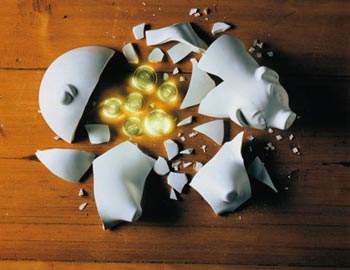

How to save and how to use the money?

Sooner or later, each of us comes to understand the need for a cash “buffer” in reserve. For a rainy day, so to speak. Someone can collect a modest amount, postponing each month slightly from their salaries, someone got a decent “buffer” from his uncle ... Anyway, the question arises of storing the available funds, and even better - their use! I just don’t want the money to just melt along with inflation.

Sooner or later, each of us comes to understand the need for a cash “buffer” in reserve. For a rainy day, so to speak. Someone can collect a modest amount, postponing each month slightly from their salaries, someone got a decent “buffer” from his uncle ... Anyway, the question arises of storing the available funds, and even better - their use! I just don’t want the money to just melt along with inflation.Not so long ago, I conducted a survey , with the hope of discovering something new for myself and in order to find out where the dear hobragiteli money is, whether they are allowed to “make it”. And, from the results of the survey and comments to him, I realized that I have something to say about this.

Under the cut a small overview of the most popular tools for the most beginners from an amateur investor :) I will briefly tell you about bank deposits, indexed deposits, mutual funds, PAMM and TMA accounts.

Questions of motivation for the accumulation of funds and the choice of currency in this post are not considered.

So, if you google on where to invest money, you can find a lot of tips in articles, blogs and (for some reason, usually women) forums. In short, they can be divided into several groups:

- The best investment is an investment in yourself - in your health, education, self-improvement, etc.

- It is necessary to invest in children - a long-term investment, which requires, however, not only financial investments, but also non-human performance and self-control.

- You need to invest money in your business - everything is in your hands and everything depends on you - and the availability and size of profits. Cards in hand!

- well, and the rest of the commonplace, such as bank deposits and mutual funds - that's what I wanted to tell about such banal things)

Employees of financial institutions, when you come to them for advice, first of all always ask a lot of questions, some of which I personally was the first to answer. For example, for how long do you want to place funds (and what is the best?), What kind of income you plan to receive (I want 10 ... 0% per year) or what risks you are willing to bear (of course, minimal). It's obvious - I want a big income in a short period of time with minimal risks. The most understandable question is how much money we are talking about. But here, too, everything is quite vague - I am ready to invest more in one tool, less in another - it all depends on what you offer. Therefore, my personal humble opinion is that it is necessary to know personally and personally about investment instruments, at least superficially, to understand where these risks come from and what to expect.

So, in order.

Bank deposit

It's all quite simple and reliable - deposits up to 700 tr. insured by the state. Choose a larger percentage and come to the bank to open an account. You can also choose online - for example, use the Yandex tool or browse the websites of local banks. It is true that, as a rule, banks do not rush to update information even on their own websites, often information on interest rates is irrelevant. It is better to choose a fine day, walk around the city and go to the most interesting banks in person. Often, you can run into sweet interest on seasonal or some New Year’s shares. For particularly fastidious when choosing a bank, you can take into account its rating .

And everything would be fine, but only it is well known that interest on deposits in banks is small. I will say more - they never outpace inflation, and therefore the “money in the bank” simply melts, albeit much more slowly than at home under the mattress. And here are the numbers: the official inflation in 2010 was 8.8%, in order to calculate the unofficial, that is, the real inflation, this number can be multiplied by one-half by the most modest standards. Thus, in order for money to at least not be lost in 2010, it was necessary for them to bring a profit of about 13.2%. Back in 2009, the largest bank percentage I met in the Russian standard and was 12.5%. It was almost a miracle, the situation is getting worse every year and now there is no such interest to be found.

Indexable deposit

Very interesting, semi-investment service. It is rare, I used it at KitFinance bank. The percentage of profitability in this case depends on your chosen market indicator, for example, the RTS index or futures contracts for food basket goods: wheat, milk, orange juice, meat, rice, sugar, etc. But the lower limit is strictly limited - you will not lose your money. If this very market indicator does not go in your favor, you just get the money invested back (with some 0.1% there) and you will not lose anything, except for time and the same ill-fated inflation, which are in a couple with each other worse. total :) But you can get a pretty good percentage. That is, this is a contribution with no fixed percentage. Here , though uncomfortable, but you can see the story.

What should be ready.

Firstly, the minimum amount of entry (opening of the indexed deposit) in the same KitFinance is 100 tr.

Secondly, as is already clear, not the fact that you will get a profit. Therefore, you should listen to analysts and can even communicate with them. For a person who is ignorant in economic affairs, it is very difficult to choose an investment goal. But, thank God, you cannot lose your money.

Thirdly, if the calculations turned out to be correct and the resulting percentage met the expectations, it would be necessary to “unfasten” the state. And here I have to dedicate you to one terrible secret with (as usual in general) the abstruse title - the refinancing rate . If it is simple, then this is a figure on which deposit interest rates set by banks largely depend. If you receive income from the bank exceeding the refinancing rate of +5 points, this income is subject to personal income tax. The current refinancing rate can be found here . Now it is 8.25%. We arrive at 5 points and get that if you earned a higher income of 13.25%, you will have to pay tax. In principle, everything is quite simple and at the same time offensive.

Well, and fourthly. The service “indexed deposit” is a rather rare phenomenon and I have never met anywhere else except in KitFinance for me personally, in our provincial town.

')

Mutual funds

Mutual investment funds. In general, when the word “investments” is used, it is necessary to immediately understand that we are talking about incomes that are as large as possible than “usually” and about risks that, as a rule, are equal to possible income. In other words, the more income you can get from an investment, the more risky it can be and, with the same ease, you can lose if not all, then much. Well this is so ... Parting words.

Actually, my story of immersion in a financial certificate begins with a simple advertising cartoon :) The cartoon tells about a wise attitude to money and that you should not keep it under a mattress (as in a bank), but there are tools like mutual funds, which in the long run can provide old age. Well, or studying in the university for your child. Or a new apartment. In general, someone what. I was interested.

The essence of the matter lies in banal speculation, and virtual units, units, are the commodity. Today, a share costs so much and it is always expected that tomorrow it will cost more :) The oldest scheme is to buy cheaper, sell at a higher price. In fact, the management company is trying to make even more money with the money invested by you, speculating on stocks, bonds, etc. And the cost of a share, as well as your income, depends entirely on the company to which you have entrusted your money. Recently, Alfa-Capital has been allocated in this field - offices are not everywhere, but all operations with mutual funds can be performed in Alfa-Bank or at any other agent (the same KeithFinance is an agent of many management companies). The tool is, in fact, very convenient - these are all Alpha Capital Mutual Funds, and here, using an example, you can consider Mutual Fund Shares.

We look at the chart and see that if we bought shares at the height of the crisis in January 2009, and sold at least in February 2010, we would have earned almost 100% of our capital for this year! Not bad, right? Only all of these if yes if only always spoil the mood. Guessing how the schedule will behave is difficult, as well as finding the entry and exit points, since income in the past will never guarantee it in the future. But that's another story.

You should be prepared for the fact that mutual funds are considered mostly as a tool for long-term investment and management companies in every way motivate customers to keep money in units as long as possible. As a rule, they charge you a small percentage of the short-term investment. For example, if you did not last a year, then the company will take its 1-1.5%. The concept of a tax on profitability of more than the refinancing rate of +5 points here is also applicable.

The minimum purchase amount of shares is quite acceptable and starts from 5 tr. (sometimes up to 30-50 and more). Subsequently, you can buy shares with even less restrictions (from Alpha from 1 tr.)

If you are willing to take risks, welcome to any management company (even VTB has one) or to any agent. Just keep in mind that the managers of these companies will pour water on the question “where to invest?”, But remain silent about specifics like fish about ice. It seems they are forbidden to advise. It is right - then they will also be blamed for just that :) The only thing, I once managed to get some aunt from KitFinance by e-mail, only I didn’t listen to her advice between the lines and was wrong: (And she was right.

PAMM accounts

Apart from the fact that you can entrust your savings to the managing director of the management company (sorry for taftology), you can also entrust them to a specific person whose success in speculative transactions you can judge for yourself. Naturally, it is better not to do this by direct transfer of cash from hand to hand, but everything is already thought out for us. For example, on a reputable Alpari service (for the grateful my partner id is 1205041), you can create an account and personally trade on the foreign exchange market. And if someone is good at it, then it's time to increase the turnover in order to increase the cherished profit. That is, to attract other people's money in order to buy more and, consequently, have a greater income. To do this, you can create a so-called PAMM-account, the profitability of which will see everything. And everyone will be able to appreciate the ability of the trader and, most importantly, to invest in it in order to get his hard interest on his money. The system is organized safely - the manager will not be able to get access to your funds, will not be able to withdraw them, etc., only to manage them to carry out transactions in the foreign exchange market. It does not work for free and takes a percentage of the profits for its work. The percentage depends on the amount of investment. On average, a trader can "zababastat" 10-50% of the profits, of course, only if this profit was obtained.

But here we are talking about a completely different possible return. The profit percentages of some traders are sometimes amazing! They reach 300% per year and more!

As you understand, I describe investment objectives according to the degree of risk increase. So, PAMM in my personal rating of a novice investor is second in risk. In order to cool down a little, look at the rating of accounts from the end (click on "Full list" and go to the last page). There are plenty of accounts that have drained their entire deposit with investor money in Alpari - you can admire them in the archives.

But if you correctly approach the choice of PAMM, then you can have your own wealth. In this, at the initial stage, official Alparish tutorial vidyushki will help (although they are terribly marketing) - only one , two , three , four , five .

It is practically useless to talk about the nuances of PAMMs - all percentages, risks, and deductions largely depend on the specific manager. I’ll just remind you once again that the choice of PAMM is a much more serious and responsible matter than the choice of the same mutual fund. It is necessary to pay attention to the duration of the account, the maximum drawdown that occurred on it, the percentage of use of the deposit (all this is described in the above videos), you should read the forum manager and, not least, do not put all the eggs in one basket !

And here I want to talk about another abstruse economic concept - diversification , which literally translates into free Russian and means non-folding-all-eggs-in-one-place, and their thoughtful distribution is the distribution of both money and risks, The goal is to reduce risks and increase money. It seems to me that everything is quite simple and clear here - you shouldn’t trust all available funds to one PAMM. At the very least, divide the capital between several, in your opinion, the best accounts, and, at the most, between several instruments. In pursuit of profit, we should not forget about mutual funds and even bank deposits. The ratios in the process of this division you choose, based on, again, on your riskiness and greed.

Perhaps, as the only worthy alternative to Alpari, I see Devlani - they brought a new concept into my life.

TMA accounts

Their convenience lies in clear answers to the questions indicated at the beginning of the post. Here, there are several accounts to choose from, for which it is specifically stated - we will trade until we reach such and such a yield or such a loss. And there is no concept of time. Trade will be conducted until it touches a predetermined ceiling or bottom. Typically, the goal is a yield of 5 to 50%, with a safety threshold of 70-80%.

It usually takes no more than three weeks to achieve a 10% profit, although my last investment took only four days. Naturally, Devlani also takes his commission on income. From personal subjective feelings, I can say that I really do not like their site on Bitrix - it is not very convenient and, moreover, it is often inaccessible due to some kind of maintenance work. Support, in comparison with Alpari, also leaves much to be desired, as well as methods and terms of depositing / withdrawing funds. However, in search of the holy grail of profitability, I personally am ready to endure a lot :)

The main nuances of Devlani are closed registration (you can use my access code DEVLANI_REF_20554) and the need to replenish the account by at least $ 500 within two months.

Managers, similar to the traders of these two companies, are also in ordinary banks. But I did not have to contact them. Actually, the first place in terms of the riskiness of investments in my rating is occupied by independent trading in the stock or currency market. To do this, money and time must be invested in learning this hard work and improving their skills. On the purchase / sale of shares of foreign IT-companies very well told roman_tik in their two posts . Well, about Forex ... I will keep silent :)

That's all. I will be glad to learn about other investor tools and your successes (and failures too) in the search for grail. Higher yields and lower risks;)

UPD: Devlani no longer exists.

Source: https://habr.com/ru/post/130720/

All Articles