Positive bias or what is common to the global crisis with a broken deadline

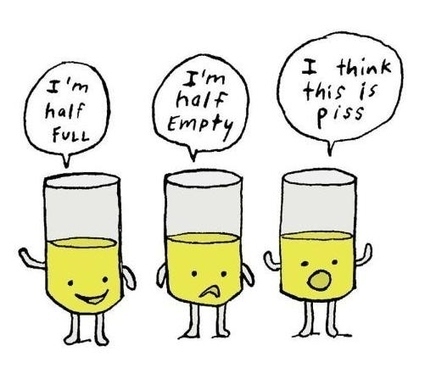

The past week was marked by a collapse in the markets, pessimistic statistics on key American indicators and general concerns that it would be worse. Now only the lazy one does not write about a possible global recession. I'm just lazy so I will not. And I will write better about how we repeatedly get into a puddle in our estimates. It doesn’t matter if we evaluate our professional qualities, the project’s deadline or the stock price. All because of - positive bias.

I did not find an adequate translation (literally “positive distortion”), therefore I will call it this way later. Let's do a little experiment. Here you have three numbers: 2, 4, 6. The sequence obeys a certain rule. Your task is to guess this rule. You tell me three numbers, and I tell you whether they suit or not. You have as many attempts. The odds are 5 to 1, which you call sequences like 8, 10, 12 (N, N + 2, N + 4) or 3, 6, 9 (N, 2N, 3N). It is quite possible that you will test several triplets that support your theory. In both cases above, my answer will be yes. Extremely satisfied with yourself, you will offer your theory. And make a mistake.

So what's the problem? Firstly, the average statistical test subject is likely to test triplets confirming his theory. Only 1 out of 5 will try the options that can refute it. Which brings us to the “second”: once having invented / accepted a thought / theory, it is very difficult to refuse it. We are looking for positive examples confirming it and ignoring negative ones that disprove it. The 2-4-6 experiment was carried out repeatedly and only 20% of the subjects correctly formulated the sought-for rule: the numbers just have to stand in ascending order.

In the more general case, we generally think that good things happen to us more often than bad things - the Valence effect . Repeated experiments confirm this. In one, absolutely funny people opened cards with a cheerful or sad face to them. Other things being equal, the experimenters believed that a cheerful face was more likely to fall out. Francis Bacon also wrote: "After accepting opinion, the human consciousness collects all the facts in its support . "

')

If it's still hard for you to believe that consciousness is playing games with you here are some more examples:

- MBA students (4th semester) overestimated the number of job offers that they would receive as well as their future initial salary.

- Students systematically overestimated the results of their upcoming exams.

- Almost all the newlyweds believed that their marriage would last until the very end, despite the fact that they knew the statistics of divorces.

- Most smokers believe that their own risk of getting diseases associated with smoking is less than that of other smokers.

- Professional financial analysts have consistently overestimated corporate earnings. Do you still want to entrust your savings to a broker who insists that the market will definitely go up?

The Ministry of Transport of Great Britain even issued a document entitled “Methods of dealing with positive bias in transport planning”. Inflated estimates are not just a Russian problem.

Another type of this effect is publication bias - the tendency among researchers, editors and pharmaceutical companies to publish positive findings and ignore negative or neutral ones. In order to deal with the problem at least somehow, serious medical journals even require you to register research in advance and publish all the results without fail.

The stronger your interest in one of the outcomes, whether moral, material or any other, the stronger your positive bias.

Therefore, the next time when you, for example, will assess your professional qualities, call the project’s end date or say that there is no crisis or it will bypass you - think, or maybe this positive bias says for you?

Those who are interested in the subject can advise the book Tali Sharot - The Optimism Bias: A Tour of the Irrationally Positive Brain

Source: https://habr.com/ru/post/126948/

All Articles