We accept payments on the site with bank cards using Skrill

Payments on bank cards on the Internet are the most popular and most universal way to pay for services. There is an opinion that the organization of accepting card payments on its website is a difficult and expensive business. In fact, this is not the case. Any competent IT specialist or freelancer will be able to do this even without a legal entity! The only prerequisite is to have your own website, the rest is comprehended in the process.

Why Moneybookers (Skrill)?

The answer is very simple - because it is the only available way for citizens of Russia. Like any simple answer, he had to come to a difficult way.

Communication in the Russian legal field leads to the need to prepare piles of papers - copies of constituent documents, extracts from the Unified State Register of Legal Entities and other attributes of paper technologies. Not every legal entity will pass the security services of payment and processing systems. Is it worth mentioning that the very idea that a person from the street will start working with money does not fit in their heads. But having received all the necessary papers with such difficulty, our people do not hesitate to then creatively interpret the customs of business.

')

Another approach is demonstrated by representatives of the Anglo-Saxon mentality. They are loyal to the initiative of citizens, but then build hard risk management. It is easy to start, but each step forward is worth the effort.

Of course everyone knows about PayPal , but it is difficult to use it for the following reasons:

- There are restrictions on the capabilities of Russian citizens in this system.

- Processing for Russian customers is not available.

- Tariffs for processing transactions outside the home group of countries are more expensive by 1% (almost a quarter)

- Well known boorish policy of blocking accounts, especially from foreign countries. It seems to be to blame for the Ukrainian roots of the founder of PayPal

Perhaps some restrictions have been lifted or will be lifted in the future, but when we chose the system they were.

Skrill , on the contrary, is a system that considers Russians to be full-fledged European citizens and refers Russia to the domestic European market. Important note: Skrill has restrictions in the United States, where the activity of this system is blocked under the pretext of its use for gambling. Such is the typical pattern of international competition.

However, in gambling the system is really popular, so almost all the worthy descriptions of working with the system are laid out on any card sites.

I also read one very ancient (since 2006) and a very large thread about Monebookers on the forum of one freelance community. The brief summary is - regular screaming from the risk management systems and not a single one, I emphasize - not a single case of loss of money!

Let's start the same

Where to begin? Of course with the rates ! I note that a characteristic feature of Russian payment sites is the lack of public information about tariffs.

It can be seen that in one transaction you will be charged 2.90% of its value plus 0.25 €. An important point - all expenses for processing card payments in the civilized world are borne by the SELLER. This is world practice! Russian e-commerce in this issue, alas, is different for the worse for the consumer.

For non-European partners, the commission is higher - 3.9%, PayPal wants a little more . And do not forget about the cross-border fees with which we get the same 3.9%.

check in

When registering, you can immediately select the type of account - "personal account" or "enterprise account". When choosing a company account immediately confuses "Organizational and legal form - please specify the legal entity." In fact, there is no legal entity, so we registered a personal account, and then wrote a letter on the status change for the business.

Looking ahead, I can give advice that will help save a lot of time. Try to register an account of the company and specify the sole trader as a form, which corresponds to the IBES or IP.

If you have decided to register a personal account, then read the instructions on some kind of freelance or poker site. After renaming Moneybookers to Skrill, only names and colors changed on the site. All text and meaning remained the same. I love this British love of tradition!

Limits and Verification

Limits and verification are the cornerstone of risk management for payment systems like Skrill or PayPal. The general principle is very simple - the more the payment system knows about you, the greater the credibility and the higher the limit on operations, such as the size of the transaction, the monthly turnover or the amount of funds for withdrawal.

All verification options are available immediately after registration, but our compatriots prefer not to bother with such nonsense and reach limits in the course of their daily activities. As a result, upon reaching the next limit, the account is blocked, the citizen catches up with the bathert and he begins to rush through the forums shouting "Help, the bullies are deprived of money!"

Therefore, the best advice would be to start verification immediately after the account was entered in the following sequence:

- Link a bank account by transferring a small amount in euros to SWIFT details available in your account. The main bank account accepts transfers in EURO, recently there was an opportunity to send a transfer in dollars to two other banks.

- Snap a credit card by debiting a small amount of money. The written-off amount must be seen in the statement and accurately indicated in the input form.

- Confirm your home address by sending an email containing a link to the site. If the letter does not come, as it was in our case (Russian Post - are you still waiting?), Then you can send a scan of the utility bill. If there is no invoice, the registration in the passport will also be scanned. You can safely join the discussion in Russian with representatives of support and show what is.

For verification, it is convenient to use cards and a VTB24 account with an old-fashioned but reliable telebank system, but I cannot recommend the miraculous savings bank.

Now you can conduct various operations at Skrill, for example, to blow money into Poker :) As electronic money, the Skrill currency is completely useless compared to Yandex.Money or Webmoney, so you can get down to the main thing - to accept cards.

In this place, I give every second reader of an article a piece of advice worth $ 20-50. To work with Skrill, use only VISA cards of the Classic class and higher. Money for MasterCard can not be withdrawn, so goodbye cool TCS-bank!

If you already have a credit or debit card, then you can check what it is like by typing the first 6 digits of the code in the Bin database checker

Business account

In order to get the seller's account, you need to launch your website and write a letter to newbusiness@moneybookers.com

In response, you will be asked to describe the activities of your company, provide the site, links to Terms and Conditions. You will also be asked to indicate publicly the address, telephone number and who you are there. Individual Entrepreneur Vasya Pupkin completely satisfied. You can make a flawless description using the recommendations of these gentlemen.

Communication will take place in English, although the site may be in Russian. After several days of anxious waiting, a visitor from England will flash in the logs and soon you will be delighted by the new status.

Connect and configure

To activate the service for receiving card payments, you will need to install an online store with a module of support for Moneybookers, which is in all popular systems. You can write the handler yourself using the documentation .

Particularly pleased with the opportunity to wind a demo post request online.

Advice from personal experience. When setting up, immediately disable unnecessary payment options that will be misleading your customers. Popular card systems - more than enough! Leave only local options for citizens of those countries that will pay you. Local options are not for Russians and Americans.

Due to some kind of tender love for Prestashop, Skrill offers fantastic rates for merchants who have installed this store. Did not check.

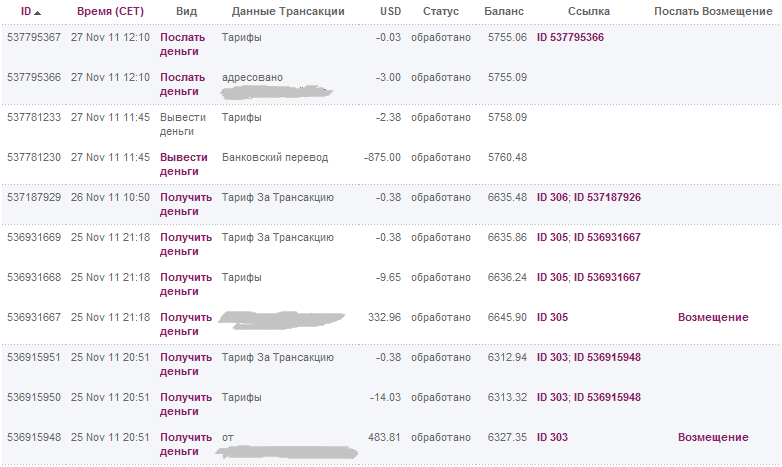

If everything is done correctly, then after a while you will contemplate a picture that is pleasing to your eye, for example:

It is interesting to count other people's money in the open window, is not it? On the right is a reimbursement button - for us it turned out to be an invaluable find. At any time, you can return part or all of the payment to your buyer for a fixed price of 0.49 €.

It would be very mean to finish an article on this idyllic moment without talking about the pitfalls. The patient reader will find out in the following paragraphs the little-known information that we have gained with the nerves of time and money.

Output delay

It turned out that all funds received on the account are frozen for 30 days. This period is intended to enable the buyer to withdraw your payment. That's right, who will allow the unknown horseradish from the mountain to immediately dispose of money freely?

Commission principle

All fees for processed payments, as well as all refunds are charged to the unfrozen amount. It looks like this. You had 100 € free on your account. If suddenly you accepted a payment of 100 € and immediately made a refund, then in addition to -3 € of commissions, you will receive -100 € to the reserves. Those. 97 € left on the account, which will be blocked for 30 days.

Commission for unsuccessful payments

If your client has a card with no money or he blunted it, you will still be charged € 0.25. And SMS comes in Russian in unreadable encoding, it’s good that the confirmation code in it is digital.

Restriction on the withdrawal of money through a bank card

A day on a credit card can be withdrawn at a time no more than 500 Euro. It quickly became clear that a month can withdraw no more than 1,500 Euros. This restriction is set by the bank-equator, in our case it is Sberbank for VISA classic. It turns out that the withdrawal of money through the card adds a commission of 0.36%.

True, at any time you can withdraw money to a bank account, but you need to clearly understand that by fighting money laundering policies, this is a completely transparent operation, which it is worth doing when fully prepared for it!

Merchant Verification

After 700 Euros from obtaining the status of a merchant, we received a notification that we need to go through the merchant verification procedure. We were sent various documents and, under the threat of blocking, no later than a week later we were asked to sign and send scans. It also took some documents confirming the location of the business. I had to be nervous and sweat, because we did not have a legal entity or a business location. In the correspondence we learned about the sole trader , we also failed to meet the 7 day period. Fortunately, as is usually the case in a capitalist country with a human, we were not turned off at the time of the correspondence. In order not to encounter this problem, try registering the Business account immediately!

Verified merchant - sky in the box!

The day before the large amount of money froze out, a letter of happiness came in which we were glad to learn that we reduced the storage period of your funds to 14 days and ... introduced a non-withdrawable deposit of 2000 Euro! I had to forget about any withdrawal of funds and start working on account replenishment. In the screenshot above, it seems that income is visible, in fact this is a net loss in the form of a frozen deposit and frozen working capital.

Connecting accepting payments by bank cards be prepared with the success of a startup to freeze a couple of monthly working capital. However, we must admit that this is a pleasant business chores.

What's next?

Further normal business development. Registration of an international company, registration of a bank account, registration of an Internet Merchant Account, reading sites about offshores. You can read it , but personally I choose the old world. Tell me, do you know another country where the tax authority publishes such a wonderful brochure ? You read and understand - the road will be mastered by walking.

Source: https://habr.com/ru/post/133563/

All Articles