Bitcoin protection word

Over the past few months, interest in cryptocurrency has greatly decreased, and along with it its value has decreased. Many, without getting into the essence, like to say: “this currency is not secured by anything”, “these wrappers are worth nothing”, “anyone can generate as much as he wants, how it can be currency”, and so on. The sad thing is that on this wave, whole articles are born that emphasize things that are not too close to the truth. The reader, who is not familiar with the topic, immediately misinterprets the idea of cryptocurrency in the head, due to which he may not be interested in them for a long time. In this article I will try to highlight Bitcoin from the right side in favor of balance, opening the look at the real state of affairs to those who are not yet in the know.

About what it is, and how the system for transferring currency and generating new coins is arranged, quite a few articles have been written explaining this in detail ( for example ). It is important to pay attention to the fact that the rate of generation of coins in the system is governed by an algorithm. Already, the complexity of generation is so high that it is unlikely to make any tangible profit without a top-end Radeon video card. But even if you find a quantum supercomputer somewhere and start generating a huge amount of coins for yourself, then very soon the system will correct the complexity again, and the generation rate of new coins in the system will again be about 6 blocks per hour. Yes, you will have quite a big profit thanks to a good farm. But this system does not bring down.

One simple question. What is gold provided for? Nothing tangible. Worse than dollars? Also nothing, but they can also be printed in arbitrary quantities (which, as far as I know, is being done actively). Unlike gold, which can not be printed. Like bitcoin. And that, and the other can only be obtained by exerting some effort and spending certain funds.

')

They like to say that Bitcoin is a kind of divorce. Suffice it to wish to grasp the essence of what is happening to see that the US dollar is a much larger divorce.

What determines the cost of cryptocurrency? Demand and supply. At the moment, the most popular Bitcoin exchange is Mt. Gox . This is a lively exchange in which anyone can participate and by their actions can really influence the course. Buy a large amount of currency - raise the rate. Sell - lower. Nowadays, by the way, there is little where you can find the same kind of exchanges where an ordinary trader can actually see his own influence on the market. This phenomenon is interesting in itself.

Who buys Bitcoin? I see here three categories: consumers, investors and speculators.

People who need cryptocurrency to spend it on something specific. Their share, I agree, is small. Now, perhaps, the biggest market for real Bitcoin use is Silk Road , a marketplace like eBay for buying and selling drugs, which operates on the anonymous TOR network. Thanks to the principles of its work, Bitcoin is ideal for this purpose: all transactions are anonymous, it is impossible to trace who has bought something and from whom. Also bitcoins accept some ordinary online stores, web hosting and the like. This also contributes to the demand for cryptocurrency.

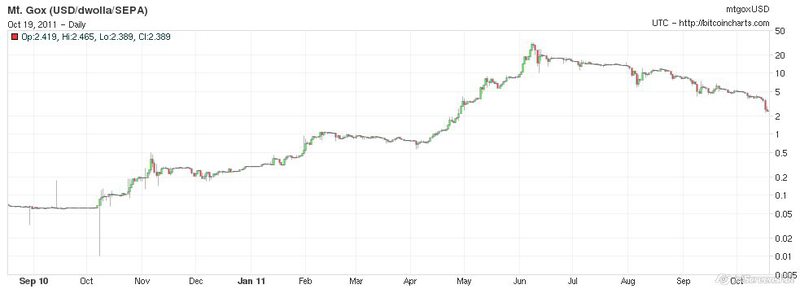

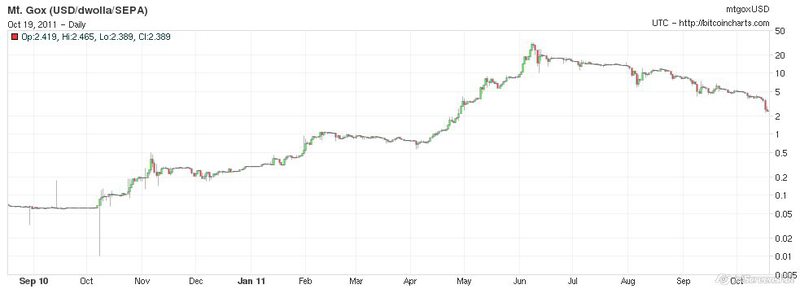

Those who consider Bitcoin a promising tool and predict its strengthening and growth of its course in the future. They, I believe, made up the majority of the market at the end of this spring, when the rate rose at an incredible pace from a price of ~ $ 1 to a maximum of ~ $ 30. I myself in that period successfully invested in cryptocurrency. However, now the currency has returned to the April levels, reducing all profits to almost zero. But in my eyes she did not fall. I save those coins that I have, and I am confident that the course will grow again. He is still not half a year old, and his story of growth is much longer than his popularity. In confirmation of this, it is enough to look at the chart of his course in the entire history:

Do you see the collapse and collapse here? Me not. Just roll back.

Why the cost of bitcoin will increase? Because demand will grow. This is an ideal tool for those cases where you want to conduct financial transactions that do not need undue attention, or when you do not want to pay commissions and taxes. When you want to be sure that your wallet will not be blocked until your identity or the legality of your transfers is ascertained. With bitcoins, everything is simple, it's like cash, only online.

These people make little difference what course is right now. They make money on his hesitation, and the larger their amplitude, the better. I do not think that their number has greatly decreased or increased over the past half year.

Now, along with the rate falls and the complexity of generating currency. Over the past couple of months, it has decreased by 30 percent. This is a good increase for those miners who stayed. For some reason, it is widely believed that the influx of new miners will raise the exchange rate. But only I think that the effect will be just the opposite. Miners do not buy currency, they sell it and thus lower the exchange rate even lower. I think the main reason for the long decline in the Bitcoin rate is precisely those miners who purchased video cards at the end of spring, raising the complexity of the generation almost 10 times. Since then, they sell the generated and gradually lower the rate, because the demand does not yet satisfy such an offer.

It is not in the fall of confidence in the cryptocurrency case. Events with theft of accounts on Mt Gox and the like, and the way they were covered in the news, of course, affected the local fluctuations of the course. And most likely it affected the confidence of investors and reduced their demand. But investors alone will not be fed, this is not a pyramid. The currency has a real use, filling the market with demand in a certain volume. The pledge of the growth rate is the spread of Bitcoin, their real use in life, the use of their advantages.

Do not forget the main thing that Bitcoin stands out:

Bitcoin is not at all simple candy wrappers and not just another electronic currency. This is an analogue of cash for the web. More precisely, even an analogue of gold, as if it was still used as cash.

Investors, be calm, the currency will grow further. And invest in projects that integrate Bitcoin into life. The more of them, the greater the demand, and the sooner the value of the currency becomes stronger.

The system does not need new miners at all. The market is full of supply, you need to stimulate demand. For those who have already mined, it is now more sensible to hold back earned in the form of bitcoins and thereby reduce the supply of bitcoins on the market.

What the system needs is integration: services accepting Bitcoin; projects doing operations with Bitcoin. Seeking ideas for startups, for you here is a whole field of virgin. And here, of course, it is much easier to promote such projects for which conventional currencies are not suitable for some reason. Or integrate Bitcoin so that for the end user it is not fraught with any difficulties.

So, supporters of the system, do not worry: Bitcoin is alive and will live and develop, there are no worthy alternatives to it. And opponents of the system, please sort it out in detail before publishing your opinions.

By the way, the other day I came up with the idea of a project that is very useful for integrating cryptocurrency into ordinary life. This is a service that automates the payment of Bitcoins on shopping sites and similar. The user of the store site simply presses the "pay in dollars" button and makes the usual payment for him in the usual currency. The service receives this money and immediately conducts it to the stock exchange, instantly changes it at the current rate for bitcoins and lists the bitcoins to the seller. The seller sold the goods for bitcoins, the user, without going into the system, simply paid in the usual way.

Thus, for the service, you only need to find sellers who are willing to accept Bitcoin and who want to simplify this procedure for unfamiliar users and popularize the cryptocurrency. The idea without implementation, of course, does not cost anything, so I publish it here, and maybe it will inspire someone to create their interesting project.

Generation

About what it is, and how the system for transferring currency and generating new coins is arranged, quite a few articles have been written explaining this in detail ( for example ). It is important to pay attention to the fact that the rate of generation of coins in the system is governed by an algorithm. Already, the complexity of generation is so high that it is unlikely to make any tangible profit without a top-end Radeon video card. But even if you find a quantum supercomputer somewhere and start generating a huge amount of coins for yourself, then very soon the system will correct the complexity again, and the generation rate of new coins in the system will again be about 6 blocks per hour. Yes, you will have quite a big profit thanks to a good farm. But this system does not bring down.

Security

One simple question. What is gold provided for? Nothing tangible. Worse than dollars? Also nothing, but they can also be printed in arbitrary quantities (which, as far as I know, is being done actively). Unlike gold, which can not be printed. Like bitcoin. And that, and the other can only be obtained by exerting some effort and spending certain funds.

')

They like to say that Bitcoin is a kind of divorce. Suffice it to wish to grasp the essence of what is happening to see that the US dollar is a much larger divorce.

Cost of

What determines the cost of cryptocurrency? Demand and supply. At the moment, the most popular Bitcoin exchange is Mt. Gox . This is a lively exchange in which anyone can participate and by their actions can really influence the course. Buy a large amount of currency - raise the rate. Sell - lower. Nowadays, by the way, there is little where you can find the same kind of exchanges where an ordinary trader can actually see his own influence on the market. This phenomenon is interesting in itself.

Who buys Bitcoin? I see here three categories: consumers, investors and speculators.

Consumers

People who need cryptocurrency to spend it on something specific. Their share, I agree, is small. Now, perhaps, the biggest market for real Bitcoin use is Silk Road , a marketplace like eBay for buying and selling drugs, which operates on the anonymous TOR network. Thanks to the principles of its work, Bitcoin is ideal for this purpose: all transactions are anonymous, it is impossible to trace who has bought something and from whom. Also bitcoins accept some ordinary online stores, web hosting and the like. This also contributes to the demand for cryptocurrency.

Investors

Those who consider Bitcoin a promising tool and predict its strengthening and growth of its course in the future. They, I believe, made up the majority of the market at the end of this spring, when the rate rose at an incredible pace from a price of ~ $ 1 to a maximum of ~ $ 30. I myself in that period successfully invested in cryptocurrency. However, now the currency has returned to the April levels, reducing all profits to almost zero. But in my eyes she did not fall. I save those coins that I have, and I am confident that the course will grow again. He is still not half a year old, and his story of growth is much longer than his popularity. In confirmation of this, it is enough to look at the chart of his course in the entire history:

Do you see the collapse and collapse here? Me not. Just roll back.

Why the cost of bitcoin will increase? Because demand will grow. This is an ideal tool for those cases where you want to conduct financial transactions that do not need undue attention, or when you do not want to pay commissions and taxes. When you want to be sure that your wallet will not be blocked until your identity or the legality of your transfers is ascertained. With bitcoins, everything is simple, it's like cash, only online.

Speculators

These people make little difference what course is right now. They make money on his hesitation, and the larger their amplitude, the better. I do not think that their number has greatly decreased or increased over the past half year.

Rate

Now, along with the rate falls and the complexity of generating currency. Over the past couple of months, it has decreased by 30 percent. This is a good increase for those miners who stayed. For some reason, it is widely believed that the influx of new miners will raise the exchange rate. But only I think that the effect will be just the opposite. Miners do not buy currency, they sell it and thus lower the exchange rate even lower. I think the main reason for the long decline in the Bitcoin rate is precisely those miners who purchased video cards at the end of spring, raising the complexity of the generation almost 10 times. Since then, they sell the generated and gradually lower the rate, because the demand does not yet satisfy such an offer.

It is not in the fall of confidence in the cryptocurrency case. Events with theft of accounts on Mt Gox and the like, and the way they were covered in the news, of course, affected the local fluctuations of the course. And most likely it affected the confidence of investors and reduced their demand. But investors alone will not be fed, this is not a pyramid. The currency has a real use, filling the market with demand in a certain volume. The pledge of the growth rate is the spread of Bitcoin, their real use in life, the use of their advantages.

Benefits

Do not forget the main thing that Bitcoin stands out:

- decentralized - we are not dependent on any management company, our accounts cannot be blocked or transmitted any information to special services, our transfers cannot be rolled back;

- anonymity - no one sees from whom and who the money goes to the network;

- the previously known volume of the issue - I emphasize, this is an advantage that none of the existing national currencies have.

Total

Bitcoin is not at all simple candy wrappers and not just another electronic currency. This is an analogue of cash for the web. More precisely, even an analogue of gold, as if it was still used as cash.

Investors, be calm, the currency will grow further. And invest in projects that integrate Bitcoin into life. The more of them, the greater the demand, and the sooner the value of the currency becomes stronger.

The system does not need new miners at all. The market is full of supply, you need to stimulate demand. For those who have already mined, it is now more sensible to hold back earned in the form of bitcoins and thereby reduce the supply of bitcoins on the market.

What the system needs is integration: services accepting Bitcoin; projects doing operations with Bitcoin. Seeking ideas for startups, for you here is a whole field of virgin. And here, of course, it is much easier to promote such projects for which conventional currencies are not suitable for some reason. Or integrate Bitcoin so that for the end user it is not fraught with any difficulties.

So, supporters of the system, do not worry: Bitcoin is alive and will live and develop, there are no worthy alternatives to it. And opponents of the system, please sort it out in detail before publishing your opinions.

PS

By the way, the other day I came up with the idea of a project that is very useful for integrating cryptocurrency into ordinary life. This is a service that automates the payment of Bitcoins on shopping sites and similar. The user of the store site simply presses the "pay in dollars" button and makes the usual payment for him in the usual currency. The service receives this money and immediately conducts it to the stock exchange, instantly changes it at the current rate for bitcoins and lists the bitcoins to the seller. The seller sold the goods for bitcoins, the user, without going into the system, simply paid in the usual way.

Thus, for the service, you only need to find sellers who are willing to accept Bitcoin and who want to simplify this procedure for unfamiliar users and popularize the cryptocurrency. The idea without implementation, of course, does not cost anything, so I publish it here, and maybe it will inspire someone to create their interesting project.

Source: https://habr.com/ru/post/130854/

All Articles