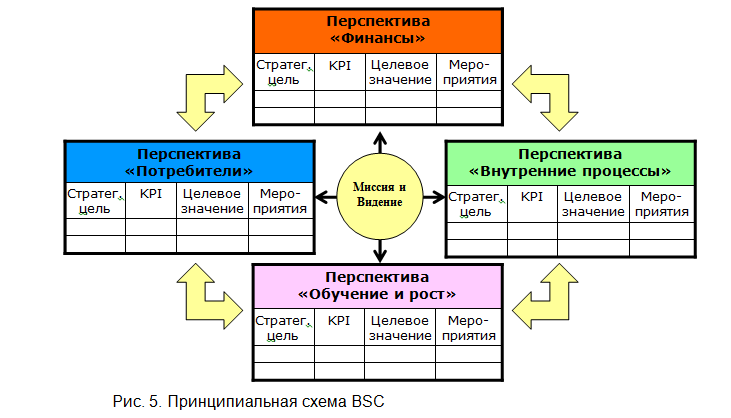

So we come to the fundamental concept of BI, which is now everyday pronounced and has the abbreviation KPI, from the English Key Performance Indicator. Very often, KPI is used in the context of the most significant financial indicators for an enterprise. At the same time, “significance” is a sufficiently conditional concept. For example, for the financial director of such "significant" indicators one can count more than a hundred. Will they be equally significant for the CEO or owner? The conventionality of significance can be eliminated if we associate the concept of KPI with a specific goal that is set for the manager. Thus, we eliminate uncertainty in the number and composition of indicators that are taken into account when assessing the effectiveness of the company's management. The defining KPI formula is as follows:

those. first goal and then KPI . Now it becomes quite simple to measure the performance of a business: if the goal is achieved in the quantitative terms in which it is set, the result is obtained. In this regard, the term "Key Performance Indicator" can serve as the most appropriate interpretation of KPI. Disputes immediately disappear regarding which indicators are considered more important and which are less important. Now everything is determined by the goal. Moreover, the effectiveness of a manager will be determined by the extent to which the goals set for him are achieved in their quantitative terms.

So, the second principle of BI is formulated as follows:

The second principle of BI: Business management is carried out on the basis of goals that should be digitized.

Modern management is based on information. This thesis is not disputed, but the quality and timeliness of receiving this information is a “stumbling block” for many business systems. The fact is that in real business management systems we have at the same time too much and too little information. And this is not a paradox. There is too much information in general, and too little information to make informed management decisions. There is another feature of the information base for decision-making. Information should flow to the manager in real time and real value. The latter means that business cannot do without modern information systems. And this is another feature of modern BI. But what information systems are we talking about in relation to BI? The role of information systems in business management is traditionally reduced to the use of ERP-class systems. These systems are designed to manage mainly the daily routine activities of companies. Systems of this class are transactional, i.e. they are based on the reflection in the system of accounting registers of real transactions occurring in business. This is not enough for BI. BI deals more with the forecast of what will be, rather than with the fixation of what has already taken place. To make such a forecast, BI requires a fairly subtle analytics. It is clear that the forecast for the short-term period can be made using the ERP system, but in many cases it is quite difficult, and a long-term forecast is almost impossible. As the need for this in modern management is growing every year, information systems are emerging that we will call BI class systems. The purpose of these systems is to serve as an informational basis for making sound and effective management decisions. And without them, highly technological and practical BI is unthinkable.

So we come to the third principle of BI.

The third principle of BI: For the practical implementation of BI it is necessary to use an adequate information computer system.

There are several such systems, and all of them provide about the same level with all the required BI functionality. The only difference is in the structure and user interface.

Ii. Business Intelligence tools portfolio structure

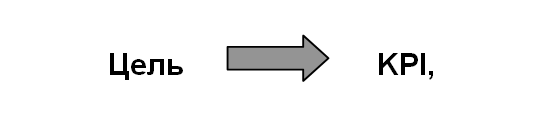

We will attempt to outline the range of modern business management tools and give a brief description of each of them. In fig. 1 shows a structural diagram of business management methods using quantitative criteria.

To understand the meaning of the figure shown in fig. 1 wall, is to realize that the company is constantly engaged in the implementation of business processes. And this is the most important content of the company. These business processes should be debugged like a Swiss watch, i.e. be reliable and beautiful. We probably won't add beauty, but we will try to ensure reliability by covering business processes with BI blocks.

Let us describe this scheme from the bottom up, realizing that the lower blocks are closer for managers to understand, and what is above is not yet possible for many, it is fundamentally understandable, and we must gradually move towards it ...

Financial and management accounting.

Financial and management accounting constitute the information foundation of BI. They provide data for all subsequent functional blocks. What are the main differences of these information blocks. Financial accounting gives some aggregated description of the state of the enterprise, which is directed outside the enterprise, is sufficiently formalized and serves as the basis for making management decisions regarding how the activity of the company as a whole should be changed. Financial accounting data are the basis for decision-making at the level of top management of the company. Financial accounting is also intended for external stakeholders (shareholders, creditors, suppliers) and summarizes the results of the enterprise.

Management accounting is accounting for the “internal kitchen” of an enterprise. It is intended to create an operational decision-making system for management and is usually confidential. Informally, management accounting exists in any organization - the value of its application essentially depends on how much management accounting data is “supplied” for making decisions in real time and value. The ideal scheme of management accounting in an enterprise is the creation of internal standards for management accounting and the computerization of accounting using some information system.

Financial diagnostics and monitoring of the company

Based on the data supplied by the financial accounting system , financial diagnostics of the company is made, which constitutes the next important block of the company's BI-system. It is about building a complete diagnostic system, which involves conducting a fundamental business diagnostics once a year and monthly monitoring. In many cases, the management of the company wants to do monitoring more often, for example, once a week or even daily.

The task of financial diagnostics is to inform the management of the enterprise in time about the changes that have occurred in the enterprise over the last period of time. To do this, use the traditional set of financial ratios, Ratio Analysis, as Western financial analysts often say. The author considers it appropriate to streamline financial performance on the basis of operating activities as the main focus of the enterprise with an eye to the value of the business. This somewhat foggy at first glance feature is illustrated in Fig. 2

The essence of the proposed approach is that the focus of the company is business value, which can be described as one of the indicators. Many take the economic value added EVA as such an indicator. Others believe that it is possible to limit the return on equity. In any case, the interest of the owner is put first. Return on capital is mainly provided by two factors: sales profitability (this indicator belongs to the group of operating performance indicators) and asset turnover (group of asset utilization performance indicators). In fact, every entrepreneur understands that a high return on the use of invested funds can be ensured by a high “sales margin” and / or a high turnover of working capital. Evaluation of liquidity indicators is an integral part of the diagnostic procedure. Their purpose is to caution the management of the company against excessive increase in turnover. "Remember the threat of bankruptcy" - say these figures. Finally, the return on the use of the funds invested by the owner can be increased by using long-term borrowed resources. This part of the company's activity (it is called financial) is characterized by a group of indicators of capital structure, which again remind of the risk of bankruptcy, but already in a more fundamental long-term context.

Cost and Profit Management

The management accounting system is not built on its own, but mainly for solving the problems of analyzing and managing costs and profits in the enterprise. This block at one time received the name " CVP-technology ", from the English term "Cost-Volume-Profit", i.e. joint analysis of costs, sales and profits. This name is conditional, as the full range of work in this unit is not limited to analysis, but involves a wide range of activities of enterprise managers in managing costs and targeted profit planning.

The purpose of this unit is to provide the owner and manager with information for making sound and strategic decisions. First of all, the owner’s concern about the total value of business profits makes it necessary to estimate profit indicators. Yes, namely, indicators, as the profit is many-sided, and we must learn to understand all of her faces.

Secondly, for making management decisions regarding the company's behavior on the market, information is needed on the relative profitability of the product portfolio. Whatever may be said about the importance of personnel management, marketing, etc., everything starts with a product that satisfies some market needs. Therefore, information on the product portfolio is strategically important from the standpoint of its profitability.

The latest in this list appears accounting for the comparative performance of various business units in the group of the company (holding). If not now, then in the near future, the owner will necessarily expand his ownership to several separate businesses, investing his own capital in each of them. He will definitely be interested in whether his capital works equally well in each of the businesses. Strategic management accounting should give him an answer to this question, and then there’s the owner’s business, whether to close inefficient businesses or be content with the situation as it is, expecting a synergy effect.

Budgeting

The pinnacle of the skill of a financial manager is the use of modern methods of financial planning and control, which are shown in fig. 1 are labeled using the term “Budgeting”.

The budgeting process in BI is presented as an organic part of the company's management system, which is designed to quantitatively substantiate the possibility of achieving the company's strategic goals, forming a kind of double loop of management: strategic management and budgeting.

The company's budget is treated as a kind of contract between the owner and the management team of the company, in which the team undertakes to ensure the achievement of the set strategic goals.

It should be emphasized that the process of setting the budgeting system, each company is trying to do in their own way. It is only important to join the general movement towards budgeting. Nowadays, one often hears from the mouth of a manager or a financial director the phrase: “we have been living for a year on a budget”. Often, this means that the word budget in the business lexicon has already been adopted, and formally the filling of several simple tables in the Excel environment takes place, which mainly compare the expected amounts of money with the amount of expenses. At its core, this is budgeting. It is all about the degree of reasonableness of the forecast monetary amounts and their relationship with the marketing and production plans of the company. The budget should not be the prerogative of the financial manager only; the budget should become the connecting technology of interaction between all key managers of the enterprise.

The first of the main tasks of budgeting is to interconnect the strategic and operational management. In fig. 3 schematically shows a combination of strategic management and budgeting. The strategy here is interpreted as a hypothesis about what strategic goals the company intends to achieve, and the budgeting system should help top management test this hypothesis.

In this scheme, strategic management and budgeting are tied up in the form of a double loop. On the first loop are formed strategic objectives and KPI companies. The second loop is responsible for the budget of the coming year. The initial requirements for the budget are the KPI values that are planned to be achieved in the coming year. The budget is not accepted if it does not provide the target KPI values of the budget year.

On the scheme there are two feedbacks. The first reflects the verification of the implementation of budget indicators, the so-called budget control. The second is the verification of the achievement of strategic goals. Crucial here is the connection of the budgeting system with the motivation system.

. , , . BI .

BI – . . , , , , , .

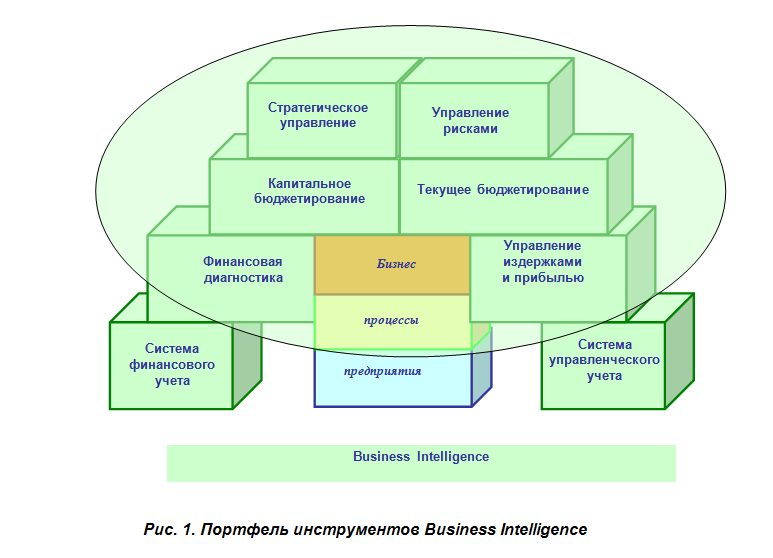

, Balanced Scorecards (BSC). « » . . :

• , () , ,

• , , - .

• BSC .

« », . four.

BSC. «» BSC . five.

, 1) , 2) KPI, 3) KPI, 4) , ,

Management of risks

– . . . , .

, . , , - . , -.

BI :

• , , .

• .

• , ,

, , , . . . :

• , 100% ;

• ;

• .

– , , «», .. .

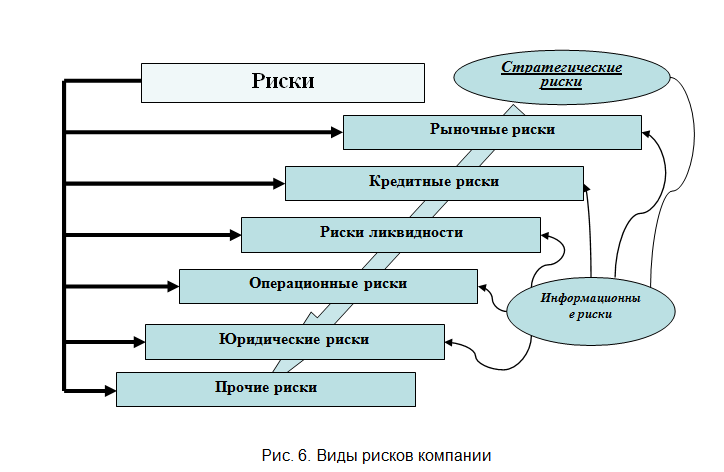

- , , . 6

. , .

BI , , …

BI , . , . , «» . . , , , . BI . , Business Intelligence.

Source: https://habr.com/ru/post/134031/

All Articles