“Investment Equalizer” is a new term in startup vocabulary

The start-up movement is booming. At the same time, the financial and legal relations between the participants of the startup (including the project manager, team, investor, co-investors, etc.) do not yet have well-established forms, standard practices, “calibrated” settings. Inflated risks, unreasonably high shares, a high degree of uncertainty - on the one hand, this is a venture business, on the other - it can be more regulated, fair, adequate to the parties' contribution to the overall success. This was the prerequisite for the emergence of a new term - “ investment equalizer ”.

Note: the musical equalizer depicted here serves only to visualize the concept and does not carry any practical load.

So, it happened. As a result of creative torment and strong-willed efforts, your startup has finally reached the stage of negotiations with an investor. Both sides are in conditions of great uncertainty. How many shares to offer to the investor and how much to ask for it? How can an investor correctly assess the prospects and risks? The first word in the bargaining is behind the startup. But then the investor usually rules — he has more experience, he has proven schemes and intuition, and of course real money. The space for bargaining is very limited. Usually, a contract between an investor and a startup is prescribed several scenarios, entailing different financial and legal consequences. However, now this mechanism is not flexible enough and perfect.

')

In this regard, I propose to the audience a new term - “investment equalizer” (investment equalizer or abbreviated IEQ). If the term takes root, then the authorship is reserved.

So, an investment equalizer is a multifactorial and multivariate system for regulating financial and legal relations between an investor and a startup, based on the dependence of the conditions of these relations on specific influencing events that occurred during a certain period of time.

It sounds flowery and academic, but it is a necessary sacrifice for the common good.

It has several “adjustment bands” (the optimal number is 7-10, but it can be more).

For each band, influencing events should be established (for example, sales, number of customers, profitability, profitability, EBITDA, etc.).

There should be a time frame in which the band is legitimate.

Also for each band is determined by the result of influence, performing the functions of the adjustment lever, that is, in fact, the specific conditions of financial and legal relations.

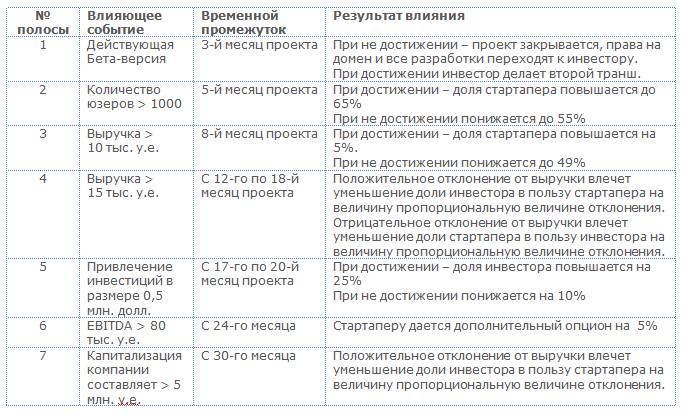

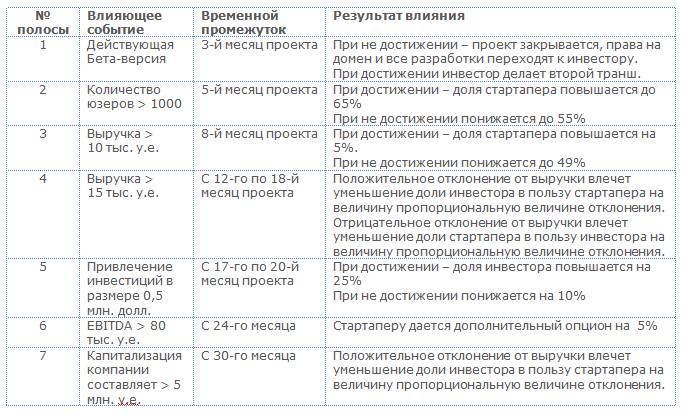

Example

Baseline: investment 100 thousand. Cu. in exchange for 40% of the shares.

Notes:

• For ease of reading, the equalizer “pauses” are arranged horizontally, rather than vertically, as is usually the case in music equalizers.

• Time gaps may overlap each other.

• The dependence between the influencing event and the result of the influence may be different: 2 options, linear dependence, dependence by formula, etc.

• There may be several effects.

• The Equalizer can determine the relationship of the many members of a startup, but in this example for simplicity, only two sides are indicated.

• Equalizer parameters may be revised or adjusted by mutual agreement of the parties.

It may be objected - that, they say, you can do without the use of this term, simply writing these conditions in the investment contract. Yes, this is true, but more often than not, for some reason this does not happen. Probably just because of the lack of a separate concept. After all, when a term or concept exists in the representation of people as an independent mental object, the scope, depth and scope of its application change.

One of the main features of IEQ is the rejection of the constant distribution of shares and the transition to the redistribution of shares, depending on the results that have been formed at a certain point in time. That is, the size of a piece of cake should vary depending on the results achieved!

It should be noted that not only the sizes of shares, but also other objects of relations, for example, ownership of the domain, ownership of the means of labor and the results of development, copyright, the possibility of transferring the share to third parties, option size, etc., may be subject to correction.

IEQ is an example of successful compilation of several business tools, resulting in a new model.

In Western business vocabulary, there is the term “ Milestone investment ” (milestone - milestone, milestone, milestone), which implies a step-by-step investment, in which the investment conditions of the next stage depend on the achievement of results at the current stage. But this approach, in my opinion, is more suitable for conventional investments and yet not flexible enough for venture investment.

Someone may see in IEQ the features of a balanced scorecard ( Balanced Scorecard or BSC) and will be right. However, the differences between IEQ and BSC are too strong to give up the term IEQ.

Key performance indicators ( Key Performance Indicators or KPI), coupled with management by objectives, as a rule, affect only the current profitability of participants and do not affect the distribution of shares, and are usually based on operating results.

The advantage of the investment equalizer is that it more flexibly and adequately takes into account the risks of the investor at the start of the project and the potential success of the startup in the culmination of the project. Motivates both parties. Stronger tied to specific results. Distributes risks and benefits more equitably.

Indeed, at the beginning of the path, the parties act blindly, based on their assumptions, sensations, which are to a very large extent subjective. It is an extremely high degree of uncertainty of prospects and risks that requires the most flexible, dynamic adjustment of the financial and legal relationship between a startup and a venture investor. There would be twice as many successful startups if a more dynamic and multi-factor model were used as the basis for relationships.

The theme of the investment equalizer can be developed by displaying new formulas, introducing new parameters and types of dependencies, improving the relationship between indicators. You can dream up what could be the settings for Facebook or Groupon. Perhaps it even comes to the use of template equalizers, which will be named after the startups in which they were used. And then the music of the venture business will sound brighter.

However, any idea should go through the running-in process and everything will depend on the reaction of the IT community and, first of all, on the habrasoobshchestva, since the term IEQ appears here for the first time. I would be grateful for the reasoned criticism and for the professional opinion.

PS To those habrogens who decide to practice using IEQ in practice, I promise a free consultation.

PPS I am grateful to Andrei Antonov, Vladimir Morgoev, Vitaly Akimov for the fact that they kindly agreed to speak as experts and provided intellectual assistance.

Note: the musical equalizer depicted here serves only to visualize the concept and does not carry any practical load.

So, it happened. As a result of creative torment and strong-willed efforts, your startup has finally reached the stage of negotiations with an investor. Both sides are in conditions of great uncertainty. How many shares to offer to the investor and how much to ask for it? How can an investor correctly assess the prospects and risks? The first word in the bargaining is behind the startup. But then the investor usually rules — he has more experience, he has proven schemes and intuition, and of course real money. The space for bargaining is very limited. Usually, a contract between an investor and a startup is prescribed several scenarios, entailing different financial and legal consequences. However, now this mechanism is not flexible enough and perfect.

')

In this regard, I propose to the audience a new term - “investment equalizer” (investment equalizer or abbreviated IEQ). If the term takes root, then the authorship is reserved.

So, an investment equalizer is a multifactorial and multivariate system for regulating financial and legal relations between an investor and a startup, based on the dependence of the conditions of these relations on specific influencing events that occurred during a certain period of time.

It sounds flowery and academic, but it is a necessary sacrifice for the common good.

How does the investment equalizer work?

It has several “adjustment bands” (the optimal number is 7-10, but it can be more).

For each band, influencing events should be established (for example, sales, number of customers, profitability, profitability, EBITDA, etc.).

There should be a time frame in which the band is legitimate.

Also for each band is determined by the result of influence, performing the functions of the adjustment lever, that is, in fact, the specific conditions of financial and legal relations.

Example

Baseline: investment 100 thousand. Cu. in exchange for 40% of the shares.

Notes:

• For ease of reading, the equalizer “pauses” are arranged horizontally, rather than vertically, as is usually the case in music equalizers.

• Time gaps may overlap each other.

• The dependence between the influencing event and the result of the influence may be different: 2 options, linear dependence, dependence by formula, etc.

• There may be several effects.

• The Equalizer can determine the relationship of the many members of a startup, but in this example for simplicity, only two sides are indicated.

• Equalizer parameters may be revised or adjusted by mutual agreement of the parties.

It may be objected - that, they say, you can do without the use of this term, simply writing these conditions in the investment contract. Yes, this is true, but more often than not, for some reason this does not happen. Probably just because of the lack of a separate concept. After all, when a term or concept exists in the representation of people as an independent mental object, the scope, depth and scope of its application change.

Refusal of constant distribution of shares

One of the main features of IEQ is the rejection of the constant distribution of shares and the transition to the redistribution of shares, depending on the results that have been formed at a certain point in time. That is, the size of a piece of cake should vary depending on the results achieved!

It should be noted that not only the sizes of shares, but also other objects of relations, for example, ownership of the domain, ownership of the means of labor and the results of development, copyright, the possibility of transferring the share to third parties, option size, etc., may be subject to correction.

Related concepts and systems

IEQ is an example of successful compilation of several business tools, resulting in a new model.

In Western business vocabulary, there is the term “ Milestone investment ” (milestone - milestone, milestone, milestone), which implies a step-by-step investment, in which the investment conditions of the next stage depend on the achievement of results at the current stage. But this approach, in my opinion, is more suitable for conventional investments and yet not flexible enough for venture investment.

Someone may see in IEQ the features of a balanced scorecard ( Balanced Scorecard or BSC) and will be right. However, the differences between IEQ and BSC are too strong to give up the term IEQ.

Key performance indicators ( Key Performance Indicators or KPI), coupled with management by objectives, as a rule, affect only the current profitability of participants and do not affect the distribution of shares, and are usually based on operating results.

Conclusion

The advantage of the investment equalizer is that it more flexibly and adequately takes into account the risks of the investor at the start of the project and the potential success of the startup in the culmination of the project. Motivates both parties. Stronger tied to specific results. Distributes risks and benefits more equitably.

Indeed, at the beginning of the path, the parties act blindly, based on their assumptions, sensations, which are to a very large extent subjective. It is an extremely high degree of uncertainty of prospects and risks that requires the most flexible, dynamic adjustment of the financial and legal relationship between a startup and a venture investor. There would be twice as many successful startups if a more dynamic and multi-factor model were used as the basis for relationships.

The theme of the investment equalizer can be developed by displaying new formulas, introducing new parameters and types of dependencies, improving the relationship between indicators. You can dream up what could be the settings for Facebook or Groupon. Perhaps it even comes to the use of template equalizers, which will be named after the startups in which they were used. And then the music of the venture business will sound brighter.

However, any idea should go through the running-in process and everything will depend on the reaction of the IT community and, first of all, on the habrasoobshchestva, since the term IEQ appears here for the first time. I would be grateful for the reasoned criticism and for the professional opinion.

PS To those habrogens who decide to practice using IEQ in practice, I promise a free consultation.

PPS I am grateful to Andrei Antonov, Vladimir Morgoev, Vitaly Akimov for the fact that they kindly agreed to speak as experts and provided intellectual assistance.

Source: https://habr.com/ru/post/130206/

All Articles