How not to lose money when paying via PayPal

You often pay with PayPal and want to be sure that you don’t overpay 1-2% of the amount of payments? Then look under the cat. PayPal “experienced users” may not be interested, but who knows ...

Mysterious events are happening on Habr ...

This article has already been published on Habré in the sandbox, but afterwards, the iwaita mystically disappeared from the sandbox and did not get into either the “published” or the “drafts”.

Recently, articles about PayPal appear with enviable regularity. Only a lazy person does not write about it, someone is waiting (waiting) for the opportunity to accept payments, someone just uses it regularly and hurries to share the news.

Of the entire mass of users, at least Russian, the vast majority still make payments through PayPal, rather than accept. The note is primarily aimed at those who regularly (or not so) make purchases on the Internet, paying for them through PayPal, but who have not very scrupulously studied all the details and documentation on the site. For some of them, I hope this article will be useful.

I occasionally use PayPal (I have an account-linked card) to pay for various purchases in overseas stores (Europe, China, slightly less than the US, etc.), as well as regularly pay for hosting services. I have been using for more than 5 years. And I started ordering via the Internet about 8 years ago. Those. I have certain experience. And I referred myself to users quite competent in these matters. However, "there is an old woman", an unexplored topic.

')

It turned out that having a Russian bank card, linking it to a PayPal account, and paying for purchases over the past 2 years, I regularly lost a certain percentage.

The bottom line is who converts money for a purchase.

Naturally, the invoice issued by a foreign shop will be in currency. Take for example my hoster in the US, regularly invoicing in USD.

If your card's account is in the currency of the invoice, in this case in US dollars, then there are no tricks. You have been billed for $ 10 - if you pay $ 10 from the card and write off. Here you have to decide where to save: changing your Tugs for dollars and then shoving them into an ATM to replenish a card, or at a bank branch when replenishing immediately with conversion.

If the account of your card is ruble or differs from the currency of the invoice for payment (for example, the account is in USD, and on the Euro card), then when you pay, the conversion process will not be controlled by you. This situation just describes my version.

How does the conversion process take place and at what rate will it be made? Let's see. The whole process of writing off money on your fingers is about the following (correct me in terms of gurus, if that): after you agreed to pay the bill, the seller, or rather, his acquiring bank (the bank through which the seller works with plastic cards, hereinafter processing center) requests your issuing bank (the one that issued the card) about the availability of the required amount in your account, and if the required amount is available, the account is debited, and the seller receives a notification that the payment has been made. Those. this chain consists of three links. Seller (account) -> PC (processing center) -> BE (bank issuer).

As a rule (this is true for most foreign online stores), the invoice amount is transferred to the PC unchanged, i.e. in the currency of the account you are going to pay. The PC contacts the BE, and determining that the account on your card differs from the paid account, converts the amount at its rate and requests the amount from your bank in the currency of your account. Those. How much will be withdrawn from your rubles account as a result, you don’t know for sure until you receive a statement about the perfect payment from your bank.

However, PayPal payments are slightly different from this scheme. PayPal (hereinafter PP) offers to "take care" of the user (this service is enabled by default) and converts the amount of the invoice to the currency of your account itself. Thus, you immediately see on the screen that XXX rubles will be written off your card, at the rate of YYY. And this, I must say, gives confidence. No worries about the amount of the future write-off, you can safely pay. Check the course, compare with the local, we believe that the difference fits into the frame. We pay.

Here is a simple user (in my face) who is accustomed to comfort and overpays those unfortunate 1-2%, because PP rate was higher than the course of the processing center. Yes, you have to pay for comfort ...

Immediately, I note that the indicated amounts of 1-2% are valid only for my case and probably depend on the specific banks participating in the payment chain.

There are several options

The first and primary is to disable conversion to PP.

The second one, which will most likely make it possible to save further, is to have the card billed in the currency in which the online store will be billed. In this case, the payment chain will be without conversion, and already the conversion of money will be completely on your conscience, whether it be intrabank conversion when you deposit or transfer from one account to another, or a third-party exchange and deposit into a currency account.

We fix the theoretical material practice.

Disable conversion to PayPal. This can easily be done by everyone.

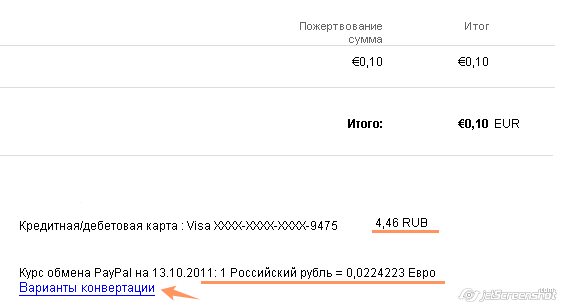

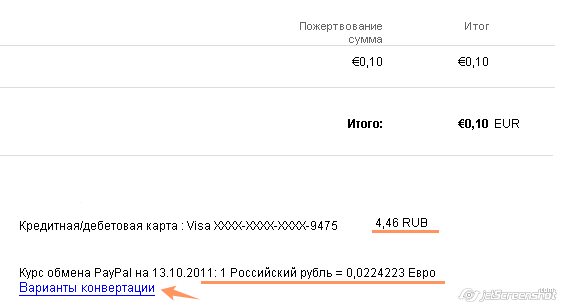

When making a payment, the PP honestly warns what exchange rate it has and offers to use it, but also offers to choose conversion options (for example, an account in Euro):

Click "conversion options" and select "I ask you to bill me in the currency of the seller":

The PP will remember your choice and on subsequent payments for the current card will default to the option you selected.

We change the currency of the card account (this trick will not be available to everyone). Some banks issue cards that are tightly linked to one account. Thus, you choose the currency when ordering a card and subsequently you cannot change the account (as far as I understand this is the most common situation).

However, there are banks that allow you to open several accounts, and bind the card to the necessary. In this case, you can go to your bank and arrange binding the card to the account in the desired currency.

But technology does not stand still, and now there are banks that, when ordering cards, open several accounts in different currencies at once. (Just my case.) That allows a simple call to the bank to bind to the desired account. And more recently, this service is available in the Internet Bank, and you can even do without calls.

I don’t give screenshots of this process, because first, it will be advertising, and secondly, for each particular bank, they will be different.

Distracting from the topic of payments to the Internet, it should be noted that this service is also very useful for frequent trips abroad. Traveling abroad, you bind the card to the account in the currency of which you will pay on the trip. The savings are not great, but save a lot of money.

Pay more attention to details, check various options, do not let your habit and comfort relax you, count your money, have the right bank.

ps I hope both I and you have not wasted time.

UPD: moved to a more appropriate blog "Payment Systems".

Mysterious events are happening on Habr ...

This article has already been published on Habré in the sandbox, but afterwards, the iwaita mystically disappeared from the sandbox and did not get into either the “published” or the “drafts”.

Recently, articles about PayPal appear with enviable regularity. Only a lazy person does not write about it, someone is waiting (waiting) for the opportunity to accept payments, someone just uses it regularly and hurries to share the news.

Of the entire mass of users, at least Russian, the vast majority still make payments through PayPal, rather than accept. The note is primarily aimed at those who regularly (or not so) make purchases on the Internet, paying for them through PayPal, but who have not very scrupulously studied all the details and documentation on the site. For some of them, I hope this article will be useful.

Prehistory

I occasionally use PayPal (I have an account-linked card) to pay for various purchases in overseas stores (Europe, China, slightly less than the US, etc.), as well as regularly pay for hosting services. I have been using for more than 5 years. And I started ordering via the Internet about 8 years ago. Those. I have certain experience. And I referred myself to users quite competent in these matters. However, "there is an old woman", an unexplored topic.

')

It turned out that having a Russian bank card, linking it to a PayPal account, and paying for purchases over the past 2 years, I regularly lost a certain percentage.

The essence

The bottom line is who converts money for a purchase.

Naturally, the invoice issued by a foreign shop will be in currency. Take for example my hoster in the US, regularly invoicing in USD.

If your card's account is in the currency of the invoice, in this case in US dollars, then there are no tricks. You have been billed for $ 10 - if you pay $ 10 from the card and write off. Here you have to decide where to save: changing your Tugs for dollars and then shoving them into an ATM to replenish a card, or at a bank branch when replenishing immediately with conversion.

If the account of your card is ruble or differs from the currency of the invoice for payment (for example, the account is in USD, and on the Euro card), then when you pay, the conversion process will not be controlled by you. This situation just describes my version.

Theory

How does the conversion process take place and at what rate will it be made? Let's see. The whole process of writing off money on your fingers is about the following (correct me in terms of gurus, if that): after you agreed to pay the bill, the seller, or rather, his acquiring bank (the bank through which the seller works with plastic cards, hereinafter processing center) requests your issuing bank (the one that issued the card) about the availability of the required amount in your account, and if the required amount is available, the account is debited, and the seller receives a notification that the payment has been made. Those. this chain consists of three links. Seller (account) -> PC (processing center) -> BE (bank issuer).

Let's see more details

As a rule (this is true for most foreign online stores), the invoice amount is transferred to the PC unchanged, i.e. in the currency of the account you are going to pay. The PC contacts the BE, and determining that the account on your card differs from the paid account, converts the amount at its rate and requests the amount from your bank in the currency of your account. Those. How much will be withdrawn from your rubles account as a result, you don’t know for sure until you receive a statement about the perfect payment from your bank.

However, PayPal payments are slightly different from this scheme. PayPal (hereinafter PP) offers to "take care" of the user (this service is enabled by default) and converts the amount of the invoice to the currency of your account itself. Thus, you immediately see on the screen that XXX rubles will be written off your card, at the rate of YYY. And this, I must say, gives confidence. No worries about the amount of the future write-off, you can safely pay. Check the course, compare with the local, we believe that the difference fits into the frame. We pay.

Here is a simple user (in my face) who is accustomed to comfort and overpays those unfortunate 1-2%, because PP rate was higher than the course of the processing center. Yes, you have to pay for comfort ...

Immediately, I note that the indicated amounts of 1-2% are valid only for my case and probably depend on the specific banks participating in the payment chain.

How to avoid overpaying

There are several options

The first and primary is to disable conversion to PP.

The second one, which will most likely make it possible to save further, is to have the card billed in the currency in which the online store will be billed. In this case, the payment chain will be without conversion, and already the conversion of money will be completely on your conscience, whether it be intrabank conversion when you deposit or transfer from one account to another, or a third-party exchange and deposit into a currency account.

Practice

We fix the theoretical material practice.

Disable conversion to PayPal. This can easily be done by everyone.

When making a payment, the PP honestly warns what exchange rate it has and offers to use it, but also offers to choose conversion options (for example, an account in Euro):

Click "conversion options" and select "I ask you to bill me in the currency of the seller":

The PP will remember your choice and on subsequent payments for the current card will default to the option you selected.

We change the currency of the card account (this trick will not be available to everyone). Some banks issue cards that are tightly linked to one account. Thus, you choose the currency when ordering a card and subsequently you cannot change the account (as far as I understand this is the most common situation).

However, there are banks that allow you to open several accounts, and bind the card to the necessary. In this case, you can go to your bank and arrange binding the card to the account in the desired currency.

But technology does not stand still, and now there are banks that, when ordering cards, open several accounts in different currencies at once. (Just my case.) That allows a simple call to the bank to bind to the desired account. And more recently, this service is available in the Internet Bank, and you can even do without calls.

I don’t give screenshots of this process, because first, it will be advertising, and secondly, for each particular bank, they will be different.

Distracting from the topic of payments to the Internet, it should be noted that this service is also very useful for frequent trips abroad. Traveling abroad, you bind the card to the account in the currency of which you will pay on the trip. The savings are not great, but save a lot of money.

Conclusions from CO

Pay more attention to details, check various options, do not let your habit and comfort relax you, count your money, have the right bank.

ps I hope both I and you have not wasted time.

UPD: moved to a more appropriate blog "Payment Systems".

Source: https://habr.com/ru/post/131213/

All Articles