The global financial crisis or what to do IT?

Absolutely “unexpectedly” the financial crisis “broke out” before our eyes. “Black Thursday” collapsed the markets around the world by a couple of percent and now the capitalization of global companies fell by $ 2.5 trillion, with $ 817 billion accounted for by companies in the S & P 500 index. In America, the well-known mortgage insurer Fannie Mae asked the state 5 billion dollars. In Europe, the German Commerzbank writes off Greece’s debts at $ 1,000,000,000, and Germany doubts that Italy can be saved from default, even by treating the EU stabilization fund. And I almost forgot - America's ranking dropped from the highest AAA one step lower - AA +, which is actually a completely unheard of.

2012 of kaming?

As usual, all this porridge was brewed not today, so a small digression into history is inevitable. It all began with Reagan and his reygonomics. Reygonomics was a response to the economic crisis in the United States at the end of the 70s. In short, Reagan proposed to stimulate domestic demand, which in turn would stimulate the economy. And despite the fact that the strategy has borne fruit: inflation and unemployment have been significantly reduced , it also gave rise to the crisis that we see today.

What is the point? Under the vague phrase “stimulating domestic demand” lies a completely understandable concept, which can be described a little simplistically: the Fed (Federal Reserve System) prints money and gives it to banks, banks give it out to people, people buy all kinds of junk that the industry produces with pleasure. Stimulation - on the face. Famous American consumption or consumerism flourished just then. Unfortunately, stimulation was required all the time, so the Fed had to print money for banks under an ever-decreasing prime rate (the percentage at which banks borrow money from the Fed). Credits were issued faster than they returned.

In order for this whole system to work, the Prime Rate had to be lowered all the past 30 years. It almost reached zero in 2008. The first thunder struck.

')

Actually, this is the reason why everything cannot continue as before - further refinancing of existing debt is impossible. The US economy can not be stimulated either by the domestic market or by the external. By and large, America has no leverage left except for the printing press. At the same time, both programs to stimulate the economy Ku and Ku-Ku showed more than modest results. “During three years, $ 5.3 trillion was printed, while real GDP grew by less than 1%.” I fully admit that the recent fall of Black Thursday was specifically triggered by the launch of a new stimulation program. However, this particular.

Then of course you can ask - where does such a fixation come from in a country of endless possibilities? The answer is simple: it was American demand that played the role of the locomotive of the world economy in recent decades. The whole globalized world is somehow tied to this. And the end of this demand will inevitably mean the end of the economic and financial system in the form in which we know it.

This crisis will not bypass Russia. A downturn in the economy will lead to a downturn in energy prices (oil). The budget deficit and less money for “mastering” will hit one way or another. But what a really gloomy picture I painted. It is unlikely that everything will collapse overnight - the decline will probably be monotonous. And of course, the fall will be uneven. Those who “climbed the most” will fall relatively hard. Overheated and speculative markets are likely to fall with a bang. And someone will definitely be able to heat up the little hands.

And what about IT? What about facebooks, linkindins, tweeters and their ilk? Everything is pretty simple with them. Of course, this is not the dotcom guys with their thirst for profit and purity. Probably in the past there were “mirror and triangular transactions” when companies bought and sold their own goods in order to raise their circulation on paper. Money is now invested in development and specialists. And this is good. The only bad thing is that obdzhektiv real estate from the beach.

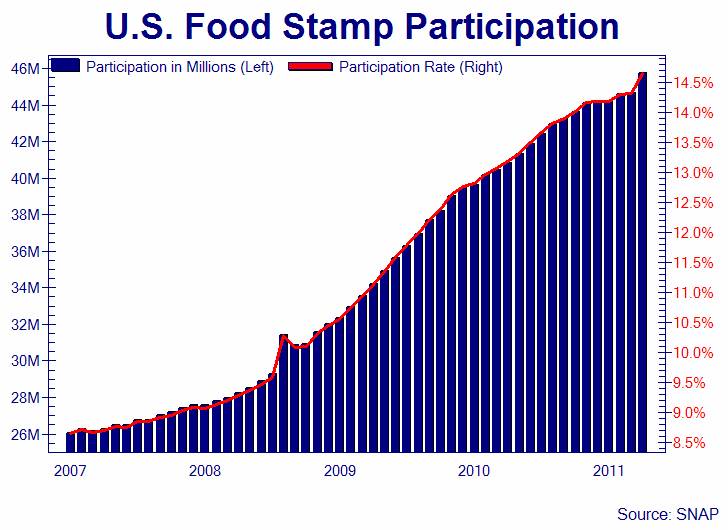

In the comments to my previous article, Koshelew says: “You are putting on people the way of thinking of an adequate economist with Maslow's pyramid and spending planning. And people do not work like that. Especially Americans with their habit of credit and "standard of living". " With all due respect, I will allow myself to disagree. Nobody canceled Maslow's pyramid, and the “habit of credits” will leave as soon as the credits cease to be issued. The number of people receiving food stamps in America has increased by about 50% since 2008 .

Every seventh American lives in poverty - this is a new record. And this is just the beginning. I think that such tent camps will only multiply. In this situation, not to the new iPhone. The IT sector is a part of the economy and the crisis will not bypass it.

In recent days, the American national debt is on everyone's lips. But there is still a household debt, which, although it has fallen a little lately, is also around 100% of GDP . And still there are debts of cities and municipalities, external debts of firms ...

As for our heroes, one can argue for a long time about the effectiveness of social advertising on Facebook or the monetization of the group, but somehow all their assessments come from the future growth of the markets. And the markets will fall. And probably even before our recent startups have time to get on their feet. And this inevitable reduction and capitalization and jobs.

So everywhere it will be bad, but everywhere it will be bad in its own way. However, good specialists will always find something to do, so I propose to study, study and study again! And of course with optimism to look to the future.

Source: https://habr.com/ru/post/125814/

All Articles