Spender or Home Bookkeeping for those who are desperate to keep it

Hello, dear readers of Habr!

Our today's post is devoted to a topic that is often discussed at Habré - personal finance accounting or as it is also called home bookkeeping. Where the money goes and how to plan a budget are very burning questions. Someone shares their personal experience in doing home bookkeeping with Excel or Google Docs. Someone is promoting their online services. Online services have a lot of different possibilities, but they all do not solve the main problem - home bookkeeping must be kept. Many people began to lead her, but after a while, in despair, they abandoned this business. Tired, there was no time and effort to drive in data from checks, to transfer all transactions into categories.

For our clients, we have created a personal finance accounting system called “Tranzhira”, integrated directly into the Internet Bank system. All transactions on cards and accounts are automatically taken into account in it . Spender can divide all card and account operations into categories by itself, build analytical tables and charts, track costs and do other things necessary to keep records of household finances. And you do not have to suffer with checks, receipts, extracts and initiate operations with your hands - the system fully automatically distributes purchases into categories.

')

How does it look in the Internet bank?

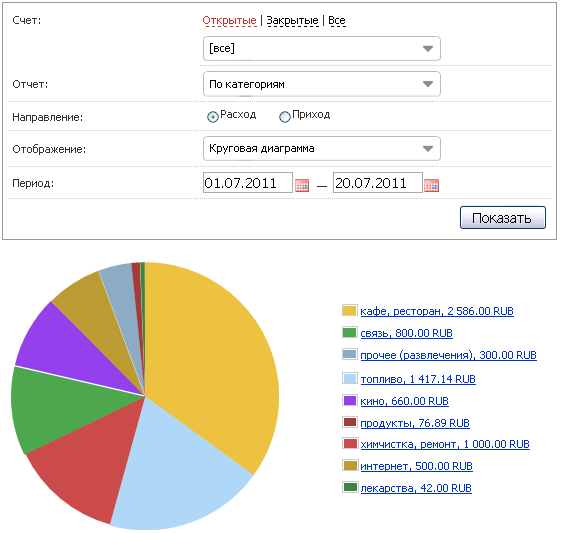

The main functionality of our home accounting system is to view reports on expenses and incomes. You can view information both on all accounts, and separately for each, for example, only on a Visa card.

It's simple: specify the account and period, click "Show" and look :)

Expense report in the form of a diagram:

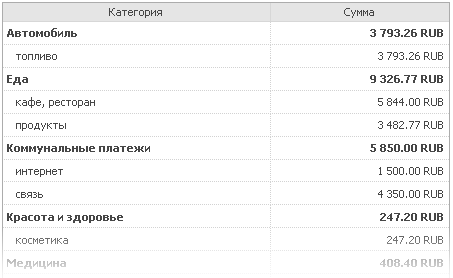

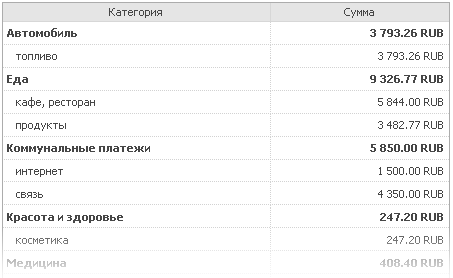

The same report can be displayed as a table:

How does auto-explode by category work?

To solve the main task of automating the allocation of expenses by category, we used several tools:

Such common operations as filling a car, buying food in a shop and cafe, paying for cellular and Internet, buying drugs at a pharmacy, buying clothes and shoes are very accurately determined by the system.

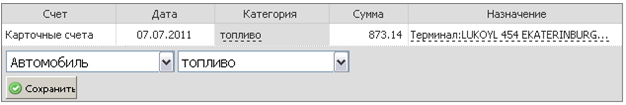

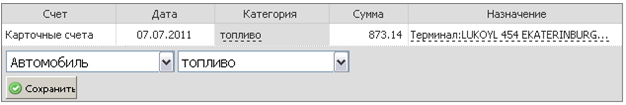

You always have the opportunity to change the category of any operation, as well as to hide certain transactions, if you do not want them to be taken into account by the system.

Manual entry operations

Of course, none of us can only pay with a card all the time, and this is not necessary. In order to fully cover all financial transactions, you can create "virtual" accounts and take into account all the cash and money on the cards in other banks. For example, we set up an account “Left Pocket”, check how much money is in the left pocket, enter the balance and then take into account operations with money from this pocket on this account.

Not only automatically counts, but also pays for itself.

Another "Spender" can do what no program for doing home accounting can do: pay for an apartment, the Internet, a telephone, and another thousand different places; you just need to set the parameters for regular payments. But we will talk more about this next time.

In conclusion, I would like to note that at the moment the service has the basic, most demanded functionality and will continue to acquire new functions, which will make it even better and more convenient. We will be glad to hear your opinions about our system and invite you to join it :-)

Read about other features of the Internet bank.

Our today's post is devoted to a topic that is often discussed at Habré - personal finance accounting or as it is also called home bookkeeping. Where the money goes and how to plan a budget are very burning questions. Someone shares their personal experience in doing home bookkeeping with Excel or Google Docs. Someone is promoting their online services. Online services have a lot of different possibilities, but they all do not solve the main problem - home bookkeeping must be kept. Many people began to lead her, but after a while, in despair, they abandoned this business. Tired, there was no time and effort to drive in data from checks, to transfer all transactions into categories.

For our clients, we have created a personal finance accounting system called “Tranzhira”, integrated directly into the Internet Bank system. All transactions on cards and accounts are automatically taken into account in it . Spender can divide all card and account operations into categories by itself, build analytical tables and charts, track costs and do other things necessary to keep records of household finances. And you do not have to suffer with checks, receipts, extracts and initiate operations with your hands - the system fully automatically distributes purchases into categories.

')

How does it look in the Internet bank?

The main functionality of our home accounting system is to view reports on expenses and incomes. You can view information both on all accounts, and separately for each, for example, only on a Visa card.

It's simple: specify the account and period, click "Show" and look :)

Expense report in the form of a diagram:

The same report can be displayed as a table:

How does auto-explode by category work?

To solve the main task of automating the allocation of expenses by category, we used several tools:

- Each transaction with a bank card has a four-digit mcc classification code (merchant category code - the source of the transaction in the PS classification) by the type of economic activity of the trading and service enterprise in which the payment terminal is installed, on the basis of which the charge is assigned one or another category.

- Payments by templates in the Internet Bank for cellular communication, Internet, utilities, replenishment of electronic wallets, etc. are automatically distributed to the desired categories.

- For payments by free details, the analysis of the payee and the purpose of the payment is made and the system tries to recognize the category.

Such common operations as filling a car, buying food in a shop and cafe, paying for cellular and Internet, buying drugs at a pharmacy, buying clothes and shoes are very accurately determined by the system.

You always have the opportunity to change the category of any operation, as well as to hide certain transactions, if you do not want them to be taken into account by the system.

Manual entry operations

Of course, none of us can only pay with a card all the time, and this is not necessary. In order to fully cover all financial transactions, you can create "virtual" accounts and take into account all the cash and money on the cards in other banks. For example, we set up an account “Left Pocket”, check how much money is in the left pocket, enter the balance and then take into account operations with money from this pocket on this account.

Not only automatically counts, but also pays for itself.

Another "Spender" can do what no program for doing home accounting can do: pay for an apartment, the Internet, a telephone, and another thousand different places; you just need to set the parameters for regular payments. But we will talk more about this next time.

In conclusion, I would like to note that at the moment the service has the basic, most demanded functionality and will continue to acquire new functions, which will make it even better and more convenient. We will be glad to hear your opinions about our system and invite you to join it :-)

Read about other features of the Internet bank.

Source: https://habr.com/ru/post/126792/

All Articles