Analysis of the world market structure using graph theory methods

Researchers at the Zurich Institute of Technology have analyzed the global financial market using graph theory methods. Scientists tried to find the most influential private financial structures. As part of the work, about 85 million companies were analyzed, dependencies between them were built, and the most significant corporations were identified.

A weighted, oriented multigraph was constructed as a data structure, constructed as follows:

The weighing process is as follows. The value of the company is recorded at the top of the graph. The edge is assigned a value in the range from 0 to 1, corresponding to the share of ownership of one company in another. For example, the edge connected the vertices A and B and had a weight of 0.51, this meant that A owned 51 percent of company B. Obviously, to assess the impact of a company on the market, it is not enough to estimate which vertices are connected to the edges that leave it - reachability from one top of the other. In this case, the numbers on the edges are multiplied (indeed, if A owns 50 percent of B, and B - 50 percent of C, then A owns 25 percent of C, the situation is A in the figure).

A few weighing examples are illustrated in the following figure:

')

Information about the companies was taken from the Orbis 2007 database. The uniqueness of this repository lies in the fact that it contains not only general information about a huge number of companies, but also individual features of an enterprise, such as company structure, risk factors, etc.

For the analysis of the graph obtained, three different methods were used:

As a result of the application of the above models was the selection of components of strong connectivity in the graph, which correspond to the world's largest holding companies and corporations.

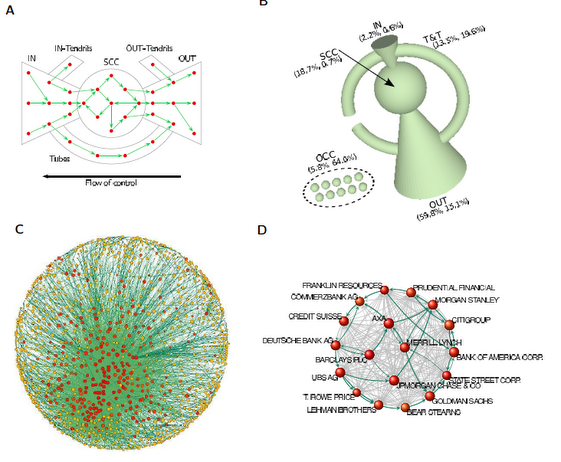

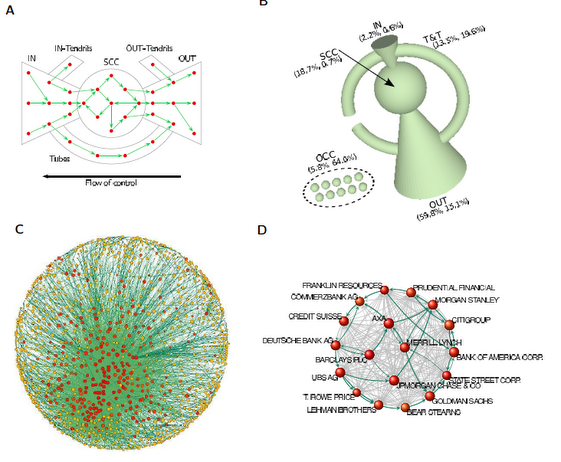

The result of the visualization of the work became diagrams such as "bow tie" (bow-tie). The center of the butterfly is a component of strong connectivity, from which dependent tendrils, which are subsidiaries, depart.

findings

The results, in my opinion, can be used for risk analysis and stress testing of both leading corporations and the entire world economy.

If the topic of financial risk analysis, stress testing is interesting, I will try to prepare a short cycle of articles on mathematical modeling of these processes (VaR, SVA, etc.).

Preprint article is available here .

Methods of building a data structure and analysis

A weighted, oriented multigraph was constructed as a data structure, constructed as follows:

- Tops - Businesses / Companies

- Two entities connected the edge with the beginning at the vertex A and the end at the vertex B, if the vertex A belonged to the part denoted by the vertex B

The weighing process is as follows. The value of the company is recorded at the top of the graph. The edge is assigned a value in the range from 0 to 1, corresponding to the share of ownership of one company in another. For example, the edge connected the vertices A and B and had a weight of 0.51, this meant that A owned 51 percent of company B. Obviously, to assess the impact of a company on the market, it is not enough to estimate which vertices are connected to the edges that leave it - reachability from one top of the other. In this case, the numbers on the edges are multiplied (indeed, if A owns 50 percent of B, and B - 50 percent of C, then A owns 25 percent of C, the situation is A in the figure).

A few weighing examples are illustrated in the following figure:

')

Information about the companies was taken from the Orbis 2007 database. The uniqueness of this repository lies in the fact that it contains not only general information about a huge number of companies, but also individual features of an enterprise, such as company structure, risk factors, etc.

For the analysis of the graph obtained, three different methods were used:

- Linear model Control over the company is divided among all owners in proportion to the ownership interests.

- Threshold model The construction scheme is similar to linear, but only if the share of owners does not exceed the established “control” threshold (in the study, this value is 50%, but this is not always true). If the company has a majority owner - that is, an entity that owned more than 50 percent of the company, then it completely came under its control.

- Density model. In this model, control over the company is divided according to the ratios of the shares of all owners. In this case, for example, if one of the owners has a small share, but all the others have an even smaller share, then he can concentrate in his hands a significant part of the control over the company.

As a result of the application of the above models was the selection of components of strong connectivity in the graph, which correspond to the world's largest holding companies and corporations.

The result of the visualization of the work became diagrams such as "bow tie" (bow-tie). The center of the butterfly is a component of strong connectivity, from which dependent tendrils, which are subsidiaries, depart.

findings

The results, in my opinion, can be used for risk analysis and stress testing of both leading corporations and the entire world economy.If the topic of financial risk analysis, stress testing is interesting, I will try to prepare a short cycle of articles on mathematical modeling of these processes (VaR, SVA, etc.).

Preprint article is available here .

Source: https://habr.com/ru/post/131222/

All Articles